FeelPic/iStock via Getty Images

The latest monthly payrolls report showed the U.S. economy added +263k jobs in November, well above expectations of +200k. By all accounts, the data print came in “hot” including the average hourly earnings climbing by 0.6% from October, compared to a 0.3% estimate. The initial market reaction was a selloff in stocks, with a jump in bond yields, based on the line of thinking that the trend will force the Fed to stay hawkish with higher rates for longer.

That said, we’re reading the data from a more positive angle. The first point here is that the labor market is likely not the primary driver of underlying inflation at this stage in the cycle. Indeed, don’t take our word for it but read the quote directly from the man himself, Fed Chairman Jerome Powell, which said the same thing just last month at the November FOMC press conference:

I don’t think wages are the principal story of why prices are going up. I don’t think that. I also don’t think that we see a wage-price spiral.

In our view, the November payroll data does not undermine the expectation that the Fed will slow the pace of its rate-hiking cycle to potentially 50 basis points later this month from the string of 75 basis point increases.

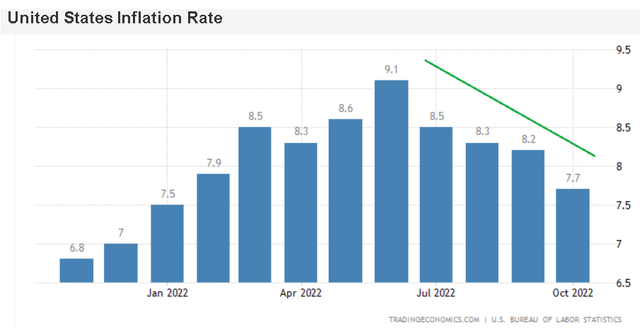

What’s more important is that all signs point to the CPI trending lower going forward. Some investors are making the mistake to assume that unemployment must surge, and the economy must collapse for the Fed to find success in its strategy to stabilize consumer prices.

Sure, the aggregate demand from the labor force is part of consumer pricing pressures, but if we look at how and why the CPI reached 9.1% this year, other factors were more responsible.

The headline-making supply-chain-disruptions from the start of the year are now easing and commodity prices including oil (USO) and gasoline are well off their highs. These components of inflation are largely independent of labor market trends, and the recent move lower will work to directly hit the annual inflation rate lower into 2023.

It’s not just energy. High-profile price categories like housing cooling off and even used-car prices are moving in the right direction based on a broader trend of normalization compared to skewed pandemic dynamics. We expect the upcoming November CPI data set to be released on December 12th to further provide confidence that peak inflation has passed.

The takeaway here is that the annual inflation rate stabilizing lower provides the Fed the flexibility to back off on the need for ever-hawkish posturing. All eyes are on the annual rate, and getting into 2023, the CPI starts hitting tough comps from last year.

With an understanding that recent rate hikes are still working their way through the economy, the path towards the terminal fed funds rate is still coming sooner rather than later. If the Fed is truly data-dependent, the CPI is more important than non-farm payrolls.

Good News Is Good News

Taking a step back for one moment. The other point to consider is that continued job gains support a view that the economy remains resilient, helping to brush aside concerns about a looming recession. Other indicators like the latest ISM manufacturing PMI are softer but highlight the many moving parts that impact inflation expectations beyond the labor market.

The setup here would look a lot worse if unemployment was surging with massive layoffs across the core services sector. All things considered; some lingering wage-price momentum is the lesser of two evils.

The backdrop of a stable labor market – despite higher interest rates while inflation trends lower is exactly the “soft landing” scenario that may be central to the bullish case for equities into 2023. Companies are still making money, and an uptick in consumer sentiment is the tailwind that risk assets need.

What’s Next For Stocks?

The bulls have been in control over the last several weeks, with the S&P 500 (SPY) above 4,000 and up more than 12% from its lows of the year. This momentum is based precisely on the encouraging inflation outlook and the expectation for the Fed to slow down the pace of rate hikes. An ongoing pullback in the Dollar (DXY) is also a positive development, as long-term bond yields (TLT) stabilize. Our interpretation there is simply the view that long-term inflation expectations will converge lower.

In our view, nothing has changed with the latest payrolls report, and we see more upside in stocks. We reiterate a call for the S&P 500 to climb towards 4,300 over the next few months. We mentioned the November CPI report, which will be the next big catalyst for another leg higher.

In terms of risk, we can always bring up the imbroglio in the Russia-Ukraine conflict that remains volatile and still has the potential to disrupt global macro conditions. While there is room for energy prices to rebound, significantly higher oil prices would also add uncertainties to the trajectory of inflation expectations.

Be the first to comment