Wiyada Arunwaikit

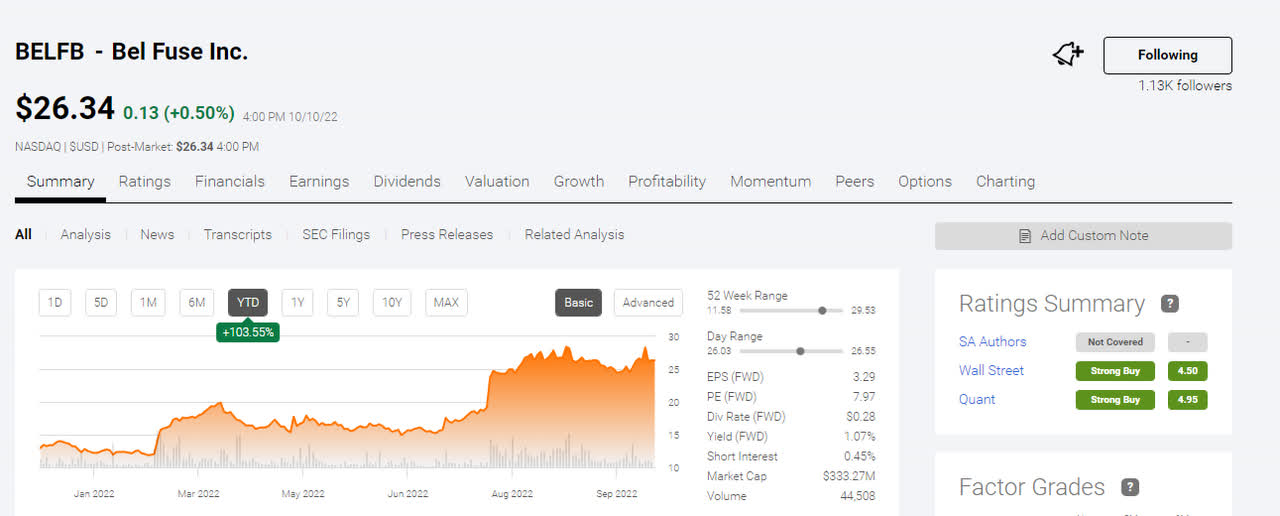

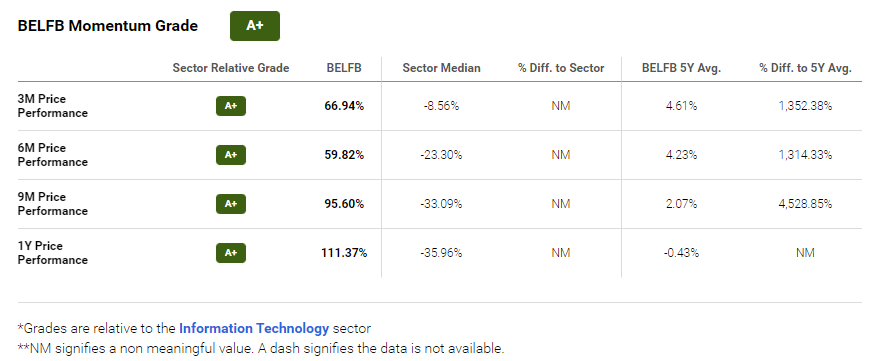

Bel Fuse, Inc. (NASDAQ:BELFB, NASDAQ:BELFA) still gets a strong buy recommendation from Seeking Alpha’s quantitative stock rating system. The screenshot below also reveals BELFB is a strong buy according to Wall Street. These bullish recommendations are in spite of BELFB’s +103.55% YTD performance.

Seeking Alpha

Bel Fuse deserves a hold rating. Prudence is a must during this period of increased uncertainty. It is unsafe to be in a buy-mode while the U.S. stock market continues to post declines.

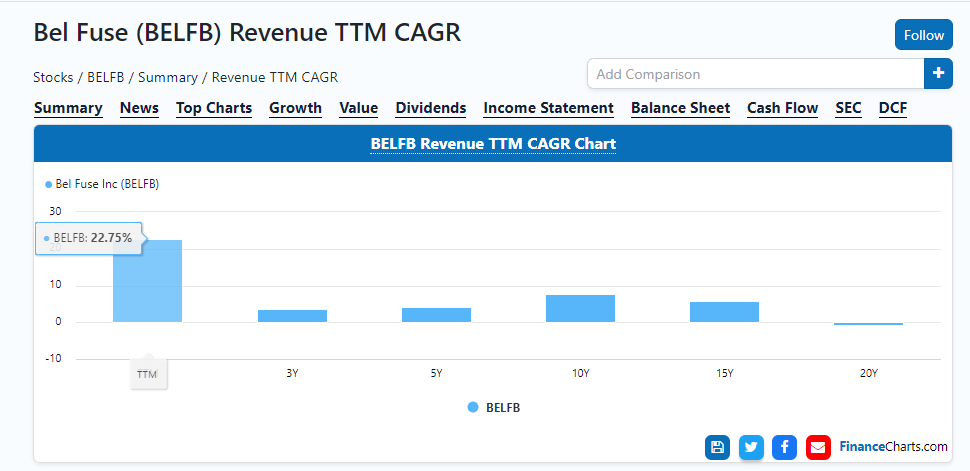

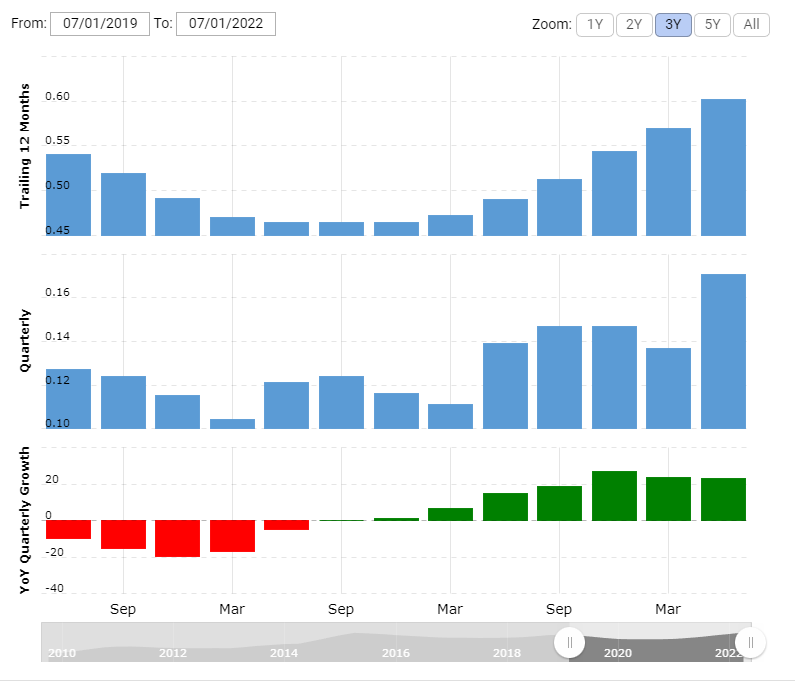

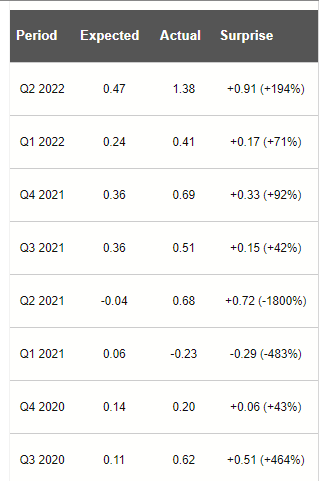

True, the euphoria over the strong Q2 EPS/revenue beat has not yet ebbed. Many investors are not doing any profit-taking on their Bel Fuse positions. They are in a hold-and-wait mode, praying for BELFB or BELFA to go higher. That +23% Y/Y growth in Q2 revenue is hinting that Bel Fuse is headed for better growth performance.

The TTM revenue CAGR of Bel Fuse Inc. is now 22.75%. This is significantly higher than its 10-year average revenue CAGR of 7.81%.

FinanceChartsDotCom

Revenue Performance Fuels The Momentum

The big improvement on growth metrics is likely why BELFB and BELFA got a bull run after its Q2 ER last August. The substantial 22% TTM Y/Y revenue development could continue this Q3 and Q4.

