Mrinal Pal/iStock Editorial via Getty Images

Dear readers,

In this article, I’m going to take another look at Hewlett Packard (NYSE:HPE). Since my last article, the company has dropped around 17%, compared to the market down around 12-13%. With valuation back down to when I originally had my “BUY” thesis, I thought it’d be a good time to take another look at the thesis here – because there is a lot to like about HPE.

Revisiting Hewlett Packard

In the last article, I spoke about significant tailwinds to the company. Those tailwinds have continued and continue to this day. This includes the recent set of company results, which we will take a look at in this article and include into our forward calculations.

As I mentioned in my article on the company, HPE is only a small part of Hewlett & Packard. The company was formed as the larger HP company split up, and what came to be within HPE was servers, storage, networking, containerization, consulting & support, and software. The former Hewlett & Packard changed its name to HP Inc and now trades under a different symbol (HPQ). HPQ would retain the personal computers, printing, and stock price history, sticking HPE with its own ticker and its own history.

Since the spit, it spun off software as well as the enterprise services business. Despite these spinoffs, HPE is the 107th largest business by total revenue in all of the US, according to the fortune 500.

So, what remains in HPE are the seven business segments of Compute, High-performance Compute & Mission Critical Systems (“HPC & MCS”), Storage, Advisory and Professional Services (“A&PS”), Intelligent Edge, Financial Services (“FS”), and Corporate Investments. The company earns more than 10% of total revenues from Compute Products, Storage Products, and Computer Services.

And it’s these excellent segments that have continued to deliver good earnings and results for some time. You might be tired of hearing this at this point (as if anyone could get tired of good news), but the consistent order growth and steady margin have continued in the face of the ongoing pressures and risks on the market.

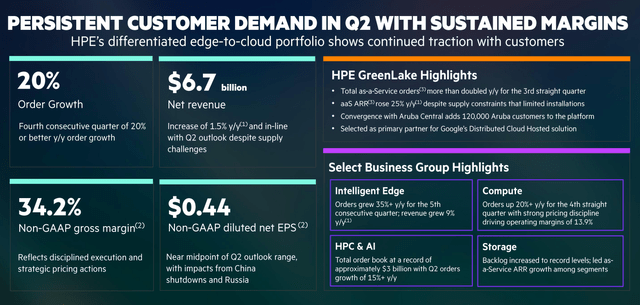

The company delivered solid order growth, increasing its backlog to record levels despite the ongoing pressures. Net revenue continued to grow, ARR continued to grow 25%, gross margins were down only 0.1 pts, and GAAP earnings on a diluted basis were flat. The company returned $214m to shareholders in the form of dividends and share repurchases, bringing the 2022 YTD total to just south of $500M.

I love cash-minting machines that keep delivering returns and cash to shareholders – don’t you? This is one such company.

And the company shows only very modest indication of any of this slowing down in any major/significant way.

The company also reaffirmed its targets for FY21 and onward. Segment performance for the company was positive except in a single segment HPC & AI. Aside from this segment, every single segment saw operating profit increases. The company has a working strategy and targets and is executing on exactly this. The tech slowdown has, as of yet, done nothing to impact the company.

Remember. There’s war in Europe and continued China shutdowns – and despite this, revenue and EPS are maintained. Consider what may happen if this wasn’t the case (in terms of headwinds). At the same time, the company managed through very strategic pricing actions, to drive resilient margins, which have continued to remain almost flat despite massive input-related headwinds and global macro downturns. The operational margins continue to emphasize the company’s focus on growth, and this gives us a significant overall upside.

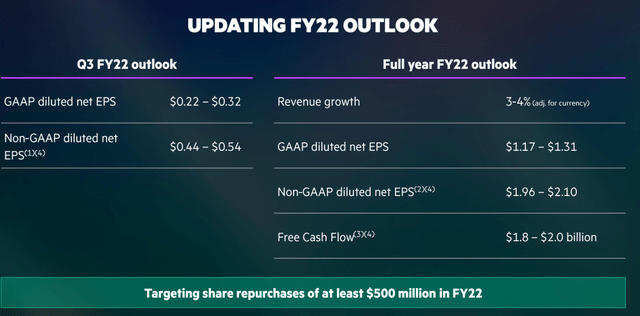

Here’s the outlook for FY22 – a great one.

Note that the company intends to continue pushing for ongoing repurchases of shares.

The company’s diverse portfolio is, as I see it, fully capable of capitalizing on the current global megatrends in cloud data, connectivity, and global storage. Its net revenue hails from computing, AI, Storage, Fintech, and intelligent edge, and the company’s split are close to a 33/33/33 split between NA/EMEA/APJ (more NA, less APJ).

What about fundamentals?

Well, that’s the other good thing. The company has over $2.2B of cash on hand, with less than $2B worth of debt. That gives the company a net cash position of $0.2B, and it’s theoretically debt-free.

On the surface, this all sounds excellent. HPE is BBB-rated, and at a market cap of over $20B, is one of the larger companies in its field. It’s also completely doubtless that the future will offer companies like HPE, if they act correctly, significant potential tailwinds – as we’ve seen the past year or so.

