bloodua

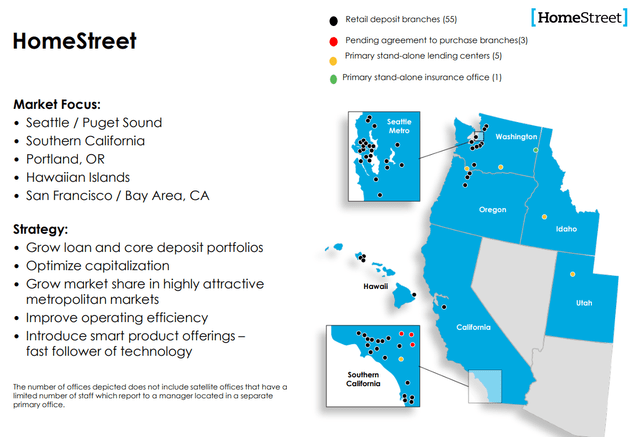

HomeStreet (NASDAQ:HMST) is a regional bank based in Seattle, Washington, and which has operations around the west coast. HomeStreet has been engaged in a corporate evolution. It was primarily focused on single-family and multi-family lending but has acquired smaller banks over the years to broaden and diversify its operations.

This transformation appeared to be going well, with HMST stock hitting new highs last year. However, things have abruptly reversed course this year with HomeStreet losing nearly half its value. So where do things stand for investors today?

Lacking A Clear Focus Market

As of HomeStreet’s latest presentation, the company currently has 55 retail branches. These span the Seattle area, Oregon, California, and Hawaii. It also a couple of lending centers outside of those markets:

HomeStreet footprint (Corporate Presentation)

In my opinion, for a bank of this size, this footprint spreads it a little bit thin. Generally, banks earn higher returns when they have strong operational synergies and branding power from running various branches in one operating area. Putting a few branches in many different markets, by contrast, may limit such operating scale.

This is perhaps visible in HomeStreet’s efficiency ratio of 68%. This ratio measures a bank’s income versus expenses. A lower score is better. HomeStreet’s 68% is significantly above what you’d like to see for an American bank; the industry average tends to be closer to 55-60%. A bank that is less efficient has to make up that gap with some other strength to justify an investor’s capital.

Unfortunately, I don’t believe the bank’s capital allocation has made up for the relatively lackluster efficiency ratio.

Share Buyback Program

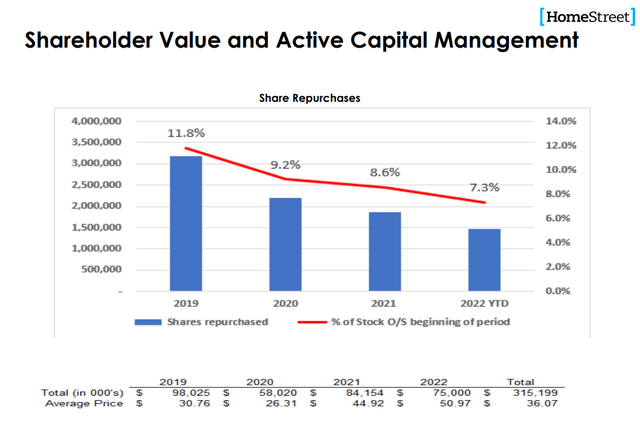

HomeStreet has run a sizable share buyback program, as detailed below. This is the bank’s slide, so the odd formatting is their choice, not mine:

HomeStreet share buybacks (Corporate Presentation)

In any case, we can see that the bank was able to repurchase more than two million shares in both 2019 and 2020, primarily because the average prices on these transactions were quite favorable, coming in at $31 and $26 per share, respectively, in those two years.

However, the company kept the share buyback program running at roughly the same velocity in 2021 and this year, which has not been nearly as favorable to shareholders. The bank paid $45/share for its stock in 2021 and more than $50/share in 2022 year-to-date.

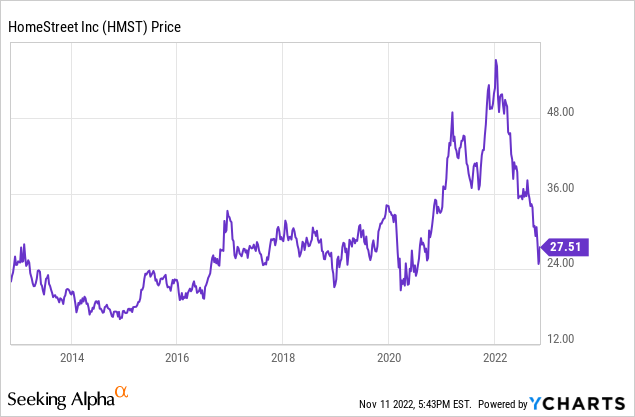

As you can see, those later share repurchases came close to top-ticking the market:

With shares now trading back to around 2013 prices, investors certainly might wish that the company had saved some of that buyback powder for a more opportune moment.

Mortgage Weakness Hits Earnings

What explains the dramatic drop in HomeStreet’s stock price? There are several factors, however the most obvious one is the weakening of the housing market.

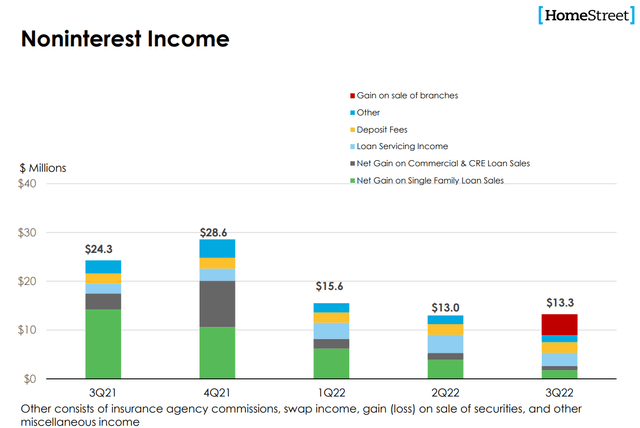

We can see this by looking at the bank’s non-interest income breakdown:

HomeStreet Noninterest Income (Corporate Presentation)

Focus on the green bar in particular. This is the bank’s profit from originating and selling single family mortgages. Last year, during the housing boom, HomeStreet was earning more than $10 million per quarter for these mortgage loans. By Q3 of this year, this former profit gusher had diminished to a trickle.

As a result, the bank’s noninterest income has fallen from around $25 million per quarter in 2021 to less than $10 million last quarter (excluding the one-time gain from selling some bank branches).

Cutting a bank’s noninterest income in half is going to have a major impact on its overall profitability. And it also hurt HomeStreet’s investor perception. In recent years, the bank has been transitioning away from such heavy reliance on home mortgages and leaning more heavily into commercial lending. However, as the graphic above shows, that transition isn’t yet complete, and mortgage lending still has a sizable impact on the bank’s overall results. With housing seem set to be in a slump for the foreseeable future, this will be a drag on HomeStreet’s intermediate-term outlook.

The glass half full view, however, would be that things can’t get much worse from here on the mortgage front. Single-family home mortgage income accounted for just 3% of HomeStreet’s revenues last quarter, down from 17% in the same quarter of 2021.

The other negative factor for HomeStreet’s profitability is that its net interest margin “NIM” is consistently going down. In a time when many banks are enjoying historic increases in their NIMs, HomeStreet’s is actually in decline. From 3.42% in Q3 of last year, it had dipped to 3.27% by Q2 this year and then plunged to just 3.00% in Q3 of this year.

