Michael Edwards/iStock via Getty Images

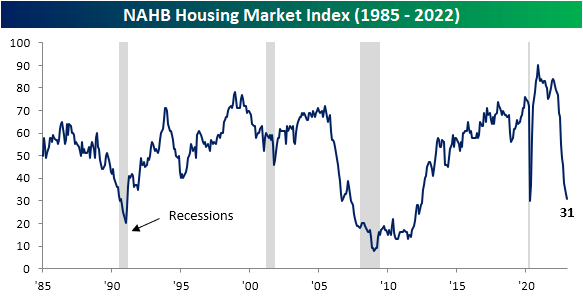

The economic calendar is particularly light today, with the only release in the US being homebuilder sentiment from the NAHB. In spite of mortgage rates sitting 0.8 percentage points below their early November peak, homebuilder sentiment has continued to fall, reaching a new low of 31 in December versus expectations for a modest increase to 34. December’s reading is now only one point above the spring 2020 low of 30.

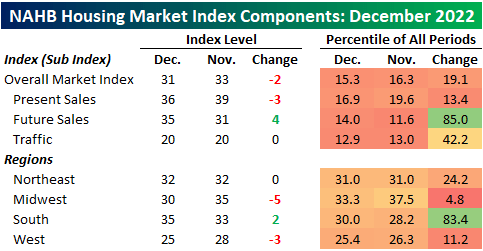

The two-point drop in December was entirely a result of the decline in present sales. That reading fell from 39 to 36, matching the April 2020 low. Meanwhile, future sales saw a large increase, rising from 31 to 35. That is only back up to the same level as October and a historically muted reading, but the month-over-month increase was the largest since September 2020. The index for Traffic went unchanged at 20 which is the lowest level since April 2020.

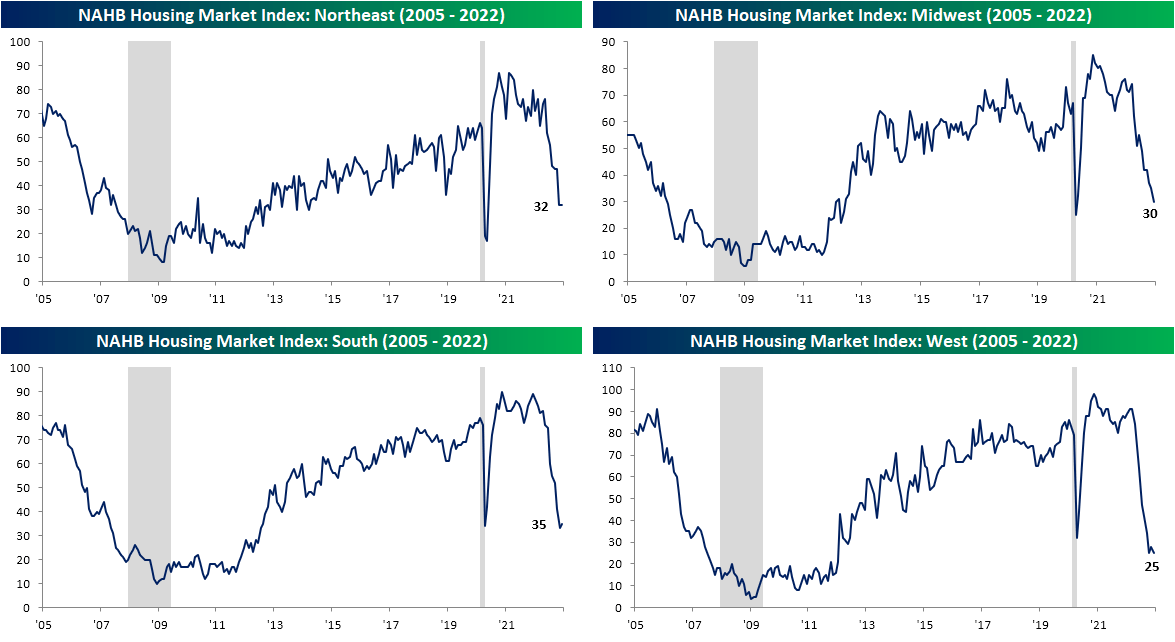

The regional readings on homebuilder sentiment echo the weakness from the headline levels, albeit there has been slightly more variability. For starters, the Northeast has seen sentiment hold up the best, as current readings are a bit more elevated off of COVID lows. The Midwest is also handily above the spring 2020 lows, but there was massive deterioration, with a 5-point drop this month. Meanwhile, the West dropped another 3 points to match the new post-COVID low and the weakest reading since January 2012. Finally, the South was the only region to see improvement in December with the index rising 2 points, but even with that, it is right near the lowest levels since the pandemic.

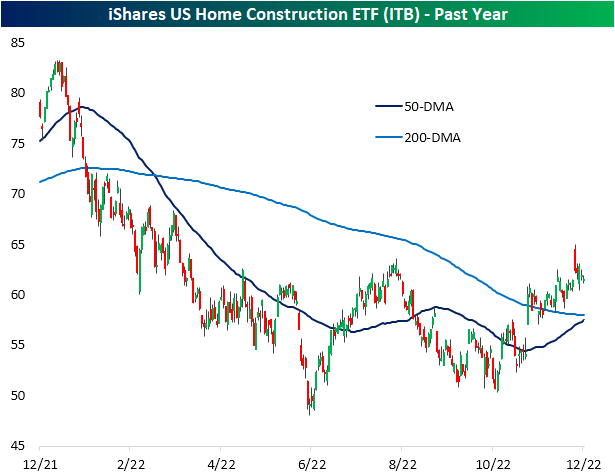

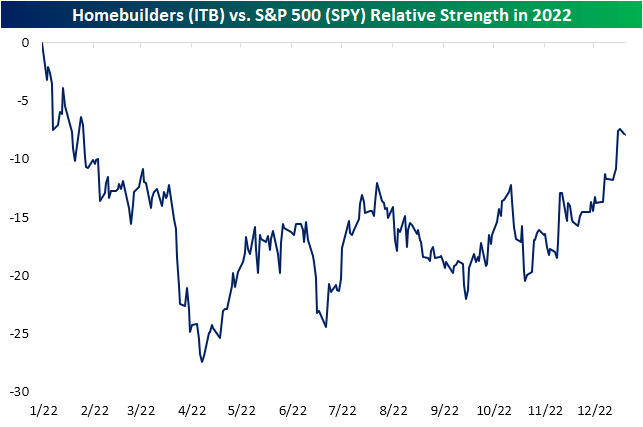

Homebuilder stocks, proxied by the iShare US Home Construction ETF (ITB), traded lower in the wake of today’s release after months of outperformance. As shown below, the ETF is trading well above its moving averages compared to the S&P 500 which has moved back below both its 50 and 200-DMAs in the past few days. As such, the relative strength line for homebuilders has continued to move higher.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment