Khanchit Khirisutchalual

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on November 25th, 2022.

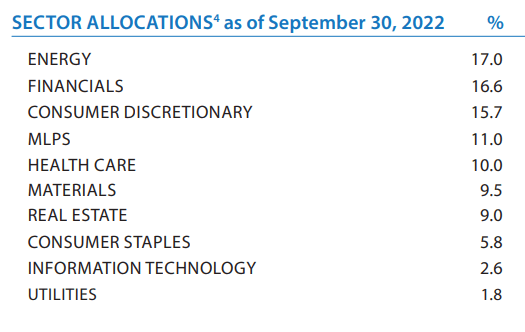

Miller/Howard High Income Equity Fund (HIE) is a portfolio focused on equity positions that can generate dividends. In a year such as 2022, with equities declining, one might assume before looking that HIE would have also performed poorly. However, the fund has chosen to tilt towards a heavier weighting in energy and MLPs generally. From around 2015 to 2020, that meant weaker historical results. In 2021 and now 2022, that heavier weighting to the energy sector has been to its benefit.

In our previous update earlier in July, we noted that the fund could be in a position to boost the distribution as it had at the start of 2021. However, with the general weakness and uncertainty of the environment, there was some hesitancy to being too confident.

They’ve still been able to take a lot of gains, too, for the year, which has resulted in their distribution coverage being quite fine. In fact, I would still believe that a distribution boost could be appropriate. Given the uncertainty of the environment, I’m not sure if they will.

Since that time, though, they have now announced a boost. They’ve been paying out a very conservative distribution relative to most other closed-end funds after cutting sharply in 2020. I think the actual distribution yield remains conservative, especially since the fund has been performing relatively well. Therefore, I believe that once again, they still have the capacity to boost their distribution further – but they may continue to be conservative and hesitant to do so too aggressively.

The fund’s discount continues to remain attractive as well, which means that I still believe that the fund is worth investing in for a more aggressive investor. With a heavier emphasis on energy and MLPs and being leveraged, it will remain a more volatile fund, as we’ve seen historically. Being a term fund coming into the last couple of potential years of its life, it would suggest that a wider discount for an extended period of time could be minimal.

The Basics

- 1-Year Z-score: -0.19

- Discount: 8.29%

- Distribution Yield: 5.76%

- Expense Ratio: 2.03%

- Leverage: 19.37%

- Managed Assets: $268.4million

- Structure: Term (expected November 24th, 2024)

HIE is classified as a “diversified, closed-end management investment company whose primary objective is to seek a high level of current income with capital appreciation as a secondary objective.”

They intend to invest “at least 80% of its total assets in dividend or distribution paying equity securities of US companies and non-US companies traded on US exchanges. The Fund will seek to invest in securities that the Investment Advisor considers to be financially strong with reliable earnings, high dividend or distribution yields, and rising dividend growth. The Fund may invest up to 25% in Master Limited Partnerships (“MLPs”), generally in the energy sector. The Fund intends to engage in an options writing strategy consisting of writing put options on securities already held in its portfolio or securities that are candidates for inclusion in its portfolio. It may also engage in covered call writing strategies, and it may buy put and call options. The Fund may write covered put and call options up to a notional amount of 20% of the Fund’s total assets.”

I view the fund’s high expense ratio as negative here. This will directly eat into the income generated from the portfolio to cover these fees. With leverage based on a floating rate, the expense ratio can head higher, too, as leverage expenses escalate.

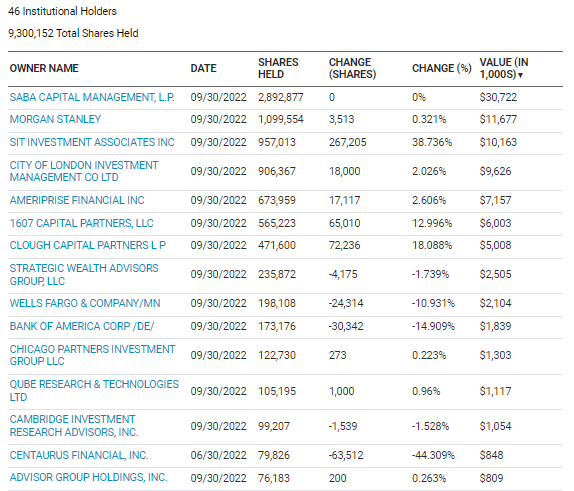

Institutional ownership of HIE remains worth noting, as it remains near 48% of the fund’s ownership. Saba’s ~15.5% stake remains. They haven’t increased their positioning in the latest quarter. However, a number of other notable activists or activist accomplices have ramped up their stake in the latest quarter. Of particular note, SIT investment Associations took their position up nearly 40%.

HIE Institutional Ownership (Nasdaq)

Those were the positives. However, RiverNorth sold out completely in the latest quarter, and Bulldog Investors also trimmed their position. RiverNorth held around 430k shares, and Bulldog still has nearly 45,800 shares. So they were and are significantly smaller stakes relative to Saba.

Performance – Attractive Discount

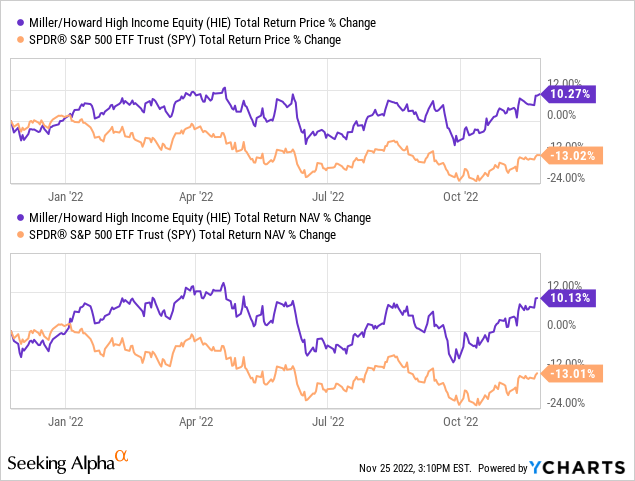

The fund is somewhat diversified but significantly overweight energy, as mentioned above. That has meant that if we compare to the broader market, such as a comparison with the SPDR S&P 500 (SPY), we’d see that HIE has performed exceptionally well on a YTD basis.

Given such a difference in the weightings of the two, I don’t feel that it is an appropriate benchmark. However, it can be something that provides us with some context of its performance on a YTD basis.

Ycharts

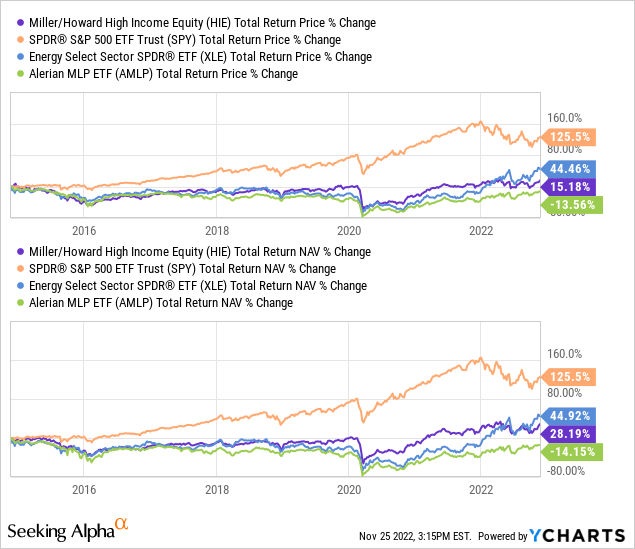

If we looked over the longer term, we would see weaker results, as one would assume with a heavy energy tilt. Included in the performance chart below is the Energy Select Sector SPDR (XLE) to gain a perspective on how much energy would have impacted this fund. I’ve also included the Alerian MLP ETF (AMLP) because HIE holds quite a significant weight of its total energy exposure in the form of MLP holdings.

Ycharts

I believe it was important to highlight to show how much stronger XLE has performed than AMLP. MLPs seem to suffer the downside, but they haven’t been able to participate in the recovery to the same extent. Still, they remain with strong and predictable cash flows that lead to high distributions to unitholders. Which, I believe, still represents a place in HIE’s portfolio as an equity income fund.

