Joe Raedle/Getty Images News

Hess Corporation (NYSE:NYSE:HES) is an American global independent energy company, with an almost $40 billion market capitalization. The company’s share price has remained more volatile than most. However, despite that pain, we expect that the company has more growth potential than most making it a valuable long-term investment.

Hess Corporation Earnings

Hess Corporation recently reported incredibly strong earnings for a company that’s in the midst of a transformation. Earnings of almost $3 billion give the company a P/E of roughly 12, strong earnings for a company that’s in the midst of substantial growth. Among the company’s strengths is Guyana production up 40 thousand barrels YoY supporting declining US production.

The company has remained cautious about increasing spending and production too fast. As a result, despite more than $200 million in quarterly U.S. capital production, the company still expects it to take more than 4 years for its U.S. production to recover. Still, thanks to Guyana, we expect production to increase substantially in upcoming years.

Hess Corporation Unique Positioning

Hess Corporation is incredibly well positioned with its impressive portfolio of assets.

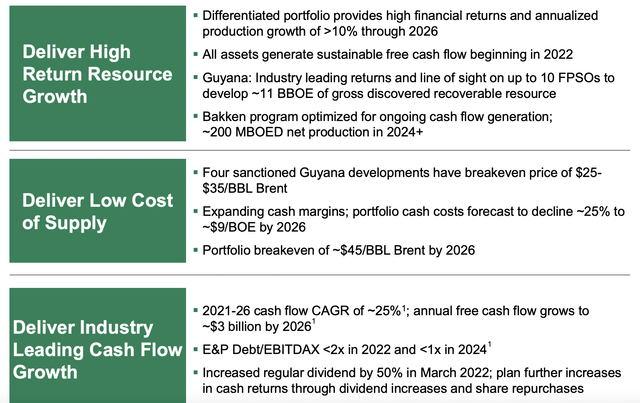

Hess Corporation Investor Presentation

Hess Corporation expects its portfolio to provide it with production growth of >10% annualized through 2026, the fastest growth of any large oil company. The company expects this year to be its first FCF positive year and in Guyana it expects to move towards millions of barrels / day of production for the Guyana assets.

The company has consistently increased its reserves and the asset is now 11 billion barrels, with additional growth potential on the horizon. The company expects cash costs to decline with a $45 / barrel Brent breakeven 2026. The company expects 2026 FCF of $3 billion, which is a roughly 8% FCF yield, that can continue to increase from that level.

Hess Corporation Improving Financials

Hess Corporation has dramatically improved its financial metrics and we expect that to continue.

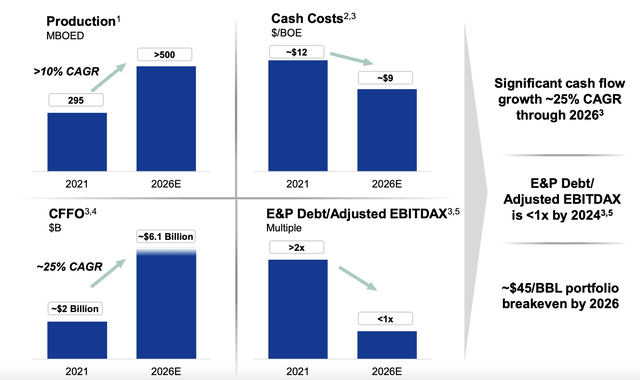

Hess Corporation Investor Presentation

Hess Corporation’s metrics are all expected to improve across the board. The company’s production by 2026 is expected to be more than 500 thousand barrels / day and by the 2030s we expect that to go past 700 thousand barrels / day. The company expects cash costs to drop to a mere $9 / barrel with an overall $45 / barrel breakeven.

The company’s CFFO is expected to be $6.1 billion with a massive $3 billion in FCF, both numbers that we expect to improve. The company’s E&P debt multiple is dropping rapidly with net debt at almost $0 given the company’s $2.2 billion cash position.

Hess Corporation Shareholder Return Potential

Putting all of this together, Hess Corporation has the ability to drive substantial shareholder returns.

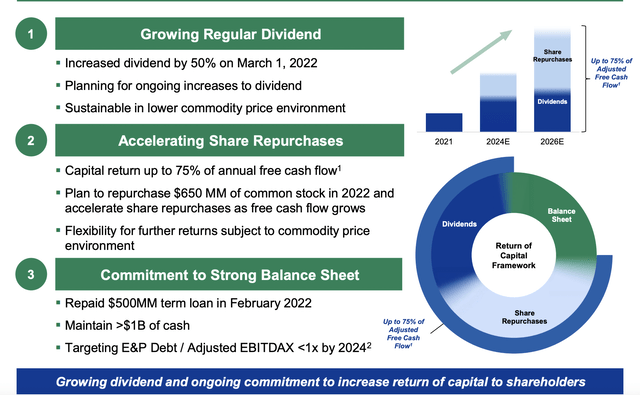

Hess Corporation Investor Presentation

Hess Corporation increased the dividend by 50% on March 1, and the company is planning for ongoing dividend increases. The company plans to return 75% of annual FCF to shareholders indicating high single-digit direct shareholder returns in 2026. The company plans to repurchase 2% of its common stock in 2022, and we would love to see that grow.

Those repurchases could help future shareholder returns to be much stronger. The company is maintaining its cash balance and managing its debt position, which we expect to continue.

Our View

Hess Corporation is one of the fastest growing larger crude oil companies on the market.

The company expects attributable production to hit 500k barrels/day in 2026, up from roughly 300k barrels/day in 2022. That’s expected to enable the company’s costs and pricing to improve significantly. The company is highlighting 2026 as when its growth transformation is complete, however, we expect it to continue long past that time.

Guyana is showing no signs of slowing down. By 2026 production might be 1 million barrels/day, but we can see it have peak production of 2-3 million barrels/day. The company is already buying back shares, and we’d like that to see it increase before the company’s FCF increases too much.

Thesis Risk

The largest risk to our thesis is crude oil prices. Hess Corporation is especially more susceptible to lower oil prices since so much of its future is based on continued growth of its asset base and ramping up its production from assets such as Guyana. Whether that ramp up pans out remains to be seen, however, it is a significant risk.

Conclusion

Hess Corporation has a unique portfolio of assets. The company is focused on rapidly growing its Guyana assets, however, it also has an exciting and well distributed portfolio of assets throughout the world. This portfolio helps highlight the value that the company brings to the table as it’s continuing to lower costs.

The company has a strong dividend that it’s increased recently and we expect to continue increasing. The company has started share buybacks and we expect it to be able to continue increasing those buybacks going forward. All of that together makes Hess Corporation a valuable addition to any investment portfolio.

Be the first to comment