Capuski/iStock Unreleased via Getty Images

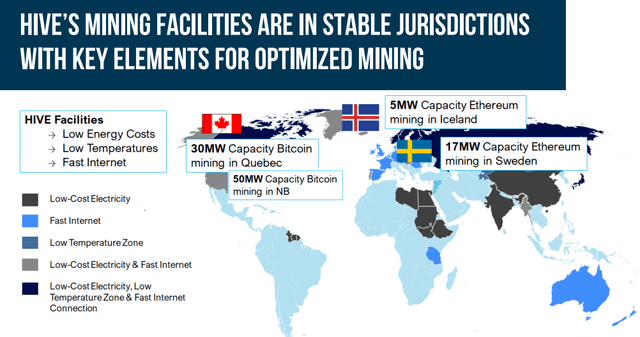

HIVE Blockchain Technologies (NASDAQ:HIVE) is one of the lesser-known names in the cryptocurrency space partially due to the fact that it mines Ethereum (ETH-USD), Ethereum Classic (ETC-USD), and Bitcoin (BTC-USD) versus the usual focus on one token (normally Bitcoin). When I wrote this article HIVE Blockchain was navigating through teething pains while aggressively trying to scale its operation. The company had numerous challenges ranging from reporting to concerns around the long-term viability of cryptocurrencies. Now many of these issues have subsided with the company having a well-formed global operation.

Hive Blockchain

But now HIVE is facing newer, more complex challenges. Today we will look at HIVE Blockchain’s current situation and discuss what investors can expect going forward from the company.

Before we get started, if you’d like definitions of a few key terms concerning cryptocurrency, please see the Crypto cheatsheet in my Riot Blockchain (RIOT) article. But of course, crypto veterans feel free to skip this section.

The Crypto Mining Conundrum

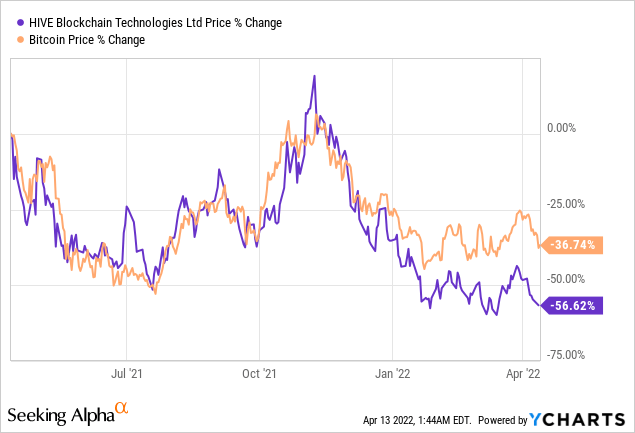

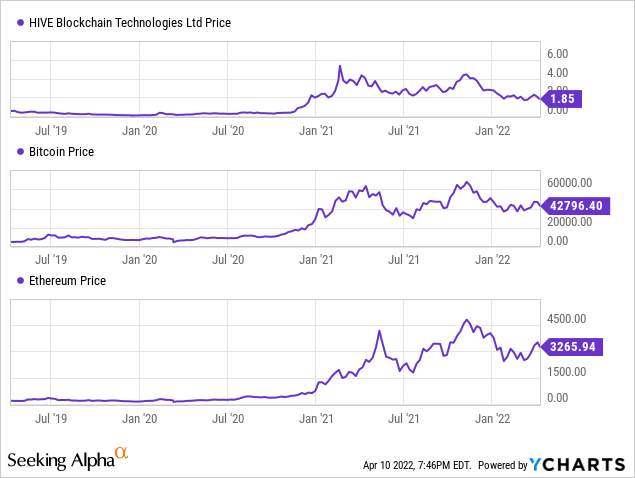

Most crypto mining currencies rely almost entirely on the tokens they mine or purchase on the open market for revenue. The problem is that at disadvantageous prices the company must hold on to the tokens for an extended period with no other income source to fund operations. Long-term crypto bulls will argue that it is better for the company to fund operations through secondary offerings while they wait for massive moves in their respective cryptocurrencies. We have seen some heavy dilution in some of the biggest names which softens the mining stocks’ ability to provide sensational moves when the crypto market gets hot. This has led to much debate as to whether it is more prudent to buy the token or the mining stock. The answer to this question has much to do with the actual miner than Bitcoins prices. That’s where HIVE stands out. They may not have the best operation yet but the stock moves. In fact, HIVE rivals Bitcoin at times. The chart below compares the token with HIVE. We can see that in bullish cycles HIVE closely mirrors BTC. But this only makes it a proxy for Bitcoin, which is useful for accounts that can’t hold cryptocurrencies.

