Dilok Klaisataporn/iStock via Getty Images

Investment Thesis

Building an investment portfolio with the goal of combining Dividend Income with Dividend Growth brings you multiple benefits: first, it ensures that you can start today with an attractive Dividend Yield. Second, the appropriate composition of Dividend Income and Dividend Growth stocks ensures that you can keep increasing this Dividend every year.

The fact that you manage to increase this Dividend Yield at an attractive Dividend Growth Rate from year to year also helps your investment portfolio become an important source of income over time, particularly for later retirement.

Selecting companies individually gives you several advantages compared to investing only in exchange-traded funds (“ETFs”), particularly if your focus is on Dividend Income and Dividend Growth: by selecting stocks individually you can achieve a higher Dividend Yield than when investing in a single ETF: the iShares MSCI World ETF (NYSEARCA:URTH), for example, has a Dividend Yield [TTM] of only 1.67%. The investment portfolio I have built for you and which I present in this article, provides a Dividend Yield of 3.11%, which is significantly higher than the Average Dividend Yield [TTM] of all ETFs (2.07%).

On top of that, selecting stocks individually, you can reach that the Dividend Growth is even higher than when investing in a single ETF. The Vanguard S&P 500 ETF (NYSEARCA:VOO), for example, has shown an Average Dividend Growth Rate 5Y [CAGR] of only 6.37%. The investment portfolio below shows an Average Dividend Growth Rate 5Y [CAGR] of 9.70%, being also significantly higher than the Median of all ETFs (6.09%).

In addition to that, through the individual composition of the portfolio, you could succeed in building up a regular monthly income in the form of dividends. Most ETFs, such as the Vanguard S&P 500 ETF, only pay dividends quarterly.

In addition, an individual composition provides you with even greater individuality. By adding companies that have a low Beta, you can ensure that your portfolio is better protected for the next stock market crash: examples of companies which have a low Beta and can contribute to protecting your portfolio in times of a stock market crash are Johnson & Johnson (NYSE:JNJ) (24M Beta of 0.35 and 60M Beta of 0.57) and Procter & Gamble (NYSE:PG) (24M Beta of 0.59 and 60M Beta of 0.42).

When comparing the selection of individual stocks to a Dividend Income ETF, it can be highlighted that through individual stock picking you could be able to achieve a higher Dividend Growth Rate. The Vanguard High Dividend Yield ETF (NYSEARCA:VYM), for example, shows an attractive Dividend Yield [TTM] of 2.99%, but has only shown a Dividend Growth Rate [CAGR] of 6.25% over the past 5 years.

However, there are ETFs which combine an attractive Dividend Yield with an attractive Dividend Growth Rate: one of which is the Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD). For this reason, it is also part of this portfolio.

Here are the pillars of my investment approach, aiming to achieve a balanced mix between the following factors:

- Relatively high Average Dividend Yield of the companies

- Relatively high Average Dividend Growth Rate

- Attractiveness in terms of risk and reward

- Companies with strong competitive advantages that provide an economic moat

- Companies with strong financials

- Companies with a relatively high brand value

- Consumer familiarity with the products of these companies

- Attractive Valuation of the companies

- Aiming to achieve a relatively high Yield on Cost when having a long investment horizon

- Risk diversification across sectors and industries

In order to achieve an attractive Dividend Yield today and an appealing Dividend Growth Rate in the future, I have selected four companies with a focus on a relatively high Dividend Yield, five companies with a focus on Dividend Growth and one ETF, that aims to combine an attractive Dividend Yield with Dividend Growth. This portfolio would provide you with an Average Dividend Yield [TTM] of 3.11% and the picks have shown an Average Dividend Growth Rate of 9.70% over the past 5 years.

The following are the companies and ETFs I have selected for you:

- Apple (NASDAQ:AAPL)

- BlackRock (NYSE:BLK)

- British American Tobacco (NYSE:BTI)

- LVMH Moët Hennessy (OTCPK:LVMHF)

- Mastercard (NYSE:MA)

- Nike (NYSE:NKE)

- Pfizer (NYSE:PFE)

- Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF

- TotalEnergies (NYSE:TTE)

- Verizon (NYSE:VZ)

Overview of the Selected Companies

|

Company |

Sector |

Industry |

Country |

Dividend Yield |

5 Year Average Dividend Growth |

|

Apple |

Information Technology |

Technology Hardware, Storage and Peripherals |

U.S. |

0.51% |

11.85% |

|

BlackRock |

Financials |

Asset Management and Custody Banks |

U.S. |

2.73% |

14.31% |

|

British American Tobacco |

Consumer Staples |

Tobacco |

GBR |

6.78% |

-1.26% |

|

LVMH |

Consumer Discretionary |

Apparel, Accessories and Luxury Goods |

FRA |

1.42% |

22.13% |

|

Mastercard |

Information Technology |

Data Processing and Outsourced Services |

U.S. |

0.65% |

17.37% |

|

Nike |

Consumer Discretionary |

Footwear |

U.S. |

1.16% |

11.14% |

|

Pfizer |

Health Care |

Pharmaceuticals |

U.S. |

3.20% |

5.70% |

|

Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF |

ETF |

ETF |

U.S. |

3.38% |

13.74% |

|

Total |

Energy |

Integrated Oil and Gas |

FRA |

4.62% |

-0.06% |

|

Verizon |

Communication Services |

Integrated Telecommunication Services |

U.S. |

6.65% |

2.07% |

|

3.11% |

9.70% |

Source: Seeking Alpha

Apple

Apple has clearly outperformed the S&P 500 over the past decade: while the S&P 500 has shown a Total Return of 217.51%, Apple has shown 703.73%. In my opinion, the company might be able to continue outperforming the S&P 500 over the next years, particularly due to its strong competitive advantages: Apple’s competitive advantages include, among other factors, a high level of customer loyalty, its own ecosystem and its strong brand value.

Furthermore, I don’t think Apple has a high Valuation at this moment: the company currently has a P/E [FWD] Ratio of 20.30. Furthermore, my discounted cash flow (“DCF”) model shows a compound annual rate of return of almost 14% at its current stock price. I consider this compound annual rate of return to be very attractive, especially considering that I have assumed a Revenue and EBIT Growth Rate of only 6% for the company over the next 5 years and a Perpetual Growth Rate of 4% afterwards.

BlackRock

Over the last years and even decades, BlackRock has continuously managed to increase its dividend year by year: BlackRock’s Dividend Growth Rate 10Y [CAGR] is 12.52% and its Dividend Growth Rate 5Y [CAGR] is even higher (14.31%). Both Growth Rates are significantly above the Sector Median (8.17% and 8.22%).

The company has a Free Cash Flow Yield [TTM] of 4.13%, which reinforces my opinion that it’s currently an attractive investment.

BlackRock’s relatively low Payout Ratio of only 50.94% further suggests that the Dividend is relatively safe. My opinion is reinforced by the fact that the company has shown a Free Cash Flow Per Share Growth Rate [FWD] of 23.18% on average over the last 5 years.

British American Tobacco

British American Tobacco has a high Gross Profit Margin [TTM] of 82.47% and EBIT Margin [TTM] of 41.35%. The company’s Gross Profit Margin [TTM] is 162.88% above the Sector Median (31.37%) and its EBIT Margin [TTM] is 411.05% above (8.09%). Both indicate the excellent market position of the company.

In addition to that, British American Tobacco pays its shareholders an attractive Dividend Yield [FWD] of 7.37%. The company’s Dividend Yield is 186.29% higher than the Dividend Yield of the Sector Median (2.58%).

Furthermore, the company’s Free Cash Flow Yield [TTM] is currently 13.35%. This high Free Cash Flow Yield reinforces my belief that the company is best suited for this portfolio, since it contributes to being attractive in terms of risk and reward and therefore makes it an excellent choice for dividend income and dividend growth investors.

