CRobertson/iStock Editorial via Getty Images

This article was coproduced with Wolf Report.

Highwoods Properties, Inc. (NYSE:HIW) is a qualitative real estate investment trust (“REIT”) based in North Carolina. It’s also a business that very few seem to be writing about right now.

Admittedly, it’s been a while since we covered it, too. iREIT on Alpha wrote a deep dive on Highwoods way back in 2020. So, it’s probably a good time for an update.

Let’s start out by saying that we’re positively inclined toward this REIT and consider it to be fundamentally sound – despite being in the somewhat volatile office sector.

(Yahoo Finance)

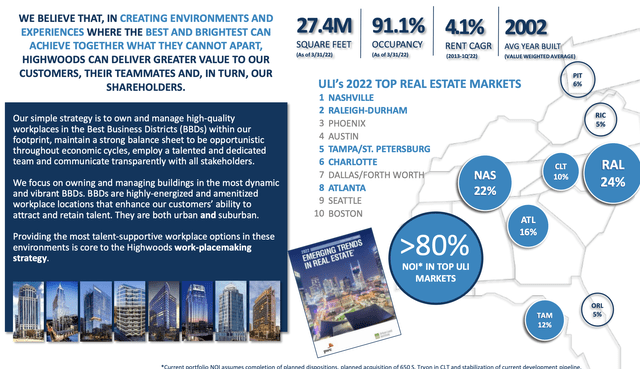

Highwoods has an interesting geographical exposure. It primarily focuses on the attractive Southeast with exposure in areas like:

· Nashville, Tennessee

· Atlanta, Georgia

· Raleigh, North Carolina

· Tampa and Orlando, Florida.

Together, those locations account for around 80% of the company’s overall geographic mix of properties.

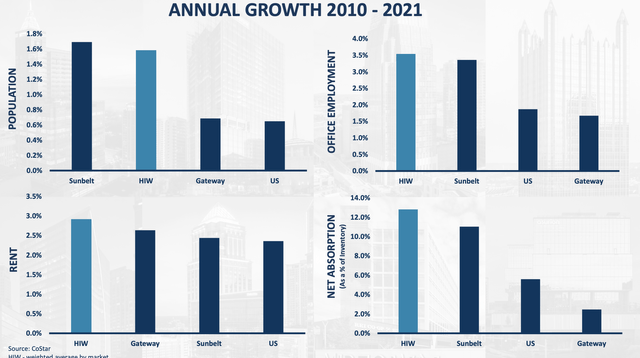

Overall, it tends to focus on the top real estate markets around. The five cities listed above are among the top ten 2022 real estate markets. They’ve outpaced or averaged national annual growth for the past 10 years.

Take a look at some of these stats…

(HIW IR – HIW IR)

More recently, these markets have performed extremely well during Covid-19. Office buildings are filling up much faster down south, and Highwoods is perfectly positioned to benefit.

Moreover, it’s doubling down on that region, having announced plans to exit the Pittsburgh market and redeploy capital into Dallas.

(HIW IR – HIW IR)

Nothing Could Be Finer…

Here are some more reasons to like Highwoods Properties…

For starters, it was one of the few office REITs that averaged rent collections of 97%-99% during the 2020 shutdowns. That’s due to its mix of tenant quality and diversification.

When one leases to tenants that “don’t care” about how the economy is going – at least figuratively – it stands to reason that lease income won’t be impacted much by a downturn.

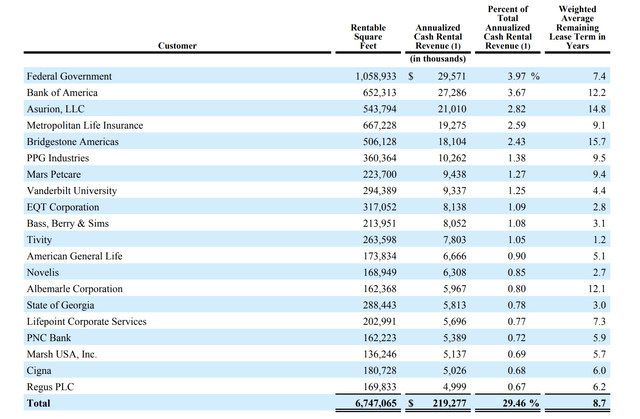

So, what sort of ABR diversification does the company have, to cause such a statement?

(HIW Annual Report – HIW Annual Report)

In essence, the government and major banks and industrials are major tenants of Highwoods.

Obviously, the government can pay its 3.97% of ABR no matter what happens and so can Bank of America (BAC), that generates 3.7% of rent from Highwoods.

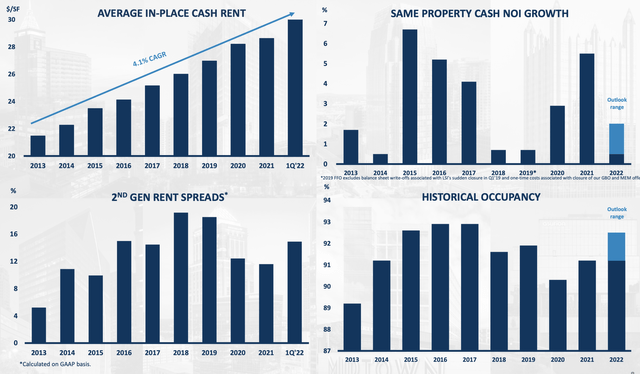

Now, the company did see some decline in average occupancy as we saw the pandemic. At times, it dropped to close to a 90% level, but that occupancy is back above 91% and is targeted to go back up to 93%.

Rent spreads for the company, which were somewhat compressed in 2020 and 2021 down to 12%, are back up to 15-16% for the latest quarter.

But you can see that even the top 20 tenants make up only 29.46% of the 2021 ABR, which means that this business is one of the best-diversified Office REITS in all of the United States.

And of course, Highwoods’ average in-place rents have been growing for the past 9-10 years, by around 4.1% CAGR for the past 8 years. NOI growth is a bit spottier, but averages at a very impressive rate, even if occupancy drawdowns have obviously seen some falls for same-prop NOI growth.

HIW IR (HIW IR)

During Q2-21 Highwoods completed 683k SF of new and renewal leases during the quarter, (12.3%) lower than the trailing four-quarter average. Over the past 12 months, the company has completed 2.9M SF of leasing, up 12.4% compared to the prior period but still (26.5%) below pre-pandemic levels.

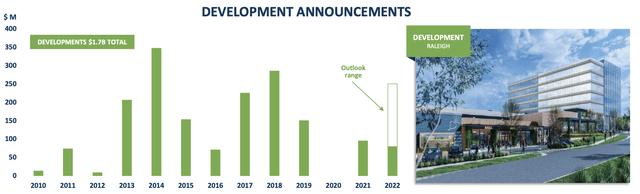

Like most REITs out there, Highwoods is an active M&A’er as well as active in disposing of various properties. Since 2010, HIW has acquired around $3.4B and disposed of around $2.8B worth of properties. The company is also an active developer, with a current development focus on Raleigh and other attractive geographies.

During Q2-21 Highwoods leased an additional 38.5k SF in its development portfolio. With the addition of two new developments after quarter end the active pipeline now includes six projects with ~1.7M SF and a total investment of $942.8M ($559.0M at HIW’s share, up 47.1% y-o-y).

HIW IR (HIW IR)

In terms of leverage, debt and maturities, Highwoods is BBB rated with a well-laddered debt schedule. The earliest significant maturities do not come until 2026-2028, giving the company ample of time and room to move.

Highwoods works with an average weighted interest rate of 3.4%, leverage of 5.3x to annualized EBITDAre and a 39.5% debt + pref/gross assets.

Furthermore, since 2011, it’s lowered its leverage from the mid-6x range to the current low 5x-range, showing a history of conservative decision-making. This is a positive.

The current company’s pipeline can be considered attractive with $238M worth of investments, at a 56% lease ratio.

It’s not as good as some peers, especially Alexandria (ARE), but it’s still good for an office REIT, especially with VA Springs II, which is 97% leased as of June 2022.

There is also plenty of potential for more development, with both office and mixed-use properties.

Yes, like most office REITs, the company has a high focus on mixed-use properties and square footage. It’s not just a focus on downtown areas either – but an attractive mix of downtown and rural areas such as Downtown Raleigh, Cary (Raleigh), and Ovation in Nashville. The pipeline calls for completions and rent stabilization for these developments going all the way to 2027.

Highwoods isn’t resting on its laurels either.

As mentioned above, Highwoods is moving into Dallas, which is of course a major market, beginning with two investments of which the REIT has 50% each. The way HIW moves into Dallas is with a JV with Granite Properties for the two properties of Granite Park Six and Fisco/Piano BBD, which together are over 1.05M square feet of space.

To fund its $130M equity investment the company plans to sell its Pittsburgh portfolio, which includes ~2.2M SF across seven operating assets and one land parcel slated for a 60k SF development.

HIW Dallas (HIW IR)

Highwoods fundamentals aren’t as solid as they were going into the pandemic, or even mid-pandemic, when the company was down below 5x in leverage with an even higher unencumbered NOI.

But this business has managed through the entirety of COVID-19 and the current macro with its head held high – expanding, growing, and managing well.

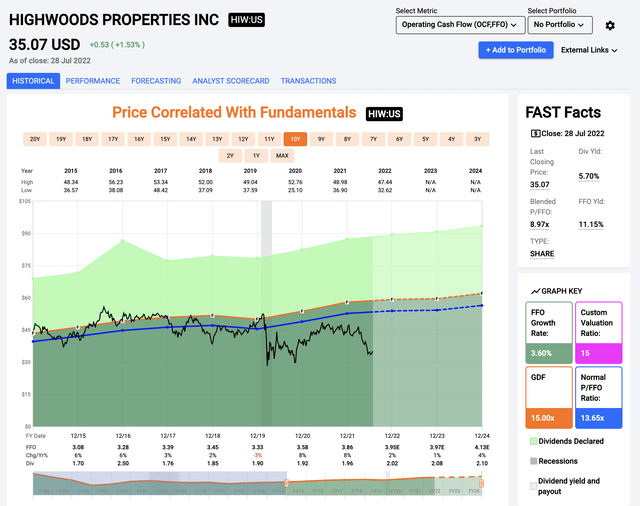

Its FFO has seen only marginal change, yet HIW is down almost 25% since the pandemic began, despite FFO actually being up every single year except 2019.

Let us show you the trends here.

Highwoods’ Valuation

As I said, on a 2022 valuation basis looking at FFO multiples, the company currently trades at a just-south-of-9x multiple. This is well below its 10-year or even 5-year average.

F.A.S.T Graphs HIW (F.A.S.T Graphs HIW)

It’s not at pandemic lows – but you can see that since 2019, this company has only generated low returns unless you bought at trough, at which case you saw RoR of 41% until today.

Is this multiple to FFO justified?

Nope!

Highwoods is an investment-graded REIT with excellent exposure to some of the most growing, attractive markets in all of the U.S. This translates to good rent spreads and good demands, and a 91%+ target occupancy for 2022 fiscal.

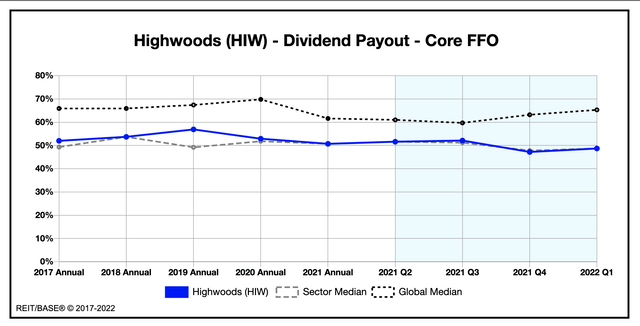

These facts alone should be enough to spark some interest from you – but if that isn’t enough, consider that the company has a 5.7% yield that’s covered at an almost 51% FFO payout ratio for the 2022E. Again, this company’s yield isn’t going anywhere.

Its dividends are safe.

Keep in mind, Highwoods is the ONLY office REIT that did NOT cut its dividend during the Great Recession. That means a lot!

That gives us the confidence to forecast an upside for HIW.

Even if we consider flat trading of 9-10x P/FFO, the annual upside to such a forward 2024 9x FFO is close to 9% per year – and that’s if the company doesn’t improve its valuation at all.

Any valuation above 9x sees ranges of 14-25%, with 25% annual RoR to a 69% total RoR until 2024E being based on a multiple of 13x.

13x happens to represent both the 5-year and the 10-year average FFO multiple for this REIT, and we see no reason, based on an FFO growth estimation of around 2-3% annually, why this company should trade below this given its fundamentals and portfolio.

This is a REIT that’s close to my heart (I live in the Carolinas) – because it’s focused on the states where many of iREIT’s employees and managers actually live and work, or frequent. (My oldest daughter is a Tar Heel too).

The key to office REITs, especially in this climate, is obviously that we want to buy them at a low multiple.

Well, with Highwoods we have that covered.

Since we have valuation covered, what else do we have covered?

Well, Highwoods has an above-sector-average EBITDA/to interest coverage of 5.7x for the 2021 fiscal, and an above-average fixed charge coverage, well above the office sector average of 3x, at 4.3x the last quarter.

It comes in close to the sector average of around 40% for total debt to capital, and well below the average when looking at debt to market capitalization.

As mentioned, it also has a Debt/EBITDA of no higher than 5.4Xxin 1Q22 – the sector average to this multiple is 7.1x.

Again, Highwoods “wins.”

Would you also like to see the company’s payout metrics?

Let’s start with this one.

REIT/BASE (Payout Ratio)

Similar trends and positives are true for payout on AFFO as well.

Again.

Safety.

The company isn’t really a major player in this field in terms of total market cap. Of the REITs covered by most analysts in this sector, only a few are actually smaller than Highwoods with a current market cap of around $7.8B.

So, what do we think of Highwoods Properties?

- We think it’s a great business with a great portfolio.

- We think the 5.7% dividend yield is safe.

- We think the REIT is significantly below where it should be trading here.

- We think you should look closer at what Highwoods has to offer your portfolio. Because we’re talking about a REIT with properties in some of the more attractive geographies in the U.S., trading below par, and with an upside even if the valuation does not improve.

It’s also investment-grade credit rated.

Combine these things, and you may understand why Highwoods Properties is currently one of our highest conviction “BUY” ratings in the office space.

Not just any “Spec Buy” either – this is a “BUY.”

There’s nothing speculative about this business’s properties.

We consider this company a “BUY” with a $50/share price target, giving us a margin of safety of close to 30%. The combined quality and valuation score of 84 and 70 respectively, means that this is currently the highest-rated office REIT that isn’t a speculative buy for us.

And that is worth highlighting.

Do you want to get into North Carolina, Texas, and Florida Real estate with high safety?

Then we would suggest that you consider Highwoods properties – because there’s a lot to like about this REIT.

Be the first to comment