metamorworks

We find it fun when an interesting company enters the public markets since it gives us the opportunity to analyze a new business and value it. What we have seen is that companies just entering the public markets tend to be more inefficiently valued, sometimes undervalued but far more commonly overvalued. One such company that has re-entered the public markets after having been privatized is Getty Images (NYSE:GETY), which recently became public once again through the merger with a SPAC.

Company Overview

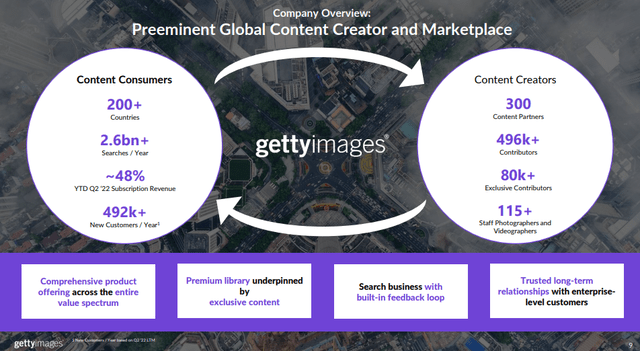

We like platform businesses because they tend to benefit from network effects, as more users join the platform it becomes more valuable and the competitive moat increases. In Getty Images’ case, it is a two-sided marketplace platform, which has on one side content creators such as photographers and musicians and other creatives, and on the other side of the platform it has businesses, ad agencies, entrepreneurs, and other types of content consumers. In general, the more content creators on the platform the better the experience for content consumers and vice versa. This creates a powerful flywheel that increases the competitive moat as the platform grows.

Getty Images Investor Presentation

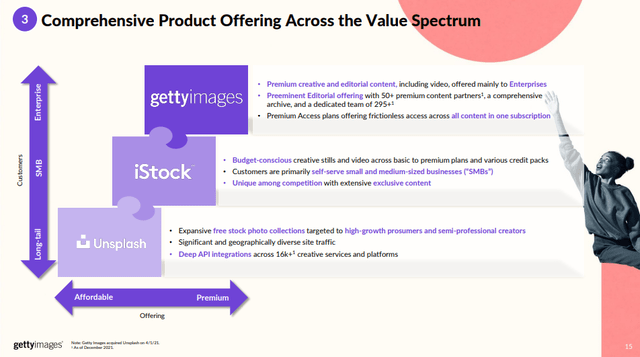

Getty Images is one of the few companies that has reached enough scale to be profitable in this business and attractive to customers. One of the few competitors that has also reached critical mass is Shutterstock (SSTK). In fact, there are so few competitors that Getty Images competes against itself, by offering similar services through other lower cost channels. It has iStock for the smaller self-serve customers, and the well know free photo site Unsplash, which is monetized mostly through advertising. For all these reasons we believe that Getty Images is a terrific business, one with a strong competitive moat and scale advantages, and a smart go-to market strategy.

Getty Images Investor Presentation

Q2 2022 Results

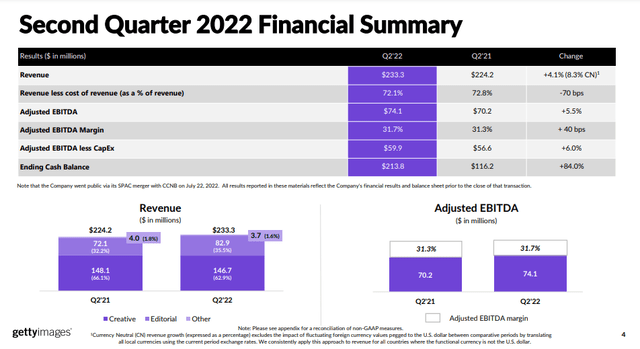

The company reported solid Q2 2022 results, with most financial metrics trending up. Revenue was up +4.1% despite currency headwinds, the cash balance was significantly higher after the SPAC combination, and adjusted EBITDA was up slightly more than revenue, showing signs of operating leverage.