LVMH

LVMH is the largest Luxury Goods Manufacturers in the world in terms of Market Capitalization ($368.17B) and also when it comes to Revenue ($75.72B). The company has managed to be among the most valuable brands in the world and possesses strong financials: its strong financials are underlined by a high EBIT Margin of 27.29% as well as an A1 credit rating by Moody’s. Its EBIT Margin is 242.97% above the Sector Median (7.96%), which is an indicator of the strong competitive advantages the company has over its rivals from the Apparel, Accessories and Luxury Goods Industry.

A Dividend Growth Rate [CAGR] of 24.43% over the past 10 years is an additional indicator that the company is an excellent fit to increase the Average Dividend Growth Rate of this portfolio.

Mastercard

Mastercard is one of the largest positions of my own investment portfolio. One of the main reasons being that I consider the company to be an excellent risk/reward choice. A high EBIT Margin [TTM] of 56.97% is proof of its excellent competitive position within its Industry. The company’s EBIT Margin [TTM] is 760.20% above the Sector Median (6.62%).

When comparing Mastercard’s EBIT Margin [TTM] with its Average EBIT Margin of the past five years (55.34%), we can see that the company has been able to further increase its profits in recent years. Due to its strong competitive advantages, I believe that Mastercard will be able to further increase its margins in the years ahead.

In addition to the above, the company’s Dividend Growth Rate 5Y [CAGR] of 17.37% indicates that it should be able to deliver attractive Dividend Growth for its shareholders in the coming years. This makes Mastercard an excellent fit for this portfolio.

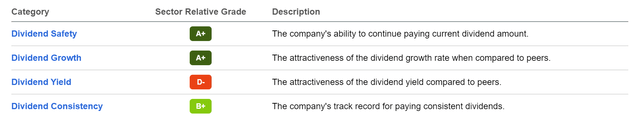

The Seeking Alpha Dividend Grades, that you can find below, confirm that Mastercard is a great choice for investors that seek Dividend Growth. The company receives an A+ rating for both Dividend Safety and Dividend Growth.

Nike

Nike is part of this selection as I believe it will be able to contribute significantly to the Dividend Growth of your investment portfolio when investing with a long investment-horizon.

Nike is the world’s leading sporting goods manufacturer in terms of Brand Value, Revenue and Market Capitalization. I consider the company to be a must have stock for an investment portfolio that aims to achieve Dividend Growth.

Nike has shown a Dividend Growth Rate [CAGR] of 14.55% over the past 10 years, which is a strong indicator that the company should be able to contribute to the Dividend Growth of your Portfolio.

In my opinion, Nike is an excellent buy and hold investment due to its strong competitive advantages. To name just a few of them: high brand value, long-term contracts with the world’s leading sports clubs and athletes as well as its continuous focus on product innovation.

Pfizer

In my opinion, Pfizer is an attractive pick to be part of this selected portfolio. This is due to the company providing its shareholders with an attractive Dividend Yield [TTM] of 3.50% and, at the same time, it has shown a relatively attractive Dividend Growth Rate of 5.90% over the past 5 Years.

Pfizer’s high EBIT Margin [TTM] of 39.96% further confirms that the company has an excellent competitive position. Furthermore, it can be highlighted that Pfizer has been able to increase its EBIT Margin over the recent years. Proof of this is the fact that its EBIT Margin [TTM] is significantly higher than its Average EBIT Margin of the past 5 years (32.59%).

Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF

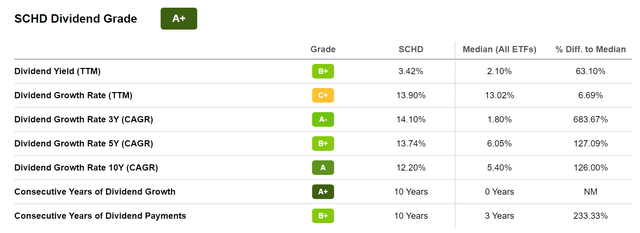

The Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF is also part of this portfolio: this is particularly due to the fact that this ETF units a combination of Dividend Yield and Dividend Growth extremely well: its Dividend Yield [TTM] is currently 3.38% and the Dividend Growth over the last 3 years is 14.10%. These figures are clearly above the Sector Median of all ETFs (Dividend Yield [TTM] of 2.10% and Dividend Growth Rate [CAGR] of 1.80% over the past 3 years). The Dividend Grades below confirm the strong Dividend of this ETF.