This is because it gives investors access to Bitcoin’s volatility in up markets but we can see that over time the relationship is dwindling. This could be due to offerings or a relative lack of interest. The stock now finds itself in a deep slump following Bitcoin & Ethereum’s recent sluggish price action.

Long-term crypto mining investors will tell you to watch out for conditions like these as dilution happens pretty regularly in this space but again, HIVE is a little different.

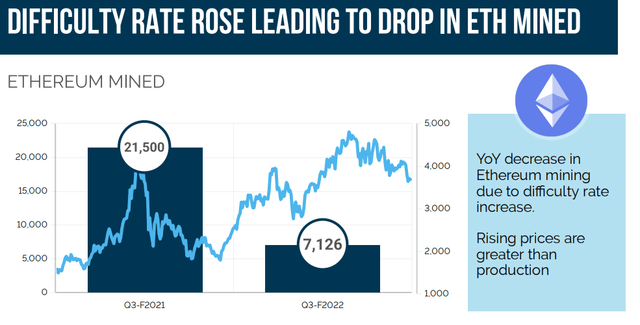

While they do dilute and have recently closed an offering, HIVE chooses a hybrid approach in that they offer stock and sell Ether regularly on the open market to fund their business. Interestingly the company is more bullish on Bitcoin, choosing not to sell its tokens with the aim of cashing out at higher prices. The move makes sense as rising difficulty rates have already blunted Ethereum production and Bitcoin is by far the most well-known token, capable of some truly sensational moves.

Hive Blockchain

Outlook

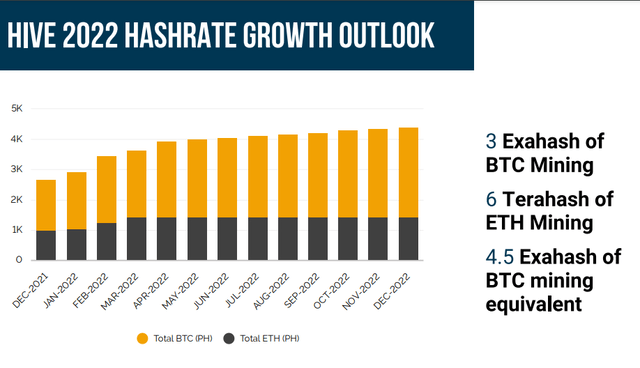

HIVE is showing strong growth due to its massive investment into its computing power and hash rate by extension. We can see the company is on the tail end of solid monthly increases and this should bode well for mining outputs through the rest of the calendar year 2022.

Hive Blockchain

The massive hash rate increases look set to cool down in mid-2022. This is a logical move when you consider that Bitcoin and Ethereum prices have stalled lately and that the company was aggressively adding to its mining Fleet in the calendar year 2021. The upcoming shift in Ethereum from proof of stake to proof of work would have likely greatly influenced the leadership team’s decision as well due to the fact that the merger looks set to almost eliminate the reliance on miners. Miners will likely migrate to Ethereum classic but this move could significantly damage the Ethereum mining industry.

Hive Blockchain

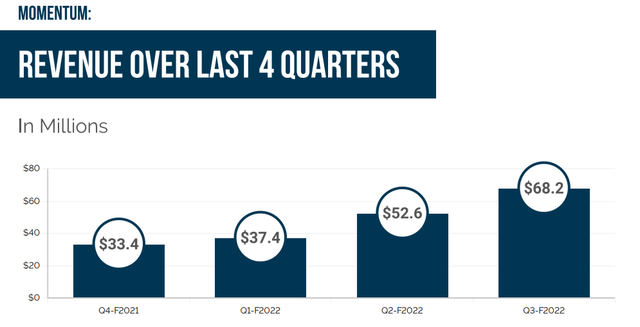

HIVE is finally making progress on the revenue front with strong sequential revenue growth for each of the last four quarters. But the loss of Ethereum mining revenue would put this trend under serious threat.

