imagedepotpro

Introduction

Home Depot (NYSE:HD) is the largest home improvement retailer in the United States. It has 2,317 stores as of December 2021 with consolidated sales of $151 billion.

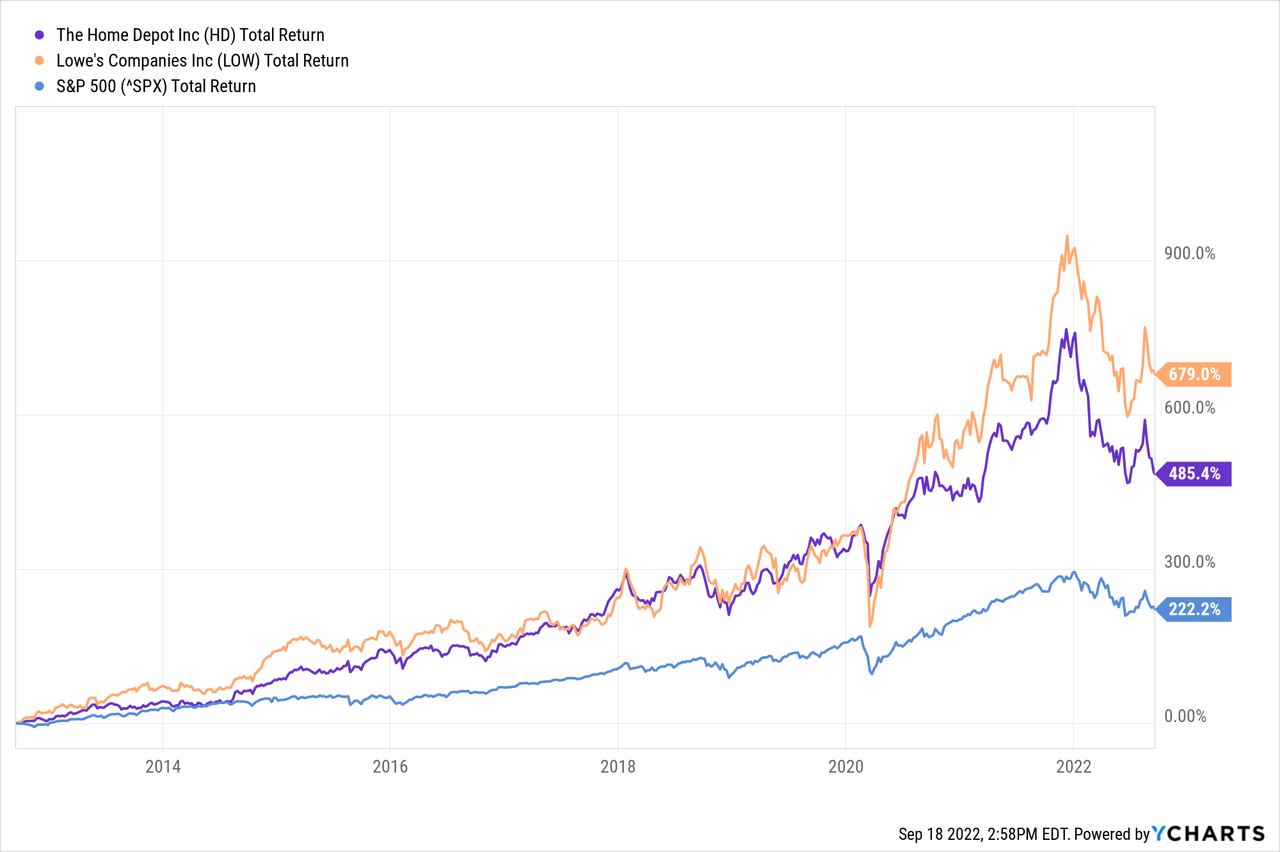

Revenue and earnings have grown strongly in recent years, and this is reflected in the share price. Shares of Home Depot have risen an average of 19% per year over the past 10 years. This is very strong compared to the average annual return of 12% of the S&P500. Smaller competitor Lowe’s (LOW) also performed strongly, and its share grew on average 23% per year over the same period.

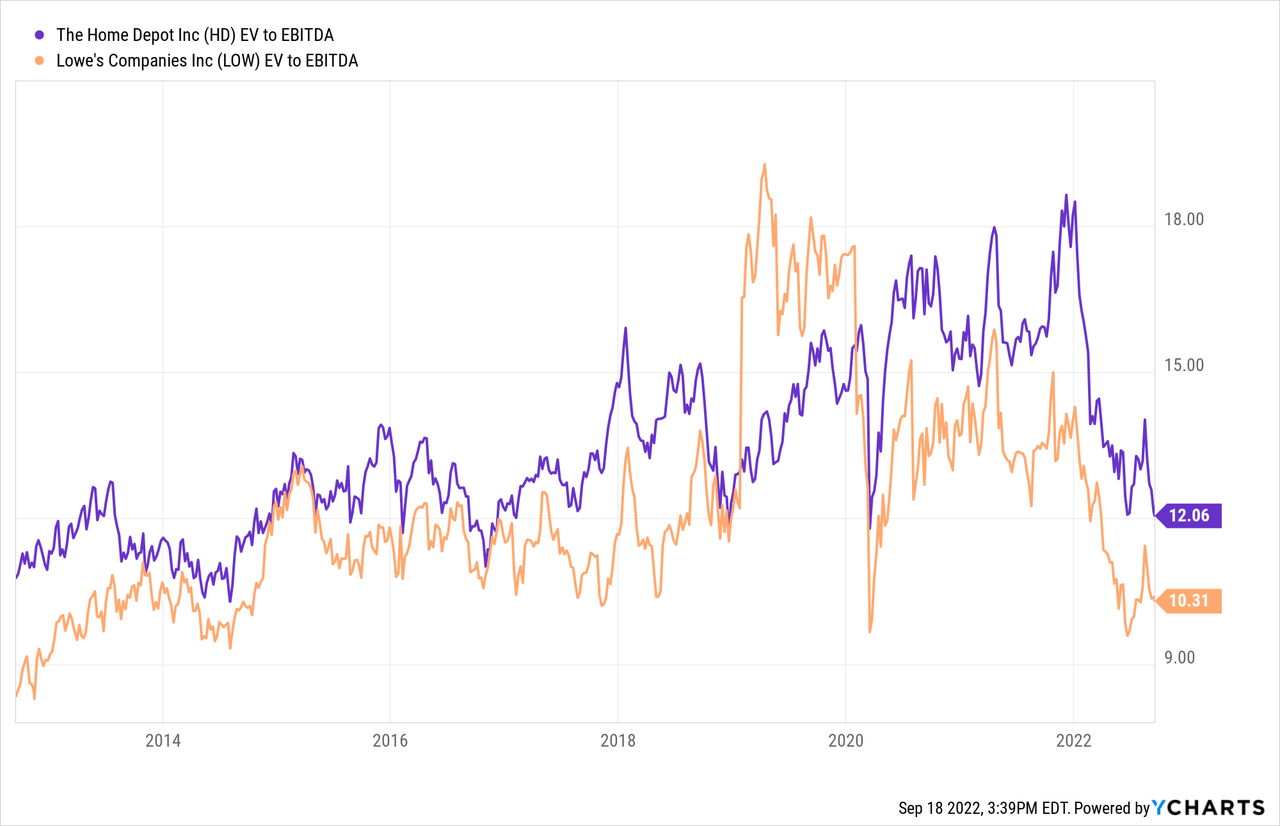

With a PE ratio of 16.6, HD seems undervalued compared to that of the S&P500 (PE ratio = 19.6). Home Depot has financed its share buybacks in recent years by taking on debt. This made some sense given the low interest rates. But in general, I don’t think it’s wise to take on debt for non-operational purposes.

Now that interest rates are higher, Home Depot is buying fewer of its own shares. Yet it continues to distribute their entire cash flow to their shareholders. The management has a friendly shareholder policy.

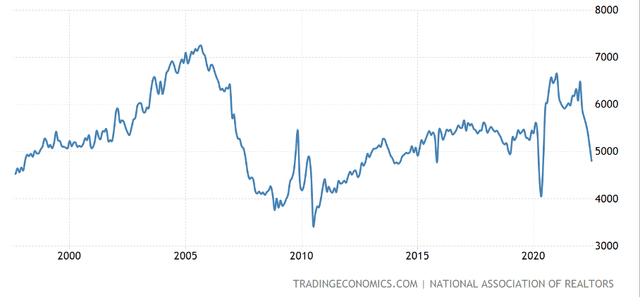

One risk for both HD and Lowe’s is declining home sales.

The valuation figures show that Lowe’s is valued slightly more attractively than HD. Due to the slightly higher valuation and possible risks, I think Home Depot is a hold.

Housing Market Does Not Look Rosy

Recent quarterly figures look good, with sales growth of 7% and earnings per share of 12%. The outlook for this year is slightly less rosy, as they assume revenue growth of just 3% and earnings per share growth at mid-single digits.

Recent developments in the housing market have helped cause Home Depot’s shares to plummet. The housing market is looking less rosy now due to high interest rates, increased inventories and declining sales. This can make homeowners less likely to refurbish their home.

A look back at 2008: In the fourth quarter of 2008, Home Depot saw their sales drop 17% from the same period a year earlier. Earnings per diluted share were $0.00, compared to $0.40 in the same period a year earlier. The outlook was bleak: for 2009 the company expected a 9% decline in sales and a 7% decline in EPS.

In 2009, it recorded a 7.2% decline in sales, but an increase in earnings per share of 13.1%. Home Depot still came out strong. Now I expect a similar situation due to the sharp rise in house prices in recent years, and the sharp rise in interest rates now.

People who have recently moved want to furnish the house according to their own wishes. Falling home sales pose a major risk to home improvement stores such as Home Depot and Lowe’s.

Currently, existing home sales in the US are falling sharply, as can be seen in the Trading Economics chart below.

Existing Home Sales (Trading Economics)

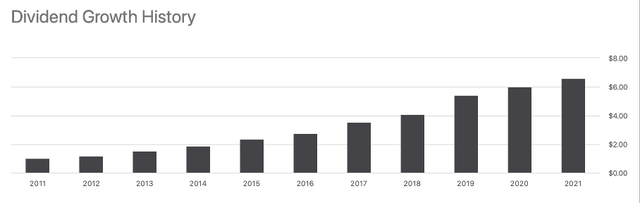

Despite the possible bad prospects, management remains very shareholder friendly. HD management has always been very loyal to their shareholders. It has offered a high dividend and a solid share buyback package for years. Partly as a result, the shares have risen sharply.

Share Repurchases Are Partially Financed With Debt

Home Depot’s dividends have risen sharply over the past 10 years at an annual average of 20%. The dividend yield is currently around 2.75%. The FWD dividend payout is $7.60 and is well backed by their $15.53 EPS.

The dividend usually grows strongly because the company’s earnings grow, but also because they repurchase shares. The share repurchase program is part of management’s strategy to return capital to HD’s shareholders.

Dividend Growth History (HD Ticker Page On Seeking Alpha)

Over the past 10 years, their number of outstanding shares has been reduced from about 1.5 billion to 1 billion shares, a reduction of about 4% per year.

In recent years, this has been partly financed by taking on debt. This seems logical as interest rates were historically low.

Currently, interest rates are rising, making it less attractive to raise debt for non-operational purposes. Home Depot recently announced a $15 billion share repurchase program, but has not announced the end date.

In 2021, Home Depot bought back nearly $15 billion in stock and paid out nearly $7 billion in dividends. In total, Home Depot has returned $22 billion to shareholders. That’s a lot, considering free cash flow for 2021 was only $14 billion. Home Depot has funded this with cash and debt.

In 2022, Home Depot adopted a more conservative stock buyback policy; YTD they have bought back nearly $4 billion worth of shares. This is likely sustainable for years to come and the repurchase yield is a solid 2.8%.

Home Depot Is Valued More Expensive Than Lowe’s

Because Home Depot partially finances its share buyback program by taking on debt, I’m including the debt in the valuation metric. EV/EBITDA is a good valuation metric because market capitalization, debt and cash on the balance sheet are accounted for in comparison with EBITDA.

Lowe’s is Home Depot’s main competitor. Lowe’s generates about 50% less sales than Home Depot, and this could allow Lowe’s to gain a larger market share. I think Lowe’s should have a higher stock valuation because the company is smaller, but Lowe’s is actually valued 20% cheaper than Home Depot.

An EV/EBITDA ratio of 12 is below HD’s 10-year median of 13, making HD slightly undervalued compared to the historical average.

Is this a reason to buy Lowe’s stock then? Recent quarterly results indicate that Home Depot’s quarterly results looked better than Lowe’s, but this is the current situation.

The future situation is difficult to determine. A recent article on SA details Lowe’s partnership with Instacart to enable same-day delivery. I don’t immediately see this as a catalyst, but if retail prices are competitive with Home Depot, consumers might be more likely to shop at Lowe’s.

Lowe’s offers more value because it can gain more market share, has same-day delivery initiatives, and is valued at a lower price than HD. Because of this, I have had Lowe’s in my portfolio for quite some time

Both Lowe’s and HD are sailing into an oncoming storm. I think Home Depot is a hold.

Conclusion

Home Depot is the largest home improvement retailer in the United States. Recent quarterly figures have been strong; revenue grew 7% year over year and earnings per share grew 12%. For 2022, Home Depot expects revenue growth of 3% and earnings per share growth in the mid-single digits. Because interest rates have risen sharply, home buyers can’t get a lower mortgage. In combination with the increased housing inventory and declining sales, the housing market does not look rosy. This directly affects Home Depot; in 2009, during the financial crisis, Home Depot saw sales fall by 7%. Nevertheless, earnings per share came in positive with a growth of 13%. Falling home sales pose a risk to Home Depot, therefore.

Home Depot is very shareholder friendly by paying a high dividend and starting a large share buyback program. In recent years, this has been partly financed with debt. This was logical given the historically low interest rates, but interest rates have now risen. Home Depot is currently returning all their free cash flow to shareholders.

The valuation measure EV/EBITDA shows that smaller competitor Lowe’s is valued more attractively. Since there are potential risks lurking and the stock valuation is valued slightly higher than Lowe’s, I’m giving Home Depot a hold.

Be the first to comment