TotalEnergies

Several factors contribute to make TotalEnergies part of this investment portfolio: the company has a Dividend Yield [FWD] of currently 4.54%, which is 43.44% above the Sector Median (3.16%). Additionally, it is currently attractive when it comes to Valuation: the company has a P/E GAAP [FWD] Ratio of 5.56, which is 32.10% below the Sector Median (8.20). Its Valuation is significantly lower than the one of its U.S. competitors such as Exxon Mobil (NYSE:XOM) (P/E [FWD] Ratio of 8.21) and Chevron (NYSE:CVX) (9.26).

TotalEnergies has a relatively high EBIT Margin [TTM] of 19.29%, which is 102.17% above its Average EBIT Margin [TTM] over the past 5 years, indicating that the company has managed to increase its profits significantly in recent years.

Verizon

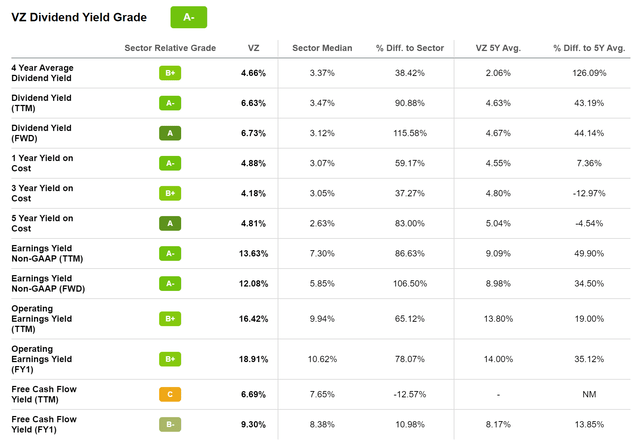

At this moment in time, I consider Verizon to be very appealing for investors. This is because the company pays its shareholders a relatively high Dividend Yield [FWD] of 6.73%, has a relatively low Payout Ratio (48.63%), has shown 18 years of Dividend Growth, and, at the same time, it currently has an attractive Valuation. Verizon’s P/E GAAP [TTM] is 8.44. Its current Valuation is 48.35% below the Sector Median, serving as an indicator for investors that the company is undervalued.

Below you can find an overview of the Seeking Alpha Dividend Grades for Verizon. The numbers strengthen my belief that Verizon is an excellent fit for dividend income investors.

Conclusion

The objective of this article was to show you how you could build an investment portfolio which, on the one hand, already provides you with an attractive Dividend Yield today, and, at the same time, is able to provide your investment portfolio with Dividend Growth. This makes it possible to constantly increase your Dividend while having a long investment-horizon, thus helping you to steadily increase your additional income.

I see the combination of the companies that I have chosen for this portfolio as being attractive. This is because they provide you with an Average Dividend Yield of 3.11% and, additionally, the 10 picks have shown an Average Dividend Growth Rate of 9.70% over the last 5 years. This strengthens my belief that they should be able to raise their dividend by a significant amount in the years ahead.

Part of this portfolio is an ETF (The Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF), which is an excellent choice from my point of view, since it combines a high Dividend Yield [TTM] (3.38%) with Dividend Growth (Dividend Growth Rate 5 Year [CAGR] of 13.74%).

In my opinion, the individual selection of stocks for an investment portfolio is important. This is because it offers you several advantages over investing only in ETFs: it gives you more individuality, you can achieve a higher Dividend Yield and Dividend Growth Rate compared to only investing in an ETF, and, at the same time, you can select companies that provide you with the chance to receive monthly dividend payments instead of only quarterly payments.

In addition to that, you can protect your investment portfolio for the next stock market crash by selecting stocks with a low Beta Factor: a Beta Factor of less than one is an indicator that the risk of investing in the stock is lower than investing in the broader stock market.

Authors Note: I hope that this article was useful for you and can serve as a starting point to build your personal investment portfolio that aims to achieve a balanced mix of Dividend Income and Dividend Growth. I would appreciate any feedback on this article! Thank you very much!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment