Igor Alecsander/E+ via Getty Images

The Brazilian Stock Market Outlook

At the moment, everything speaks for the Brazilian stock market, and there are fundamental macroeconomic reasons for this.

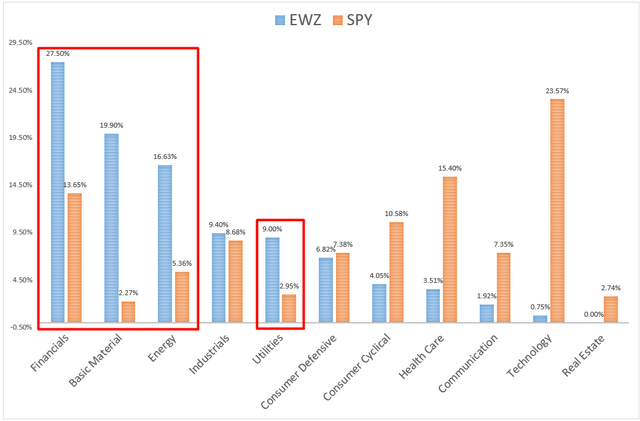

First, the asset structure of the Brazilian market, which you can see by looking at the iShares MSCI Brazil Capped ETF (EWZ), is very different from the U.S. market (SPY) – it’s all about the dominance of financials, energy, basic materials, and utility companies over technology, health care, communication, and consumer cyclicals companies.

Author’s calculations, based on Seeking Alpha

This export-oriented country thanks to its proximity to the United States and its pretty neutral relations with China, has taken over the function of replacing the main commodity producer [Russia] from the beginning of 2022, after the start of the war in Eastern Europe.

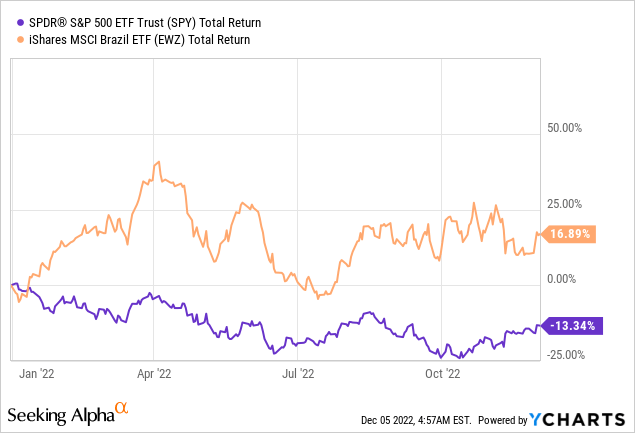

Commodity companies – value stocks – prefer to pay generous dividends to their shareholders, especially at the peak of the bull cycle. This characteristic has allowed EWZ to far outperform SPY in terms of total return since the beginning of the year (by more than 30%).

In 2023, I believe this market will remain attractive despite the strong growth we saw in 2022. Based on what BofA’s commodity research team writes in its recently released commodity outlook, the upside price potential in metals, stable energy prices, and backwardation point to modest positive total commodity returns globally in 2023. So the Brazilian economy, because of its sector mix, will have an advantage over developed markets and China, which will continue to overpay for the opportunity to obtain the necessary resources.

Second, the current macroeconomic environment in Brazil is helping to strengthen the country’s currency and stock market valuation, as Larry Brainard and Jon Harrison from TS Lombard write [November 21, 2022 report]:

Brazil remains one of the few EM in which headline and core inflation are steadily declining. We expect Banco Central to keep rates on hold through H1/23, with policy easing likely in H2. High-interest rates, positive real rates, and falling inflation will support the currency and local debt. Despite gains this year, the real remains undervalued vs pre-pandemic REER. The outlook for growth next year is weak, but high-interest rates are likely priced into equity markets, which remain relatively undervalued despite recent gains. The strong showing in legislative elections for Bolsonaro’s allies should reduce the possibility of a sharp policy shift to left. The appointment of market-friendly economists to the transition team is an early indication that Lula will run an orthodox centrist administration. The key challenges ahead are tax reform and fiscal sustainability. The new administration has raised some concerns about the future fiscal trajectory by looking to increase social spending, but in our view, the political incentives remain for centrist policy. We expect recent market turbulence to continue until Lula appoints his Finance Minister, but our base case remains that he will choose a market-friendly team.

Source: TS Lombard [November 21, 2022]

This London-based research boutique highlights Brazil as the most promising of the major emerging markets, expressing it through allocation scales:

TS Lombard [November 21, 2022]![TS Lombard [November 21, 2022]](https://static.seekingalpha.com/uploads/2022/11/24/49513514-1669283075351462.png)

Against this background, the question naturally arises as to which industry should benefit from the ongoing changes.

A few days ago, Goldman Sachs published EM Market Outlook 2023, in which the bank’s analysts recommend paying attention to the Domestic Cyclicals [Consumer Discretionary] sector when it comes to Brazil:

GS, November 22, 2022 [author’s notes]![GS, November 22, 2022 [author's notes]](https://static.seekingalpha.com/uploads/2022/11/25/49513514-16693545251285267.png)

This choice of sector partly coincides with the thesis that the newly elected Lula government will try to increase social spending – the population should have more money available, and therefore more funds should be directed to different goods.

In addition, the central bank’s key interest rate should be systematically lowered over the next few years, according to the calculations of another Societe Generale study:

SG, November 23, 2022 [author’s notes]![SG, November 23, 2022 [author's notes]](https://static.seekingalpha.com/uploads/2022/11/25/49513514-16693561496248589.png)

This should be the largest decrease among the EM countries, which will theoretically have a positive impact on the country’s economic development.

Putting all this together, I come to the following conclusion: the Brazilian stock market looks quite promising despite its double-digit total return this year. Macroeconomic processes around the world point to continued positive tailwinds for Brazilian companies or foreign companies with a significant amount of business in the country.

So I like Bunge Ltd. (NYSE:BG)

As Old West Investment Management writes in its Q1 2022 letter to investors, Bunge is one of the biggest agribusinesses and food companies in the world. It dominates its market with 3 other worldwide companies: Archer-Daniels-Midland (ADM), Cargill, and Dreyfuss.

According to its most recent 10-Q filing, Bunge operates through 4 segments:

- Agribusiness (70.5% of total sales) – both inputs and outputs being agricultural commodities (high volume and low margin);

- Refined and Specialty Oils (25.7%) – involves the processing, production, and marketing of products derived from vegetable oils;

- Milling (3.8%) – processing, production, and marketing of products derived primarily from wheat and corn;

- Sugar and Bioenergy (0.44%) – 50% interest in BP Bunge Bioenergia, a joint venture with BP PLC (BP).

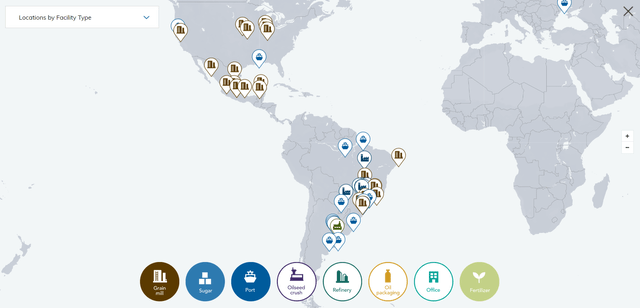

The first two segments together account for the lion’s share of the company’s revenues – almost 96%. At the same time, most of the operational activities are based in Brazil – a look at the map on the company’s official website is enough to see where the facilities of the various sub-segments are located:

The company is headquartered in St. Louis, Missouri, but still has the most exposure to Brazil – making it riskier compared to the same ADM, which is more geographically diversified than Bunge.

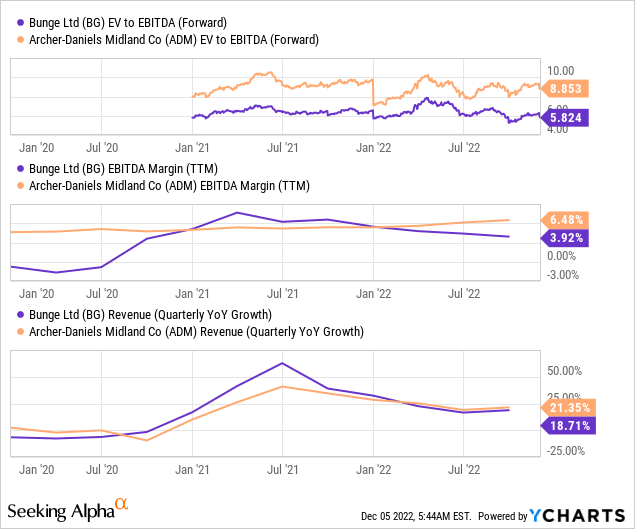

In addition, ADM appeared to be much more resilient than Bunge in recent months on most available metrics in terms of margins and profitability, which explains the current discount of Bunge’s valuation (about 52% to the valuation of ADM based on EV/EBITDA multiple):

Despite the obvious reasons for today’s discount, I expect Bunge to see increased demand for its products for reasons I detailed in my latest article on CVR Partners (UAN).

Here is my elevator pitch from that article, so as not to divert your attention: the widespread shutdown of ammonia/fertilizer production in Europe due to price instability (caused by the war in Ukraine) has led to a global redistribution within the world’s fertilizer and food supply chains. More ships are heading to Europe to meet the growing demand of the “depleted market” (Europeans are willing to pay more than anyone else to avoid being left with an empty plate after harvest). So CVR Partners’ share price will likely double to offset the expected increase in dividends to $40-60 per unit – this is not yet expected by the broader stock market, according to my analysis.

Why am I writing about this here? The thing is, Bunge should see an increase in demand for its products for exactly the same reasons, and given the overall favorable environment for Brazilian-related stocks, the existing discount should be easily offset when the company’s finances smooth out – this is my base-case investment thesis.

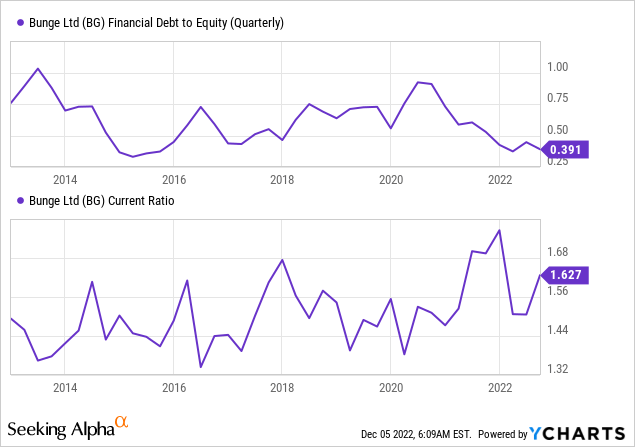

Bunge has a fairly comfortable level of current ratio (1.6x), which, against the backdrop of minimal leverage (0.39x) in recent years, indicates the stability of the company, even if my thesis does not materialize shortly.

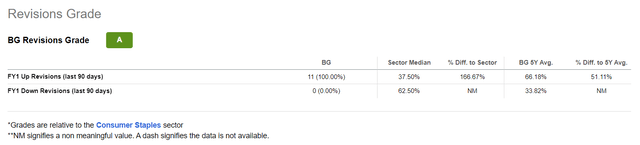

Although much of the commodity BG sells has fallen sharply from its highs due to disinflationary processes, the Street’s analysts seem to agree with my outlook – in the last 90 days, the company’s EPS/sales estimates have been revised upward 11 times (in total) without a single downgrade revision (far better than the average company in this industry over the same period).

But at the same time, current forecasts point to a serious decline in EPS throughout calendar 2023:

Seeking Alpha, BG [author’s notes]![Seeking Alpha, BG [author's notes]](https://static.seekingalpha.com/uploads/2022/12/5/49513514-16702394280946636.png)

That is, the likelihood that the company will be able to compensate for the decline in sales prices due to larger volumes is most likely not taken into account by the general market to this day.

Bottom Line

Of course, the operations in Brazil, as well as the looming global recession [in which I believe], pose rather serious risks to my thesis. However, this is true for any emerging market representative – does this mean that we should not invest there? It’s a question of accepting or mitigating the risks – that’s something everyone has to decide for themselves. Personally, I accept the risks in Brazil, but I cannot accept the risks in China.

Anyway, I think now is a good time to cautiously start building a position in Bunge stock and slowly build it up to 100% of desired value by the second to the third quarter of next year, given the high probability of a recession in 2023. Dollar averaging seems to be a good alternative to the usual buy-and-hold approach.

So based on the above, I rate Bunge stock as a Buy.

Be the first to comment