With falling equity markets, Treasury yields, and mounting fears surrounding the coronavirus, the Federal Reserve, or the Fed, has responded with a historic 50 basis point cut in interest rates.

The Treasury yield curve, equity markets, including bank stocks like Bank of America Corporation (BAC), have all fallen.

In this article, I analyze U.S. growth and Treasury yields as well as the expected hit to revenue that the bank could face in the upcoming months. From there, we’ll explore the key stock price levels for the correction and the relief rally.

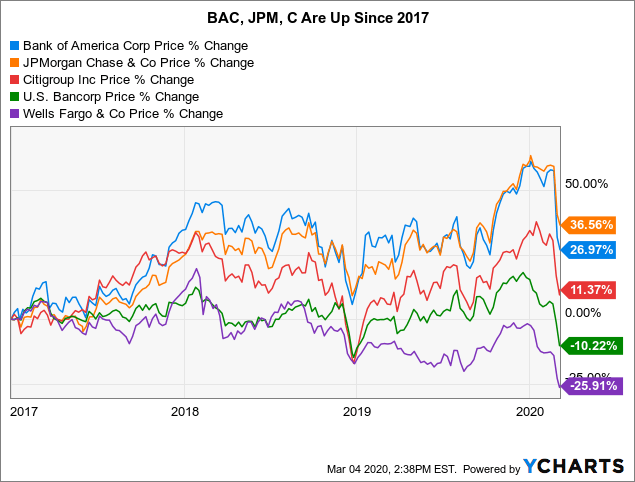

Misery Loves Company

Banks are down by double-digit percentages, including BofA, which is down over 19% since early February (in blue).

- JPMorgan Chase & Co. (JPM) is down 14%.

- Citigroup Inc. (C) is down ~16%.

- U.S. Bancorp (USB) down 15.5%.

- Wells Fargo & Company (WFC) is down 14.5% since then.

2017 Perspective

To put the markets in perspective, the major banks are still up since 2017 except for WFC and USB.

- BofA is still up over 26% since January 2017.

- JPMorgan Chase & Co. is up 36%

- Citigroup Inc. is up ~11%.

- U.S. Bancorp down -10%.

- Wells Fargo & Company is down -25%.

However, it’s those 2017 levels that are likely to be challenged if we have another move down and a deterioration in the economy.

Data by YCharts

Data by YCharts

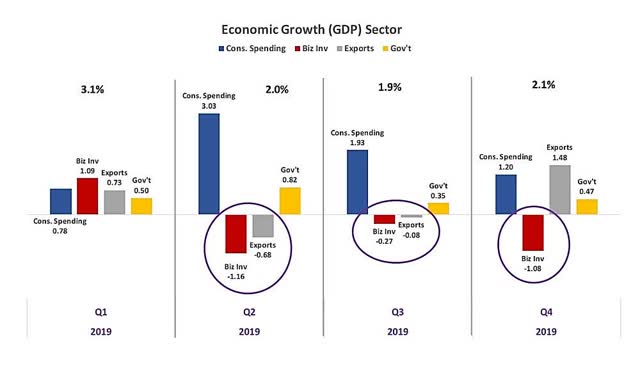

The Hit to the Economy

I’ve highlighted this chart before, but I wanted to show how U.S. growth was challenged before Coronavirus.

Below are the four key drivers for growth in the U.S. economy: consumer spending, business investment, exports, and government spending.

If Coronavirus outbreaks continue, it’s likely that we’ll see a further drop in consumer spending, business investment, and fewer exports overseas.

Data source: BEA. The graph and analysis by Chris B Murphy.

Data source: BEA. The graph and analysis by Chris B Murphy.

Also, with China slowing and Europe and Japan close to a recession, it’s unlikely that U.S. foreign sales will increase this quarter or next quarter.

However, that doesn’t mean we’re in a recession; it could simply mean that we’re in an economic slowdown, meaning approximately .5% to 1.5% growth in the U.S.

Treasury Yields

The 10-year Treasury yield is typically driven by the market – reflecting expected economic growth and inflation – but it also reflects the nervousness in the global markets as capital rushes into bonds for safety. The 2-year yield is driven, in part, by the Fed’s monetary policy.

To the Fed: Be Careful What You Wish For Mr. J. Powell

The Fed wanted lower rates, and it’s likely that’s where we’re headed.

- The 10-year yield broke an all-time low below 1.43% (orange line).

- The 2-year yield is not far behind since it looks like the market will test .196% for the 2-year’s all-time low.

- It’s hard to imagine that the 10-year yield was at 1.95% in December 2019, and it’s fallen approximately 100 basis points since then.

It’s likely the fall in yields will have a negative impact on bank stocks like Bank of America. How much of an impact on the stock falling yields will have is uncertain, since we’re in uncharted territory for the 10-year yield. The Fed clearly wants lower rates at the short-end of the curve, and if they’re not careful, it may get out of control.

If the coronavirus worsens significantly in the U.S., it’s possible the market will anticipate further rate cuts by the Fed at their March meeting and beyond. That’ll likely push the 2-year yield lower-to test its all-time low of .196%.

Negative Yield: There’s an outside chance that if the 2-year breaches below .196% before the Fed’s March meeting and they cut another 25 bps, we could see a negative yield for the 2-year Treasury.

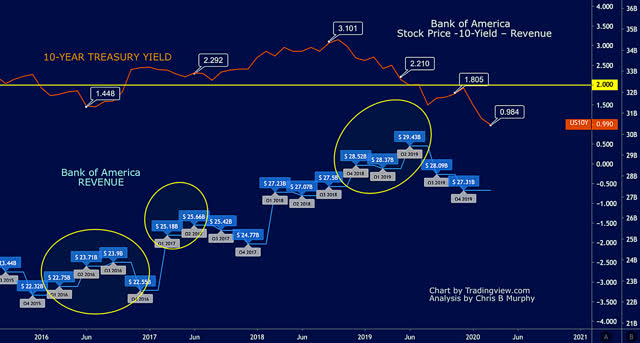

Revenue vs. 10-Year Treasury Yield

The combination of slower economic growth and lower yields is likely to lead to a short-term revenue hit for Bank of America in Q1 and probably Q2 2020. Also, the bank’s net interest margin, or NIM, as well as net interest income will likely decline as well.

Approximately 50% of Bank of America’s total revenue of ~$22 billion comes from net interest income. The profit from this income, or NIM, is predominantly from the spread or rates it charges for loans and credit cards versus the interest the bank pays to depositors.

Below is a chart comparing the 10-year yield with the quarterly revenue for Bank of America over the last few years.

- In 2019, revenue was $27 billion to $29 billion when the 10-year yield was expected to rise well above 2%, and possibly near 3%.

- In 2017 to 2018, revenue was $24 to 25 billion while the 10-year yield hovered around or just above 2%. (middle yellow circle)

- In 2016-2017, revenue was $22 to $24 billion when the 10-year yield was bearish and trading below 2% or near 1.44%. (far left circle)

Stock prices also move in anticipation of higher revenue as yields rise, and the economy improves. That’s why you see the revenue numbers lag behind the 10-year yield. For example, the bank produced approximately $29 billion in revenue in Q2-2019 well after the 10-year yield touched 3% in late 2018.

Revenue Takeaway

With the 10-year yield currently, at the time of this writing, below 1%, BofA is likely to take a $2 billion hit to revenue in Q1 and perhaps Q2.

Looking at the chart above, we can see that when the 10-year is near the 2% level, the bank produces ~$25B in revenue. It’s possible we could revisit $25B. Of course, BAC has generated new loans and clients since 2016-2017, so past results don’t equate to future performance.

However, from Q4-19 and into 2020, we can see a $2B revenue drop from the highs of $29B to $27B as the 10-year yield declined 100 basis points to 2%. We have to assume that another 100 basis point drop from 2% to ~1% will, at the very least, lead to another $2B hit to the top line or revenue.

Noninterest income should provide some stability, which is 50% of the bank’s revenue. However, trading income is included as fee income and will likely take a hit too.

Relief Rally & Correction Levels

Below are some key price levels that investors may have orders or institutional investors may have algorithm orders.

A relief rally could bounce BAC back to $29 and possibly $31 but watch for selling at those levels. I think if yields are still low on stock rallies, traders who didn’t have a chance to get out, might sell going into $30.

Watch $27.70 for any break lower, because it’s the February low. Anytime a stock breaks a previous monthly low is a sign of a strong short-term correction.

Watch $26.50 for any break lower, because the stock hit this level many times over the weeks and months since 2017.

The 50 and 200 monthly moving averages (yellow and orange lines respectively) should consolidate and offer huge support in the short term. It looks like they might line up around the $26.50 area so look for a lot of volatility in that zone.

Caution

Caution

Please watch yields on any BAC rally; price and yields should correlate together. Look for the 10-year yield to probably bounce back 1.43% or the previous all-time lows. Subsequently, look for BAC to bounce as well.

However, if yields don’t jump on price moves higher, the stock is gonna come back down. This is no time to be a hero; please watch for the fundamentals to support the price moves.

Takeaways

It’s really hard to determine the true impact of yields and the coronavirus on revenue in Q1 since January should have been decent for the bank. The impact of the coronavirus on economic growth has yet to be fully realized, but it’s likely that the yield curve is pricing in a recession and a substantial U.S. outbreak.

Whether the move in yields is overdone remains to be seen. But if the Fed is going to continue to cut rates this year, it’s clear that we will see lower yields for longer.

Even if we have an economic slowdown whereby the U.S. has one quarter of little-to-no economic growth, but the coronavirus gets resolved, banks are still bullish in the long term. Bank of America can handle a $2-to-$4 billion hit to revenue and still hold up pretty well. I believe the market is pricing in far worse.

It’s only if we have two quarters of negative growth, a recession, that there will be a prolonged bear market for bank stocks, in my opinion. However, please monitor the economic numbers coming out in the upcoming weeks. Bank of America’s earnings report is a month-and-a-half away. Look for downgrades to the forecast for the 2020 numbers including the upcoming quarter.

More to follow. Good luck out there.

To have the next article emailed to you, click the “Follow” button and check “Get email alerts.”

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment