Editor’s note: Seeking Alpha is proud to welcome Stratos Capital Partners as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

eric1513

The Bear Market Is Here

The U.S stock market has been overwhelmed by fear amid aggressive monetary tightening by the Federal Reserve. Wall Street analysts are also struggling to agree on the outlook for the U.S economy and equity returns for 2022 and 2023.

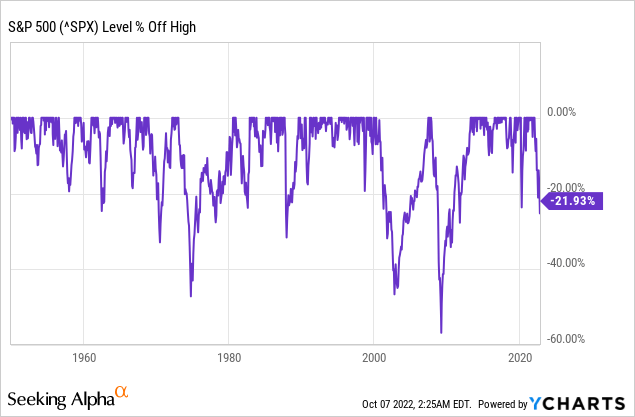

Given the heightened uncertainty, it is understandable that investors are scrambling for safety. The S&P 500 Index (SP500) is in a bear market at the time of writing, down almost 22% year-to-date. Meanwhile, fixed income (US10Y) is starting to look compelling, offering yields at levels not seen in more than a decade.

Don’t Trust Your Senses

What seems like good common sense would be to cut losses, preserve capital, actively manage risks, and seek shelter in the safety of cash or investment-grade bonds until the economic storm passes.

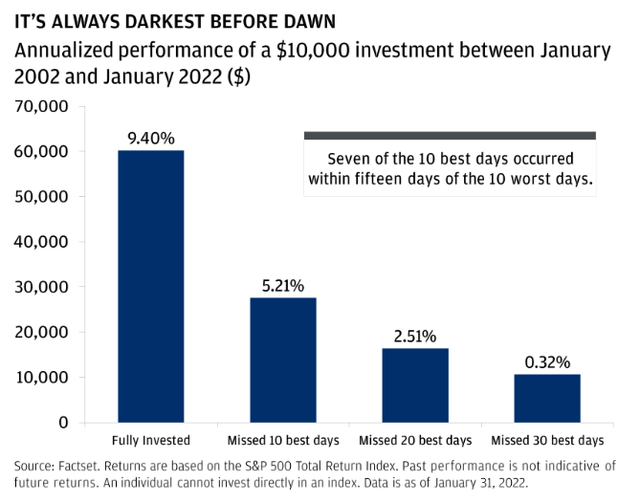

But common sense rarely works when applied to financial markets. Stock markets almost always move ahead of economic fundamentals. So by the time investors are feeling comfortable with the economy and the stock market, they would have already missed the move. This is how investors turn into traders. And most traders lose.

Instead of trying to time market turning points to perfection at the risk of being completely wrong and having to chase the market, investors are better off sticking to a time-tested all-weather investment strategy. Focus on “TIME IN THE MARKET” instead of timing the market, and allow returns to compound over time. Not only does having a solid strategy give you some visibility over how your portfolio is likely to perform over time, but it also spares you from experimenting with crystal balls and having to make decisions on the fly.

J.P.Morgan, The case for (always) staying invested.

Different Bear, Same Strategy

Financial history has proven time and again for more than a century that bear markets provide the best opportunities for investors to boost portfolio returns. Even without sophisticated research or financial tools, every investor can adopt time-tested principles to beat the market over time. Only good discipline is required for this strategy. Stock picking is entirely optional.

1. Start with a rule to systematically increase/reduce portfolio allocation to equities

For example, whenever the S&P 500 Index is in a correction of (-10% from peak), increase allocation to equities by 5%.

If the index falls further into a bear market (-20% from peak), increase allocation to equities by another 10%.

If the market falls even further (-40% from peak), increase allocation to equities by another 20% or to the maximum limit depending on your strategic allocation limits and personal risk tolerance.

Do the opposite by reducing allocation to equities when the market has fully recovered and is making new highs. Just remember that bull markets tend to run much longer and further than bear markets do. An alternative method is to rebalance your portfolio every year, by buying more equities when equities are down and selling them when they do well.

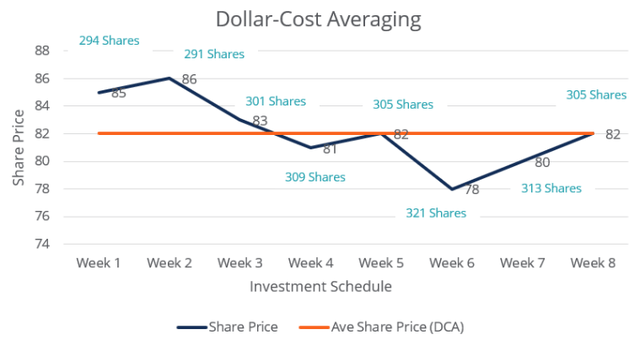

2. Dollar Cost Averaging (DCA) reinforces the principle of buying low, by accumulating more shares when share prices are low

DCA is suitable for investors who are planning to invest regularly over an extended investment horizon. By investing a fixed dollar amount of money into stocks every month or every quarter, investors are systematically buying more shares with the same fixed amount of money when share prices are low.

