naphtalina/iStock via Getty Images

Today I am going to cover a different type of company, Azenta (NASDAQ:AZTA), a $4.4bn life sciences company. Azenta was once known as Brooks Automation, a leading provider of precision automation and cryogenic storage solutions to the semiconductor market. In 2010, they began the life sciences segment, which today is a standalone company known as Azenta, leveraging their expertise for biopharma customers, supporting them from research to clinical development with sample management, automated storage, and genomic services expertise.

The company has more than 12,000 customers around the world, with operations in 100 countries. The client list includes major pharmaceutical and biotechnology companies, research hospitals that do clinical research, as well as academic and governmental institutions. Services include sample procurement and sourcing, informatics and data software, and sample repository solutions. Services also include genomic sequencing services for companies without in-house capabilities for the same.

The company’s life sciences offerings are divided into two, products and services. Under products, they have Automated cold storage solutions, Consumables and instruments, and Controlled rate thawing devices. The company acquired Barkey in July 2022, and now they have the Barkey plasmatherm, the only automated cell thawing device approved by the FDA.

Under services, they have Genomic Services, which offers gene sequencing and gene synthesis services, and Sample Repository Solutions.

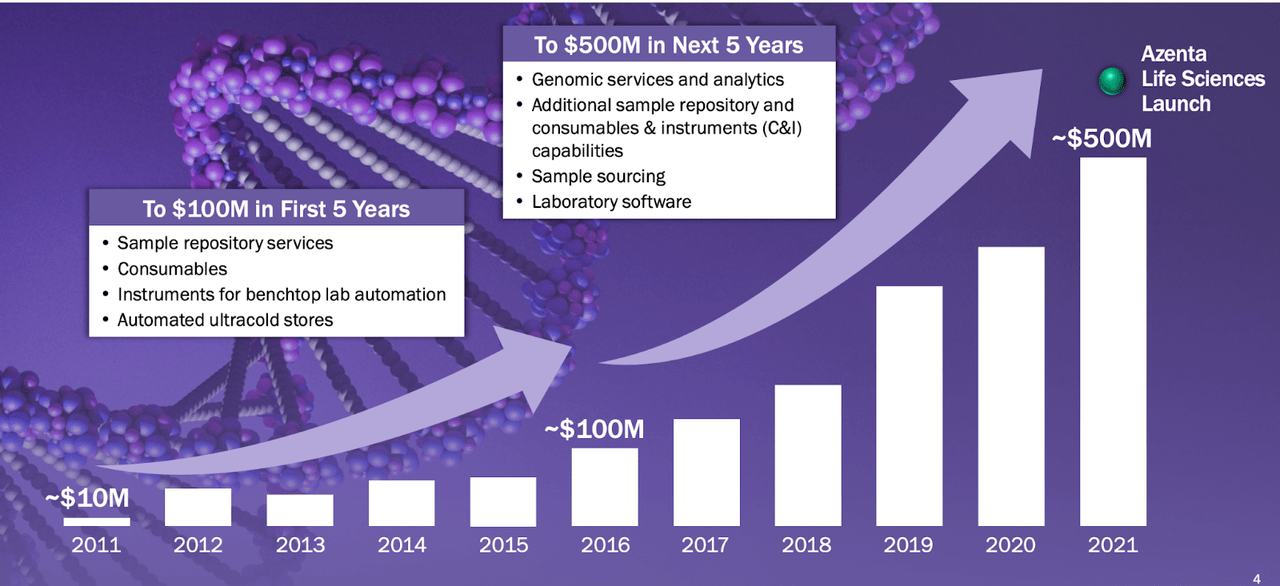

The company makes around 63% of its ~$550mn revenue from the services segment, and the other 37% from the products segment. In the last 4 years, the revenue figures were $334mn, $389mn, $514mn and ~$555mn respectively. Thus, revenue has grown significantly over the years, nearly doubling in the last 4-5 years. Here’s a slide that sums up the enormous growth chart of the company.

Revenue growth (AZTA website)

Of all their diverse revenue streams, consumables and instruments make up 25%. This is part of the products offerings; while products itself is about half the services revenue, that single stream is the dominant revenue earner among all the various streams.

In the last 10 years, the company has spent ~$1bn in around 10 acquisitions, which include cold storage companies to gene sequencing companies. The company has been able to increase its ROIC (return on invested capital) to more than its WACC (weighted average cost of capital) in just 5-7 years.

This year, the company completed the sale of its semiconductor automation business, netting over $2bn. The company had a cash balance of $2.5bn, and then it acquired B Medical Systems, which now gives it a cash balance of $1.9bn. The company undertook a $1.5bn share repurchase program, with plans for an initial $500mn in an accelerated share repurchase program. About this program, here’s an interesting take from their latest earnings call:

But even with these 2 new companies in our portfolio and the success we’ve had, at this point, we find ourselves faced with the reality that our shares are significantly undervalued. So much so that at this time, it’s difficult to find any target acquisition that would give us a higher return as can be achieved by the repurchase of our own shares.

The company’s strong balance sheet enables it to make strategic acquisitions which have added to organic growth over the years. About the company’s progress and transformation, here’s a very nice summation from their latest earnings call:

Over the past decade, we transformed a small cyclical semiconductor capital equipment components business into a global market leader. And as we did so, we leveraged the core technologies and cash flow from that business to create a unique world-class life sciences business that meaningfully outgrew the life sciences market over the past 5 years. Today, our revenues are 4x greater than they were 5 years ago.

In line with that trend, the company guided that fiscal 2023 revenue is expected to grow approximately 30% compared to fiscal 2022.

The company’s business model is a low capex one. Here’s a quote, again:

Capital expenditures for the fourth quarter were $14 million, which included laboratory equipment for our Genomics business, additional storage equipment and freezers as well as investments to expand our SRS footprint in Indianapolis and our genomics lab here in the Boston area. For the full year, capital expenditures were $73 million, including $19 million for the new China building.

So the cash reserve they have is preserved for strategic acquisitions, or, as in this case, share buyback.

After Brooks Automation became AZTA, there were two small sales by people in the management, valued at $19k and $10k. However, in recent months, there have been two large open market buys from senior management, worth a quarter million and a half million dollars respectively. The company is very heavily institutions owned, at 98%.

Bottomline

I liked AZTA. This is a new type of company for me; however, I was glad to see this company being able to avoid the headwinds that were ravaging the biopharma industry even a few months ago. I think AZTA deserves a closer look.

Be the first to comment