Spencer Platt

Taiwanese fabless semiconductor solutions provider Himax Technologies, Inc. (NASDAQ:HIMX) has underperformed the market for years. This is a reflection of the volatile market in which the company operates. Nevertheless, Himax has been able to grow revenues and profitability over the last five years. There is a question as to the long-term profitability of the company, but, within the near-term, the market is likely to reward it for its excellence.

Soul Destroying Stock Market Performance

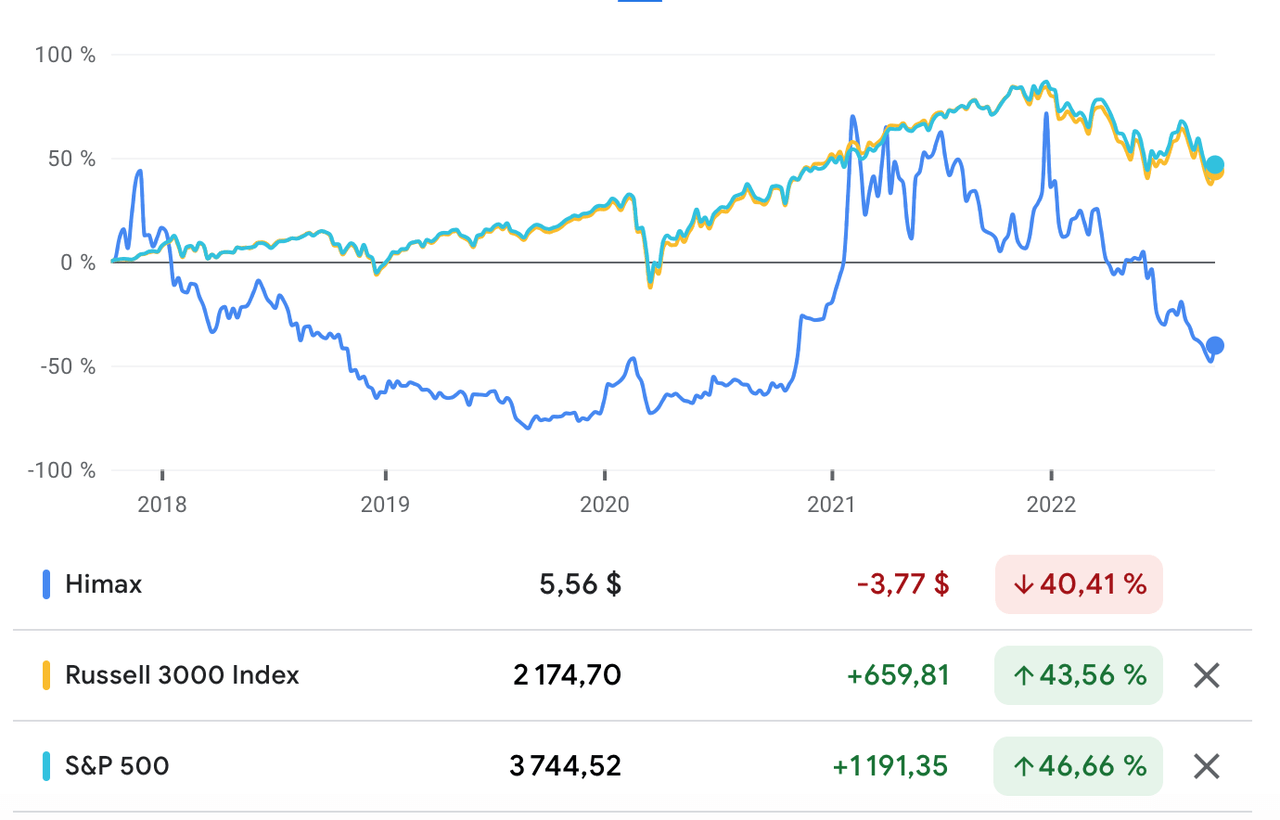

In the last five years, Himax has had the kind of stock market performance that would make any investor sick to their stomachs. The share price has plunged 40.41% across the last five years, during a bull run that saw the Russell 3000 rise 43.56%, and the S&P 500 go up 46.66%.

