Charles Wollertz

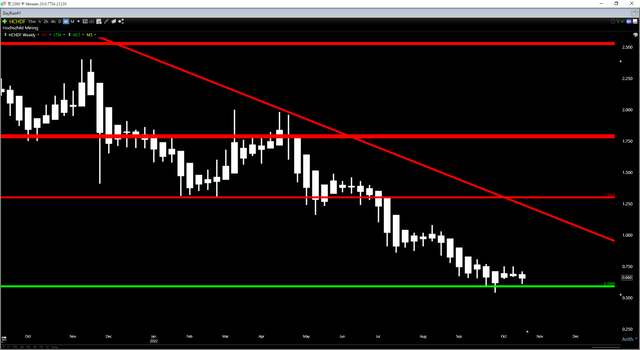

Just over three months ago, I wrote on Hochschild Mining (OTCQX:HCHDF), noting that if the stock slid below US$1.25 near key support, it would present a buying opportunity, but the best trading strategy was to sell at a 17-20% profit. While the stock gave exactly after rallying off this level following its May pullback, it has since been decimated, being cut in half and dropping below US$0.70 per share. This has left Hochschild trading at its cheapest valuation in years, and it is one of the only precious metals stocks sitting at or near its 2016 lows at a time when gold traded near $1,200/oz.

While this pullback might appear nonsensical, it’s important to note that Hochschild has seen a sharply declining production profile and rising costs over the past six years, and two of its mines are staring down very short mine lives. This is certainly not ideal, and replacing reserves at its assets won’t be easy when its metals price assumptions are above spot prices ($1,800/oz gold, $26.00/oz silver). Given this deterioration in the investment thesis, the underperformance is not surprising. Let’s look at the recent results and see whether this negativity is priced into the stock:

Hochschild Mining Operations (Company Website)

H1 2022 Results

Hochschild Mining released its H1 2022 interim results in late August, reporting production of ~96,000 ounces of gold and ~5.07 million ounces of silver, representing a 9% and 14% decline from the year-ago period. This sharp decline in output, combined with lower silver prices, led to a significant decline in revenue and adjusted EBITDA, with revenue down 12% to $347.8 million and adjusted EBITDA plummeting to $130.5 million (34% decrease year-over-year). However, the H1 2022 results were actually buoyed by hedging 2.0 million ounces of silver at ~$27.00/oz, which the company will not benefit from in 2023 when its hedges run out.

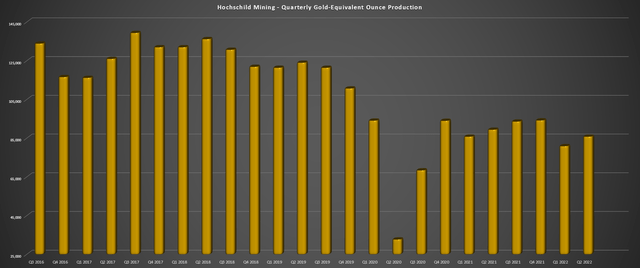

Hochschild Mining – Quarterly GEO Production (Company Filings, Author’s Chart)

Looking at the chart above, we can see that Hochschild Mining’s quarterly attributable gold-equivalent ounce production has continued to decline since 2017 levels, partially impacted by moving its Arcata mine into care & maintenance. However, the company has also been impacted by steadily declining grades at Pallancata, where grades have slid from ~360 grams per tonne of silver and ~1.30 grams per tonne of gold (FY2018) to ~160 grams per tonne of silver and 0.72 grams per tonne of gold in H1 2022. Combined with lower throughput, this has significantly impacted the mine’s quarterly output.

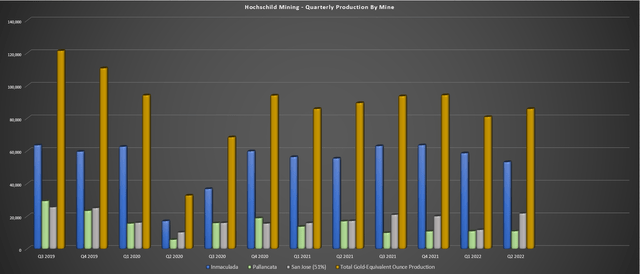

Hochschild Mining – Quarterly Production by Mine (Company Filings, Author’s Chart)

In terms of the H1 2022 production, the star performer, as usual, was Inmaculada. This flagship asset produced the bulk of Hochschild’s GEOs in the first half, with Hochschild reporting production of ~111,800 GEOs at all-in-sustaining costs [AISC] of $1,015/oz. Meanwhile, Pallancata produced just ~1.56 million silver-equivalent ounces at an AISC of $33.10/oz, impacted by inflationary pressures, a higher proportion of conventional mining, and lower-than-planned grades. These costs were up over 80% year-over-year, and while they will improve in H2 2022, the asset’s AISC FY2022 is expected to average $29.85/oz, making it a little difficult for this asset to generate any free cash flow.

Finally, at the company’s 51% owned San Jose, production was down sharply to just ~33,400 GEOs on an attributable basis at an AISC of $1,649/oz (H1 2021: $1,214/oz). The lower production was related to lower throughput, offset by higher grades, with production impacted by COVID-19-related exclusions in Q1 and a fire in the crushing area, which temporarily affected operations. The company noted that this didn’t impact full-year production forecasts, but costs were much higher due to inflationary pressures and higher mine development capex, and without an increase in the gold price, AISC margins per gold-equivalent ounce could come in below $275/oz this year.

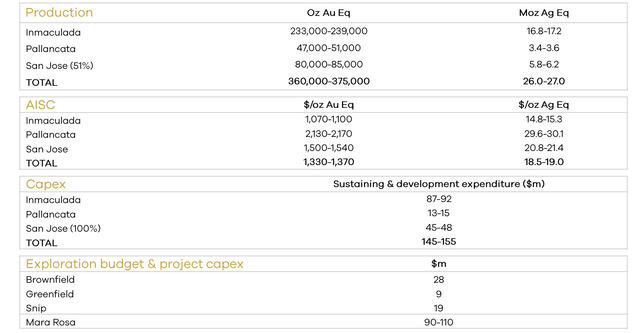

Hochschild Guidance (Company Presentation)

The good news is that the company is on track to meet its guidance of 360,000 to 375,000 GEOs, with outperformance at Inmaculada helping to offset much lower production at Pallancata. That said, annual production was still down sharply from its high of 514,000 GEOs in 2018, and while its Mara Rosa Project will provide growth (12% complete), this could be offset by Pallancata, which may head offline by late next year due to a lack of reserves. Hochschild noted that it’s confident in the medium to long-term outlook for this asset, given exploration success, but it’s hard to be confident in the short-term outlook, which will take ~60,000+ GEOs offline. Let’s take a closer look at costs:

Costs & Margins

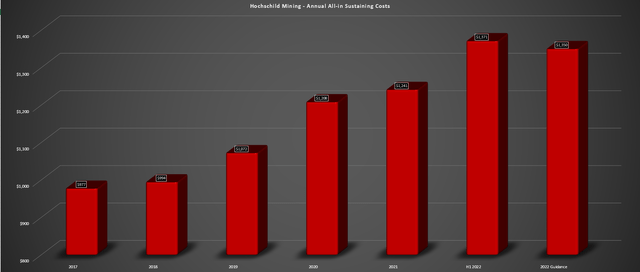

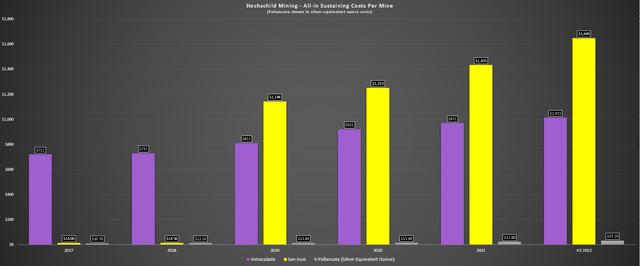

At the same time that consolidated production has been declining, costs have been increasing rapidly. As the chart below shows, Hochschild’s consolidated AISC has increased from $977/oz in FY2017 to $1,241/oz in FY2021 and is expected to come in at $1,350/oz+ in FY2022. It’s worth noting that after including G&A, costs are closer to $1,470/oz, placing Hochschild’s costs well above the industry average (FY2022 estimates: $1,260/oz). In an $1,800/oz gold price environment, all-in-sustaining costs of $1,450/oz – $1,470/oz aren’t a big deal. However, in a $1,650/oz gold price environment, Hochschild now has razor-thin AISC margins and relatively non-existent all-in cost margins.

Hochschild Mining – Annual All-in Sustaining Costs (Company Filings, Author’s Chart)

Some investors will note that Mara Rosa will provide an opportunity to improve costs significantly, given that it’s expected to have all-in-sustaining costs of $850/oz. I think these costs are likely a little ambitious for a small-scale open-pit operation after accounting for inflationary pressures, but even if costs come in at $925/oz, this would still help drive all-in-sustaining costs lower on a consolidated basis. That said, this asset won’t help for another two years, with commercial production not likely to be reached until at least Q3 2024. In the meantime, if gold prices remain under pressure, Hochschild will continue to struggle from a free cash flow standpoint.

Valuation

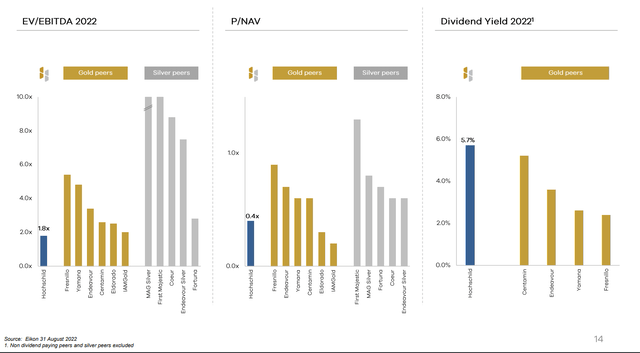

Based on ~514 million shares and a share price of US$0.66, Hochschild trades at a market cap of $339 million and an enterprise value of ~$450 million. This is a very reasonable valuation for a mid-tier producer. Most mid-tier producers (300,000+ GEOs per annum) trade well above $800 million market caps, even in Tier-2 jurisdictions, especially if they have silver exposure. As we can see below, Hochschild trades at a massive discount to its gold peer group, especially given its recent decline, and a large discount to its silver peer group on a P/NAV basis. That said, while Hochschild is cheap, there are reasons for this discount.

Mining Company Valuations vs. Hochschild (August 31st, 2022) (Eikon, Company Presentation)

For starters, the company’s Pallancata Mine has a very short mine life, sitting on reserves of just ~920,000 tonnes, translating to less than 1.5 years of mine life based on reserves at a ~600,000-tonne per annum production rate. Secondly, even if the life is extended, this operation has razor-thin margins and is expected to lose over $5.00/oz on an AISC basis this year relative to guidance ($29.60/oz – $30.10/oz silver-equivalent AISC). Third, San Jose’s costs have risen to the point that they’re also quite elevated (FY2022 cost guidance: $1,520/oz), and this asset also has a very short mine life of just ~1.48 million tonnes (FY2022 mine production of 450,000+ tonnes).

Hochschild – All-in Sustaining Costs Per Mine (Company Filings, Author’s Chart)

Finally, the company is still awaiting its EIS approval at Inmaculada, anticipating that it will get its approval before year-end. This is key to continued development and production at its flagship operation. The delays in securing this were related to the notification from SENACE (National Service for Environmental Certification of Sustainable Investments of Peru) of the cancellation of the 2021 virtual town hall for the second modification of its EIS citing safety concerns. Hochschild believes this decision was premature and unfounded, but while the town hall in 2022 was held successfully, Hochschild has yet to receive approvals. Ultimately, receiving approvals shouldn’t be an issue, but it’s created uncertainty from a timing standpoint.

Finally, Hochschild’s costs have been trending higher over the past few years and at a much higher rate than its peers. While the Mara Rosa Project will help to bring down consolidated costs, it’s difficult to call Hochschild a growth story given that Mara Rosa is likely to just displace production at Pallancata, which could have to head offline by Q4 2023 due to a lack of reserves. So, while some producers can grow revenue and cash flow even in a flat metals price environment due to production growth (2022-2025), I see this as being more difficult for Hochschild, and any further weakness in metals prices could further dent its relatively thin margins at San Jose.

Summary

To summarize, I do not see a strong investment case here, given that Hochschild has two very short mine lives (San Jose, Pallancata), weak margins, operates out of Tier-2 jurisdiction profiles, and has uncertainty related to the Inmaculada EIS approvals short-term. This doesn’t mean the stock can’t enjoy a strong bounce if silver heads back above $21.00/oz, but I would view any sharp rallies toward its downtrend line near US$1.00 as profit-taking opportunities.

HCHDF Weekly Chart (TC2000.com)

For investors looking for exposure to silver, I see SilverCrest Metals (SILV) as being the much more attractive option, benefiting from sub $10.00/oz all-in sustaining costs [AISC], extremely high-grade reserves, and a property that is ripe for new discoveries. I believe SilverCrest should be able to grow reserves per share and cash flow per share consistently, and investors don’t have to worry about lower metals prices given its ~45% AISC margins. So, if I were looking for silver exposure, I think there are much more attractive opportunities elsewhere.

Be the first to comment