Petmal

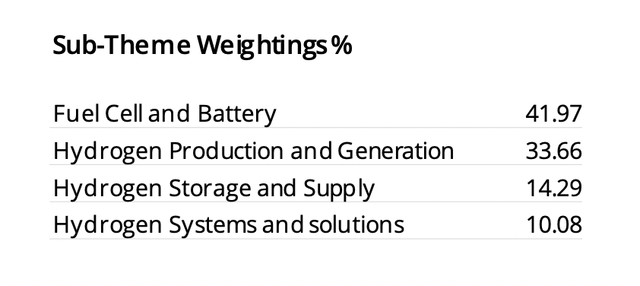

I believe hydrogen power is likely to perform well in the next several quarters, and that the Direction Hydrogen ETF (NYSEARCA:HJEN) is a reasonable alternative non-core holding to get some diversified exposure to the industry. HJEN’s portfolio holds 30 companies involved in hydrogen power. The fund is based upon the Indxx Hydrogen Economy Index, and primarily includes themes such as hydrogen generation and storage, hydrogen fuel cells, hydrogen stations, and hydrogen-based vehicles. HJEN’s fact sheet lists the following sub-theme weightings.

HJEN sub-themes (HJEN Fact Sheet)

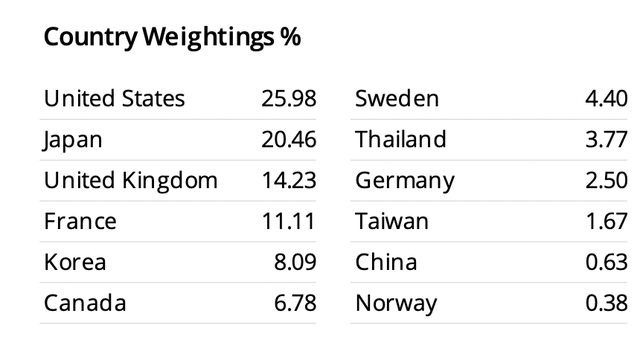

Many of the hydrogen energy related holdings in HJEN are not traded on the domestic markets. Just over 25% of the portfolio’s holdings are domiciled in the United States, with numerous other nations contributing a meaningful percentage of the portfolio.

HJEN country weightings (HJEN fact sheet)

HJEN has been in a downtrend since late 2021, and it looked as though the ETF was about to break, but HJEN just bounced off of its upper resistance. I believe HJEN is likely to break out of this apparent continuing bottom range between the low $14s and the high $18s. I suspect we are currently in the sell the news phase of a trend, and some of the fast money is now turning over their positions on the recent move higher.

HJEN daily candlestick chart (Finviz.com)

The recently passed and signed Inflation Reduction Act included a substantial amount of spending related to climate change and green energy alternatives that include hydrogen power. Hydrogen fuel cells, hydrogen fuel, and electrolyzers that produce hydrogen are all likely to see growth in sales over time, and the Inflation Reduction Act should hasten the rate of adoption.

As a result, it is looking like hydrogen power production could end up being one of the larger relative beneficiaries of the Act’s commercial spending benefits. Beyond that, hydrogen power appears under-owned compared to most alternative energies that are accepted as green and/or ESG friendly, and especially solar power.

The Inflation Reduction Act promotes hydrogen power with the creation of a 10-year production tax credit for clean hydrogen. These credits may be elected to be claimed as an investment tax credit. The Inflation Reduction Act also includes hydrogen energy storage technologies as eligible for these investment tax credits.

The Inflation Reduction Act also introduces a substantial credit for clean commercial vehicles. Commercial vehicles are a key initial use case for hydrogen power, such as for trucking fleets and bus systems. Similarly, the act expands the alternative fuel station credit, which should help accelerate the production of commercial hydrogen fueling stations.

While this recent move over the last two weeks appears at a trajectory that is unlikely to sustain itself, the industry is coming off of a capitulatory bottom. As a result, HJEN may outperform the broader market in the coming quarters. There is also reason to believe hydrogen related companies should have a strong tailwind here, due to the significant benefits to the industry within the Inflation Reduction Act. Further, HJEN’s structure of primarily holding international companies may act as a hedge in the case of a weakening dollar.

Conclusion

Hydrogen power related companies and the HJEN ETF were in a multi-quarter downtrend that may now be ending. In addition to that potential technical move, hydrogen power is a key beneficiary of the Inflation Reduction Act. This favors the types of companies that HJEN holds. Also, HJEN holds a substantial number of international equities, which adds diversification and may outperform in the case of a declining U.S. dollar in the second half of 2022.

Be the first to comment