Liliya Filakhtova

One of the biggest narrative trades in crypto since the market stopped going down in mid-June has been the renewed optimism in a merge of Ethereum’s (ETH-USD) proof of work mainnet and proof of stake Beacon Chain; now scheduled for mid-September. But a slightly underappreciated component of moving from proof of work to proof of stake consensus is the miners who were previously securing the PoW network no longer have the same incentive in a PoS model because the transaction validation mechanism is completely different.

For Ethereum miners, this is particularly problematic because ETH mining is still done with GPUs rather than with the ASIC machines required by most other PoW networks. Ethereum miners can’t simply switch to securing Bitcoin (BTC-USD) because their machines aren’t capable of profitably mining it. Some of the ETH miners are now upset about the change to a PoS model, and there is a proposed fork of Ethereum that is reportedly picking up a little bit of steam. According to Decrypt:

Ever since a prominent Chinese Ethereum miner announced his intention to resist the upcoming Ethereum merge and create a new, parallel network and cryptocurrency, the idea has begun to gain some traction.

This effort is led by ETH miner Chandler Guo and has support from Tron (TRX-USD) founder Justin Sun. Sun also owns the Poloniex exchange and has said the exchange will support the hard fork called EthereumPoW (ETHW-USD). I’m going to flat out say that I don’t think ETHW is going anywhere. The Ethereum community broadly isn’t supportive of the hard fork and Circle has already said it won’t support USDC that lives on a forked PoW Ethereum chain. I’ve been sharing my thoughts about ETHW with BlockChain Reaction subscribers, and you can join the service with a free two-week trial to get access to that deeper rationale.

For this article, though, there are two questions HIVE Blockchain (NASDAQ:HIVE) investors should consider going forward:

- What is the post-ETH merge revenue impact on HIVE?

- What are the viable alternatives for HIVE’s GPU machines?

Impact on HIVE Blockchain

With ETHW looking more like a stunt than a viable option for displaced GPU miners, the logical question is what will be done with those machines. This is of significant importance to HIVE Blockchain specifically because a large portion of the company’s mining revenue has historically come from mining Ethereum. In HIVE’s monthly production updates, the company refers to the ETH that it mines as “BTC Equivalent.”

| Mining Production | BTC | BTC Equivalent | ETH % of Total |

|---|---|---|---|

| January | 264 | 161 | 37.9% |

| February | 244.4 | 132.6 | 35.2% |

| March | 278.6 | 168.8 | 37.7% |

| April | 268.8 | 189.5 | 41.3% |

| May | 273.4 | 185.8 | 40.5% |

| June | 278.5 | 142.3 | 33.8% |

| July | 279.9 | 185.2 | 39.8% |

Source: HIVE Blockchain

The year-to-date monthly average for HIVE is 38% of the company’s mining production coming from Ethereum. That’s a large portion of HIVE’s mining revenue that is scheduled to disappear in mid-September and short of selling the GPU machines, it appears the best-case scenario regarding revenue from alternatives is going to be source fragmentation.

HIVE’s Post-Merge Strategy

During the July production update, HIVE elaborated on its strategy for GPU machines following a theoretical successful merge of Ethereum to proof of stake:

HIVE’s GPU fleet is comprised of two types of cards, our legacy fleet comprised mostly of RX580s, and can be repurposed for other GPU mineable coins. The second type being our data center grade cards, namely our Nvidia fleet which we announced last year when we joined the Nvidia Partner Network; these cards have other applications in high-performance computing (HPC) applications. HIVE has been developing a new platform for our data center grade cards to create new streams of revenue. The Company foresees the creation of new streams of revenues from GPUs, such as providing HPC services for rendering, AI, ML, molecular modelling, etc.

Let’s take the GPU mining angle first. The unfortunate reality for HIVE is most GPU mineable coins are not generally used in DeFi or other on-chain activities. Thus, there is not a large demand for the coins that would necessitate higher coin prices and by extension profitable mining. Many seem to believe when Ethereum’s merge is complete, the GPU mining machines will shift to another cryptocurrency that can be profitably mined with the same hardware. On the surface, the obvious choice appears to be Ethereum Classic (ETC-USD) and that coin has seen one of the strongest rallies in crypto because of that speculation; up 200% since mid-July.

To be clear, HIVE is already mining ETC at its Iceland facility. But it’s a small MW facility compared to the rest of the company’s operational footprint.

Is ETC Mining Scalable?

