Scott Olson/Getty Images News

Hostess Brands, Inc. (NASDAQ:TWNK) is a leader in the offering of sweet snacks. The company manufactures, markets, and distributes its iconic snack products in North American mostly under the Hostess and Voortman brands. While the company products are well established and have been available for decades, the current public company that produces the products has only been in operation during the last decade. Revenue is steadily increasing, and EPS is looking stronger over the last several quarters. With strategies that are growing its market share, Hostess may be well positioned for further growth. I believe the current market price at this writing of about $22.50 is a fair value for Hostess at this time.

Company Logo (Hostess)

Source for image, data, and information: Hostess

The Company

It seems hard to imagine many people that don’t know at least one of Hostess popular products. Chances are that you have tried at least one of their offerings, or at least tried a product from a competitor that very closely resembles the Hostess product. Hostess Twinkies may be one of the most known product names, but many others such as Hostess Cupcakes and Hostess Ding Dongs are very well-known too. The full list is too long to mention but includes Ho Hos, Dolly Madison, Zingers, Suzy-Q’s, Snoballs, Donettes, Coffee Cakes, Honey Bun, and Voortman, Cloverhill, and Big Texas branded products. Hostess states that they are the second leading brand by market share in their category as determined by Nielsen, at 21.3% of the total market.

Products (Hostess)

Hostess operates five baking facilities, and they use distribution centers and third-party warehouses to distribute their products. Most products are first sent to a centralized warehouse in Kansas, before being shipped on to other locations. Hostess sees a great benefit in using a Direct-to-Warehouse [DTW] model for distribution. Hostess has arranged with its customers to ship directly to the customer’s warehouse where the customer then distributes the products to its retail locations. This saves Hostess the expense of delivery to countless individual points of sale, and it allows for instant exposure to all new market areas as the customer adds to its own locations. Hostess also notes benefits that DTW brings to managing inventory.

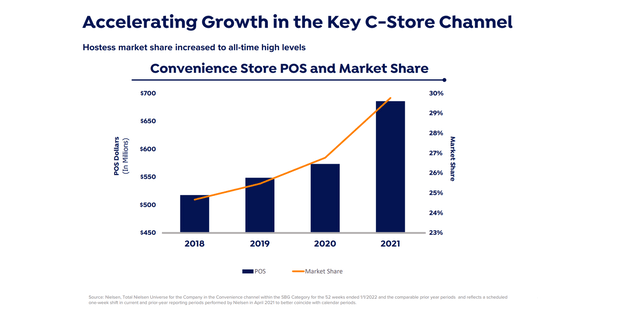

Hostess believes that its DTW model is partly enabled by the company’s “extended shelf life” technology, but their products are perishable and so bakery goods are shipped promptly to distribution centers. Still the DTW model has proved so versatile that Hostess has found that it can reach small store size markets much easier by using DTW, such as those outlets like drug stores and convenience stores. In fact, the convenience store market is proving to be a great growth opportunity and it represented 31.3% of revenue for Hostess in 2021.

C-Store Growth (Hostess)

DTW also allows Hostess to use pre-built displays that allow the customer to prominently display the Hostess products to achieve higher sales. All considered, Hostess see the DTW concept as providing a competitive advantage, as other competitors are said to primarily use a Direct-to-Store [DSW] delivery method instead.

Some of Hostess’ top customers are large, with their top 10 customers bringing in 59.5% of total revenue. Walmart is noted as the largest single customer representing 18.9% of all revenue. But no other customer accounted for more than 10% of revenue in 2021. This is among the variety of outlets that Hostess products are offered at such as mass merchandisers, supermarkets, and convenience, drug, and dollar stores.

Competition and Growth Potential

Hostess refers to Nielsen data to compare their competitive landscape. Little Debbie, Hostess, and Entenmann’s are listed as the top three companies in the sweet baked goods category, and the three together are said to account for 66% of retail sales. The remaining competitors are made of large national bakeries, supermarkets, and smaller operators. The top three brands major competitive advantages may include superior brand recognition, long-standing retail relationships with their customers, or other factors such as the quality of the product.

Hostess sees multiple avenues of growth including its recognition of the snack industry growth in general of 4.8% over the last three years, per Nielsen data. Hostess offers a variety of products to capture the snacking desires of customers that are designed to appeal to taste or occasion. For example, donuts, muffins, and other snacks are often consumed for breakfast while other items such as cookies, cakes, brownies, and pies are “all-day” snacking items.

As mentioned, Hostess’ list of products is extensive, and they continue to add new products to entice consumers. Hostess Bouncers is a new product coming in the summer of 2022 along with the new Hostess Boost Jumbo Donettes which contain the caffeine equivalent of one cup of coffee.

Newer Products (Hostess)

Hostess enters into partnerships and licensing agreements that allow for other growth opportunities that leverage their popular brands. Partnerships include product offerings like popcorn and pudding mixes. Also, the Hostess and Voortman brands are distributed by third parties to international locations.

Hostess products are offered on a growing number of e-commerce platforms and the company is increasing its digital advertising efforts. Their program is helping to identify areas to target, and they expect this to serve as a driver to continue to grow sales.

Acquisition is a key component of Hostess’ growth plan as evidenced by their purchase of the Voortman brand in 2020. Voortman has expanded the company’s reach into the cookie market. Hostess saw the opportunity to convert Voortman’s products into its DTW strategy which should allow for a boost in Voortman’s availability to consumers as well as provide a presumed increase in margins.

Valuation

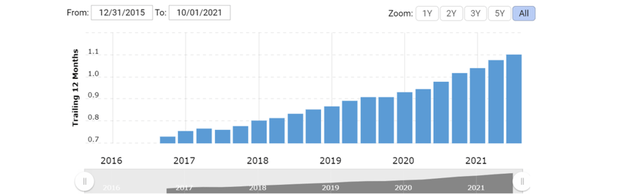

Hostess has delivered steady revenue growth as is illustrated in the Macrotrends graph shown below.

Revenue Graph (Macrotrends)

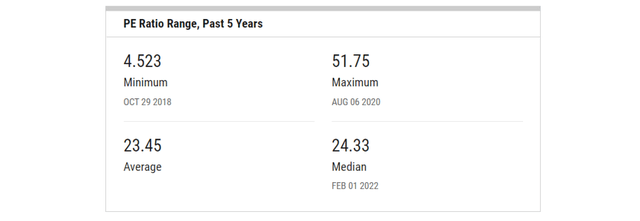

The adjusted TTM EPS is currently $.88 which yields a share price of about $22.50 based on the current P/E at this writing at around 26. Note that according to YCharts, the 5-year average P/E for Hostess is 23.45.

Average P/E Data (YCharts)

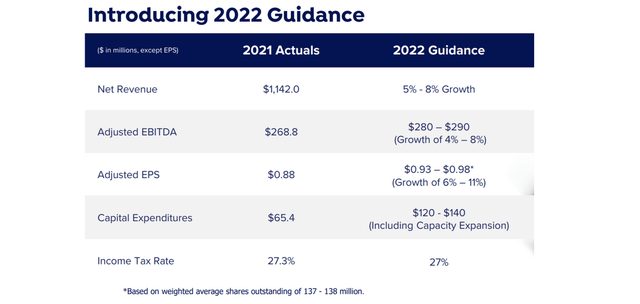

Hostess provides guidance for 2022 and forecasts an expected $.93-$.98 EPS. If you roughly split the difference and use an EPS value of $.96 and apply it to the 5-year average P/E of 23.45 that would result in a share price of $22.52. I think this allows for the current market price to be reasonable, but only towards a potential realization of the 2022 forecast. For those reasons, I am currently neutral on this stock, but I would find it attractive on a substantial dip.

Also, while I do see this value as fair today, think it’s worth watching how Hostess performs through the year, and an upgrade is possible if results prove to outperform the forecast. The steady revenue growth is a positive factor that I believe can add lead to added value to Hostess over time.

Guidance (Hostess)

Risks

The company provides a full list of risks in its annual filing. I recommend reading that in its entirety, but I will add a few notes. The most obvious, and perhaps biggest risk for many companies today is the current geopolitical environment. All risks, including market or world events, can lead to share values that do not reflect the thesis of the article.

Hostess’ raw materials include cooking oil, sugar, coatings, and flour. Also, fuel is used for ovens and to transport products. If any of these are in short supply, or if the costs rise those factors can adversely impact the company’s margins. Hostess believes their sourcing efforts should serve to mitigate most issues and multiple sources are employed to spread the risks.

Final Thoughts

I like to find companies that are growing strong and that are currently undervalued in the market. I did not actually see that in Hostess. They are growing, but the market has recognized it. What I did find more interesting though is that the company in its current form has only been around just a few years. What I wonder is whether they could be close to a time when they have been around just long enough to start picking up steam. The current revenue CAGR of 10.62% since 2014 may be a telling factor.

It’s hard to say, but this is one I would like to keep watching. This could turn into one of those that becomes more satisfying later.

Popular Products (Hostess)

In the meantime, I might just find one of these to do the trick.

Be the first to comment