AerialPerspective Works

Thesis

Western Asset High Income Fund II (NYSE:HIX) is a closed end fund focused on fixed income. The vehicle has a broad mandate, being able to invest in global investment grade and high-yield bonds:

The fund seeks to maximize current income. As a secondary objective, the Fund seeks capital appreciation to the extent consistent with its objective of seeking to maximize current income. Under normal market conditions, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in high-yield debt securities. The Fund may invest up to 35% of its total assets in debt securities of issuers located in emerging market countries. It may also invest up to 30% of its assets in zero coupon securities, payment-in-kind bonds and deferred payment securities, and up to 20% of its assets in equity securities

Source: Annual Report

The fund runs a high duration of almost 7 years, which has dragged down its performance significantly in 2022. Over longer time frames the vehicle benchmarks favorably with better known names such as PFN from PIMCO or DHY from Credit Suisse. Multi-asset CEFs tend to be a bit tricky because investment managers need to prove their acumen across sectors via robust long term performances. HIX is a bit of a mixed bag here, with the fund having outperformed only during the 2020/2021 zero rates environment.

The vehicle is currently utilizing interest income for its distributions, and has been fairly prescriptive around minimizing its usage of ROC historically. The fund has historically traded at small discounts to NAV, and is currently clocking in at a market price which is -6% under its net asset value. For a true buy-and-hold investor this is a fund that is going to get you somewhere around 7% annually if held over 10 years. The fund has its cyclicality accentuated by its high duration, but manages to keep itself in the middle of a returns cohort. There is nothing to get excited about here, but also nothing negative. Holders of the name should keep the shares on the back of the expected 2023 recovery.

Performance

The fund is down over -24% year to date:

On a longer time frame, however, the vehicle performs in line with DHY and the PIMCO behemoth PFN:

We can see that HIX outperformed during the zero-rates period after Covid, especially due to its long-duration build. As opposed to pure high yield funds, HIX runs significant duration exposure given its long weighted average life for the bonds in the portfolio.

Holdings

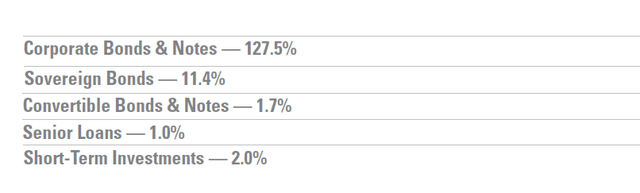

The fund holds mainly corporate bonds:

The allocations add up to more than 100% due to the fact that the fund factors in the leverage utilized. We can see that outside the “Corporate Bonds” and “Sovereign Bonds” buckets the remaining asset classes are negligible.

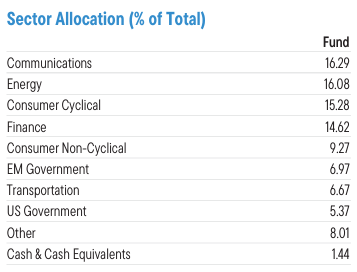

From a sectoral standpoint the top four industries constitute more than 60% of the fund:

Sectors (Fund Fact Sheet)

From a ratings distribution standpoint, the fund has a middle-of-the-road construction, reflective of its multi-asset approach:

Ratings (Fund Fact Sheet)

The vehicle tends to increase / decrease allocations to investment grade bonds and leveraged loans, as it seems permissible by market conditions:

A number of changes were made to the fund during the reporting period. We increased the Fund’s opportunistic allocation to investment-grade corporate bonds, including credits in the communication services industry. We also increased both the Fund’s corporate and sovereign emerging market exposures given improved valuations.

Source: April 2022 Annual Report

HIX is actively trading its collateral allocation among a number of asset classes. While this flexibility is commendable, multi sector fixed income funds like this one need to post returns that justify this broad mandate.

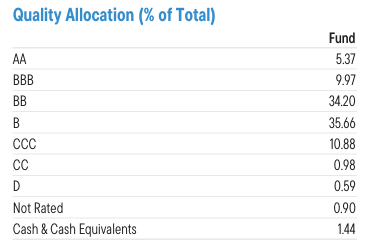

The fund has a very long duration profile for an overweight HY bond fund:

Details (Fund)

At almost 7 years the duration has had a significant impact on the fund’s performance this year.

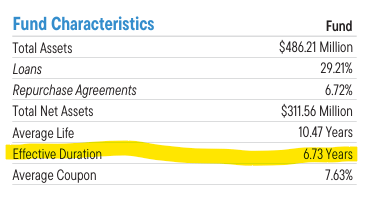

Premium/Discount to NAV

The fund usually trades at a discount to net asset value:

Premium / Discount to NAV (Morningstar)

We can see how historically this CEF has traded at discounts to net asset value. 2021 was the only period in time when the vehicle traded at a premium to NAV.

Distributions

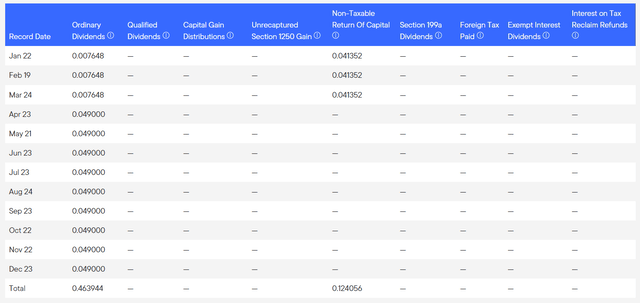

The fund tends to fully cover its distributions from interest income:

The fund provides its breakout for fiscal year 2021, where only the first three months were marked by the usage of ROC. The actual dollar distribution has been $0.049 for the entire year in 2022.

Conclusion

Western Asset High Income Fund II (HIX) is a CEF with a broad mandate in the fixed income space. The vehicle holds investment grade and high-yield bonds from multiple jurisdictions, in conjunction with a sovereign bond sleeve. The manager is actively adjusting allocations as per its internal pricing models, to identify undervalued sub-sectors. The fund has a middle-of-the-road historic total return, with an outperformance during the zero rates Covid environment.

The fund is currently trading with a -6% discount to net asset value, which is very much within its historic trading range. More than other vehicles, this CEF relies on the asset manager to actively switch allocations as it deems favorable, and generate alpha through its positioning. Having a high duration of almost 7 years, the fund has been hard hit by the rise in risk-free rates this year. Holders of the name should keep the shares on the back of the expected 2023 recovery.

Be the first to comment