deimagine/E+ via Getty Images

Big 5 Sporting Goods Corporation (NASDAQ:BGFV) is a national retail outlet for sporting goods with 431 stores. It operates in a competitive arena. DICK’S Sporting Goods (DKS) is considerably larger, with 858 stores. Walmart (WMT) and other large retailers offer many of the same types of items as Big 5. Other physical and internet retailers compete in specific categories including shoes, sportswear, ski equipment, and camping equipment.

The dividend of $0.25 will next be paid on September 15 to shareholders of record as of September 1, 2022. That means investors can earn a very high rate of interest by buying stock during the remainder of August. The wisdom, or not, of that will be discussed below.

In this article I will examine where Big 5 would fit, or not, in portfolios. My own portfolio consisted largely of small to mid-cap biotech stocks until about 2 years ago. While I am mostly retaining those companies, I have also been gradually adding slower-growth, less risky dividend stocks. Big 5 is clearly a dividend stock, but it may not fit well in every dividend-oriented portfolio. Perhaps the most important issue is whether the dividend is sustainable.

Big 5 Q2 2022 Results

Most retailing is seasonal, and sporting goods has its own specific dynamics. The fourth quarter, the gift giving season so big for many retailers, is not Big 5’s strongest. It coincides with initial sales of winter clothing and ski equipment. The first quarter, Winter, also tends to have weakness. The second quarter is typically strongest, as Spring compels people to venture outside with new clothing and equipment. Then the third quarter slacks off a bit as some summer sales continue, followed by the addition of back-to-school, including school sports, sales.

To give context, here are revenue results for Big 5 for the four quarters of 2021:

|

BGFV revenue, $ millions |

|

|

Q1 2021 |

273 |

|

Q2 2021 |

326 |

|

Q3 2021 |

290 |

|

Q4 2021 |

273 |

Big 5 in Q2 2022 (fiscal, ending July 3) reported revenue of $254 million, which was down 22% from $326 million in the year-earlier quarter. In fact it was below every 2021 quarter. Same store sales were also down 22%, but the company pointed out that going back two years for comparison, same store sales were up 4%. 2020 was a less than stellar year because of the pandemic, while 2021 was boosted by government stimulus checks.

After expenses net income was $8.9 million, or $0.41 per share. That is down significantly from Q2 2021, when net income was $26.8 million or $1.63 per share. Big 5 ended the quarter with $36.6 million in cash. It had no long-term liabilities, but it did have accounts payable of $115 million, accrued expenses of $68 million, and lease liabilities. On the positive side it had $19 million in prepaid expenses, $14 million in accounts receivable, and $338 million in inventory.

Post-pandemic Outlook

The price of any stock tends to be more about the future than the past. We know the past, but we are guessing about the future even when we use the word forecasting. Given the interest rate raises from the Federal Reserve, and the likelihood they will continue for a while, we may see a flattening of consumer demand, or even a recession. Meanwhile margins are a crucial issue for retailers: how much will suppliers want to raise their prices, and how much of that can be passed on to consumers? In Q2 margins were strong, 310 basis points higher than in pre-pandemic second quarters, though down 102 basis points y/y. CEO Steve Miller reported that because inventory has been kept current, Big 5 can use promotions strategically, rather than to clear excess inventory at low margins. A focus continues to be on keeping costs down, which has been a key to the company’s long-term success.

My assumption is that sales will normalize and that if there is a recession, the United States will be able to pull out of it by lowering interest rates. I believe at some point gasoline prices will be flat or even down y/y, at which point inflation will become a non-issue about as quickly as it became an issue. I see no reason to expect a significant decline or increase in Big 5 sales from current levels so long as the store count remains about the same. There is no reason to expect a significant expansion or contraction in the number of stores.

Dividend Sustainability

While short-term dividend plays are practiced by some investors, most of us want to know whether a dividend rate is safe. Of course, no dividend can be guaranteed safe. However, Big 5 has a fairly steady retail model. In Q2 GAAP EPS was $0.41. That means, as $0.25 per quarter is currently paid out for the dividend, there is $0.16 to reinvest in the company, or accumulate as cash. The dividend results in a payout of about $5.5 million per quarter. With cash balances at $36 million, if there is a particularly weak quarter, the dividend could be paid out of cash balances instead of cash flow. For that reason, I think the dividend is safe and sustainable. At the closing stock price of $13.49 on August 15, 2022, that results in an annual yield of 7.55%. That is a very nice dividend. My only caveat is that I do not expect Big 5 to grow significantly, so neither will the dividend. That may not be as good in the long run as a company that is paying a dividend that can grow over time.