Bel Fuse’s Q1 revenue was $136.7 million, up +23.6% Y/Y. We can expect that Q3 and Q4 would also deliver +20% revenue YoY. If this speculation proves true, BELFB could bounce back to $29. The upside probability is it could even post a new 52-week high, breaching the $30 price mark. The bull momentum continues if consistent EPS/YoY improvements is announced for Q3 and Q4 F2022.

Bel Fuse’s revenue performance is in an ascending pattern since 2018. It is safe to expect a record F2022 revenue.

MacroTrends.net

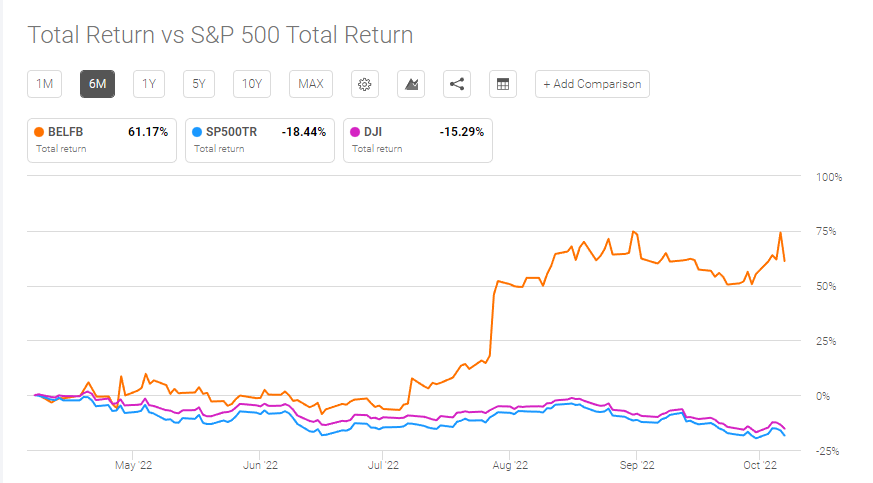

The quantitative algorithm of Seeking Alpha has a strong buy for BELFB because of its Momentum Grade of A+. BELFB has defied the bearish stock market vibe, it continues to outperform the S&P500 and DJI. BELFB has a 6-month total return of +61.17. This is in big contrast to SP500’s -18.44%.

Seeking Alpha Premium

Can It Sustain A 20% Revenue CAGR?

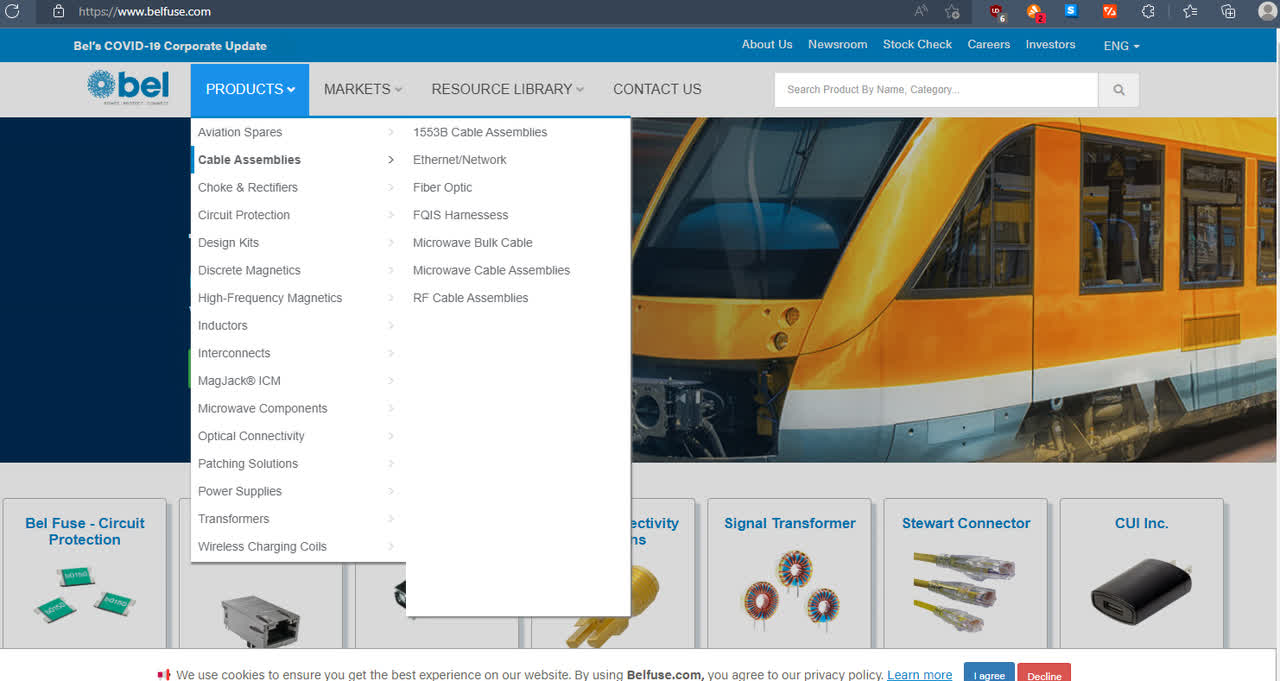

Bel Fuse acquired two companies last year. The purchase of Current Concepts and EOS Power are partly why Bel Fuse now touts a revenue CAGR greater than 20%. Inorganic growth is a great way to expand the already comprehensive list of Bel Fuse products. The very diverse product portfolio could be confusing. On the other hand, the high number of products enhances Bel Fuse’s role in the $484.99 billion electronic components industry.

BelFuse.com

The estimated CAGR of the global general electronic components business is 10.4%. It will be worth $805.88 billion by 2026. This is a decent growth rate. It ensures Bel Fuse is unlikely to see revenue CAGR less than 8%.

