M. Suhail

This story was written on July 5 for subscribers of Reading The Markets. It has been updated as of the evening of July 10, where italicized along with the technical chart.

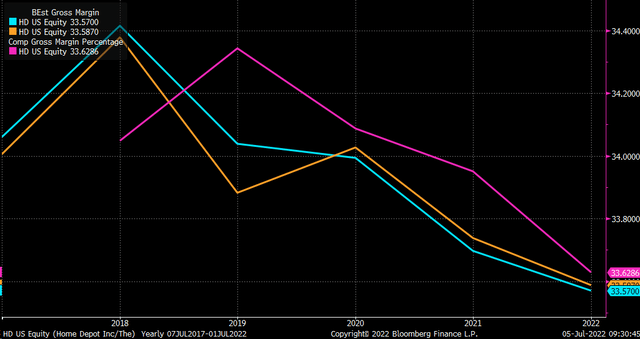

Home Depot (NYSE:HD) shares have plunged in 2022 due to soaring interest rates which have helped to slow the housing market. On top of that, higher inflation rates have eaten away at some of Home Depot’s gross margins and made those margins much more volatile over the past year.

Estimate Discrepancies

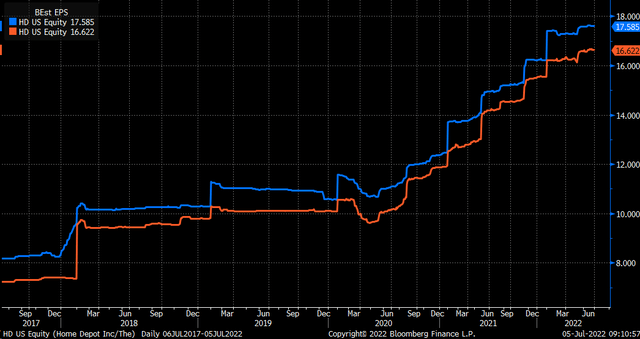

Despite a weakening housing market and reported margin volatility, analysts’ earnings estimates for Home Depot’s fiscal 2023 and 2024 are holding up. Analysts are forecasting earnings for Home Depot to rise to $16.62 per share in 2023 and $17.59 in 2024. That is a growth rate of 7.02% in 2023 and 5.79% in 2024.

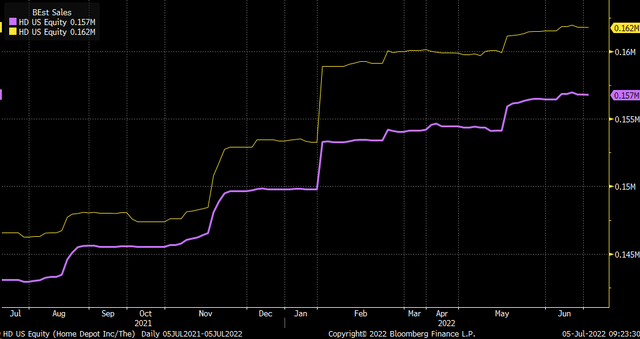

Even sales estimates for Home Depot continue to rise. By 2023 analysts see sales reaching $156.79 billion and $161.76 billion in 2024. That would suggest that revenue in 2023 will grow by 3.73% and 3.17% in 2024.

Meanwhile, analysts see gross margins staying around 33.6% in both 2023 and 2024. That is roughly flat to where gross margins had been in fiscal 2022 when they were at 33.62%. What is strange is that revenue growth is expected to be much slower than earnings growth, which would suggest analysts see margins expanding somewhere, and based on gross margins estimates, it isn’t evident to be true.

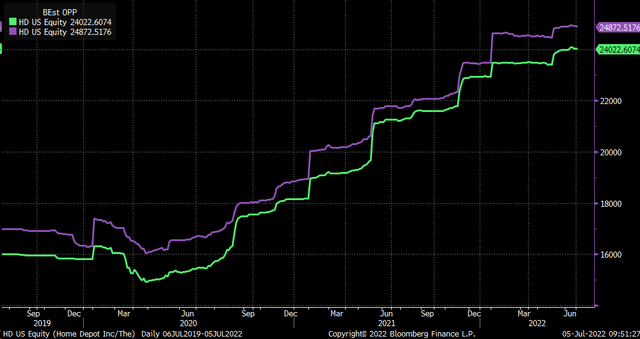

Operating profits are forecast to rise by 4.26% in 2023 to $24.02 billion and another 3.54% in 2024 to $24.87 billion. Again, this growth rate is expected to be faster than revenue growth in both years, pointing to operating margin expansion, suggesting that analysts see costs coming down somewhere.

What is odd here is that earnings growth is still much higher than operating profit growth. That would suggest that analysts’ earnings estimates are too high or that the company will be buying back enough stock in the coming two years to deliver earnings growth that exceeds revenue growth and operating profit growth.

A Big Bet The Shares Fall

The discrepancy in estimates is leading someone to make a very aggressive and bearish bet on Home Depot. On July 5, the open interest for the August 19, $210 puts, increased by roughly 22,300 contracts. The data shows that the put contracts were bought on the ASK for $1.34, implying Home Depot is trading at or below $208.66 by the expiration date. That would be a massive decline in Home Depot stock from its current price of about $277 on July 5. It is also a big wager with nearly $3 million premiums paid.

The odds of the stock falling that sharply over the next month and a half seem really low. This bearish bet appears to be a cheap way for someone to get short the equity, with a minimal capital outlay.

Technicals Point To Lower Prices

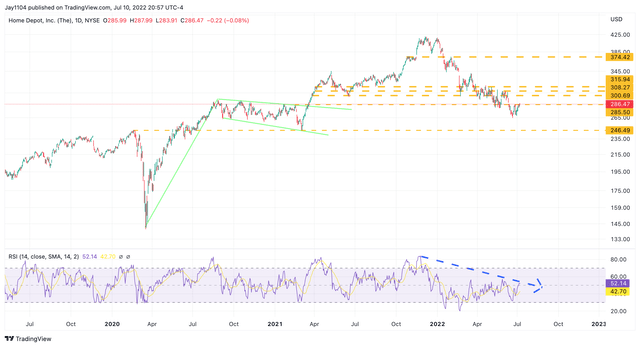

From a technical standpoint, a decline below $210 doesn’t seem likely, but a drop to around $245 does seem possible. That would take the stock back to its pre-pandemic highs. The equity recently fell below support at $285, and that price point has become a level of resistance. Given the sharp run higher in the stock starting in March 2021, Home Depot doesn’t have much support until that $245 area on the technical chart.

Additionally, the relative strength index is in a pronounced downtrend, suggesting a great deal of bearish momentum in the stock over the near term.

Since this story was written on July 5, the stock has hovered around resistance in the $285 region. To this point, it has failed to push above the $285 region on three attempts. Additionally, the RSI remains in a very steep downtrend.

Updated on July 10, 2022 (TradingView )

Home Depot has undoubtedly been a big performer over the past two years, but it seems that solid performance may end. There appear to be too many discrepancies in analysts’ estimates at this point in the economic cycle to suggest the shares rally. Higher input costs and weakening consumer demand should lead to margin erosion in this business model, not margin expansion. Right now, unless Home Depot is going to be buying a lot of stock in the near term, earnings estimates seem too high.

Be the first to comment