shaunl/E+ via Getty Images

I have Douglas Dynamics (NYSE:PLOW) rated as a Buy at this point in time for the following reasons:

- PLOW has decent fundamentals, but they look better compared to their true competitors.

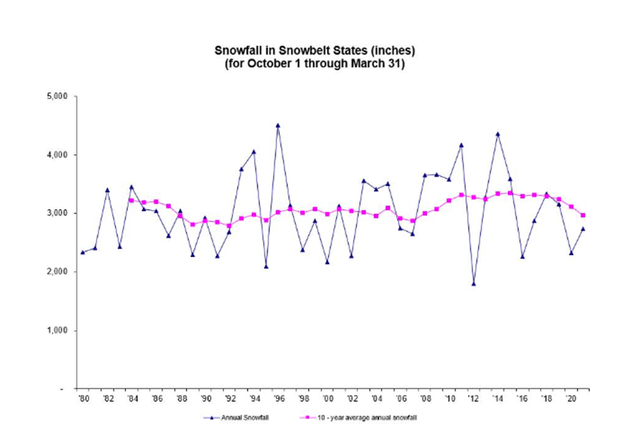

- Their product line is very niche and will be in demand for quite some time due to consistent snowfall.

- They are market dominant in their product line of plows and salt spreaders.

- A very conservative DCF indicates the share price is at fair value and they tote a healthy 3.43% dividend.

- There are some risks with supply chain, and they are heavily dependent on senior management, but I believe PLOW has a good grasp on addressing these.

- Their cash generation hasn’t been eye opening, but they’ve done a good job paying off their debts with excellent results in their recent Q2 earnings.

- It is better to enter a position now, rather than waiting for winter to come, when the price will most likely rise.

Business Overview

Douglas Dynamics is a small cap premier manufacturer and upfitter of commercial work truck attachments and equipment. Their product line includes snowplows and salt spreaders for light trucks under their “Work Truck Attachment Segment” and other upfitting solutions in their “Work Truck Solutions Segment”. Their business strategy is manufacturing their product line and selling to a distributor network of professional snowplow contractors.

Summary

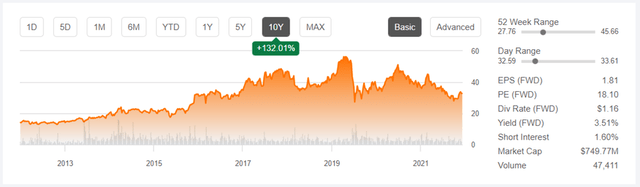

PLOW is currently trading near the bottom third of the 52-week range. This is most likely because PLOW dropped in revenue, profit, net income, and free cash flow in the height of the pandemic in 2020.

Share Price The Last 10 Years (Seeking Alpha)

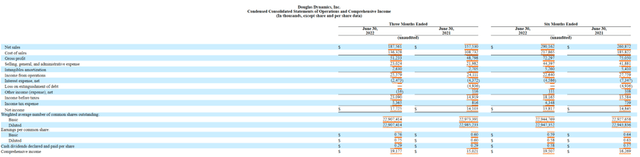

Recent Q2 earnings have shown drastic improvements in these values, including the refinancing their debt. The recent income statement shows increase in Net Sales, Gross Profit, and Net Income.

Income Statement (Douglas Dynamics 10-Q)

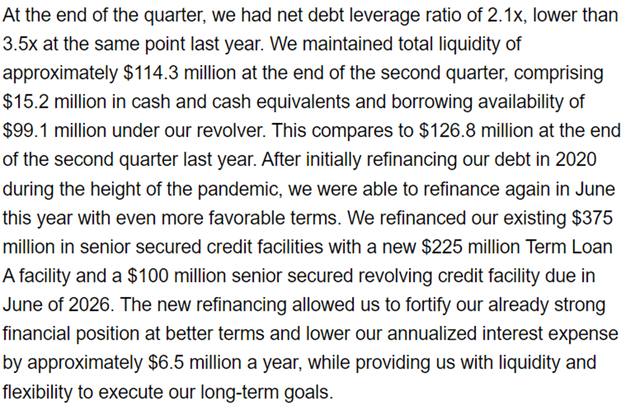

As noted, they didn’t generate as much cash compared to June of 2021, because much of it was going towards financing debt.

Douglas Dynamics, Inc. (PLOW) CEO Robert McCormick on Q2 2022 Results – Earnings Call Transcript (Seeking Alpha)

Despite a struggling supply chain, this cyclical stock is trading at a low price and still generating revenue, profits, and paying off debt. Contractors are most likely putting their orders in now to get ready for winter, but the market is not investing to help PLOW in this same regard. Now seems to be a good time to build a position as this stock will most likely be trading out of “buy range” in the winter, especially if we see more than normal snowfall.

Average Snowfall in Snowbelt States (Douglas Dynamics 10-K)

By looking at this trend provided by PLOW’s 10-k, we can see snowfall generally remains constant over the last 40 years, with some instances of very high and very low years. This is the type of stock that seems tricky to constantly buy and sell by trying to predict weather patterns. Though weather monitoring technologies improve, its generally considered impossible to predict years out. It makes more sense to buy at a low price and reap the rewards during high years when they inevitably come. What makes PLOW special is they can generate cash during low snowfall years and with supply chain disruptions. They do this by splitting part of their business into non weather pertaining solutions in their work truck solutions segment which is also growing.

Douglas Dynamics, Inc. (PLOW) CEO Robert McCormick on Q2 2022 Results – Earnings Call Transcript (Seeking Alpha)

Overall, PLOW had a struggling 2020 but there is light ahead after seeing their Q2 results. They are doing a good job building the cash back up, while paying off debt. They provide the investor with a sense of safety by proving the snow removal market demand, and by splitting their business into industries that do not rely on weather conditions. This is a good start, but we still need to look at valuation, risks, competitors and other aspects to determine if this will be a good pick entering the winter.

Valuation

DCF Analysis

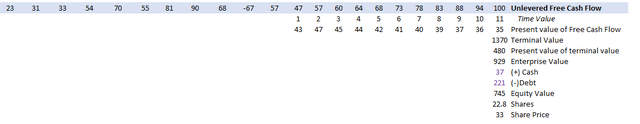

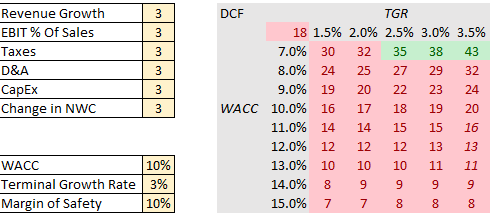

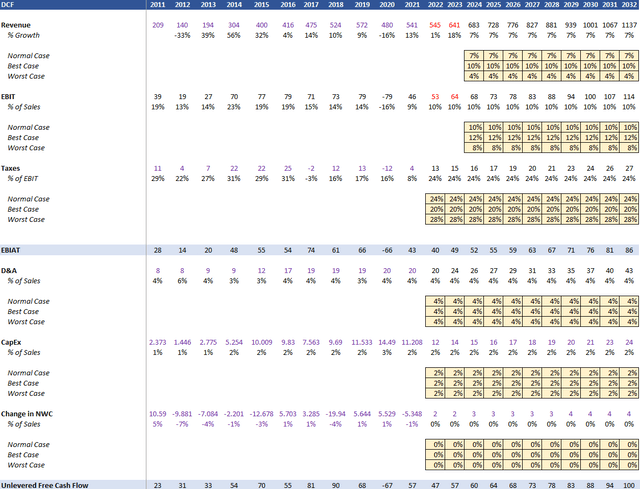

A fair value of $32 per share was found by a 10-year Unlevered DCF analysis using CAPM and averaging a worst case, best case, and normal case scenarios. Revenue and EBIT projections were used from average results of (12) analysts for 2022 and 2023 from Financial Modeling Prep. Personal projections were used thereafter with the following conservative assumptions:

Revenue

- Normal Case Scenario: 7% YOY

- Best Case Scenario: 10% YOY

- Worst Case Scenario: 4% YOY

EBIT

- Normal Case Scenario: 10% YOY

- Best Case Scenario: 12% YOY

- Worst Case Scenario: 8% YOY

Taxes

- Normal Case Scenario: 24% YOY

- Best Case Scenario: 20% YOY

- Worst Case Scenario: 28% YOY

D&A: 4% YOY

CapEx: 2% YOY

Change in NWC: 0% YOY

WACC: 10%

Terminal Growth Rate: 2.5%

Margin of Safety: 10%

Judgement Day: 2032

After the assumptions were made, Unlevered Free Cash Flow was calculated and discounted to find a fair value.

Cash Flow Calculations (Author)

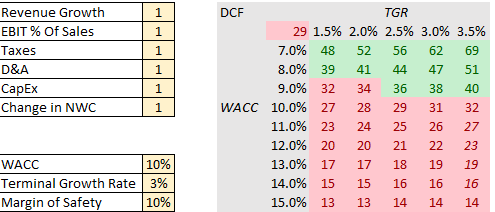

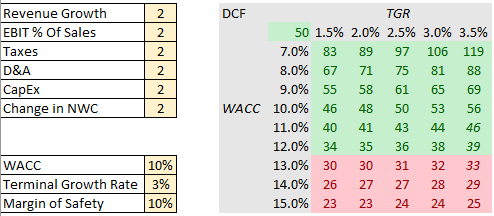

This was repeated for the three different cases and shown in each sensitivity table.