Getty Images Investor Presentation

Looking at some of its key operating metrics and y/y increases, the number of images in its collection was up +7% to 474 million, its video collection was up +22.2% to 22 million, and the last twelve months total purchasing customers was up +12.6% to ~843,000.

Competitors

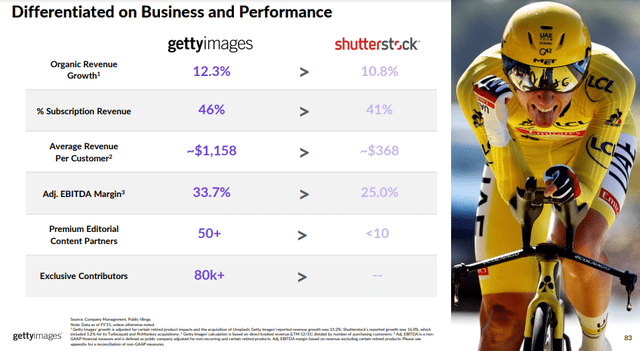

Getty Images compares favorably against Shutterstock on a number of measures, including organic growth rate, percentage of revenue coming from subscriptions, average spent per customer, adj. EBITDA margin, and content partners. We do believe that Getty Images deserves a valuation premium over Shutterstock for these reasons, but as we’ll soon see, the current valuation premium is excessive in our opinion.

Getty Images Investor Presentation

Growth

Getty Images believes that it can grow significantly in a number of ways. First, it believes it can continue increasing annual subscription revenue with a comprehensive suite of subscription products, mostly for Getty Images and iStock. Second, it believes there is significant room for growth in video. Currently only about 25% of Getty Images customers license video, and only about 9% of its iStock customers do so as well. Video is growing rapidly, with FY’21 y/y growth of 19%. Third, Getty Images believes it has room to increase its investments in marketing. It estimates that an additional 1% in marketing spend as a percentage of revenue drives ~7% of incremental growth. It remains to be seen if it can really get that type of performance improvement from increasing marketing spend, but if the company is right this could unlock a lot of growth. Currently Getty Images is spending ~6% of revenue in marketing, compared to ~15% for Shutterstock.

Financials

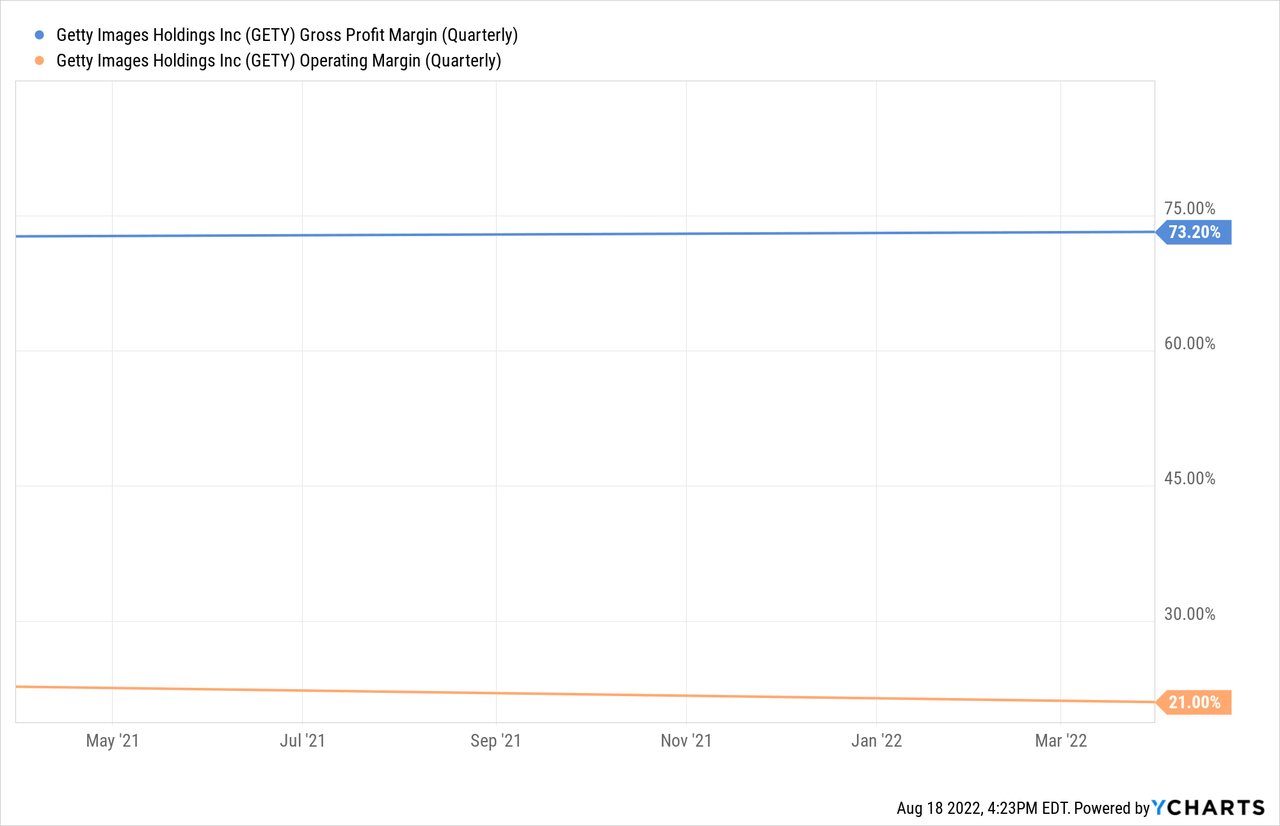

Another reason we believe Getty Images is a terrific business is that it has very high profit margins, with gross profit margin ~73%, and operating profit margins around 21%. These margins are a reflection of the competitive moat the company has, which together with the potential growth make Getty Images a very attractive business.

Balance Sheet

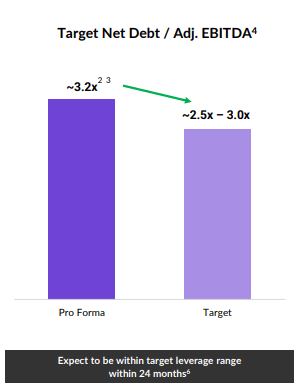

The company does have a significant amount of debt, with a pro forma net debt to adj. EBITDA leverage ratio of ~3.2x. The company is looking to deleverage to a target ratio of around 2.5x to 3.0x.

Getty Images Investor Presentation

Valuation

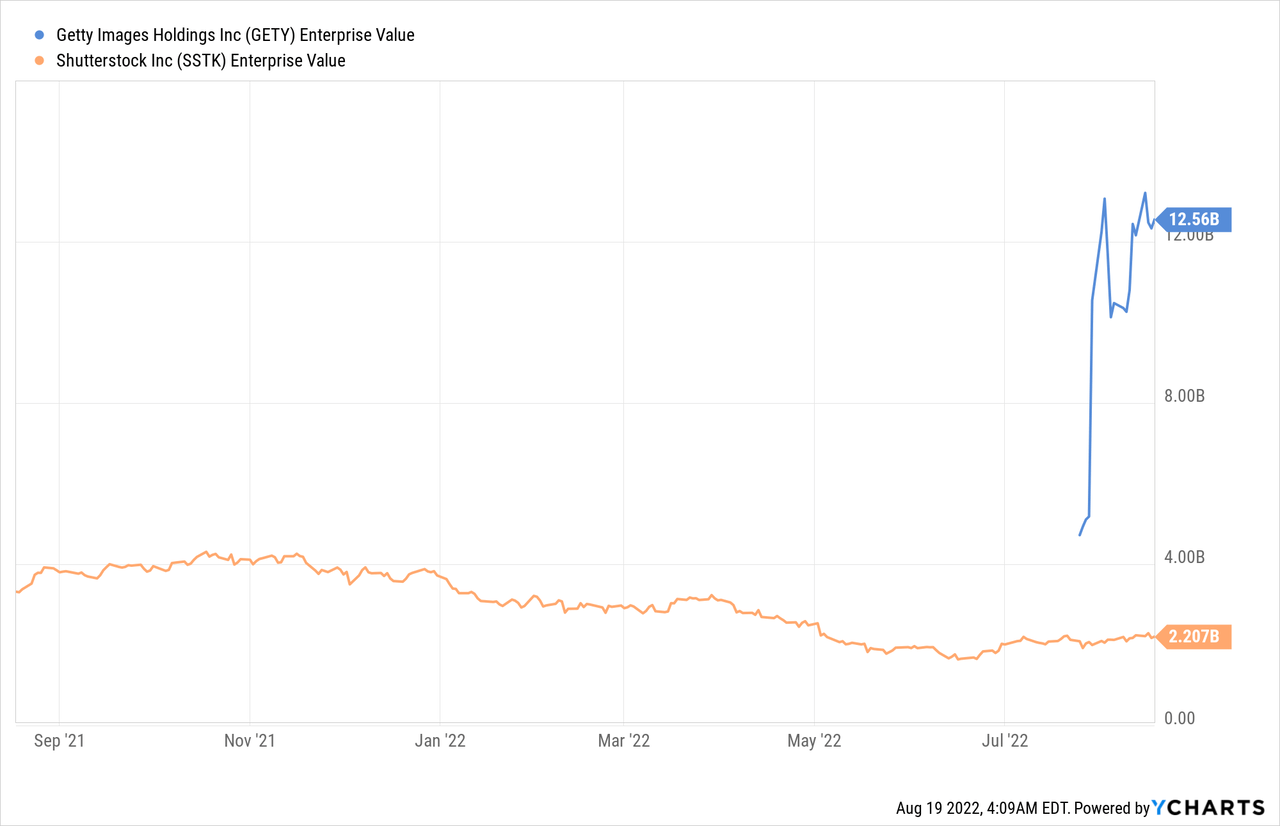

The main problem we have with Getty Images is its ridiculous valuation at current prices. This becomes clear when comparing its valuation against its closest competitor Shutterstock. Both companies are similar in size in terms of revenue, with Getty Images guiding to almost $1 billion in revenue for FY22, and Shutterstock having trailing twelve months revenue of ~$800 million. Despite the similar size of the businesses, Getty Images is trading with an enterprise value of almost 6x that of Shutterstock. We do believe Getty Images deserve a premium valuation, but being valued at such a huge premium is just ridiculous and we will be very surprised if it lasts. SPACs have had a tendency to spike when they start trading, only to see their share prices decline to more reasonable valuations after some time in the market.

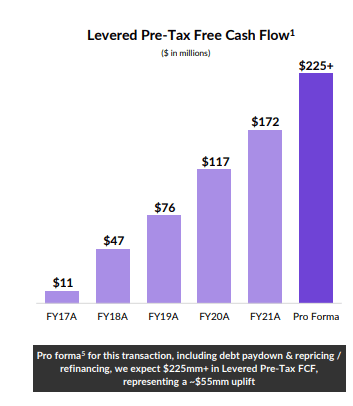

Looking at other metrics beyond revenue, we get a similar conclusion. For example, Getty Images estimates its pro forma pre-tax levered free cash flow at ~$225 million. That means that at ~$12 billion, the company is trading at ~55x pre-tax free cash flow.

Getty Images Investor Presentation

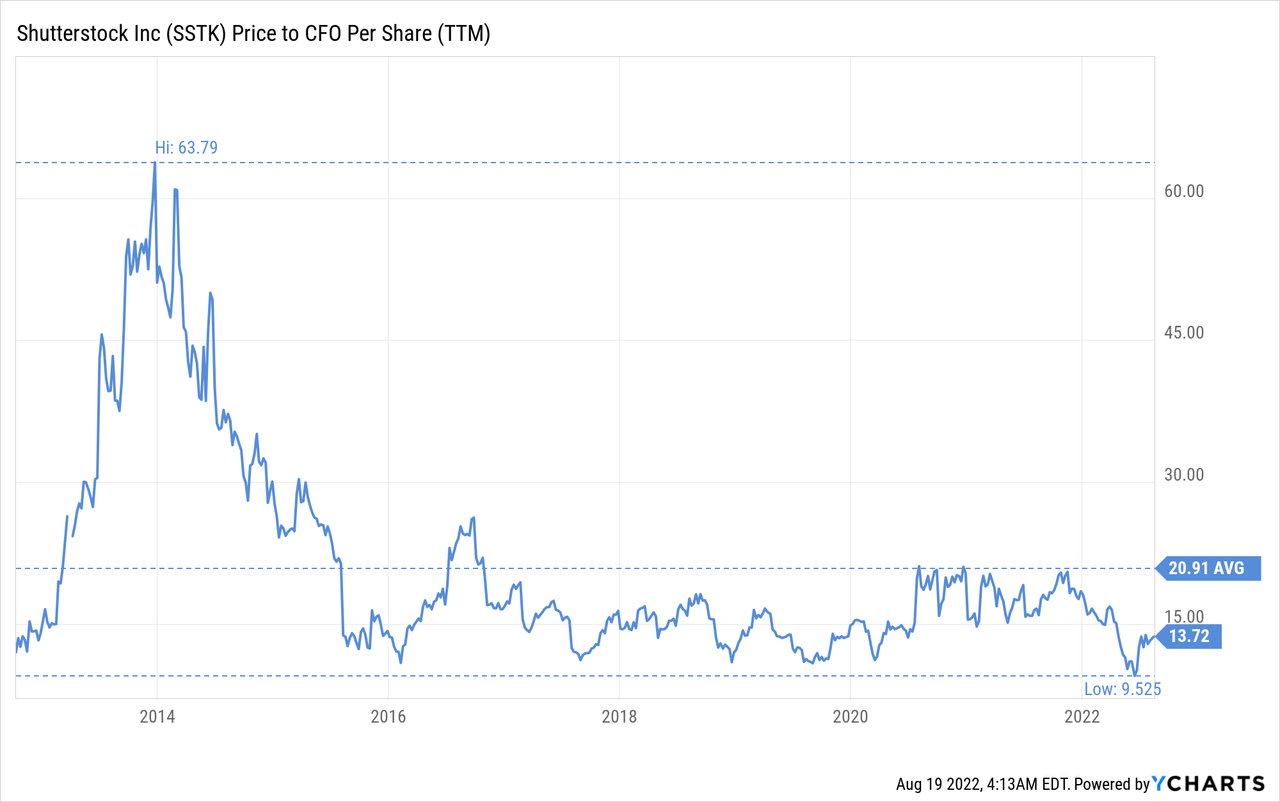

Meanwhile Shutterstock is trading at less than 15x cash flow from operations. Getty Images is therefore getting a ~4x valuation premium over Shutterstock. We don’t think that Shutterstock is incredibly undervalued, but instead that Getty Images is significantly overvalued.

Risks

We believe that the main risk for Getty Images investors is the overly stretched valuation. It would not surprise us that once the excitement from entering the market subsides, that shares will move lower to a more rational valuation. While we view Getty Images as an attractive company, we have to remember this is not a hyper growth company that deserves sky-high valuation multiples. There is also some risk from the debt load the company carries, but the risk is mitigated by management’s commitment to deleverage.

Conclusion

We believe Getty Images is a terrific company with highly durable revenue, strong profit margins, and free cash flow generation. The company is guiding for long-term revenue growth in the 5-7%+ range, which we believe is achievable, and with some operating leverage earnings could grow in the high single digits to low double digits percentages. Unfortunately, shares are currently trading at a ridiculously high valuation, both in absolute terms and compared to its closest competitor.

Be the first to comment