Source: Google Finance

If you think that the company’s share price has gone up while the rest of the market has gone down, you’re wrong; in the year-to-date, the stock has plunged 57.3%, compared to 22.47% for the Russell 3000, and 21.93% for the S&P 500.

However, the market seems to be ignoring the fast improving financial performance of the firm. When that is recognised by the market, the stock price will inevitably go up.

Improving Profitability

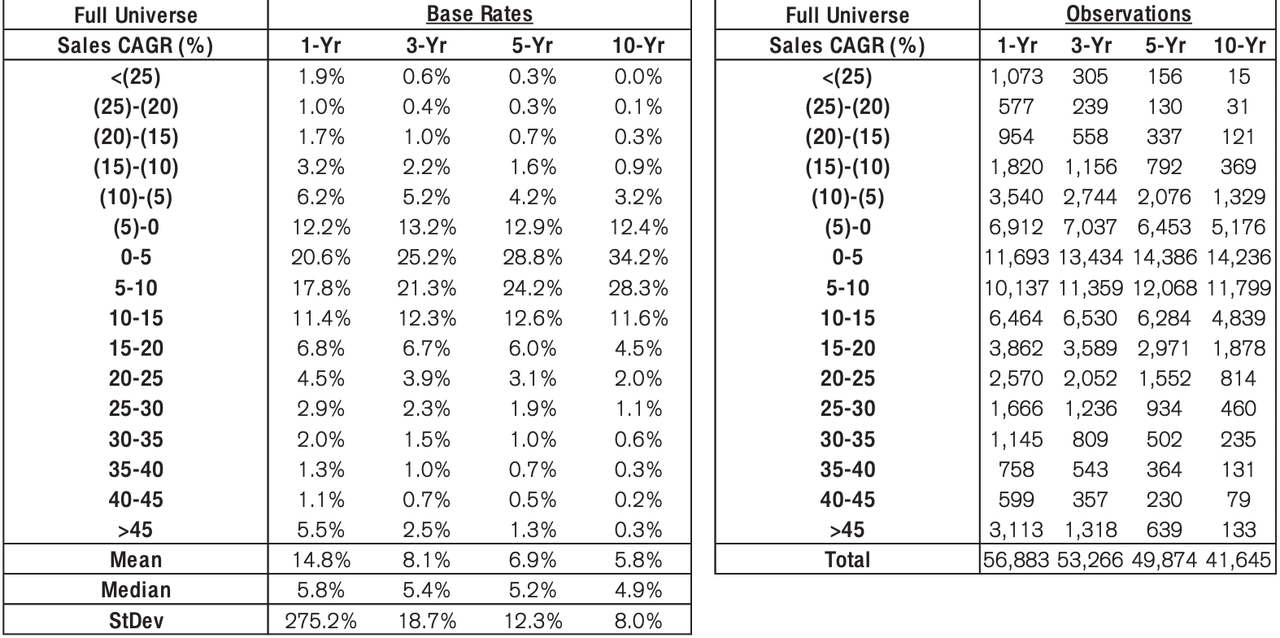

Himax grew revenue from more than $685 million in 2017 to nearly $1.55 billion in 2021, for a 5-year revenue compound annual growth rate (CAGR) of 17.69%. According to Credit Suisse’s The Base Rate Book, just 6% of firms were able to earn similar rates of growth between 1950 and 2015.

Source: Credit Suisse

In the year-to-date, revenue has risen to more than $1.598 billion.

Gross profitability has risen from nearly 0.21 in 2017, to nearly 0.47 in 2021. This is well above the 0.33 threshold that Robert Novy-Marx found to be a market of an attractive business. In the trailing twelve months (TTM), gross profitability has declined somewhat to 0.42.

Himax’s operating profit margin continues this story of accelerating profitability, rising from an anemic 1.2% in 2017, to 35.2% in 2021. In the TTM period, operating profit margin declined marginally to 34.6%.

Net income has also risen sharply, from $27.97 million in 2017 to $436.9 million in 2021. That gives us a 5-year net income CAGR of 73.28%. That gives us a base rate of 0.3% of firms in the 1950 to 2015 period.

Source: Credit Suisse

In the TTM period, net income has risen to $447.62 million, continuing a pattern of improving profitability.

Himax’s returns on invested capital (ROIC) has risen from 8.5% in 2017 to 81.4% in 2021. Stock market returns follow the direction of ROIC, and it is promising that, although ROIC declined to 70% in the TTM period, the overall direction is toward improvement.

The company’s profitability has allowed it to spit out larger amounts of free cash flow (FCF), rising from $2.77 million in 2017 to $403.19 million in 2021, for a 5-year FCF CAGR of 170.77%. In the TTM period, FCF declined mildly to $389.56 million.

The direction of the company’s financial performance is upward, and very strong, and will be reflected in the stock market over time.

Market Volatility

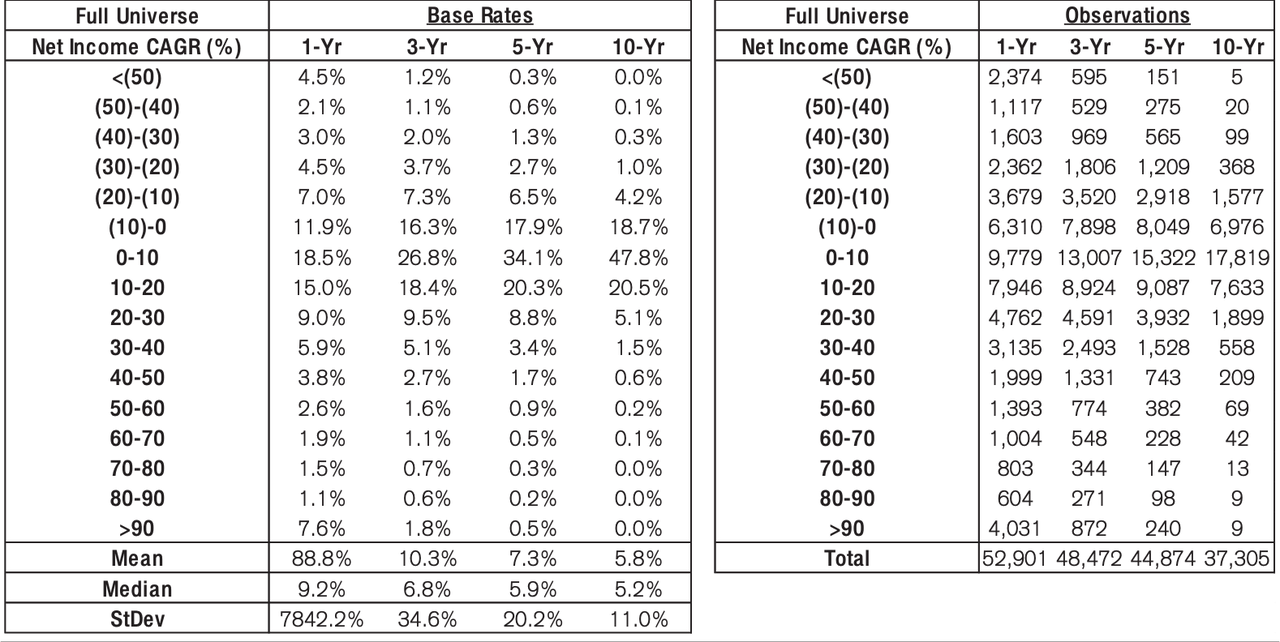

Himax is a fabless semiconductor solution provider that manufactures imaging processing technologies. The majority of the firm’s revenues derive from the flat panel display semiconductor industry. Global demand for flat panel displays fluctuates greatly, as the chart below shows:

Source: Statista

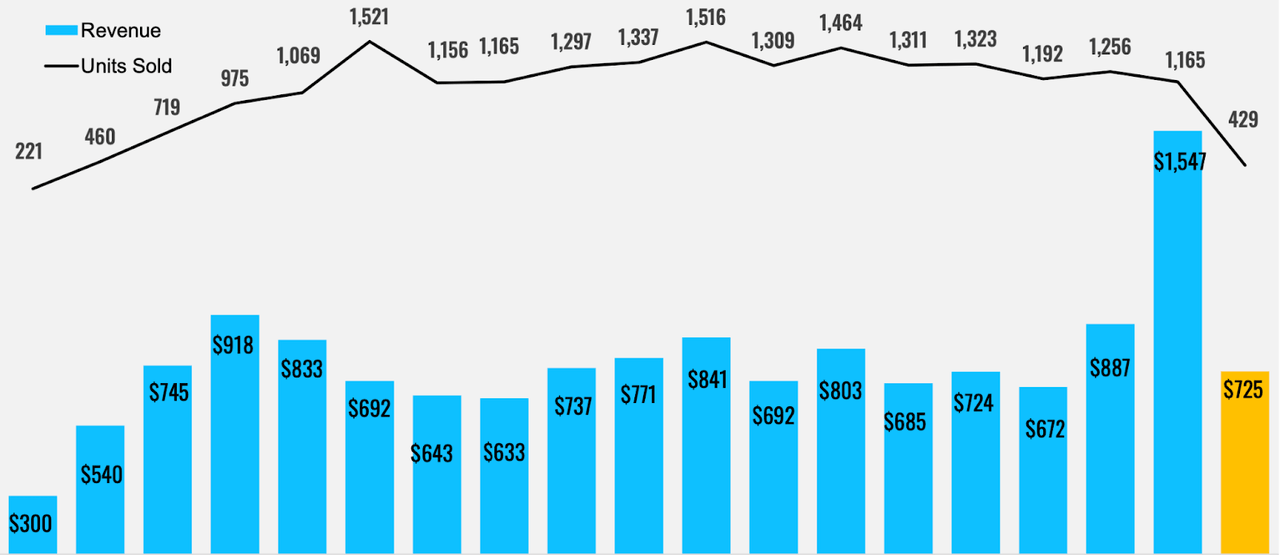

That volatility can be seen in the company’s own revenue and units sold numbers:

Source: Himax August 2022 Investor Presentation

A reflection of the volatility of the market is that Himax expects revenue to decrease by between 35% and 39% in Q3. Although Himax operates in a volatile market, it has been able to grow its market share in the industry. As one of the world’s leading fabless IC design companies, the firm has been able to attract partners such as Alphabet Inc. (GOOG) (GOOGL), and Qualcomm (QCOM) and grow its market share. Himax has a 40% market share in the driver IC for automotive displays.

While the company has gotten many things right, market volatility means that Himax cannot be a long-term holding for an investor, because of the boom and bust nature of the business. The volatility is a risk, because it encourages firms to chase the direction of the price, expanding production when prices go up, until the bubble bursts, after which, prices collapse. That instability can make it hard to build long-term wealth. In addition, the volatility shows that, despite the importance of the industry, the industry’s products can still be put off by managers.