Sensitivity Table 1 – Normal Case Scenario (Author)

Sensitivity Table 2 – Best Case Scenario (Author)

Sensitivity Table 3 – Worst Case Scenario (Author)

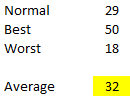

An Average of the three cases was taken to find a fair value of $32

Average of Cases (Author)

Douglas Dynamics seems to look in the buy range even with conservative values for revenue growth, and extremely conservative values for EBIT margin and a margin of safety. The DCF is fine to get a general feel about the price, but further valuations in some ratios and a comparative analysis was done.

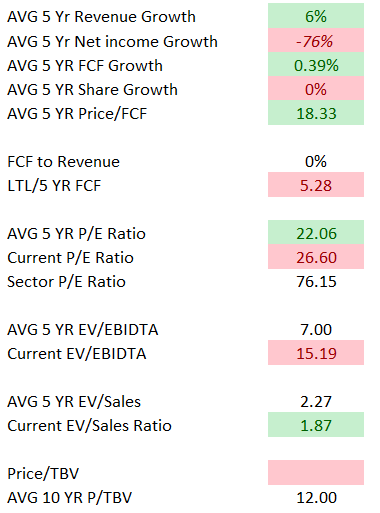

5 Year Averages (Author)

Douglas dynamics have decent fundamentals over the last 5 years. Though small, revenue growth and cash flow growth are a good sign. PLOW had an abysmal 2020 and 2021 regarding net income. This does raise red flags, but it is mostly due to the pandemic, supply chain issues, and paying off debt. They are having some issues paying off long term liabilities each year by looking at the LTL/5 YR FCF rating, but it’s not game breaking and they established improvements in their recent Q2 performance. Very high EV/EBIDTA compared to themselves, but this will be analyzed more in the comparative analysis. It looks like their EV/Sales is good, however.

Comparative Analysis

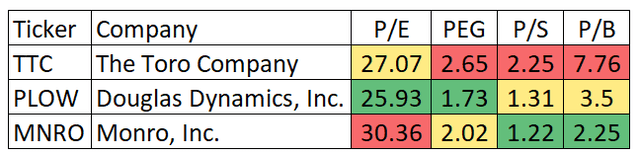

Plow mentioned in their 10-k that they feel very confident in their market position for snowplow equipment. This is true as they own most of the companies that manufacture this equipment, which helps distinguish some sort of moat. They have a couple competitors, however, with The Toro Company (TTC), which creates Boss Brand equipment, and Monro, Inc (MNRO) for work truck solutions competition. A comparative analysis was done to look at some key ratios of their true competitors. It seems PLOW takes the cake on P/E and PEG ratios and still is competitive on P/S and P/B. This helps build confidence in their relatively decent fundamentals. Furthermore, Senior Management seems very confident in their quality and lean manufacturing practices to have the best product available.

Between the DCF, comparative analysis, and fundamentals, it looks like PLOW is just inside the buy range right now. Waiting until winter may put this out of range if the stock price moves up though.

Risks and Mitigates

Supply chain

PLOW is reliant on off-shore sourcing that leads to susceptibility to natural disasters, global health epidemics, war, a weakening dollar, foreign regulation, and tariffs. They plan to address this risk by continuing to increase supplier count and increase inventory for sudden surges of demand.

Senior Management

PLOW is heavily dependent on a senior management with many years of experience in the snowplow industry. If they are unable to retain, attract and motivate qualified employees, it may adversely affect their business. They tackle this issue by focusing on turnover rates and an internal education system called DDU (Douglas Dynamics University, Diversity & Inclusion).

Commodity Costs

Increased costs in steel and petroleum could result in decreased gross margins. Fortunately, this is something that will adversely affect all manufacturers of snow equipment, so it doesn’t seem to crutch them. Though this played a major role in their 2020 performance, many another competitors also had these issues, so it’s hard to stick this directly on PLOW. The inclusion of more suppliers should help this cause as well.

High Dividend

They have a high dividend of 3.43% which means some cash is distributed to investors rather than the business. Although, this is one of the attractive components to this company, so it may be helping them attract investors and provide capital in the long run.

Conclusion

Overall, Douglas Dynamics seems like a good value play at the current price but waiting until the winter will put it out of the buy range. They have a moat and market advantage in a niche product line that will always be needed. They manufacture high quality products, and their fundamentals look better than competitors. Combine this with a positive DCF analysis and a healthy dividend and we have a stock in the buy range. There are some concerns with risks, but management is addressing each one. This seems like a stock that will explode during the winter, especially during one with heavy snowfall. Value investors interested in this position should build a position now rather than waiting until winter comes.

Be the first to comment