monsitj/iStock via Getty Images

Introduction

I like to write about companies that lack coverage on SA and today I’m taking a look at Holley (NYSE:HLLY). It’s a U.S. supplier of high-performance automotive parts for car and truck enthusiasts and was listed on NYSE in March 2021 through a special-purpose acquisition company (SPAC) company named Empower. I think that demand looks sticky and that the company looks undervalued at the moment. In Q1 2022, Holley’s revenues surpassed $200 million while its net income came in at $16.9 million. Let’s review.

Overview of the business and financials

Holley was established in 1903 and during its listing it was described as the “largest and fastest growing platform in the enthusiast branded performance automotive aftermarket category”. The company finished 2021 with sales of $692 million, which it claims is 2-3 times larger than the sales of its nearest competitor. At the moment, Holley has a network of 17 manufacturing facilities and 15 R&D/engineering facilities across the USA and Canada. It also has 16 distribution centers.

The company says that performance enthusiasts can spend over $7,000 on its products over the course of a multi-year project. It has a strong focus on the direct-to-consumer (DTC) business model, with about $117 million of its 2021 sales coming from this channel. Holley has also been relying on revenues from new products, with 35% of its gross sales coming from products introduced since 2016.

I think that demand is sticky as 82% of all car and truck enthusiasts consider budgets on parts recurring expenses, according to Holley. About 64% of the company’s clients frequently trade-in their cars and trucks to begin new personalized vehicle builds. Around 54% of Holley’s consumers earn over $75,000 per year.

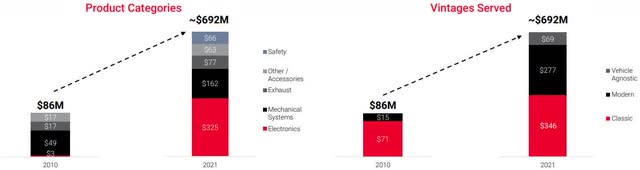

Turning our attention to the financial performance of the Holley, I’m impressed at how well the company has managed to diversify its revenues over the past decade and how fast sales have grown. In 2010, the company had net sales of $86 million and the vast majority of them came from exhaust products for classic cars. Today, almost half of sales come from electronics products and a significant part of them come from owners of modern cars and trucks.

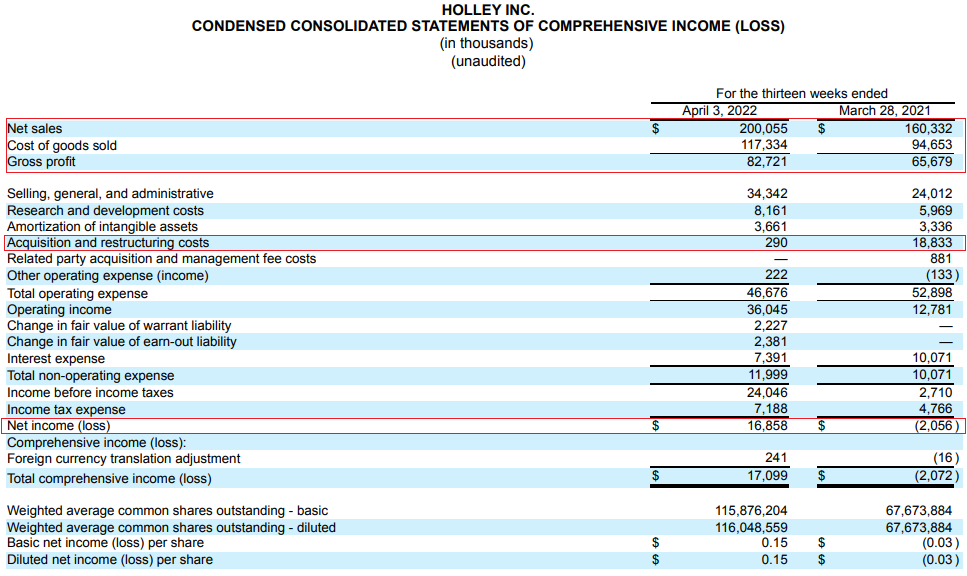

In Q1 2022, net sales rose by 24.8% to $200.1 million while the gross profit increased 25.9% to $82.7 million. It seems that the company hasn’t been affected by inflation and global supply chain issues in a significant way as the gross margin increased to 41.3% from 41.0% a year earlier. The net income for Q1 2022 came in at $16.9 million. Unlike Q1 2021, acquisition and restructuring costs were low. On an adjusted basis, net income increased rose to $21.5 million from $15.1 million in Q1 2021.

Holley

I have to point out that a lot of the sales growth was not organic. Excluding the impact of acquisitions, Holley’s sales grew by 13.5% or $21.6 million in Q1 2022. M&A is an important part of Holley’s growth strategy, and the company has completed a total of 14 acquisitions since 2014. They have contributed over $35 million in growth and cost synergies so far.

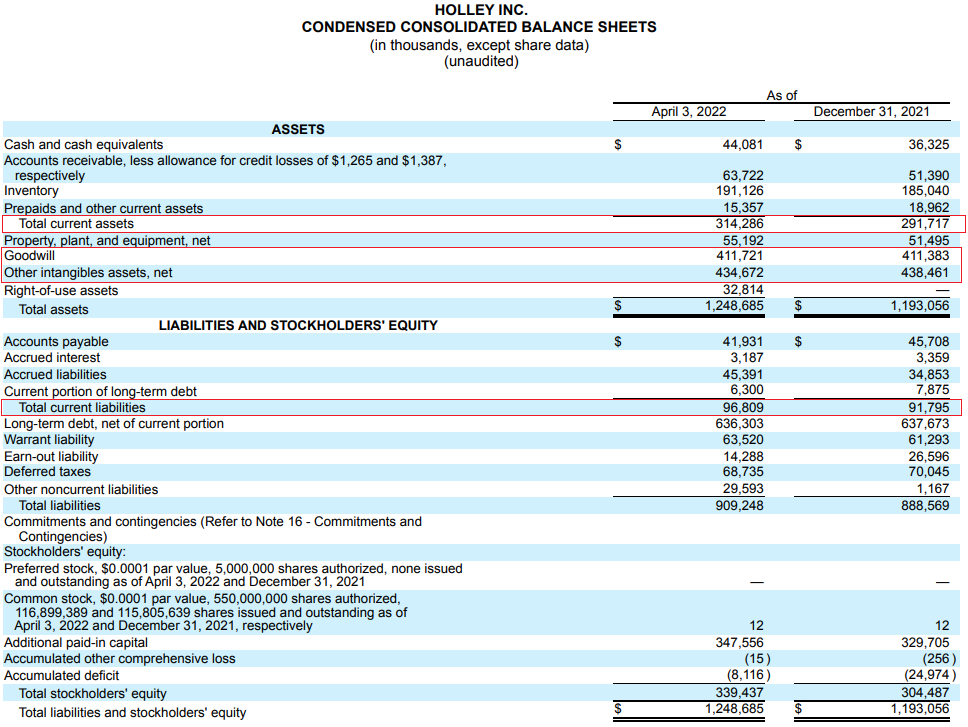

Turning our attention to the balance sheet, Holley has an asset-light business model, and you can see that goodwill and intangible assets account for the majority of the asset base as of March 2022. I think that the balance sheet looks strong as working capital is positive and the company had a total of $97.6 million available under its revolving credit facility as of April 3. Capital expenses for 2022 are expected to come in at between $14 million and $16 million.

Holley

Looking at the guidance for 2022, Holley expects to book net sales in the range of $765 million to $790 million as well as adjusted EBITDA of between $186 million and $194 million. According to my calculations, the company currently has an enterprise value of $1.85 billion, which means that it’s trading at a 2022 EV/EBITDA multiple of about 9.75x as of the time of writing. In my view, it’s a good business with sticky demand and a long history of growth and I think that the company should be valued at around 12x EV/EBITDA. This puts my target share price at around $14.40. Unless Holley’s financial results start to become affected by inflation and supply chain issues, I think this share price level could be achieved by the end of 2022.

So, what are the major risks for the bull case? Well, I just mentioned the most significant one – inflation. High inflation usually erodes purchasing power and leads to a decrease in discretionary spending and this can eventually affect even businesses with sticky demand. I think that another major risk is increasing interest rates as Holley has over $600 million long-term debt. This could eat away at the company’s earnings. As of April 3, the weighted average interest rate on Holley’s borrowings under its credit facility was 4.5%.

Investor takeaway

Holley has been around for over a century, and I think it has built a leading position in the US market for high-performance automotive parts for car and truck enthusiasts. The vast majority of the company’s clients have high earnings, and they consider budgets on parts recurring expenses, which is why I think that demand is sticky.

The revenues and profits of Holley are growing fast, and the company seems well-funded to continue to execute acquisitions over the coming years. Overall, I think that Holley should be trading at 12x EV/EBITDA, which translates into around $14.40 per share. However, beware of high inflation affecting the purchasing power of the US consumer.

Author’s Note: Thank you for reading my analysis. Please note that I will be launching a marketplace service named Bears and Resources on June 7. I plan to share my live portfolio and my shortlist and discuss exclusive investment ideas. Early subscribers will receive an Early Bear discount.

Be the first to comment