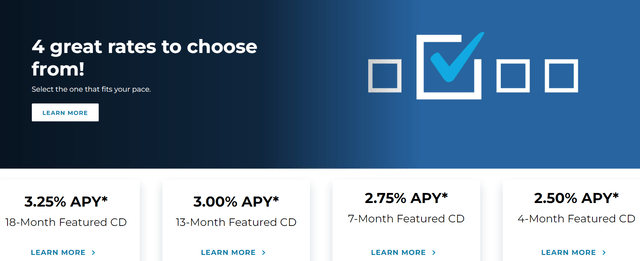

HomeStreet is offering relatively high interest rates to attract deposits. In fact, at the time of this writing, this is what you see on bank’s homepage:

HomeStreet savings offers (HomeStreet’s website)

In one sense it is understandable why HomeStreet is offering higher-interest deposit rates, such as 3.00% on 13-month CDs. This allows the bank to lend more capital into the market at much higher interest rates. Over time, as HomeStreet builds out its branch footprint (or interest rates go back down) it can reprice these funds with cheaper options.

In the near-term, however, issuing a bunch of expensive CDs eats up any immediate benefit from higher interest rates on the bank’s loans. Also, of note, HomeStreet has 70% of its loan book in hybrid loans. These are loans which start off at a fixed rate and then turn into a variable-rate loan after a set period, often 3-5 years. This means that HomeStreet may see a delay before it fully profits from higher interest rates, as it needs loans to enter their variable period to get the additional interest rate kicker.

None of this is to say that HomeStreet’s strategy is wrong or malfunctioning at the moment. Do realize, however, that the bank is executing on a longer-term plan and is not maximizing its net interest margin or earnings in the immediate term. This has, understandably, led to a sharp selloff in HMST stock this year as traders have seemingly decided to exit the name until the immediate headwinds to the company’s earnings start to let up.

Large Dividend Pays Investors To Hold

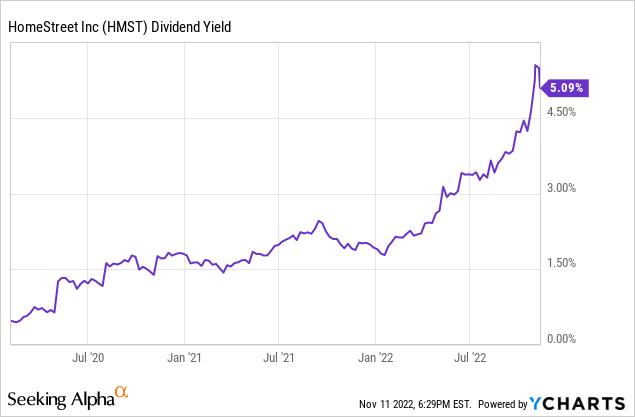

The silver lining of HomeStreet’s messy 2022 is that HMST stock has now become a yield play. The bank raised its dividend to 35 cents per quarter ($1.40 annually) in January. At the time, this amounted to a 3.0% dividend yield and didn’t seem all that unusual.

With the drubbing in the stock price since then, however, the dividend yield has now topped 5%:

One thing to consider is that the company only instituted a dividend three years ago; there’s not a long track record of paying a dividend through up and down economic cycles here. As such, investors might be a little more cautious trusting the suddenly high yield on offer in HMST stock.

That said, the dividend appears to be safe. Analysts are forecasting a 33% decline in HomeStreet’s earnings this year thanks to the mortgage slowdown and falling net interest margin. Even so, the bank should earn about $3.68 for full-year 2022 and then see earnings rebound at least slightly in 2023. That’s far more than necessary to cover a $1.40 per share dividend.

The bull case here is a pretty clear one. The bank is trading around 7x forward earnings and offering a 5% dividend yield. For investors that want pure deep value and don’t mind potentially waiting a few years for the share price to recover, HMST stock looks like a fine purchase today.

On the other hand, 2023 is probably going to be another tricky one for the bank. I’m skeptical that the mortgage market comes back that quickly in markets such as Seattle or Southern California. Meanwhile, the bank’s contrarian approach to managing its balance sheet and funding is likely going to be a drag on earnings for at least the next few quarters. The bank has reasonable prospects over the longer-haul and the dividend is certainly attractive, however it feels like there will be a more timely entry point for HomeStreet shares next year.

Be the first to comment