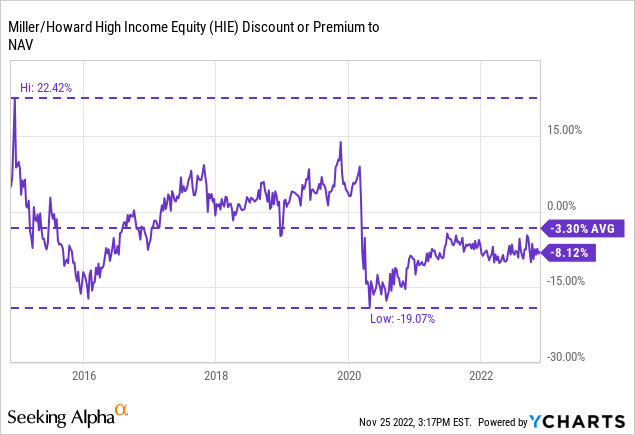

For a rather extended period of time, HIE had enjoyed trading at a premium. That is despite the fund’s lackluster performance during that period. What seemed to have dropped the fund to such a significant discount – where it remains – was the distribution cut.

Ycharts

With the fund’s termination set to take place in around 2 years, the discount should naturally reduce further and further from here. Of course, that doesn’t tell us if it’ll be a positive result or not during this time. The NAV could fall to meet the share price, or the share price could rise to meet the NAV price. Ideally, both would rise higher and eventually converge as it draws near their termination.

They have the option to extend the term for up to a year. That could be done with only Board approval, meaning that shareholders wouldn’t get to decide for themselves if it is extended.

Distribution – A Small Boost

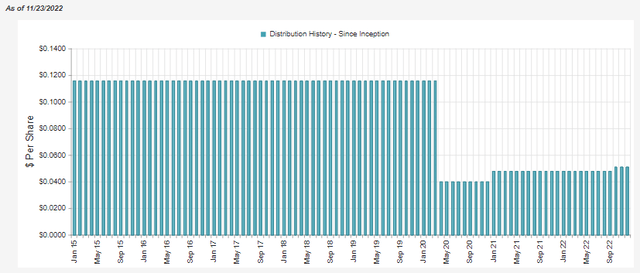

They had for years paid the same monthly distribution. That’s what seemed to generate a lot of investor attention to push it to a premium.

HIE Distribution History (CEFConnect)

A high yield is often one thing that attracts investors to push CEFs to trade at unusual premiums. It generally doesn’t end well.

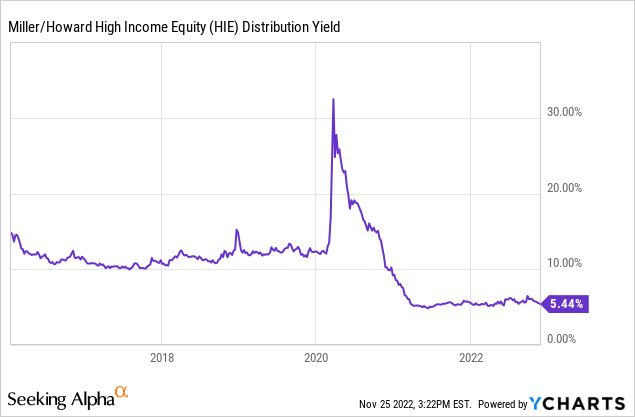

Ycharts

The opposite is often true too. When a fund pays a conservative distribution, it often gets neglected and trades at a wide discount. With HIE being a fund that cut its distribution and paying a more conservative level, it’s basically a double-whammy.

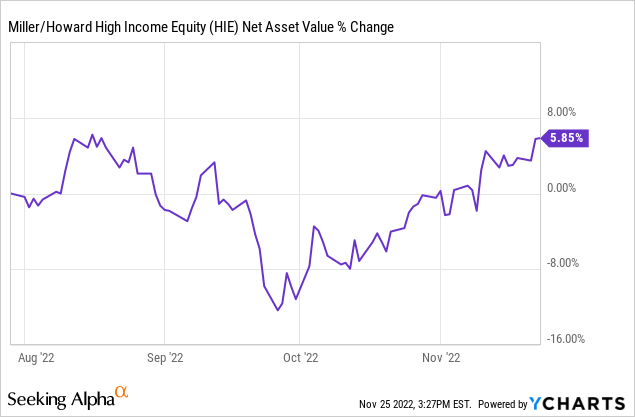

On the other hand, a more conservative payout means a higher likelihood that distribution boosts can take place. Since our coverage earlier this year, that’s exactly what has happened – as we can see in the chart above. The payout went from $0.048 per month to $0.051. That is good for a 6.25% increase.