Moving all GPU capacity from Ethereum to Ethereum Classic while sustaining miner profitability is currently not possible. It would take an ETC price 50 times higher than current levels to equal the amount of miner revenue generated currently from mining Ethereum. Because of the coin price differences, the block reward revenue difference from Ethereum to Ethereum Classic is extreme. Since the beginning of July, the daily average revenue to miners from Ethereum is $21.3 million. For Ethereum Classic, it’s just $487k. And that ETC figure is benefiting from a large spike in the coin’s price over the last few weeks.

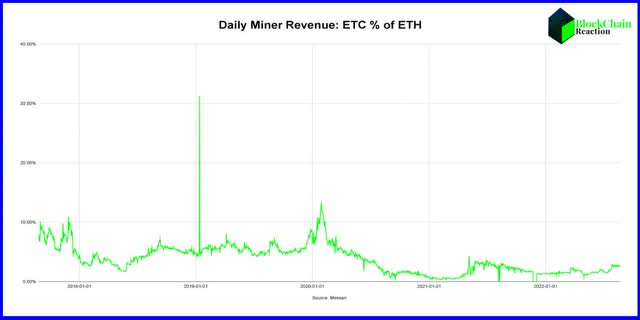

If you look at a much longer-term view, ETC miner revenue as a percentage of ETH miner revenue has been trending lower for a while and has averaged just 1.7% year to date. Without a coalition of ETH miners and developers working together to migrate Ethereum activities from DeFi and NFT sales over to Ethereum Classic (or ETHW), we are unlikely to see robust fundamental demand for Ethereum Classic for transactions and gas payment.

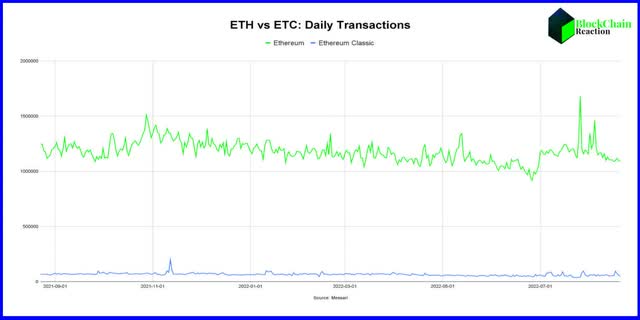

This chart shows the daily adjusted transactions of both Ethereum and Ethereum Classic according to Messari. While ETH is generally above a million daily transactions, ETC has only eclipsed 100k in a day twice in the last year. The point is, there isn’t enough activity on Ethereum Classic to justify higher coin prices and without exponentially higher ETC prices, GPU miners won’t find a revenue savior in Ethereum Classic post-ETH merge. The money just isn’t there.

Other Options?

Of course, HIVE has already noted in its own strategy verbiage that pivoting to other GPU mineable tokens isn’t the only part of the plan. They will also look to using the machines for different computing activities altogether; including rendering and AI. One theoretical fit is Livepeer (LPT-USD) (OTCQB:GLIV). Last month, I was able to chat with Livepeer co-founder Doug Petkanics for the BlockChain Reaction podcast. In our conversation, he mentioned how the GPU chips that are used for Ethereum mining can be used for other purposes like transcoding video on the Livepeer network:

People who are mining cryptocurrencies using GPUs, or graphical processing units, the type of device that’s used to mine Ethereum, for example, they can continue using the portion of those units that are used to hash cryptocurrencies. But those GPUs happen to have video encoding chips on them that can’t hash cryptocurrencies; they just sit there doing absolutely nothing. And what Livepeer allows them to do is say, ‘oh, when video encoding needs to be done, we can make additional money for that without disrupting our cryptocurrency mining.’ And that’s really powerful. It’s almost a no-brainer value proposition to these miners.

Video transcoding and rendering are certainly very interesting potential applications, but like ETC, there is not much of a revenue footprint ready and waiting for displaced ETH miners. According to Livepeer’s website, the network has paid out a little over $203k in fees. That’s not going to get it done for companies like HIVE that historically generate several million dollars on a monthly basis.

Summary

Ethereum miners are in an incredibly tough position, and HIVE Blockchain is no different. Best-case scenario for HIVE in September would be if the merge is yet again delayed. But with the success of the testnet merges, it seems increasingly more likely that this time is for real and the merge is going to take place when developers say it will. While I think HIVE Blockchain leadership is on the right track with their thinking as to how to monetize the company’s GPUs post-merge, the reality at least in the crypto market is that there doesn’t appear to be a viable option. I think if the company can find non-crypto businesses that are willing to pay for computing services, HIVE can recoup at least a portion of the revenue it’s about to lose from Ethereum’s shift to full proof of stake consensus. But it’s probably going to be a very bumpy ride, and shareholders need to be prepared for that. I don’t personally hold HIVE shares. But if I did, I would look to take some exposure down.

Be the first to comment