A Diverse Portfolio of Products

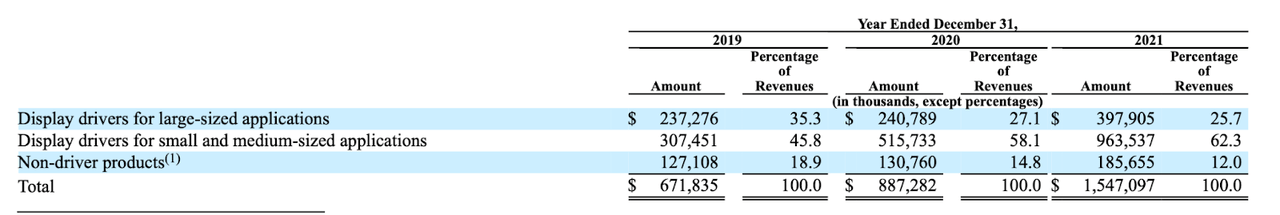

62.3% of Himax’s 2021 revenues came from display drivers for small and medium-sized applications, while 25.7% came from display drivers for large-sized applications, and just 12% from non-driver products.

Source: 2021 Annual Report

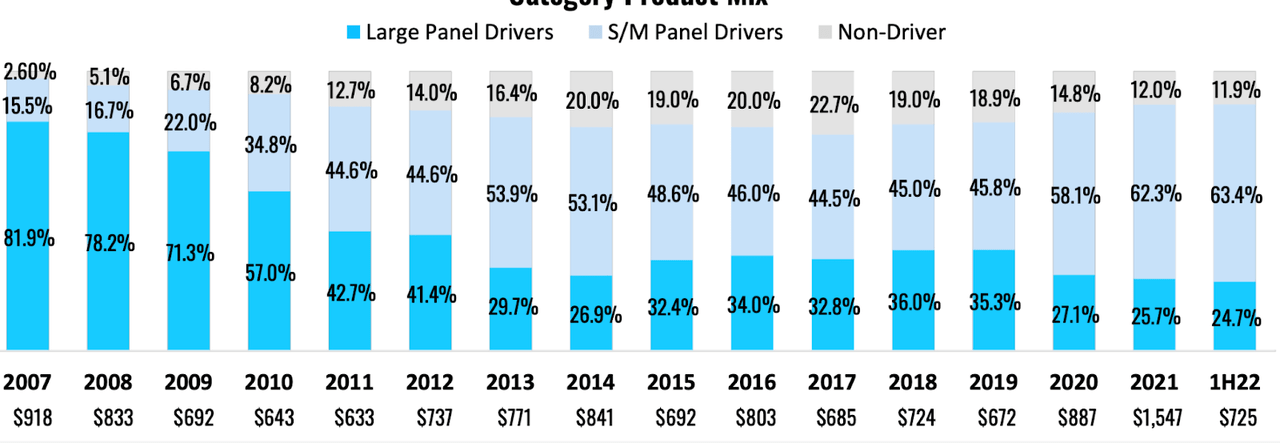

It should be noted that, since 2007, the company has steadily increased its product mix, which has made it more robust, and less prone to influence from fluctuations from any one product line.

Source: Himax August 2022 Investor Presentation

Customer Concentration is a Risk

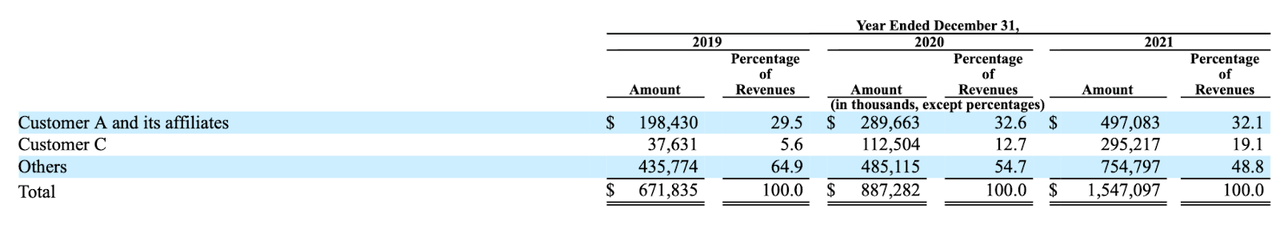

The company’s revenues emanate from a limited number of customers. One customer is responsible for 32.1% of its revenues, while another is responsible for 19.1% of revenues. This obviously results in a great deal of risk, in that if one of those two customers switched to another manufacturer, there would be a meaningful impact on the company. However, given the switching costs that this would involve, this is not a very high level risk.

Source: 2021 Annual Report

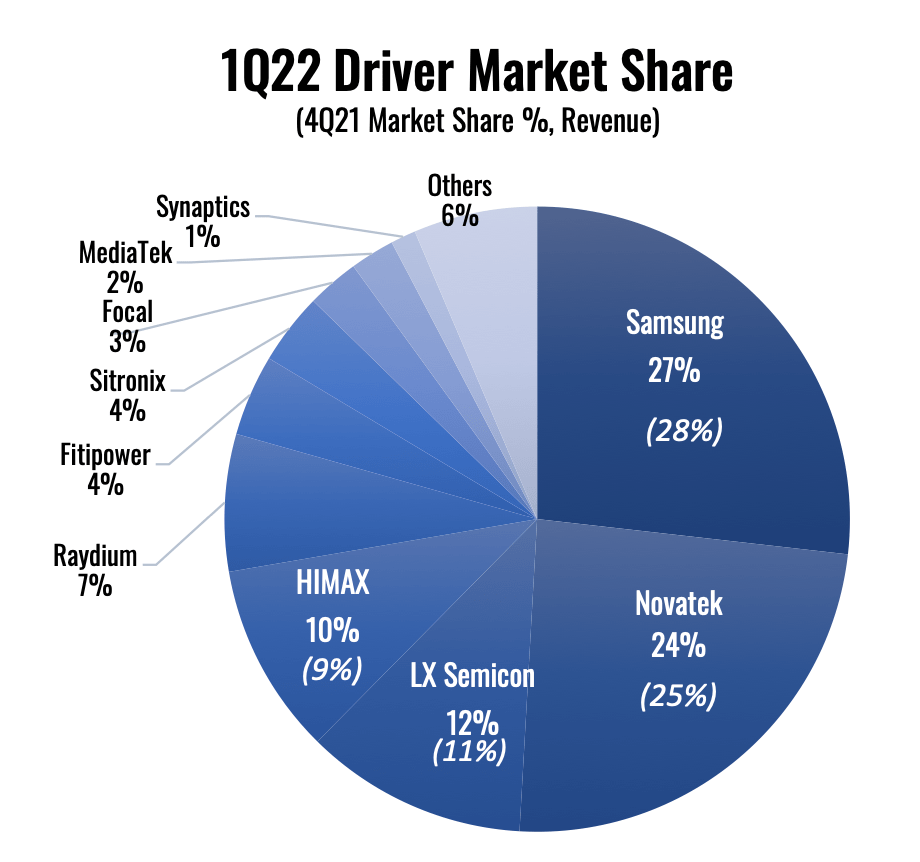

The company is a market leader, for instance, in the display driver IC (DDIC) market, Himax has 10% of the market. As a leading manufacturer across its product lines, it is not only less likely that a customer would leave, but Himax would probably be able to make up for losing that customer with new business.

Source: Himax August 2022 Investor Presentation

Valuation

Himax has an FCF yield (FCF/enterprise value) of nearly 55%. After years of deep losses for investors, the value of the company has declined to such an extent that over half the firm’s enterprise value is in the form of FCF. In comparison, the FCF yield of the 2,000 largest firms in the United States, as calculated by New Constructs, is 1.5%.

Conclusion

Himax is a very profitable and attractive business. Given the direction of profitability, the market will recognise its merits, at a time when many businesses are struggling for profitability. However, there is no evidence that the company has the kind of downside protection that will make it a long-term holding for an investor. Himax is a business that is likely to go up, in recognition of those fundamentals, but which should not be held for too long.

Be the first to comment