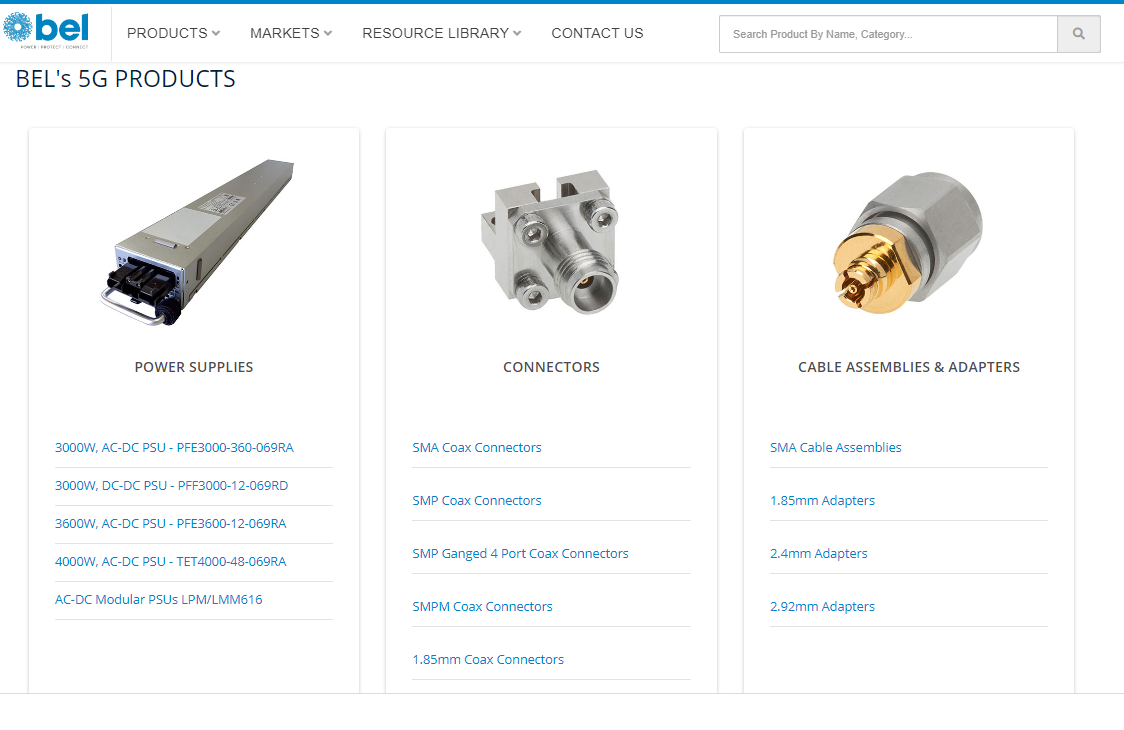

Bel Fuse can acquire companies that will let it become more relevant in 5G, data centers, and security. Buying and dipping in too many markets is something that a small company like Bel Fuse cannot afford. BELFB’s total cash is only $65.83 million. Its net operating cash flow is just $17.7 million.

BelFuse.com

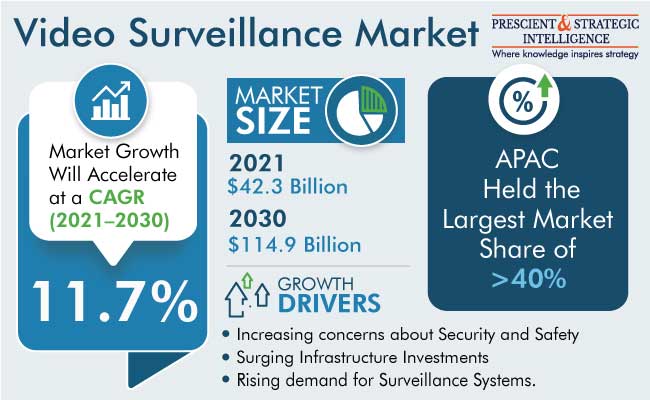

Supplying the electronic/electrical components for the video surveillance market is an attractive core business. The $42.3 billion video surveillance industry is growing at 11.7%. It will be worth $114.9 billion by 2030. Bel Fuse has security-related products that are essential to manufacturing video surveillance systems.

psmarketresearch.com

The power supply-related products of Bel Fuse makes it a key player in the $50 billion data center infrastructure industry. This niche market is growing at 12% CAGR. It is projected to be worth $120 billion by 2028.

Bel Fuse.com

This company can provide SFP transceivers for Ethernet needs of data centers and server farms. It can supply Wi-Fi antennas and the components for battery chargers. Bel Fuse sells wireless charging coils for phones, unmanned vehicles, domestic robots, navigation systems, gaming devices, and other smart devices. The wireless charging industry was worth $5.48 billion last year. It is growing at a CAGR of 22.73%, and it is expected to become a $34.65 billion market by 2030.

Gaming-related electronic products can also help Bel Fuse sustain a double-digit growth rate. The gaming hardware industry had a market size of $34.2 billion. It is expected to grow to $56.8 billion by 2032. Bel Fusion markets power, protection, connector, and magnetic electronic components for the gaming hardware industry.

The other important tailwind for BELFB is the $5 billion 5G infrastructure industry. It is growing at 48.5% CAGR, and it is expected to grow to $167 billion by 2030. A strong focus on 5G-related components could help Bel Fuse maintain a double-digit revenue CAGR.

Belfuse.com

Conclusion

My hold rating for Bel Fuse Inc. is mainly due to its already high YTD gain of $103.55%. The most prudent move now is to take profit before the company reports its Q3 EPS and revenue numbers. Yes, the quarterly revenue of Bel Fuse is in an upward trend. Unfortunately, we cannot foresee the future.

The tangible risk is that the investing community might turn bearish on BELFB. This company might not report a 20% or higher Y/Y revenue achievement for Q3. As for quarterly EPS, Bel Fuse has been beating EPS estimates for the past eight quarters. Gauge the investor emotions based on quarterly revenue numbers.

NextEarningsDate.com

My hold rating might be wrong because BELFB is clearly a flying-high stock that is defying the bearish climate. You can buy more Bel Fuse shares if you like momentum stocks. Based on the chart below, BELFB is a stock market darling.

Seeking Alpha Premium

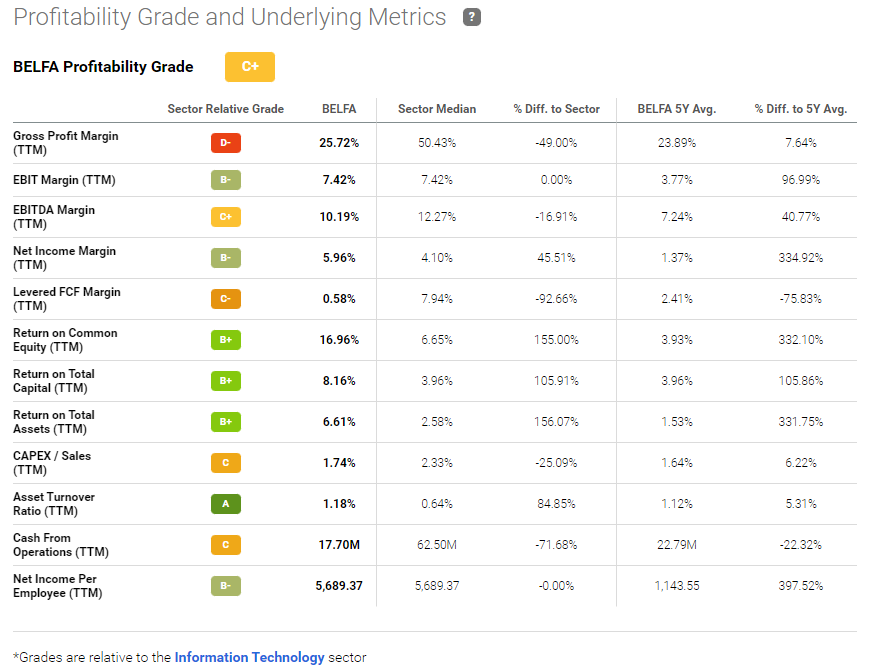

My hold recommendation for Bel Fuse is partly due to its margins. It is a long-term handicap that Bel Fuse is engaged in the low-margin business of making and selling electronic components. Seeking Alpha’s quant algorithm only gives BELFB a profitability grade of C+. This is due to its 25.73% gross margin and 5.96% net income margin.

Seeking Alpha Premium

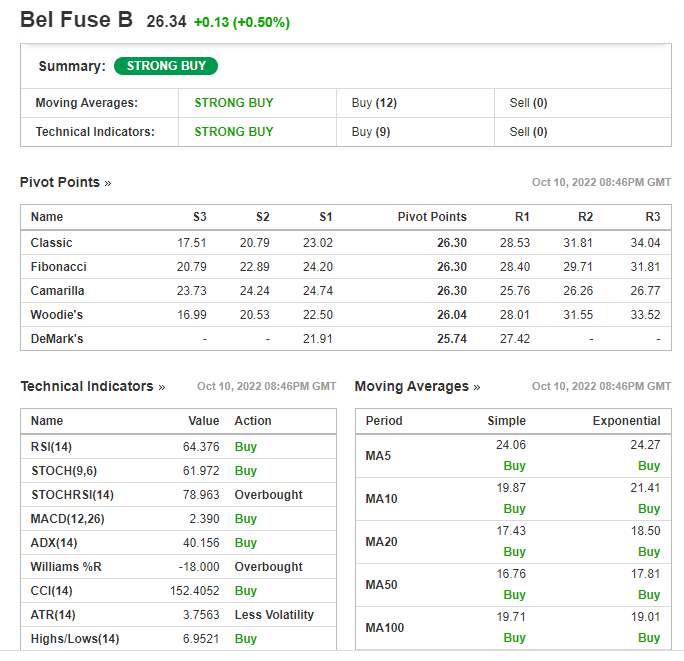

Technical indicators and moving averages are saying that BELFB is still a Strong Buy. You can ignore my hold recommendation for Bel Fuse if you like technical trade signals. Based on the chart below, Bel Fuse’s RSI of 64.376 has not yet elevated it to Overbought territory.

Investing.com

Value-wise, BELFB’s +103.55% YTD has not made it overpriced. Its forward GAAP P/E valuation is only 9.07x. Its forward Price/Sales is 0.58x, more than 76% lower than the Information Technology’s sector average of 2.48x. If you have extra cash for value investments, buy more BELFB.

Be the first to comment