WorSangJun/iStock via Getty Images

A Quick Take On HireRight Holdings

HireRight Holdings Corporation (NYSE:HRT) went public in October 2021, raising approximately $422 million in gross proceeds from an IPO that was priced at $19.00 per share.

The firm provides personnel background verification and related services for organizations.

HRT looks to be at the mercy of a labor market downturn, which will likely punish the firm’s growth and profit results in the coming quarters.

I’m therefore on Hold for HRT in the near term.

HireRight Overview

Nashville, Tennessee-based HireRight was founded to create a suite of background verification and HR compliance solutions for companies worldwide.

Management is headed by President and CEO, Guy Abramo, who has been with the firm since 2018 and was previously Chief Executive Officer of GIS.

The company’s primary offerings include:

-

Screening Manager

-

Applicant Center

-

Connect – API integrations

-

Self-Service platform

-

Other related services

The firm seeks mid-sized and large customers through its direct sales organization and partner network.

HRT also markets its background check services to SMBs through its self-service website, backgroundchecks.com.

HRT’s Market & Competition

According to a 2021 market research report by The Insight Partners, the global employment screening market, one of the firm’s focus areas, was an estimated $4.2 billion in 2020 and is forecast to reach $6.4 billion by 2028.

This represents a forecast CAGR of 5.5% from 2021 to 2028.

The main drivers for this expected growth are increased populations in urban areas, resulting in greater job opportunities and employee demand.

Also, the number of applicants for each job opening has increased, along with a larger number of contract & temporary workers.

Major competitive or other industry participants include:

-

First Advantage

-

Sterling Check Corp.

-

Accurate

-

Certiphi

-

Cisive

-

Disa

-

Checkr

-

GoodHire

-

Asurint

HRT’s Recent Financial Performance

-

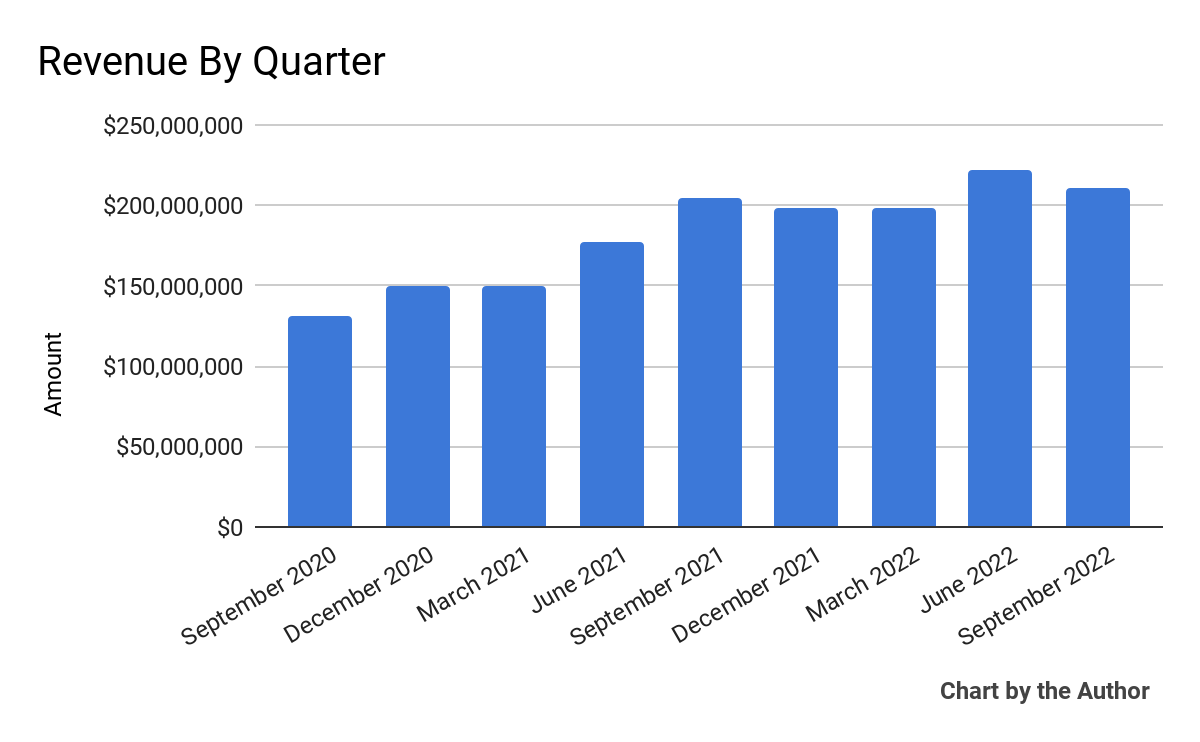

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

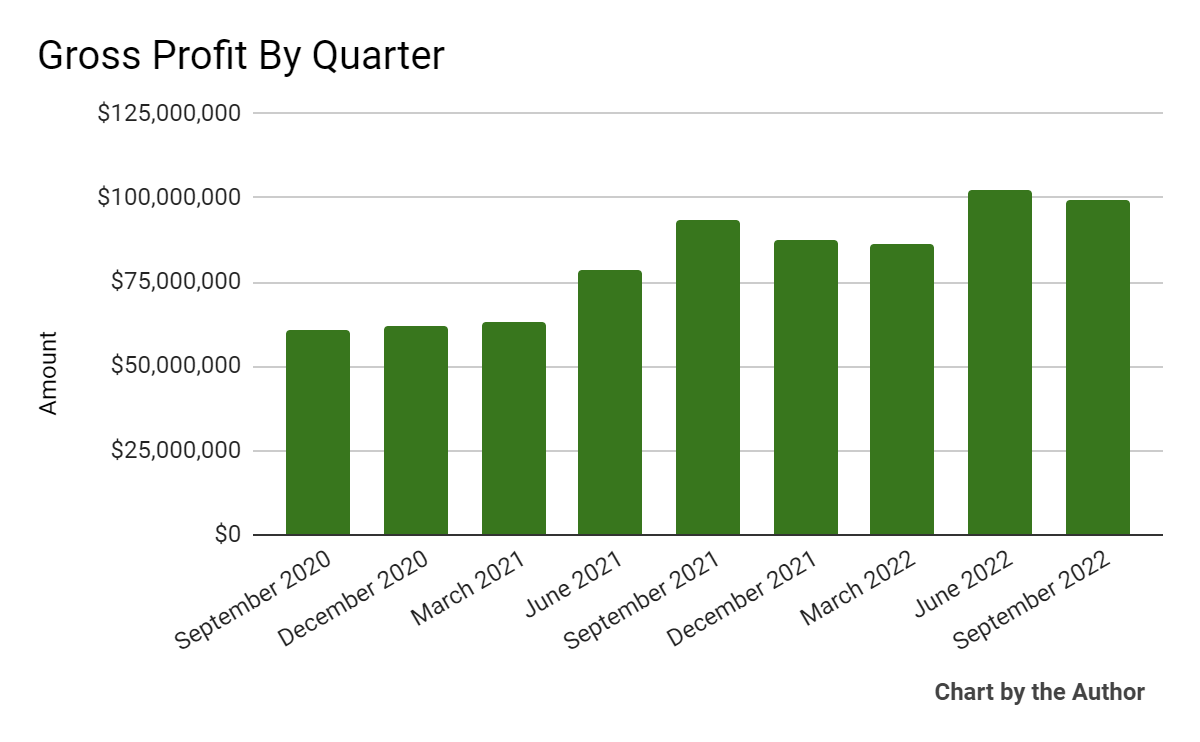

Gross profit by quarter has also risen with the same general trajectory as that of total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

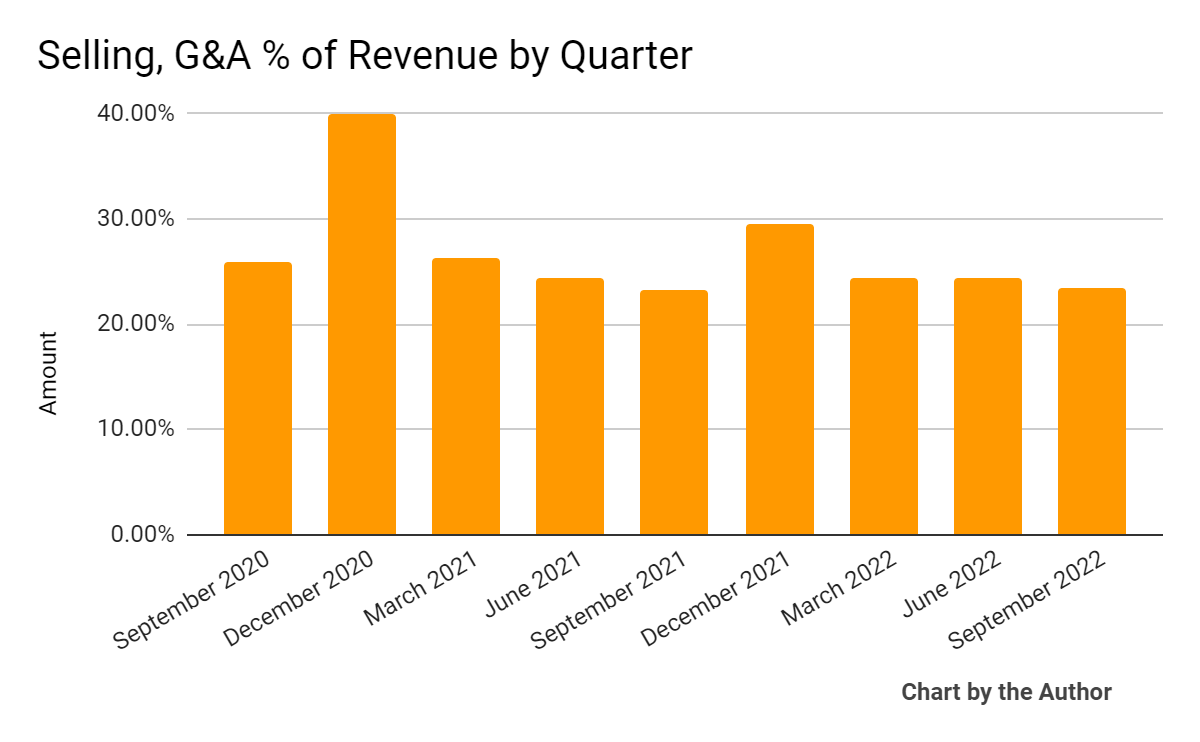

Selling, G&A expenses as a percentage of total revenue by quarter have trended lower as revenue has increased:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

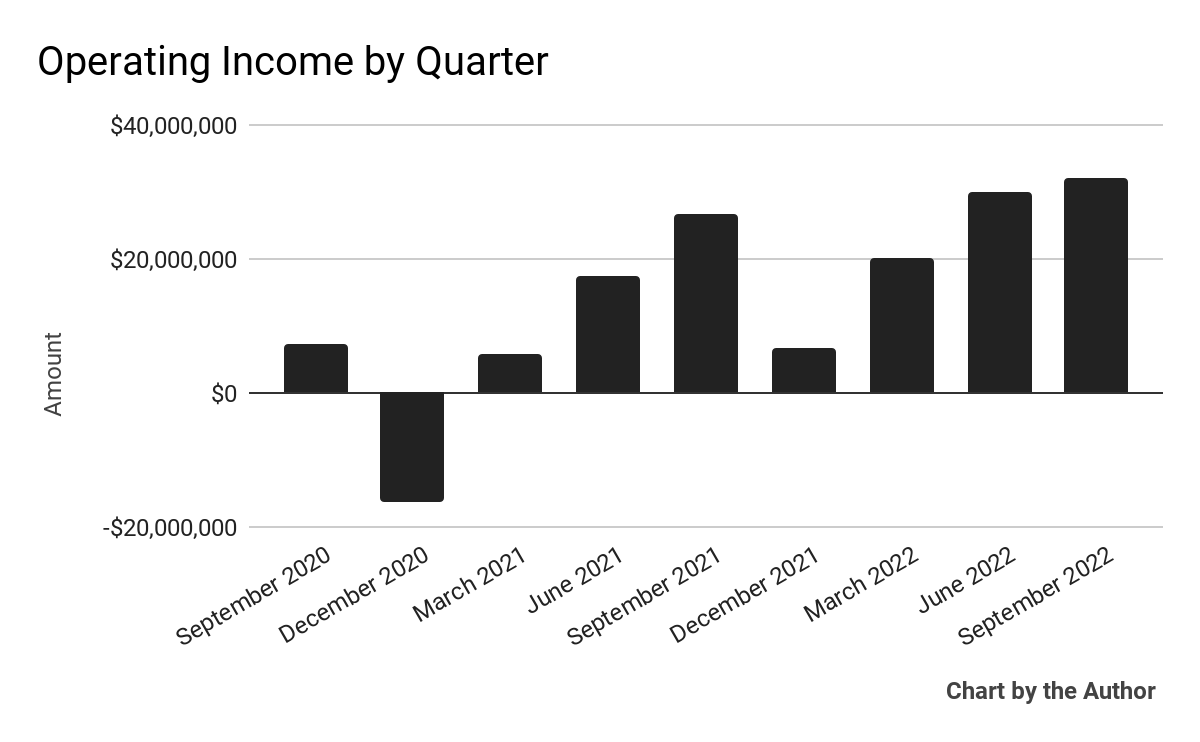

Operating income by quarter has risen per the chart below:

9 Quarter Operating Income (Seeking Alpha)

-

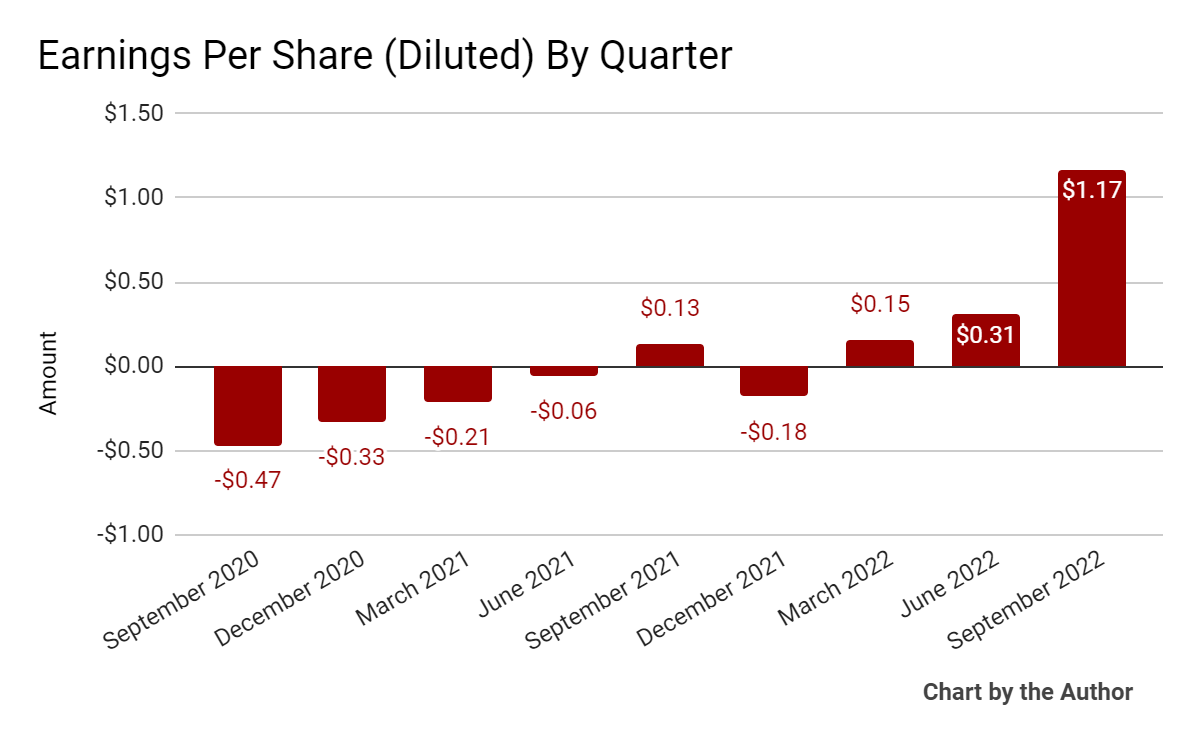

Earnings per share (Diluted) have risen significantly in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

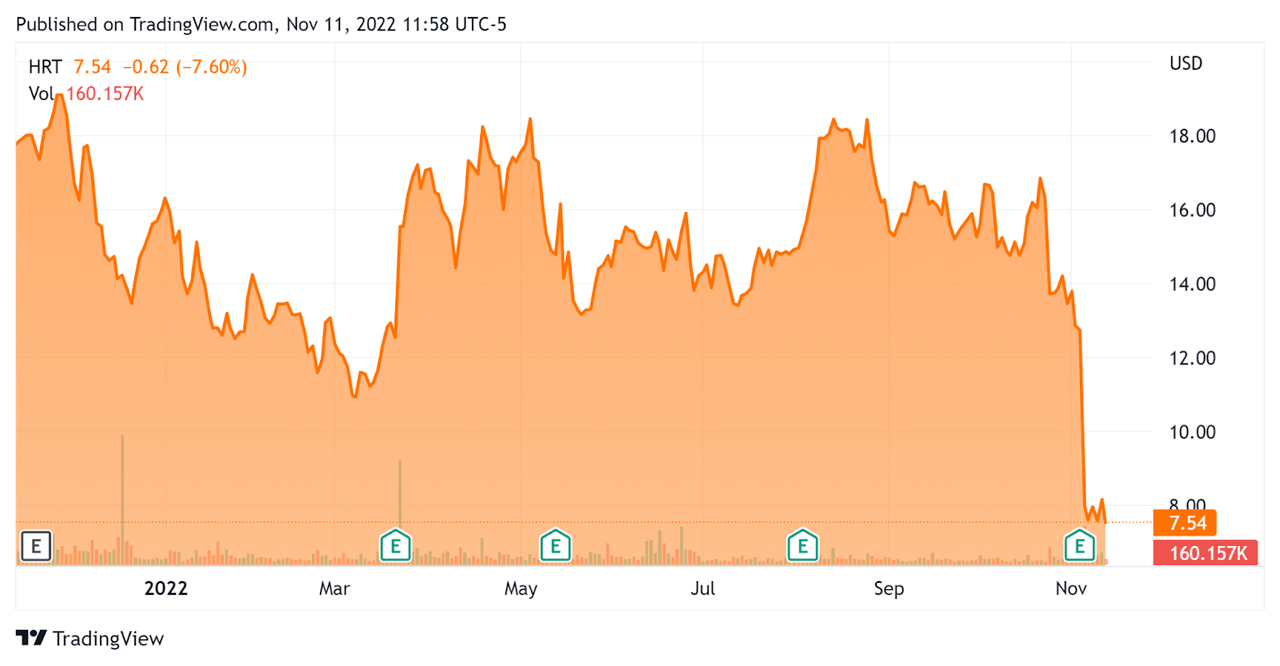

Since its IPO, HRT’s stock price has fallen 58.3% vs. the U.S. S&P 500 Index’s drop of around 14.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For HireRight

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.40 |

|

Revenue Growth Rate |

21.7% |

|

Net Income Margin |

14.0% |

|

GAAP EBITDA % |

19.9% |

|

Market Capitalization |

$603,290,000 |

|

Enterprise Value |

$1,160,000,000 |

|

Operating Cash Flow |

$99,360,000 |

|

Earnings Per Share (Fully Diluted) |

$1.45 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Sterling Check (STER); shown below is a comparison of their primary valuation metrics:

|

Metric (TTM) |

Sterling Check |

HireRight |

Variance |

|

Enterprise Value/Sales |

2.09 |

1.40 |

-33.0% |

|

Revenue Growth Rate |

29.1% |

21.7% |

-25.3% |

|

Net Income Margin |

3.9% |

14.0% |

262.3% |

|

Operating Cash Flow |

$103,280,000 |

$99,360,000 |

-3.8% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On HireRight

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the slowdown in macroeconomic conditions and U.S. dollar foreign exchange headwinds.

The company also lost one of its largest customers due to a “substantial price increase from one of our suppliers.”

Management began to see a “noticeable decline in volumes” from many of its enterprise customers in the 2nd half of Q3.

As to its financial results, revenue rose only 2.6% year-over-year, while gross profit increased 6.2%.

The company’s customer retention rate was 97%.

Selling, G&A expenses as a percentage of revenue were slightly higher year-over-year, while operating income rose, as did earnings per share. However, EPS rose due to a non-cash reversal of a tax liability.

For the balance sheet, the firm finished the quarter with cash and equivalents of $146.5 million and $693 million in debt.

Over the trailing twelve months, free cash flow was an impressive $94.3 million, with only $5.1 million in capital expenditures.

Looking ahead, management has reduced forward guidance, with full year 2022 revenue now expected to be $802 million at the midpoint of the range and adjusted EBITDA of $182 million at the midpoint.

Regarding valuation, the market sold HRT’s shares heavily after the conference call, likely due to management’s guidance drop, loss of a major customer and negative comments on the near-term macroeconomic headwinds as companies lay off employees or freeze hiring.

The primary risk to the company’s outlook is a recession in 2023, with a growing labor market downturn as an apparent policy goal of the U.S. Federal Reserve’s interest rate hikes.

A potential upside catalyst to the stock could include the Fed pausing its rate hikes amid slowing inflationary pressures.

HRT looks to be at the mercy of a labor market downturn, which will likely punish the firm’s growth and profit results in the coming quarters.

I’m therefore on Hold for HRT in the near term.

Be the first to comment