Galeanu Mihai/iStock via Getty Images

Thesis

Pioneer Diversified High Income Fund (NYSE:HNW) is a fixed income closed end fund from the Amundi family. The vehicle is rather small, with assets under management that total 85 million. What makes this CEF stand out is its high allocation to catastrophe bonds, which make up over 12% of the portfolio. Usually we see many CEFs that have fixed rate bonds coupled with floating rate loans as the main asset classes in the collateral pool. HNW is a bit different, having fixed rate debentures, catastrophe bonds and CMBSs as its principal pillars. The fund is also on the aggressive side when utilizing leverage, with a 36% ratio.

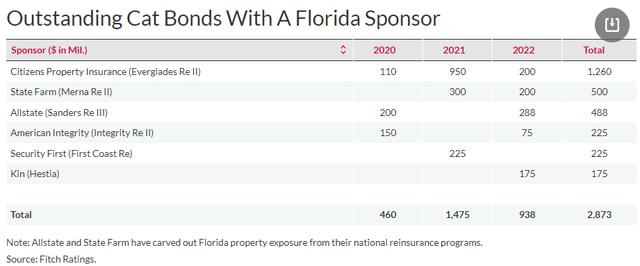

Catastrophe bonds are notable because they represent an uncorrelated risk to the wider capital markets. While 2022 has seen a rise in credit spreads as a direct result of deteriorating macro factors, until recently, catastrophe bonds were largely unaffected. That changed markedly with Hurricane Ian. We have an entire section below in the article dedicated to catastrophe bonds and their structure, but suffice to say they are debt instruments which are contingent on natural disasters occurring. Prior to Ian there had been no severe occurrences in 2022 to trigger any cat bond losses. Per Fitch, Ian has now triggered ILS losses:

However, the ILS market will assume a fair share of losses from Ian, with Fitch estimating total insured losses of $35 bil.-$55 bil., second only to Hurricane Katrina at $65 bil. ($90 bil. in 2021 dollars).

There are a few catastrophe bonds with Florida exposure, but more importantly the natural disaster has now moved spreads wider for a certain section of the ILS asset class:

Cat Bonds with Florida Exposure (Fitch)

We can see this correlation in HNW’s performance, which has lagged its peers since October.

The CEF is currently trading at a -9% discount, and we expect this to persist in the next few months. The fund has been on the aggressive side with its leverage, and its bet on catastrophe bonds has backfired this year after Hurricane Ian. Long term this fund offers annualized total returns in line with the index and closer to a 6% annual rate.

Holdings

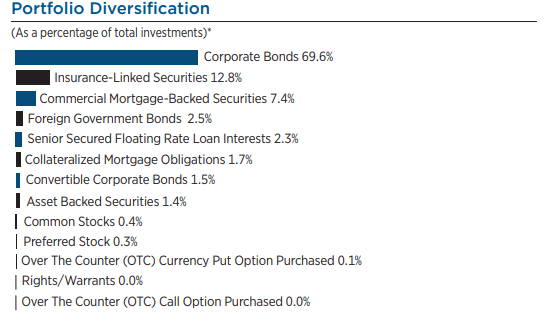

The fund is overweight fixed income securities in the form of corporate bonds:

Sectors (Annual Report)

We can see the largest collateral compositions being corporate bonds, insurance-linked securities (i.e., catastrophe bonds) and CMBS securities. Usually CEFs in this space blend fixed rate corporate bonds with floating rate leveraged loans. Not here. Banks loans are negligible in this portfolio, representing just 2.3% of the collateral pool.

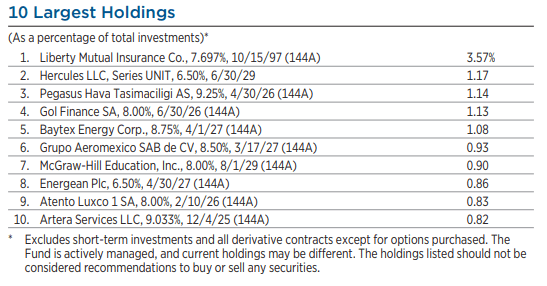

The fund has a granular build, with only one asset above a 2% portfolio threshold:

Holdings (Annual Report)

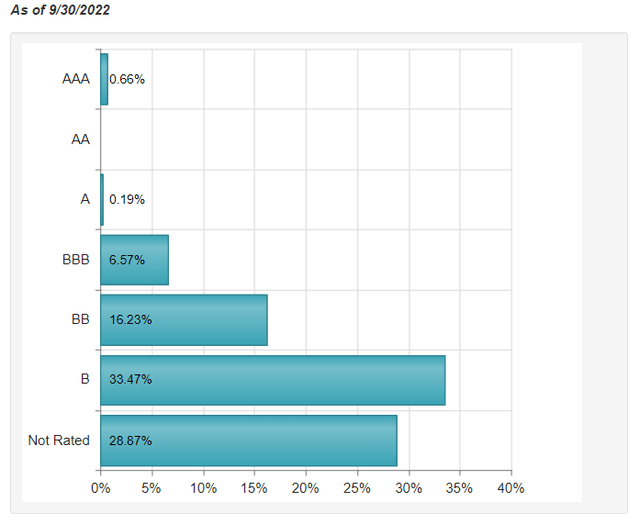

From a rating perspective the CEF is overweight “B” credits which compose the majority of the portfolio:

Ratings (CefConnect)

To note that many catastrophe bonds are not rated, which explains the large bucket for such credits within this fund.

What are Catastrophe Bonds?

Catastrophe bonds are a form of securities where insurers transfer risk from a catastrophe or to capital market investors. Insurers and reinsurers typically issue cat bonds through an SPV (special purpose vehicle). Cat bonds pay high interest rates and diversify an investor’s portfolio because natural disasters occur randomly, and are not correlated with other economic risks. The incidence of hurricanes and tornadoes is largely unrelated to economic and financial activity. During the great financial crisis of ’08-’09, cat bond prices were virtually unaffected outside of liquidity bid/ask spreads.

That said, there are some cases where cat bond losses might happen at the same time as a downturn in the broader economy. For example, if a high-magnitude earthquake were to hit the San Francisco Bay Area, there could be both substantial losses on many catastrophe bonds and large drops in stock prices. Depending on how a cat bond is structured, if losses reach the threshold specified in the bond offering, the investor may lose all or part of the principal or interest

A retail investor might ask how they can lose money via a cat bond. Usually, there are three common types of triggers for a cat bond: indemnity, industry loss, and parametric. “Indemnity triggers base cat bond payouts on the actual insurance losses experienced by the issuer, and function similarly to traditional reinsurance. Industry loss triggers base payouts on aggregate losses to the insurance industry and employs a third-party modeler to provide an independent estimate of these covered losses. And finally, parametric triggers base payouts on the measured strength of the covered catastrophe-such as an earthquake’s magnitude or a hurricane’s wind speed and barometric pressure.”

Performance

The fund is down over 30% this year:

Total Return (Seeking Alpha)

We are using another CEF that contains catastrophe bonds as a comparison, namely Pioneer High Income Fund Inc (PHT). This CEF was reviewed here. We can see from the above graph, courtesy of Seeking Alpha, that HNW underperforms significantly in the cohort. The same dynamic can be observed on a 3-year time-frame:

Total Return (seeking alpha)

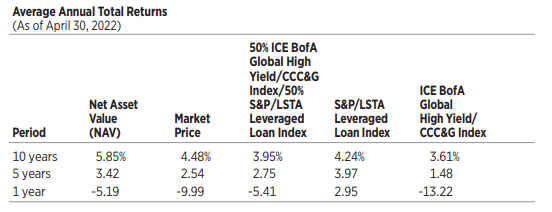

Long term, HNW does not seem to be able to outperform its benchmark, even with leverage:

Annual Total Returns (Annual Report)

For a true buy-and-hold investor the expected total annual return is closer to 6%, rather than the current dividend yield of 10%.

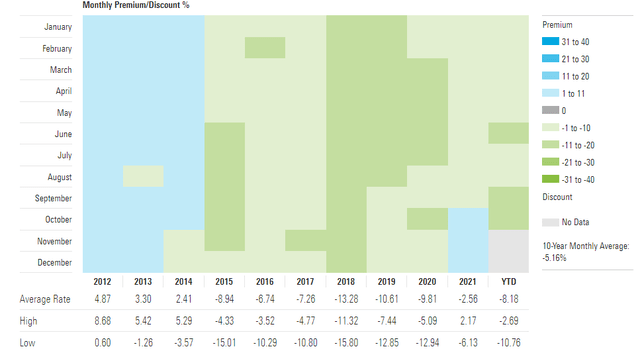

Premium/Discount to NAV

The fund has been trading with a discount to net asset value for almost the entire past decade:

Premium / Discount to NAV (Morningstar)

On average we can see the CEF trading with a -6% discount, with the vehicle trading at a premium only briefly during the zero rates environment observed in 2021.

Conclusion

HNW is a small CEF from Amundi. The fund contains corporate debentures, catastrophe bonds and CMBS securities. We find the catastrophe bond market very interesting due to its uncorrelated risk to the wider capital markets. However, this year has been different, with Hurricane Ian widening spreads in the ILS market as well. This occurrence combined with HNW’s aggressive leverage of 36% has resulted in the fund underperforming. HNW is down over 30% this year, and trails its peers on a long-term basis. New money should look at vehicles with better risk/reward ratios, while existing shareholders should Hold until the end of 2023.

Be the first to comment