It isn’t necessarily the largest bump in the payout, but I believe that their coverage should remain strong. This can be reflected by the fund’s NAV rising since our previous update. Additionally, the fund’s NAV distribution rate at 5.28% is still quite conservative and reasonable. That would be another clue that coverage should remain strong.

Ycharts

Since they haven’t posted any new annual or semi-annual reports, we don’t have any specifics. If history is any guide, they will post a new annual report at the beginning of January.

HIE’s Portfolio

The portfolio overall remains with a 28% allocation to energy and MLPs. Some of this could be from increasing their holdings in energy-focused names. It can also happen simply from the appreciation of the names in this sector relative to the rest of the sector exposure.

HIE Sector Allocation (Miller/Howard)

The portfolio’s last reported turnover was 67%. This has exceeded 100% and even went as high as 277% in 2020. So the portfolio manager is generally quite busy. That’s why this is one that I generally try to pay particular attention to what they’re holding and go through what changes might have taken place. It can change so drastically; that’s why it can be unfortunate that they aren’t one of the funds that update investors monthly. Instead, they stick with the minimum quarterly updates.

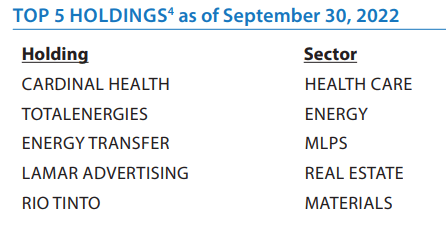

With that, we have seen some different top names show up. Previously it was Energy Transfer (ET), Altria (MO) and TC Energy (TRP). We now have only ET remaining as a top-five position.

HIE Top Five (Miller/Howard)

Cardinal Health (CAH) has taken the top spot in the healthcare field. Certainly not a bad way to go to be more defensive. That’s exactly why healthcare has become more popular lately, with most analysts expecting a recession next year. CAH was a holding in the fund earlier this year too.

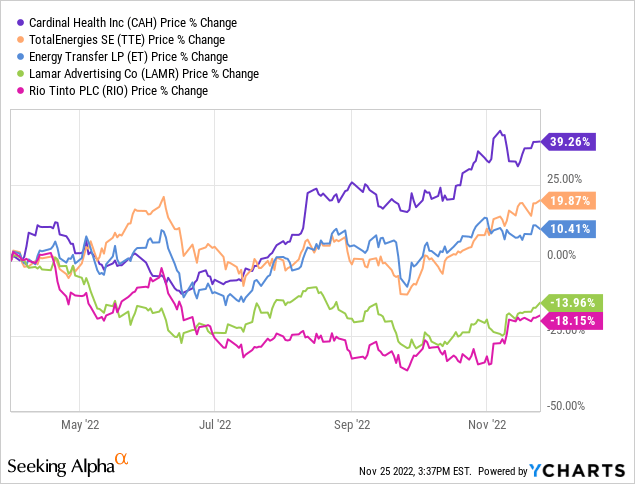

In fact, they held the same number at 168k shares from the end of April 2022 to the end of July 2022. We don’t know if they’ve added any shares since the end of July, as that is when the N-PORT was reporting through. However, we can see that CAH has performed incredibly well since April 2022. Meaning that it has contributed to some of the allocation increase to the top position.

Ycharts

It was the best-performing of the top five holdings. Only Lamar Advertising (LAMR) and Rio Tinto (RIO) have shown negative results during this time. The number of shares held in RIO remained the same during the same period we highlighted above (end of April through the end of July.) For LAMR, they had increased the number of shares held from 75k to 100k.

TotalEnergies (TTE) and ET had performed quite strongly in this period too but were still dwarfed by CAH’s strong run. The number of TTE ADRs held remained the same. On the other hand, they significantly increased the number of ET units held from 750,500 to a total of 1,100,500.

Again, we won’t know the changes in holdings until the next annual report or N-PORT is posted. The N-PORT should show up first, but shortly after, the annual report should be available.

Conclusion

HIE remains an attractive but riskier fund. They are leveraged and invest more heavier in energy positions that can make the fund more volatile. The big draw for the fund currently is the fund’s attractive discount, being a term fund with around two years left and significant institutional ownership. Notable is that the largest of those institutional owners are also known CEF activists.

Be the first to comment