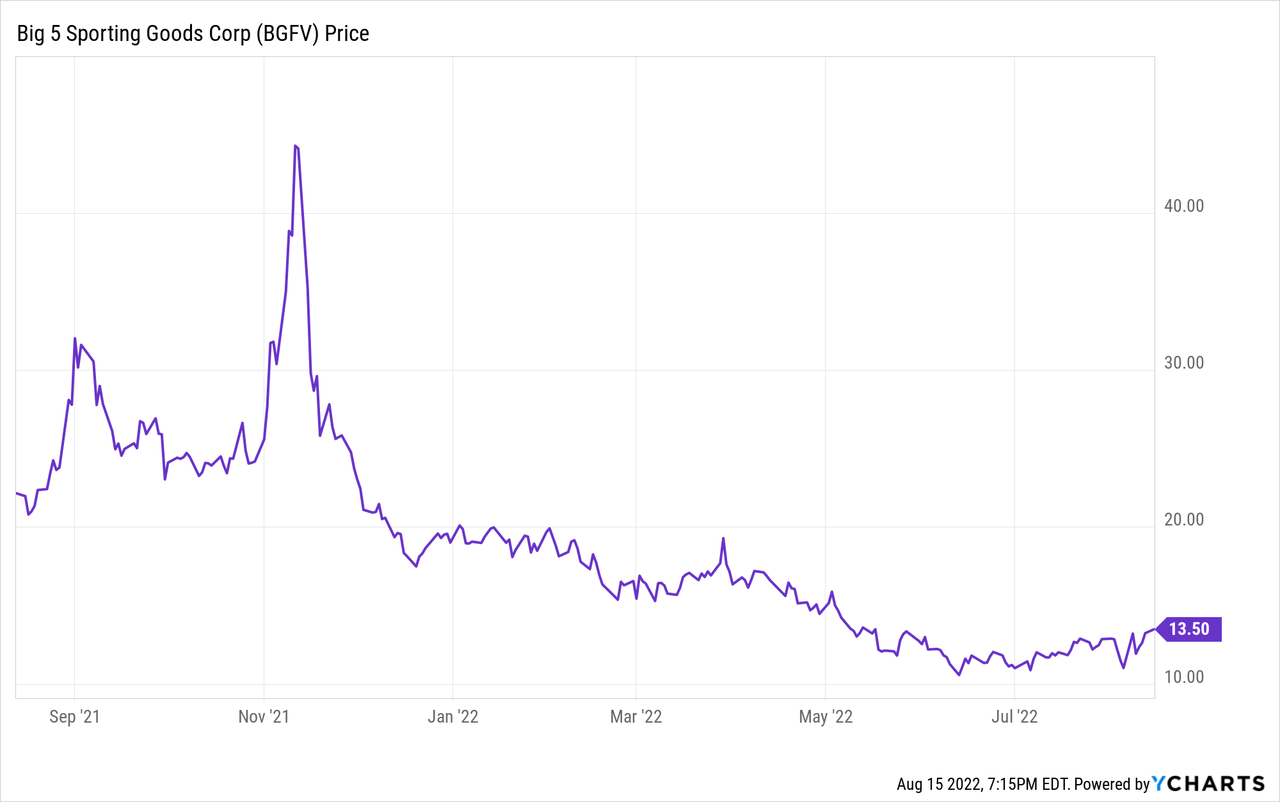

The stock has been quite volatile lately, with a 52-week low of $10.40 and high of $46.30. That means at the current price, while volatility is likely to continue, there is not a lot of downside risk. Since the stock is set to pay a dividend to stockholders of record on September 1, if the price remains steady buying by then will generate an extra $0.25 per share pretty quickly. Beware, however, that often stocks fall by more than the dividend amount when they go ex-dividend. Best to decide mainly on the basis of the longer-term dividend rate.

Conclusion

Even before the advent of the internet sales model, retail has been a dynamic, survival-of-the-fittest area for investing. Big 5 has been around since 1988 and survived in the very competitive sporting goods sector. I shop there and have always found my local store to be clean, well-stocked, and with helpful (but not redundant) employees. For those investors who are seeking dividends, understand the lack-of-growth model, and are diversified, I think Big 5 can be a good fit. As I am adding dividend stocks to my own portfolio, I added an initial bit of Big 5 in late May and may add more over time.

Be the first to comment