SimonSkafar/E+ via Getty Images

We are constantly on the lookout for beaten down names. One name which is getting hit today is Hibbett, Inc. (NASDAQ:HIBB), and it is one of a number of retailers that has seen heavy short interest over the last year. The stock has started to climb out of the doldrums on the back of a broader market rally. However, we expect volatility this week as attention returns to comments from Fed Chair Jerome Powell that he will give this week, which has industry insiders a bit concerned.

With that said, Hibbett, Inc., which is a much smaller competitor in the sporting goods space, has in our opinion a very reasonable valuation, especially if you can buy shares at a discount. Today, it reported earnings which did miss estimates, and the Street is punishing Hibbett, Inc. stock. But we think you can leverage the weakness on this report, as well as any weakness on the next market correction which could come this week, to scale into a trading position. Let us discuss.

BAD BEAT Investing Trading Service

The play

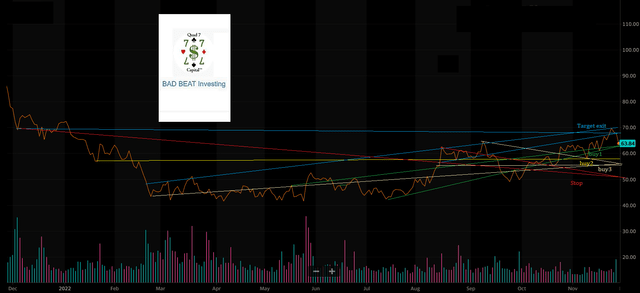

Target entry 1: $60.70-$60.90 (30% of position)

Target entry 2: $59.00-$59.25 (30% of position)

Target entry 3: $56.00-$56.25 (40% of position)

Target exit: $67 (if only the first two legs filled); $63 (if all three legs filled)

Stop loss: $51

Options have wide bid asks with moderate liquidity so they are tougher to trade but traders can consider Jun 2023 $60 strikes for $13, $11.50, and $10 on the way down and look to exit with 25% profit whether it is off the first strike or averaging down.

But what happens if I only get the first buy and it goes to the exit point? This does happen, and it is a high-quality problem, folks, because you still made money. Our teachings are that you never buy all at once. You scale in on the way down into quality companies at fair prices and profit on the reversal. Should you buy all at once and the stock falls 20%, you would need a 25% rally to break even from the lows. If you scale in as prescribed and shares fall 20% from when you start buying, you need only around an 8-9% retracement to break even, depending on the exact buy points.

Discussion

This is a sporting goods store play. We have liked the space generally since early 2021, though this year has been tremendously difficult for many retailers. As you can see, Hibbett, Inc. stock has been smashed earlier this year and has spent the last few months tinkering along the 50-60 range, recently starting to climb. We want to use the weakness to scale in.

Hibbett, Inc. has room to grow. Their new store openings are performing above expectations, and we think management will continue to identify opportunities to extend its market reach. It has grown steadily. There are more stores than you may think. At the end of Q3 there were 1,126 stores, up 30 from a year. In the quarter, they opened 11 new shops and closed two underperforming ones. We like the conservative pace at which they open shops and waste no time closing underperformers.

How about performance? Net sales for Q3 increased 13.5% to $433.2 million compared with $381.7 million a year ago. These results missed estimates slightly by $13 million. However, we are more than impressed with comparable sales increased which jumped 9.9% versus the prior year and increased by 51.7% compared to the pre-COVID 2019 Q3. This comparison is better than 2020, which was the pandemic year, and 2021, which enjoyed crazy comps over 2020. So 2019 is the most relevant comparable period prior to the COVID-19 pandemic. Physical location comparable sales were up 7.9% while online sales increased 22.0% on a year-over-year basis.

Now, some of the negatives in the form of inflation led to higher cost of sales, mostly on labor and merchandising costs. Gross margin was 34.3% of net sales in Q3, which was down 200 basis points compared with 36.3% of net sales a year ago. Much of this was on lower margins per product. The company ate some costs rather than passing it all on to the consumer. The company did have a benefit from solid logistics operations of approximately 45 basis points, however. To help offset the gross margin issue, the company reduced its operating and selling expenses to 23.9% of net sales, down from 25.2% of net sales.

As a result of the higher top line and relatively decent operating expenses, we thought earnings would be stronger. But depreciation, taxes, and income expense all rose, which weighed. Still net income widened to $25.6 million or $1.94 per share, up from $1.68 per share. However, the per share jump is a result of the company’s shareholder friendly practices, a reason we like the name.

However, we have to point out, that for the year so far, EPS is just $6.71 versus $9.74 a year ago. While it is a dip this year, 2021 is a tough comp. Looking ahead, the company should grow EPS, and we like the shareholder friendly nature of the company.

Shareholder friendly and strong balance sheet

First, the balance sheet is sound. The company has $25.1 million of available cash and cash equivalents on its balance sheet and $51.7 million of debt outstanding, leaving $73.3 million available under its $125.0 million unsecured credit facility. The reason EPS is doing better is ongoing share repurchases. During Q3, the company repurchased 160,637 shares for $9.0 million. The company also paid a quarterly dividend equal to $0.25 per share, and that means the yield is 1.5%, which is not strong, but is a nice bonus. The yield improves as shares fall, which means investors are paid to wait for a bounce as we scale in

Risks

We want shares to fall to balance out the risk profile here. One hidden risk, or at least one that is not obvious, is that the company has an inventory problem. You see, a year ago the supply chain was shot. Companies could not get goods. Now, they can. Companies ordered so much, that there is a supply gut. Inventory is a big issue here. Inventory was $405 million, up 56.4% from a year ago. That is a lot to move. Other risks include the tightening of markets, higher interest rates on debt, higher transportation and shipping costs, and higher labor costs. The company, like others, faces a number of business and economic risks, but the outlook remains positive.

Looking ahead

So where do we go from here? Well, total net sales for the full year are expected to increase in the low-single digit range in dollars compared to fiscal 2022 results. Comparable sales are expected to be in the range of flat to positive low-single digits for the full year. Full-year brick and mortar comparable sales are expected to be in the flat to positive low-single digit range, while online revenue growth is anticipated to be in the positive high-single digit range. That is strong, and combines with expected net new store growth is expected to be in the range of 30 to 40 stores.

The issue is still in margins and costs, and this will take a few quarters to really play out as inventory is moved. As a result of product margin headwinds, higher freight and transportation costs, and the sales mix, gross margin as a percent of net sales will fall about 300 basis points compared to fiscal 2022 results. For the year, gross margin should be around 35.1% to 35.3%, which remains above pre-pandemic levels. EPS should land around $10.00-$10.25 in our estimation based on the inputs we are seeing.

Thus, with our buy points, we will be buying Hibbett, Inc. shares at just over 5.5X FWD EPS. That is strong, especially with preliminary consensus estimates for nearly $11 in EPS next year, which would be 10% growth. The risk-reward balances out. We think you buy Hibbett, Inc. on the pullback.

Be the first to comment