Hive Blockchain

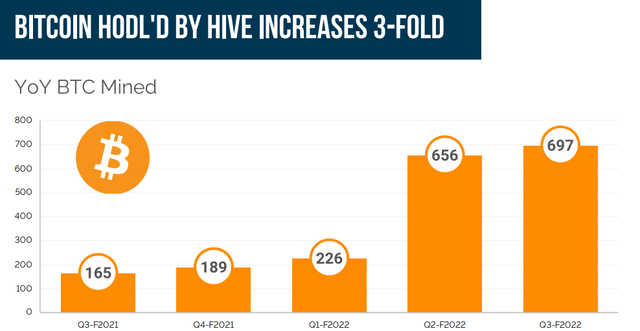

As mentioned earlier HIVE is holding on tight to its Bitcoin. The company’s massive investments in hashrate seem to be finally playing dividends and Bitcoin mining figures have improved massively.

Hive Blockchain

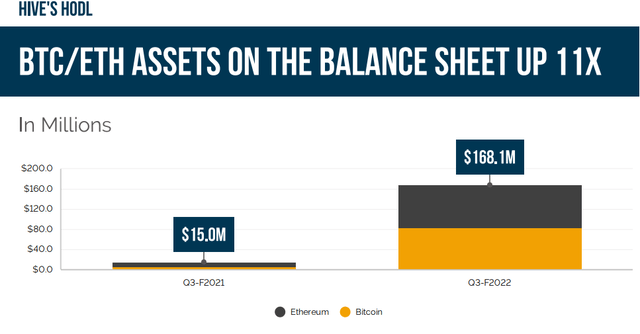

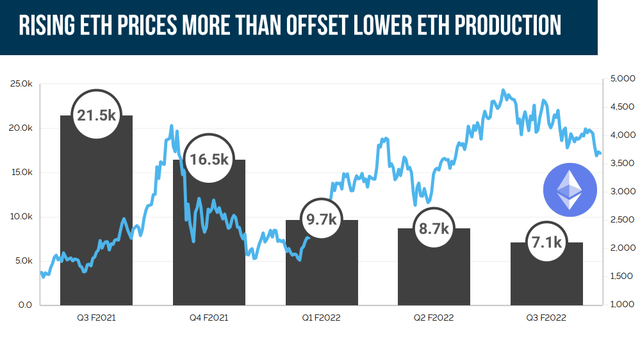

With that, the company’s balance sheet has also strengthened significantly. With a healthy $67 million on hand and available to fund operations, eliminating the need for the company to preemptively dispose of any of its 168 million dollar crypto war chest for liquidity. It is important to note that the crypto merger is unlikely to hurt Ethereum prices so there is no rush to unwind the position outside of funding operations and that rising prices have offset lower production due to increased difficulty.

Hive Blockchain

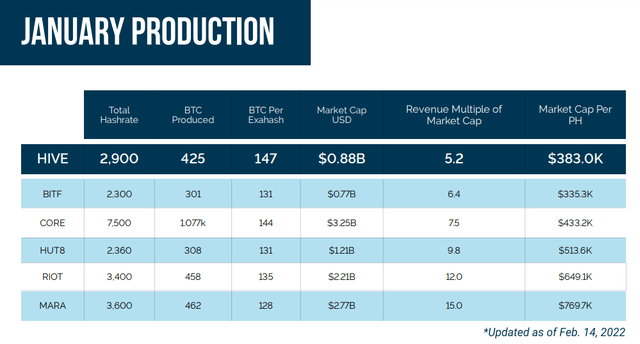

HIVE is also beginning to challenge some of the biggest players in the crypto mining space with respect to its overall hashrate and Bitcoin production figures. For a long time, Marathon Digital (MARA) was the leader in the space but recent troubles have slowed their progress significantly. Interestingly the revenue multiple of market cap implies that HIVE Blockchain is somewhat undervalued with respect to its peers but that is understandable with the uncertainty surrounding Ethereum mining in the coming months.

Hive Blockchain

Because of this, the company may end up hanging its hat on Bitcoin which is not without risk. One key risk is the scarcity of Bitcoin. Difficulty rates have been rising and this is forcing miners to increase their overall hashrates to earn tokens at the same rates (discussed in greater detail here)

The Takeaway

The HIVE leadership team is doing everything it can to balance mining targets and financial responsibility. While signs look unfavorable it is unclear how the Ethereum merger will impact the Ethereum mining industry. It is important to note that Ethereum prices will likely be fine, what’s at stake is the investment in the Ethereum mining fleet. So far there have been challenges with rolling out the merger but investors should watch for negative headlines in the coming months. HIVE is making notable progress but the merger is shaping up to be an impactful binary event. It is unlikely that this will break the company but negative headlines will likely drive the stock downward. It would be prudent to avoid the stock until then.

Be the first to comment