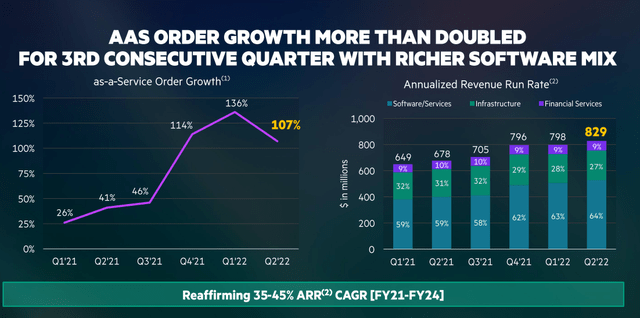

It’s also a clear shift that organizations may no longer want IT as a tailored solution with products on-site, essentially “purchasing” the products and being left to manage it but would rather purchase IT as a service – again, as we’ve seen the growth in the company’s AAS-specific segments.

Overall, the company has delivered superb results once again, expecting to continue to grow earnings during the coming fiscal.

Let’s look at how this impacts the valuation.

HPE – the company’s valuation

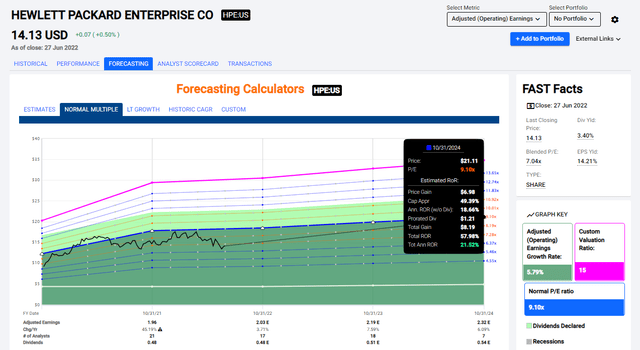

That is the company’s current discounted P/E valuation, based on a 5-year forward average of 9.1X. This company has a consistent history of beating expectations and results. An annual upside of almost 22% or almost 70% in less than 3 years is excellent for a business such as this.

Estimating this company to go higher isn’t something relevant – HPE usually doesn’t go any higher than this. But even at a sub-10X P/E forward valuation, this company delivers solid results and returns. That’s why I’m increasing my stake in HPE at this time.

The yield isn’t market-beating – but at 3.4%+, it doesn’t have to be. The combined capital appreciation upside together with that dividend produces enough returns to satisfy even conservative investors.

If we look at analyst averages, S&P Global gives the company a $13 low and $21 high. That means the current share price is very close to the lower end target of the most conservative analyst here. 20 analysts give the company an average of $17.1, which gives us an analyst average upside of 21%. 10 of the 20 analysts following the company have it at a “BUY” or “outperform” rating at this time.

More interestingly, the company is one of the lowest valued in its peer group. At an NTM P/E of close to 7X, the company is significantly cheaper than Apple (AAPL), Samsung, Dell (DELL), Seagate (STX), and other relevant businesses it can be compared to.

The company is a BBB-rated IT business with deep roots trading at a P/E of 9X or an earnings yield of well over 8%. That’s excellent, no matter what way you slice it. Its limited history means that the company won’t go up to 15X or above here, but we can use the relatively well-established discount average to see where the company might go going forward. HPE has managed a 6-year EPS growth of over 10% and is expected to continue growing at this, 10+% CAGR until 2024 – though this does include a 40% EPS bounce back in 2021, followed by 2 years of meager, single-digit growth.

Still, the upside based on today’s numbers makes for an appealing trend based on a 9.1X 5-year forward P/E average.

The bullish thesis for the company is based on solid foundations and expectations of significant continued outperformance, in line with what’s already been presented over the past few quarters. Company results are expected to grow in line with the current macro, which sees more appeal for things like cloud, data centers, AI, and other segments where HPE is currently active.

The bearish thesis for the company is based on arguing against the growth prospects of the company, pointing to the fact that revenue is actually pretty flat and margins floating around a mark that’s somewhat below its competitors. This is considered “unimpressive” for growth-oriented investors.

However, this conservative nature, yield, and the company’s slow but steady process are exactly what I consider to be attractive for the company. HPE is a net-cash investment-grade business, well above the often unprofitable, growth-oriented alternatives to which it is compared. Revenue may be expected to grow slowly – but the company’s growth sectors and segments are expected to see continued impressive growth in cash flows, which translates to growing earnings of between 3-9% per year.

Based on this and based on just how much the company is being discounted here, I consider HPE a “BUY” with a worthy upside of over 20% annually for the next few years. At any time historically, buying the company at a P/E of 7X has been a good idea. Upsides from this valuation have seen returns over 30% annually, which should be enough to please even the pickiest of investors.

I’m at a “BUY” here.

My thesis for HPE is:

- After a decline, I believe HPE trades at a very attractive overall valuation. My new, improved valuation including the company’s recent outperformance and raised 2022E is now $18.5/share. I retain this valuation target here.

- I consider this company likely to continue to outperform.

- Despite its performance, it’s still below 9X average P/E, which makes it one of the more appealingly valued IT businesses out there at the moment. It’s also one of the very few IT businesses I’ve currently invested in and hold as a “BUY”.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation but hovers within a fair value or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment