Kevin Winter/Getty Images Entertainment

Preferred shares tend to evoke warm fuzzy feelings as they come with big yields and higher protection. They tend to attract the “I want my dividend, capital losses be damned”, crowd. There is nothing wrong with that, most of the time. Permanent losses on preferred shares are rare and if you are happy with the yield you start off with, you generally are happy. There are exceptions of course and mandatory convertible preferred shares lead that exception list. Paramount Global (NASDAQ:PARA) and its preferred shares, Paramount Global 5.75% SR A Mandatory Convertible Preferred 01/04/2024 (PARAP) are stocks that we have extensively covered previously. When we last wrote on this pair we marveled at the fact that sanity had returned into the market.

At present, PARAP should track PARA very well, although your relative total return will be impacted to some extent on taxation of dividends. We will be watching PARAP carefully to see if it offers an advantaged long entry into PARA at some point.

Source: 13.86% Yielding Shares No Longer A Trap

What a silly thesis that turned out to be. PARAP shareholders pretty much decided right there and then that they were not going to let math stand in their way and went ahead to create another widespread.

What Do We Mean By That?

PARAP converts, forcefully, into PARA. In case you are just being acquainted with this knowledge and you dared to ask “when?”, then you literally missed the description of the shares.

That conversion is now loss making again. There are two reasons for this. The first being that PARAP is so expensive relative to PARA. The second being that those large dividends which investors wrap around themselves like a security blanket, are coming to an end. When we first pointed out discrepancies in this spread there were almost 3 years of dividends left. We are now down to just 7 (1.75 years).

So today if you bought, or even hold (for those who keep saying we did not buy it today) these shares, the math is rather bad.

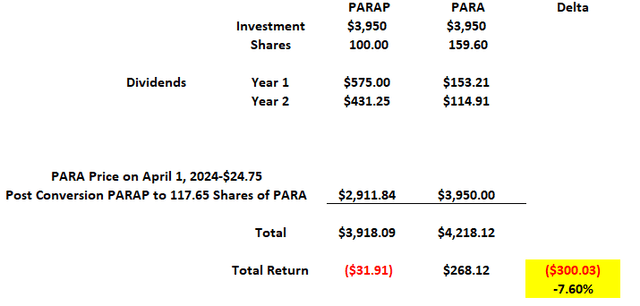

100 Shares for PARAP works out to $3,950. For that price you can get about 159.6 shares of PARA at $24.75.

100 Shares of PARAP produce a gigantic $575 in dividends. PARA can hardly compete with that but there is a respectable $153.21 coming your way annually.

Now let’s run that altogether.

Assuming PARA stays constant between now and April 1, 2024, you take a $31.91 loss on your investment. This would expand to over $131.91 assuming a 15% tax on dividends. So you are taking a good sized hit even after dividends.

Compared to PARA you are worse off, to the tune of 7.60% on your investment.

But I am Bullish!

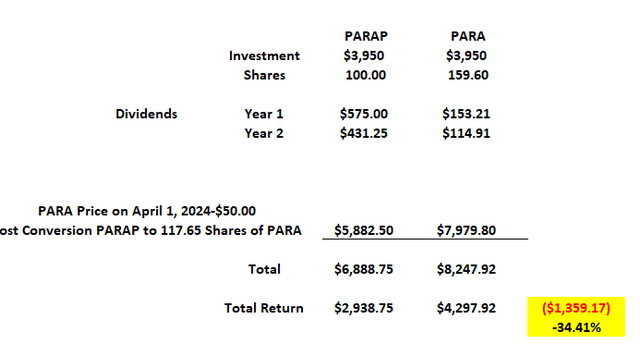

This seems to be the biggest counter argument for throwing themselves into this money pit. PARA will rise and hence PARAP will do well. That is actually a bigger fallacy than just buying it for the imaginary “dividend”. The reason is that the higher PARA goes, the worse is your relative position. For example, if PARA doubles, your gain on PARAP is 34.41% less.

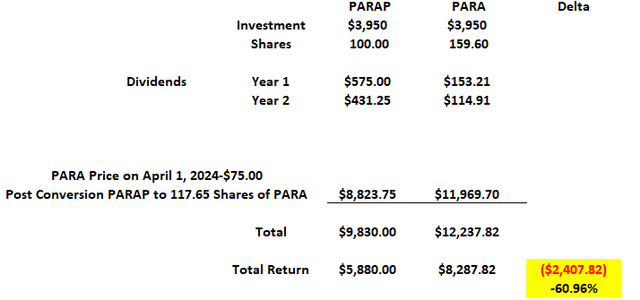

If PARA triples, your relative gain on PARAP is even worse.

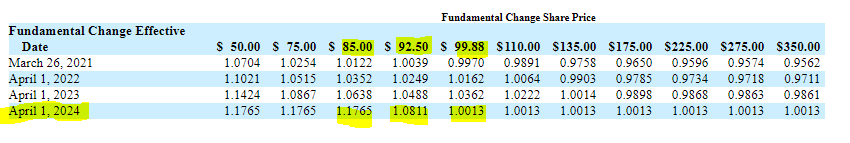

We have not even gone to the fantastical heights where PARAP conversion ratio drops off.

PARA 10-K

PARA’s advantage grows, the higher it goes.

The Logical Stance

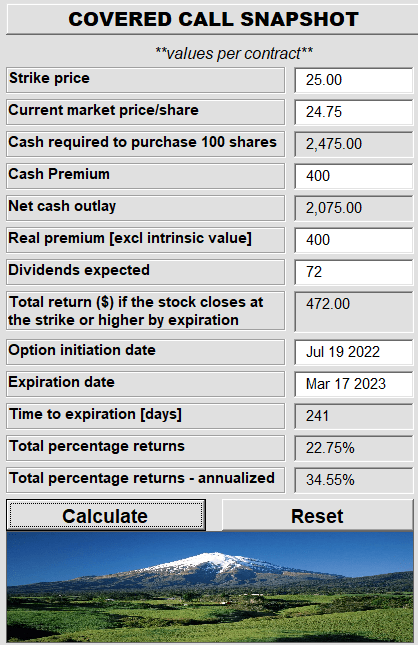

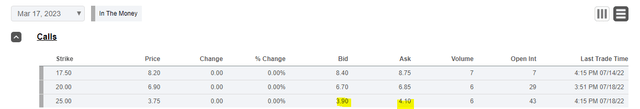

If you are bullish on PARA, the shift from PARAP to PARA makes sense again today. Investors wanting a higher yield, can use the options on PARA to add the extra income. For example, the March 2023 $25 calls can be sold for about $4.00.

This would create a total yield of 34.55% assuming the price just stays flat.

Author’s App

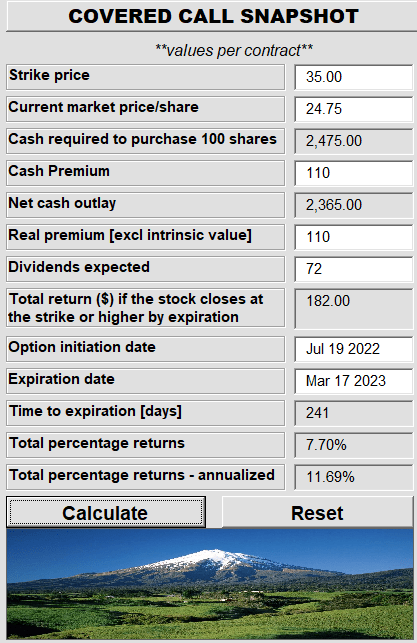

This is more than twice that on the preferred shares, even ignoring that the preferred share yield is pure fiction. If you are more bullish on PARA, you can consider a further strike option. The $35.00’s would create a double digit total yield, but obviously it would be far lower than the closer strike.

Author’s App

Whichever way you go, remember that the large yield of PARAP is a mirage.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment