Sundry Photography/iStock Editorial via Getty Images

By Valuentum Analysts

Demand for home improvement and construction activities remains strong according to one of our favorite income growth ideas Home Depot Inc (NYSE:HD). When Home Depot reported its fourth quarter earnings for fiscal 2021 (period ended January 30, 2022) in February 2022, the company beat both consensus top- and bottom-line estimates while also issuing out promising guidance for fiscal 2022.

Home Depot also announced a 15% sequential increase in its dividend in conjunction with its latest earnings report. Its new quarterly payout sits at $1.90 per share or $7.60 per share on an annualized basis. Shares of HD yield ~2.4% as of this writing.

Earnings Update

In the fiscal fourth quarter, Home Depot’s comparable sales rose by 8.1% (with US comparable sales growth coming in at 7.6%) due to a 12.4% increase in average ticket size offsetting a 3.4% decline in customer transactions versus year-ago levels. Sales per retail square foot rose 8.3% during this period. During Home Depot’s latest earnings call, management had this to say on the firm’s comparable growth:

The growth in our comp average ticket was driven primarily by inflation across several product categories. Core commodity categories positively impacted our average ticket growth by approximately 185 basis points in the fourth quarter, driven by inflation in lumber, building materials and copper. — Ted Decker, CEO and President of Home Depot

Home Depot is doing its best to pass along cost increases to its customers, though there are limits to this strategy. Management noted that the number of transactions worth over $1,000 grew by 18% in the fourth quarter of fiscal 2021 versus year-ago levels. This is primarily due to robust demand growth from its professional customer base (‘Pro’) as demand growth from its do-it-yourself (‘DIY’) customer base has cooled off after skyrocketing higher during the earlier stages of the coronavirus (‘COVID-19’) pandemic. Overall, demand from both customer segments remained solid.

Here is some additional commentary from Home Depot’s latest earnings call (emphasis added):

We saw continued strength in both our Pro and DIY customers. During the fourth quarter, Pro sales growth outpaced DIY growth. Sales growth for both our Pro and DIY customers accelerated in the fourth quarter relative to the third quarter and showed strong double-digit growth on a two-year basis for both customer groups. Sales leveraging our digital platforms grew approximately 6% for the fourth quarter and approximately 9% for the year. Over the past two years, sales from our digital platforms have grown over 100%. — CEO and President of Home Depot

Developing its digital presence and omni-channel selling capabilities while focusing on improving the economics of its e-commerce operations remain key priorities for Home Depot. Management noted that “approximately 50% of (its) online orders were fulfilled through (its) stores in fiscal 2021” during the firm’s latest earnings call. In-store fulfilment options are significantly more economical than home delivery fulfilment options.

Home Depot’s GAAP revenues grew 11% year-over-year last fiscal quarter as the company benefited from comparable sales growth, sustained digital sales expansion, and strength from its Pro customer base. The firm’s GAAP gross margin fell ~35 basis points to hit 33.2% as inflationary headwinds took a toll. However, relatively modest total operating expense growth of 4% enabled Home Depot to grow its GAAP operating margin by ~85 basis points year-over-year last fiscal quarter.

Beyond economies of scale, Home Depot benefited from reduced pandemic-related expenses, the roll off of acquisition-related expenses (Home Depot completed its ~$8 billion all-cash deal for HD Supply in December 2020), and “solid expense management” according to its CFO and EVP, Richard McPhail, during the firm’s latest earnings call. The company’s GAAP operating income grew 18% year-over-year last fiscal quarter, and its GAAP diluted EPS grew 21% year-over-year due to a combination of net income growth and a smaller outstanding diluted share count. Home Depot exited fiscal 2021 on a high note.

Cash Flow Cow

For all of fiscal 2021, Home Depot grew its GAAP revenues by 11% (reaching $151.2 billion), its GAAP operating income by 26% (reaching $23.0 billion), and its GAAP diluted EPS 30% on a year-over-year basis (reaching $15.53). The company’s comparable sales rose over 11% in fiscal 2021 due to marginal customer transaction growth and meaningful growth in its average ticket sizes versus fiscal 2020 levels. For reference, Home Depot’s comparable sales grew by almost 20% in fiscal 2020 versus fiscal 2019 levels, highlighting its sustained momentum on this front.

Home Depot exited fiscal 2021 with a net debt load of $37.7 billion (inclusive of short-term debt), a product of recent acquisition activity and its history of pursuing large share repurchase programs. We view its net debt load as manageable considering Home Depot generated $14.0 billion in free cash flow in fiscal 2021, defining free cash flow as net operating cash flow less capital expenditures. Last fiscal year, Home Depot spent $7.0 billion covering its dividend obligations. Home Depot also spent $14.8 billion buying back its stock in fiscal 2021, which was partially funded by its balance sheet.

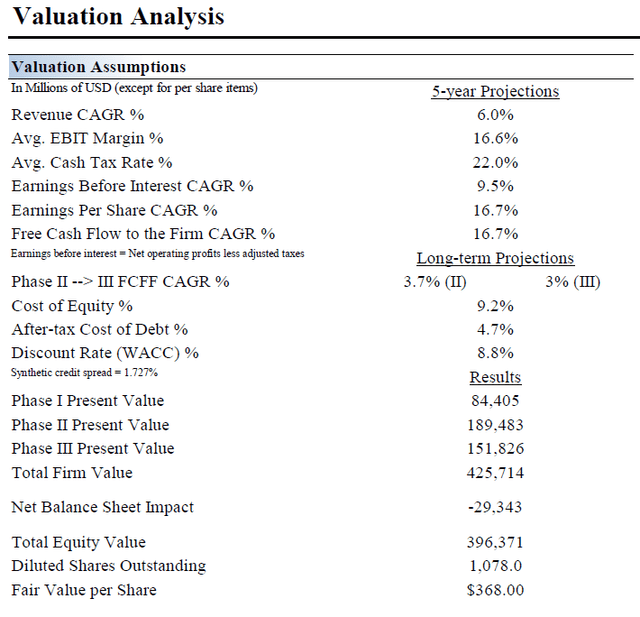

In our view, Home Depot should consider paring down its net debt load by slowing down the pace of its share repurchases. Our fair value estimate for Home Depot is $368 per share, derived through our discounted free cash flow analysis process. We think management’s pace of share buybacks should consider both its balance sheet strength and whether shares are trading at a discount to our estimate of their fair value. As of late-March 2022, Home Depot’s stock was trading at a significant discount to its fair value and a moderate amount of share repurchases at these levels represent a good use of capital, in our view.

The upcoming graphic down below highlights the key valuation assumptions we used to obtain our fair value estimate for Home Depot.

Home Depot’s fair value estimate sits at $368 per share. (Valuentum Securities)

Guidance

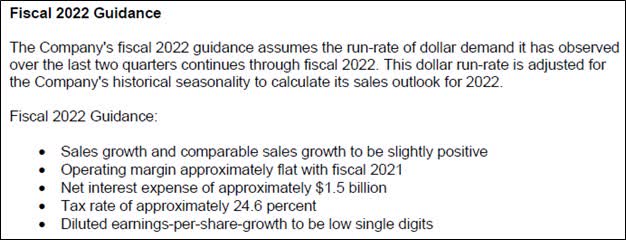

Looking ahead, Home Depot expects to post “slightly positive” sales and comparable store growth in fiscal 2022 and its operating margin is expected to be broadly flat with its fiscal 2021 performance. We appreciate the resilience of Home Depot’s business model, margin performance, and growth trajectory. Home Depot expects its near term growth rate will keep slowing down as it did from fiscal 2020 to fiscal 2021 due to tailwinds from the DIY home improvement boom fading. With that in mind, we appreciate that Home Depot expects to keep building on past successes (put another way, that its comparable sales growth is expected to remain positive in fiscal 2022 after putting up banner performance in both fiscal 2020 and fiscal 2021).

An overview of Home Depot’s guidance for fiscal 2022. (Home Depot – Fourth Quarter of Fiscal 2021 Earnings Press Release)

Home Depot views itself as targeting a $900+ billion total addressable market (“TAM”) in North America, with half of that coming from its consumer (or DIY) customer base and the other half coming from its professional customer base. Its Pro operations includes its maintenance, repair, and operations (‘MRO’) segment which was significantly enlarged through its acquisition of HD Supply. For reference, Home Depot has stores in the US (including US territories), Canada, and Mexico along with a sizable MRO presence across North America. The company views its market share standing at ~17% with ample room to grow that figure going forward.

Home Depot is targeting a $900+ billion TAM which underpins its promising growth runway. (Home Depot – Fourth Quarter of Fiscal 2021 Supplemental Material)

Concluding Thoughts

We appreciate that Home Depot expects its growth story to continue. The company is a stellar free cash flow generator catering to a large TAM with ample room to grow going forward, though we would like to see Home Depot’s net debt load shift lower over the long haul.

So far, Home Depot has done a stellar job offsetting inflationary headwinds via pricing increases, improvements in the economics of its e-commerce operations, controlled operating expense growth, and economies of scale. Looking ahead, we expect Home Depot will continue to grow its payout at a robust pace. The home improvement retailer represents a tremendous dividend growth idea.

Be the first to comment