DCA enforces discipline by taking the guesswork of market timing out of the decision-making process and takes advantage of price volatility to achieve a lower average price. DCA is meant to be implemented across market cycles and aims to average out the price of multiple purchases over time.

The chart below shows an example of how an investment of $200,000 can be split into much smaller purchases of $25,000 each to be executed over 8 weeks.

Corporate Finance Institute, Dollar-Cost Averaging

If the investment was invested in full at the beginning, a total of 2,353 shares would be purchased at $85 a share. However, using the DCA approach, more shares are purchased when the market is in a decline. Thus in the example, the same investment amount split into smaller purchases over 8 weeks would result in 2,437 shares being purchased at an average share price of just $82.

For investors who are worried about entering at the market peak, DCA can help to systematically split up the lump-sum investment into separate smaller purchases while taking advantage of the price volatility.

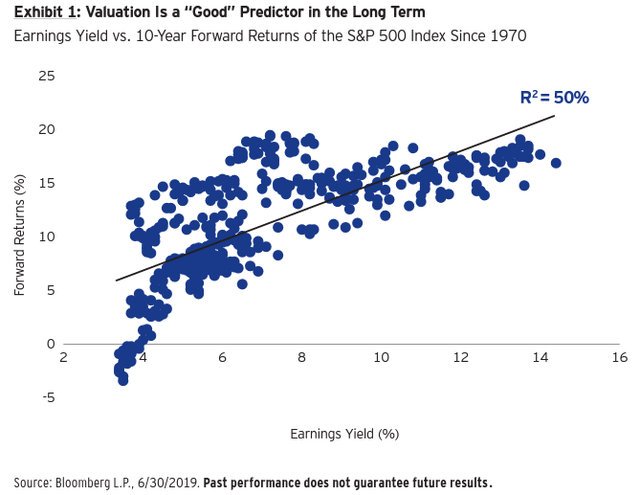

3. Invest in value because value investing is a well-established factor that produces superior returns

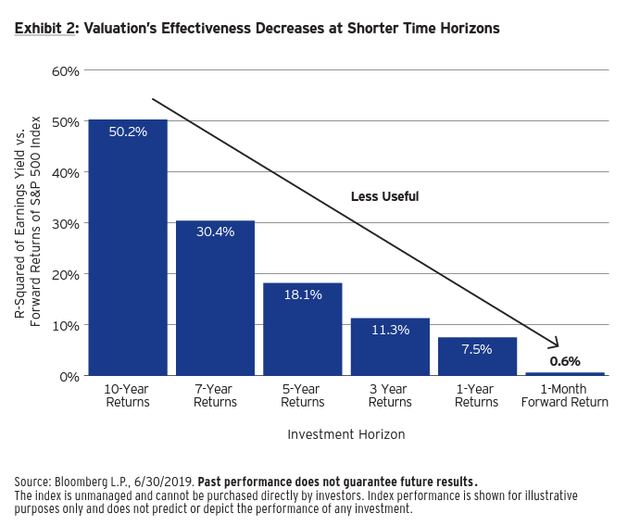

Countless research papers have shown that stocks with high earnings yield (EPS/Price) tend to generate high subsequent returns. This relationship is also more pronounced for longer investment horizons.

Invesco, “Dynamic Asset Allocation Through The Business Cycle”

This relationship is also more pronounced for longer investment horizons.

Invesco, “Dynamic Asset Allocation Through The Business Cycle”

A Strategy That Works Across Market Cycles

Such a simple strategy to beat the market may appear too good to be true. But perhaps if we take a historical view of past bull and bear market cycles, we will better appreciate the fact that financial markets become more predictable when we take a long-term view.

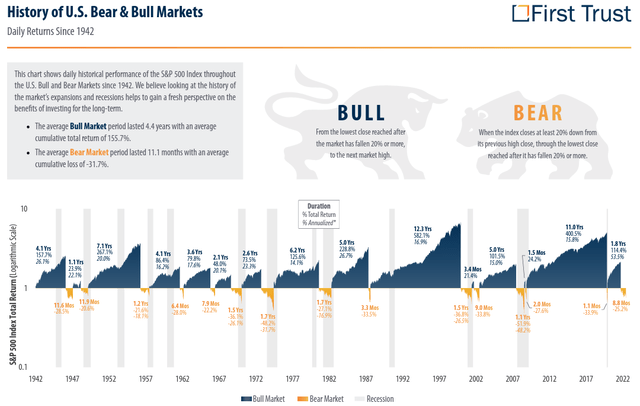

As the chart below shows, the U.S stock market hasn’t really changed that much since the 1940s.

First Trust Advisors, History of U.S Bear & Bull Markets

Bear markets in the past have not only registered declines of similar magnitudes, but they were also similar in terms of duration. On average, a bear market suffered a cumulative loss of -31.7% and lasted just 11.1 months. The largest bear market in terms of drawdown was during the Global Financial Crisis in 2008-2009 with a loss of -51.9%.

Conclusion

Presented with the historical record, investing does seem a lot less complicated. Indeed, there is little reason to panic in the current market environment, unless you believe we are headed for a crisis that is much larger than the ones we have survived since 1942. If anything, the chart above would suggest that now is probably a pretty good time to start buying stocks.

Be the first to comment