memoriesarecaptured/iStock Editorial via Getty Images

One of the most frustrating things about being a value investor is that, from time to time, the market will blatantly ignore or underappreciate companies that are posting strong financial results. A great example of this can be seen by looking at Hostess Brands (NASDAQ:TWNK), the famous confectionery business that produces household names like Twinkies, CupCakes, Donettes, and my personal favorite, Ho Hos. Despite posting strong revenue growth, increasing guidance for the year, and achieving attractive cash flows, shares in the business have experienced some resistance because of a decline in the broader market. It would be different if shares of the company were expensive. But at this point in time, they don’t look overly priced. Even though the market might disagree with me, I believe that the data is indicative of a bullish case here that leads me to keep the ‘buy’ rating I assigned to the stock previously.

Tasty results, unappetizing price fluctuations

Back in the middle of September of this year, I wrote an article that took a somewhat bullish stance on Hostess Brands. In that article, I talked about the interesting operating history that the company had seen over the prior few years, with revenue and profits rising nicely even throughout the COVID-19 pandemic. That trend continued into the 2022 fiscal year and, I believed, should continue for the foreseeable future. While shares of the company weren’t exactly cheap, they did look affordable relative to similar firms and were not terribly priced on an absolute basis. All of these factors combined led me to rate the business a ‘buy’ do you reflect my view at the time that shares should generate returns that would exceed what the broader market would achieve over a similar window of time. Since then, the market has disappointed. While the S&P 500 is down by 2.2%, shares of Hostess Brands have seen downside of 2.9%.

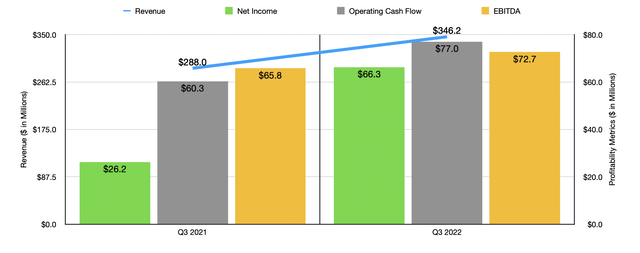

Based on this small return disparity, you might think that nothing special has happened from a fundamental perspective at the company. But in my opinion, you would be wrong. Consider results for the third quarter of the company’s 2022 fiscal year. This is the most recent quarter for which data is available and is the only quarter for which we did not have data when I last wrote about the enterprise. During that time, revenue came in at $346.2 million. That’s 20.2% higher than the $288 million the company generated the same time last year. Management’s decision to increase prices, as well as a change in product mix purchased by customers, contributed almost all of the 20.2% rise in revenue the company experienced. Interestingly though, the firm still added to the amount of product that it sells. Total volume growth added 0.1% to the company’s top line. When you consider the surge in pricing the company went with, that serves as a testament to the firm’s brand power.

With the rise in revenue also came an increase in profitability. Net income nearly tripled from $26.2 million to $66.3 million. Interestingly, this occurred even as the firm’s gross profit margin dropped from 34.4% to 33.3% in response to inflationary pressures. The primary driver behind this increase, then, involved a $32.2 million swing in other expenses and income. According to management, this swing from a net expense to a net profit was driven largely by a $33 million payment associated with insurance in connection with an acquisition the company made. But this does not mean that other profit figures were unimpressive. Operating cash flow, for instance, increased from $60.3 million to $77 million, while EBITDA for the company expanded from $64.8 million to $72.7 million.

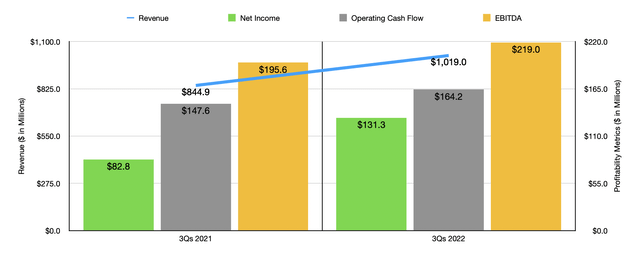

The results achieved in the latest quarter showed continued strength for the company during a year when results as a whole have been positive. For the first nine months of 2022, for instance, revenue came in at $1.02 billion. That’s up nicely from the $844.9 million reported the same time last year. Net income jumped from $82.8 million to $131.3 million. Other profitability metrics followed suit, with operating cash flow expanding from $147.6 million to $164.2 million, while EBITDA for the company rose from $195.6 million to $219 million.

When it comes to 2022 in its entirety, management has become even more optimistic. Previously, the firm was forecasting revenue growth of 15% or more. That number has now been increased to between 17% and 19%. Profitability has also been revised higher, with EBITDA of between $290 million and $293 million anticipated. In prior guidance, the company had forecasted that the metric would come in near the high end of the $280 million to $290 million range. Earnings per share have also been revised higher, with an expectation of profits of between $0.96 and $0.98 cents. Previously, the low end of that range was $0.93 per share. At the midpoint, this should translate to net income for the company of $133.9 million. Unfortunately, we don’t have any guidance as to what operating cash flow will look like. But if we annualize results experienced so far, we can anticipate a reading of $225.8 million.

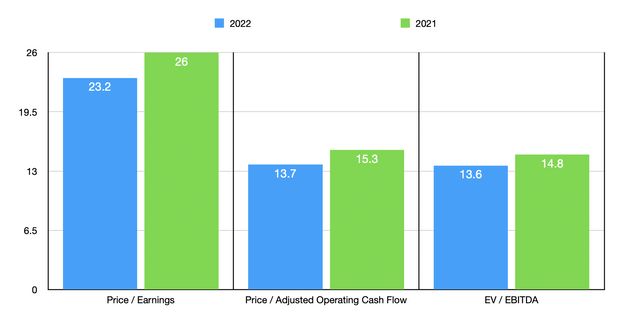

Using these figures, I calculated that the company is trading at a rather lofty price-to-earnings multiple of 23.2. Though it is worth noting that this is lower than the 26 reading that we would get using data from 2021. The forward price to adjusted operating cash flow multiple, however, is considerably lower at 13.7. That stacks up favorably against the 15.3 reading that we get using data from last year. Meanwhile, the EV to EBITDA Multiple for the company should drop from 14.8 to 13.6. Although not exactly cheap on an absolute basis, shares don’t look unreasonably priced at this time. As part of my analysis, I also determined, by looking at five similar firms, the shares are cheap on a relative basis. As you can see in the table below, Hostess Brands was the cheapest of the group using all three valuation metrics.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Hostess Brands | 23.2 | 13.7 | 13.6 |

| Utz Brands (UTZ) | 127.9 | 25.4 | 34.9 |

| The Hershey Co. (HSY) | 30.8 | 21.7 | 21.9 |

| Mondelez International (MDLZ) | 29.4 | 18.4 | 21.7 |

| J.M. Smucker Co. (SJM) | 29.2 | 16.7 | 15.3 |

| J&J Snack Foods (JJSF) | 61.7 | 112.1 | 25.5 |

Takeaway

At this point in time, I understand that Hostess Brands may not look to be all that appetizing to some investors. But to me, the picture is looking up. Robust fundamental performance, combined with a share price that is not unreasonable and that is cheap relative to similar firms, all makes for a bullish case to me. My case is further strengthened by management’s decision to increase guidance for the year. When all combined, this makes me confident enough in the company to keep the ‘buy’ rating I had on the stock previously.

Be the first to comment