TU IS

Over the past year, Fastly (NYSE:FSLY) stock is down 70%. Clearly, the bear market has thrown Fastly out. If you bought FSLY near the 52-week highs around $58… let alone all-time highs over $120, forget about it. This stock isn’t seeing that type of valuation anytime soon.

But there are some things to like about a company that still has acceptable revenue growth, a new CEO, and a valuation that trails its peers.

In the past, Fastly traded at a premium multiple. Sector hype and over exuberance led to the high multiple, but some was based on strong revenue growth.

Revenue Growth Stalls

| Year | Revenue | Growth % |

| 2023* | $484.2M | 15% |

| 2022* | $419.7M | 18% |

| 2021 | $354.3M | 22% |

| 2020 | $290.9M | 45% |

| 2019 | $200.5M | 39% |

*Earnings Estimates Via Seeking Alpha

When revenue falls to a mid-teens forward projection and the company has no operating profits, investors get a tummy ache. When the Federal Reserve is raising interest rates at the same time – investors puke.

Obviously, the recipe for Fastly is to reaccelerate revenue growth. The company’s former CEO Joshua Bixby oddly proclaimed the company would achieve $1B in revenue by 2025 back in November of 2021.

Not surprisingly, 6 months later Bixby announced he’s stepping down and a new CEO is coming in September.

Few are expecting incoming CEO Todd Nightingale to reaffirm 2025 guidance that would imply a 33% CAGR from 2022’s forward revenue estimate of $419M. If somehow he does (or guides anything significantly higher than mid-teens growth), FSLY is undervalued.

Here’s why.

Competition

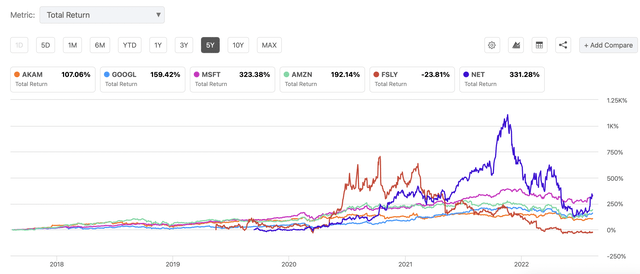

Close competitors in this space are Cloudflare (NET) and Akamai (AKAM), along with mega cap giants Amazon (AMZN), Microsoft (MSFT) and Google (GOOG) (GOOGL) which bundle Content Delivery Network (CDN) and security inside a cloud offering.

As a side note, I personally wouldn’t move forward with an investment in FSLY, NET, or even AKAM until you fully allocate positions in AMZN, Google and MSFT.

Seeking Alpha

The primary reason is the mega cap stocks have outperformed the group with less volatility. However, for periods of time Fastly and Cloudflare have outperformed. In fact, Fastly’s closest rival Cloudflare is outperforming the group since the stock went public.

That’s great news for Fastly, as investors clearly still have an appetite for the sector.

| Company | FSLY | NET | AKAM |

| Market Cap | $1.47B | $25.42B | $15.25B |

| TTM Revenue | $389.4M | $812.6M | $3.57B |

| 2023 Growth Est | 15.35% | 36.5% | 6.74% |

| 2023 FWD P/S | 3.04x | 19.18x | 4.01x |

| GAAP Profits | No | No | Yes |

Putting the mega caps aside, clearly FSLY has been tossed out by investors. NET Price/Sales (P/S) multiple is over 6 times higher than FSLY while revenue & growth rate is roughly 2x FSLY.

Investors pay a 4x multiple for AKAM forward sales estimate vs FSLY 3x, likely in part due to the fact AKAM has GAAP Net Income – despite the fact AKAM’s growth rate is less than half of FSLY.

Compared to peers, Fastly stock has priced in quite a bit of downside. Any upside guidance (or results) produced by the incoming CEO is likely not priced into the stock.

That’s the good news. Bad news is it’s not going to be easy.

Organic revenue growth, particularly one that re-accelerates seems unlikely. Fastly was able to accelerate revenue during 2020 particularly because its pricing is based on traffic levels. The “stay at home” environment fueled increased internet traffic and therefore higher revenue.

Another way to grow is through acquisition. Fastly has been active this year in the acquisition space. In March, the company acquired Fanout and in May acquired Glitch.

According to Q2 cash flow data, total spent on acquisitions in 2022 came in at over $25.2M – with the bulk likely on Glitch which now has over 1.9M developers.

While Glitch generates some revenue via a subscription model, the goal outlined by management during the Q2 conference call seems to indicate it’s simply a part of a long sales process to get developers using Fastly with the hopes of it leading to future business.

So we see it [Glitch] as being very important on the sales journey and not only that developer moment of inspiration, but that carries through the entire enterprise cycle. So, we believe it’s going to serve two main purposes, obviously, on the revenue side. But the other thing, when you get so many people experimenting with the tools, you actually start to find new use cases.

Former CEO Joshua Bixby Q2 Conference Call

Interesting approach, but likely not going to move the needle from a revenue perspective very quickly.

After paying off a $235M convertible note at a 25% discount in Q2 – Fastly’s cash & equivalents of ~$480M is balanced off by over $700M in debt.

Combine the balance sheet with the fact FSLY hasn’t had positive operating cash flows in 7 quarters and it’s not like Fastly can go on an acquisition shopping spree.

Buyout

But the fact Fastly doesn’t have the cash to grow via acquisition might be overlooking the obvious.

Fastly itself is an acquisition target. Some loose speculation was floated about Google being interested in acquiring Fastly in April. Story probably checks out since Google is trying to quickly scale up its Cloud business and a ~$1.5B company before takeover premium is literally about 2 days of revenue.

Either way, theoretically there’s often a floor under a stock that falls 70% but still is achieving double-digit revenue growth. Not to mention the synergies with a mega cap company could solve many of Fastly’s negative cash flow problems.

Bottom Line

Fastly is not a buy & hold stock. That’s not a knock on Fastly. There’s few economic environments where investors should hold unprofitable companies with declining revenue growth outlook.

However, the floor valuation for FSLY is likely not far from current market cap. At the same time, I don’t want to hold a stock for a long time where the best possible outcome is a buyout (since that caps the upside).

If you’re looking for a long-term investment, Fastly isn’t it. However, the depressed valuation and upside spike if a takeover materializes are intriguing enough that any investor in close to the current valuation should continue to hold and be quick to take profits when/if the opportunity comes.

Be the first to comment