JHVEPhoto/iStock Editorial via Getty Images

Thanks to the recent sell-off in technology and semiconductor stocks, shares of AMD (NASDAQ:AMD) are a strong buy again. AMD offers investors a very compelling setup here: strong expected revenue growth due to acquisitions of data center businesses (Xilinx and Pensando), new product launches and a significant free cash flow ramp that could power shares higher. I believe investors are misreading AMD’s value proposition below $100 and the stock has considerable rebound potential!

AMD completes accretive Xilinx acquisition

Shares of AMD have fallen lately although the company completed the acquisition of Xilinx. As opposed to Nvidia (NVDA), which walked away from its proposed acquisition of U.K.-based semiconductor firm ARM in February due to regulatory resistance, AMD successfully acquired Xilinx which is set to fuel AMD’s revenue and free cash flow growth in the future. The acquisition of ARM brings world-class technology and expertise to AMD’s already strong product lineup especially regarding adaptive SoC products, graphics and AI engines. The acquisition of Xilinx is also expected to be accretive to “non-GAAP margins, non-GAAP EPS and free cash flow generation in the first year”, according to AMD’s last statement issued after the acquisition was completed.

Pensando acquisition

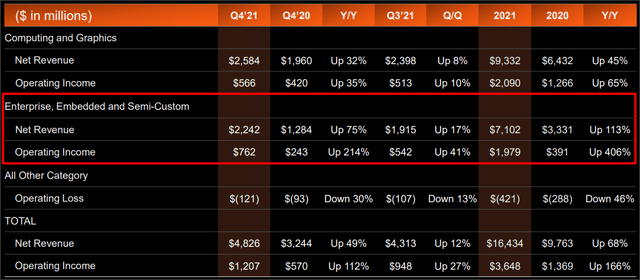

Just after completing the Xilinx acquisition, AMD is itching to grow its data center footprint even faster. Last week, AMD announced the acquisition of data center company Pensando for $1.9B. The acquisition is meant to accelerate AMD’s penetration of the market for cloud, enterprise and edge applications. The decision to acquire Pensando shortly after Xilinx makes strategic sense for AMD, not least because the data center segment has replaced the computing and graphics segment as the main driver of AMD’s revenue growth. Data center revenues grew more than twice as fast as computing and graphics revenues for AMD in FY 2021. The computing and graphics segment still generated $2.2B more in total revenues, but I expect this to change in FY 2022 and FY 2023, in part because of AMD’s acquisitions of Xilinx and Pensando. The data center business is set to become the largest — regarding total dollar contribution — and fastest growing segment for AMD going forward.

New product launches likely to see strong customer adoption

AMD generated free cash flow of $3.2B in FY 2021 and achieved FCF margins of 20% last year. New product launches such as the Ryzen 7000 series desktop processors could drive additional revenue and free cash flow growth for AMD going forward. AMD is going to launch its new Ryzen 7 5800X3D desktop processors on April 20 which will improve the firm’s desktop CPU lineup. The new Ryzen processor will only be the second chip after the Milan-X server CPU to include AMD’s 3D V-Cache which promises higher gaming performance and will likely do well regarding customer adoption. Gaming benchmark tests, which just leaked ahead of the launch, show that the Ryzen 7 5800X3D performance ties with Intel’s gaming processor i9-12900K and in some cases delivers even better performance.

AMD’s 3rd gen AMD EPYC processors with 3D V-Cache technology, dubbed Milan-X, offer up to 66% better performance and have launched at the end of March. New-gen launches of AMD’s highly successful data center CPU, EPYC, could drive additional free cash flow margin gains for AMD in FY 2023 and beyond.

Xilinx integration will add at least $1.0B in free cash flow annually

The Xilinx acquisition is also going to add a significant amount of free cash flow to AMD. Last year, in FY 2021, Xilinx generated revenues of $3.15B and free cash flow of $1.04B which calculates to a free cash flow margin of 33%, meaning Xilinx’s FCF margins were even better than AMD’s margins. Going forward, I see Xilinx to add at least $1.0B in annual free cash flow (before synergies) to AMD which could bring AMD’s total free cash flow to around $6.0B annually by FY 2023.

Revenue growth and valuation

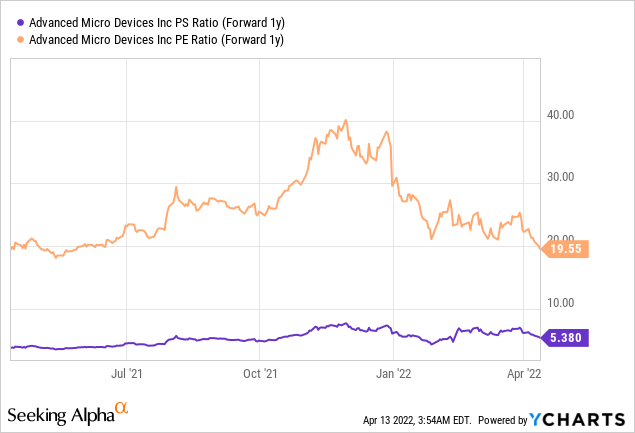

AMD is expected to generate revenues of $25.5B in FY 2022 and $29.1B in FY 2023, but these may be low estimates and underestimate the potential that Xilinx and Pensando bring to the table, especially because Xilinx has higher FCF margins than AMD. After a drop below $100, shares of AMD trade at a P-S ratio of 5.4 X and a P-E ratio of 19.6 X. AMD has traded at significantly higher ratio in FY 2021. I believe below $100, and at less than 20 X earnings, AMD’s potential, especially in the data center business, is hugely undervalued!

Risks with AMD

In the past I assumed that a slowdown in AMD’s revenue and free cash flow growth would hurt AMD’s valuation prospects. In the case of slowing top line growth, and possibly weaker gross margins, pressure could build on AMD’s valuation… but this clearly is not the case yet. Now that the Xilinx acquisition has been completed successfully, I believe the risk relating to an investment in AMD has materially declined. This is because Xilinx and AMD’s products are complimentary which helps create tailwinds for revenue growth, gross margins and free cash flow. Since Xilinx also has higher free cash flow margins than AMD, AMD could be set for a major revaluation in FY 2022.

But there are risks, too. The biggest risk, as I see it, is possibly a decline in pricing strength which has helped AMD achieve record results in FY 2021. A decline in semiconductor demand and prices would likely hurt AMD’s gross margins. Decreasing gross margins are often considered to be the canary in the coal mine for the semiconductor industry and they would likely result in a lower valuation factor for AMD.

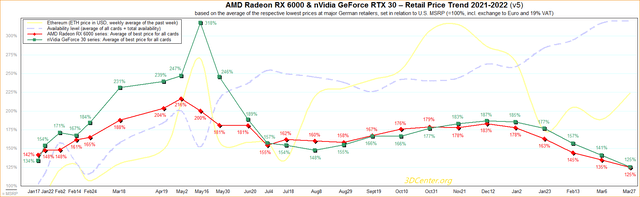

Easing chip crunch

One factor that could work against AMD going forward is the changing supply situation for graphics cards. A big driver of revenue growth in computing and graphics in FY 2021 was the shortage of graphics cards which has boosted average selling prices. This graphics card shortage has started to ease in FY 2022 with AMD Radeon RX 6000 series prices dropping to just 1.25 X of the manufacturer’s suggested retail price. If the chip supply situation further improves in the coming months, pricing pressure on AMD’s graphics cards could build, leading to lower average selling prices.

Final thoughts

Shares of AMD are back in a “buy the drop” situation below $100. I believe AMD’s revenue and earnings potential is deeply undervalued again. New acquisitions will also add to AMD’s revenue growth and it is likely that investors still underestimate AMD’s top line and earnings potential. I also believe that the risk-reward at this price level is exceptionally attractive and the risk profile remains heavily skewed to the upside!

Be the first to comment