Drew Angerer

Beyond Meat (NASDAQ:NASDAQ:BYND) is the only vegan plant-based meat company I regularly follow because of its brand name, celebrity spokespersons, and tasty products.

It looked like BYND stock was making a massive comeback until the McPlant deal with McDonald’s went south and caused the stock to crash.

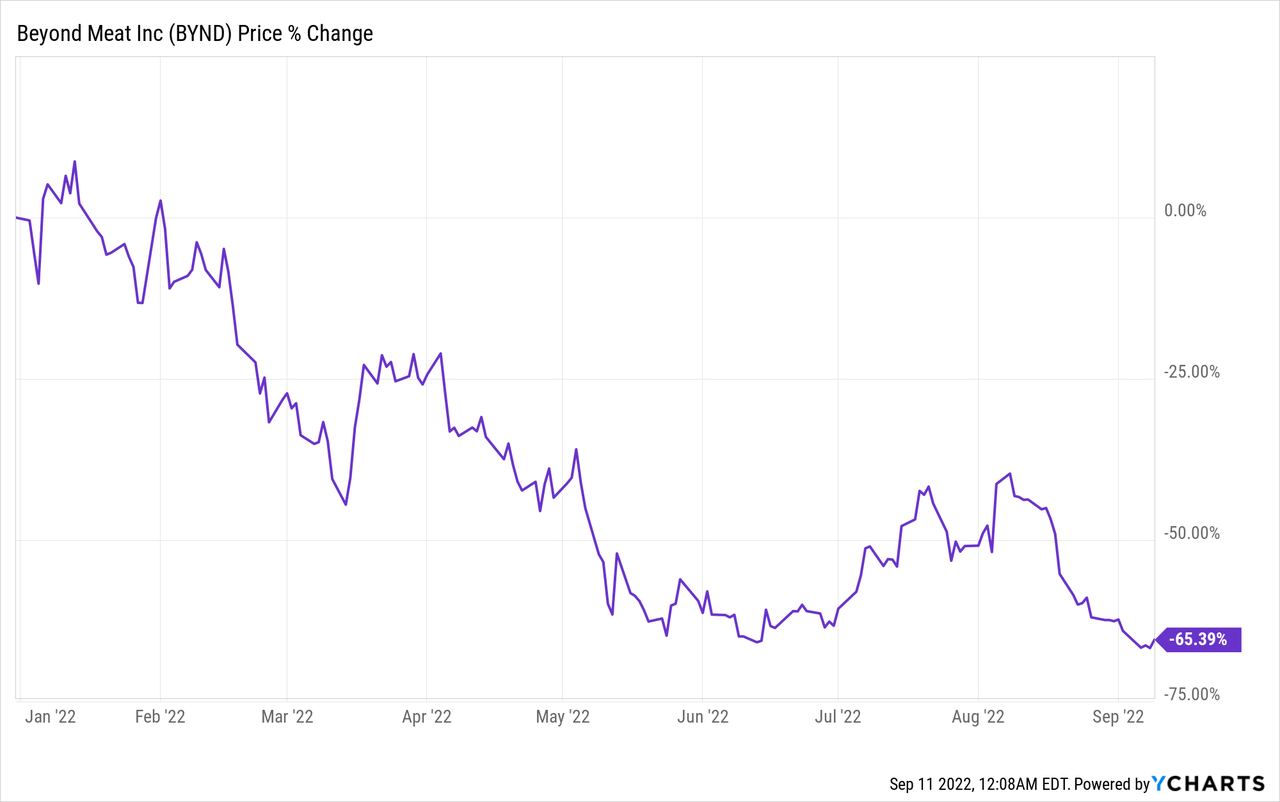

Now, BYND shares trade around $21 down nearly 65% YTD.

Short sellers helped drive down Beyond Meat stock as the company fights to attract more plant-based customers.

In this article, I’ll provide an update on how Beyond Meat is doing so far in 2022 and share why I’m still bullish on the company despite the disappointing McPlant USA trial run.

Beyond Meat Business Update

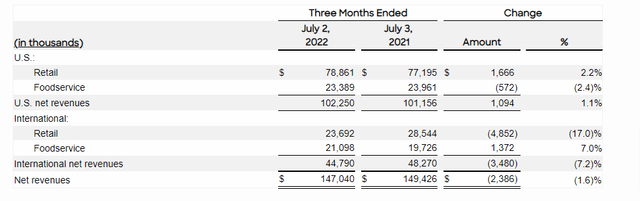

Q2 2022 didn’t go as expected for Beyond Meat. The company hit $147 million in sales (Down 2% YoY) and recorded a net loss of $97.1 million.

Beyond Meat Q2 2022 Results (beyondmeat.com)

Beyond Meat lowered its 2022 outlook to the $470 million to $520 million range, citing inflation and consumer price sensitivity as the main reasons.

Management stated that consumers are choosing cheaper private-label plant-based meats or traditional meat products over the more expensive Beyond Meat product offerings.

The company also cut its workforce by 4% to achieve an annual $8 million in cost savings.

Beyond Meat has $454.7 million in cash on its balance sheet, with $1.1 billion in long-term debt.

Why the McPlant Launched Failed in the USA

The biggest letdown was the failure of the McPlant launch in the United States. Beyond Meat partnered with McDonald’s to sell a plant-based burger in several US locations around the country, but sales were extremely low.

McPlant Burger (mcdonalds.com)

McDonald’s discontinued the McPlant nationwide, and this was one of the reasons why BYND shares took a nosedive last month.

The truth is, McDonald’s failed to produce a proper vegan burger. The McPlant made several key errors:

- McPlant burgers were cooked on the same grill as meat burgers.

- McPlant burgers came with mayonnaise and cheese, which is a no-no for vegans.

- McDonald’s tried to convert meat eaters instead of catering to vegans.

It’s no surprise that McDonald’s dropped the ball on the US McPlant launch, but hopefully, Beyond Meat will address these issues in future McDonald’s partnerships.

According to Truly Experiences, around 6% of Americans are vegan and McDonald’s must launch a 100% vegan burger instead of worrying about meat eaters.

The goal is to let meat eaters choose veganism on their own terms. Do not try to convert them because they will remain vegan once they try it and notice the health benefits.

Future Partnerships Pipeline

While the McPlant was an epic failure in the United States, Beyond Meat has partnered with Panda Express to bring back plant-based Orange Chicken nationwide in the United States until November 30th (or while supplies last).

Beyond Meat Panda Express Orange Chicken (beyondmeat.com)

The company also has a deal with Taco Bell to sell plant-based meat by the end of the year.

My Bullish Take On BYND

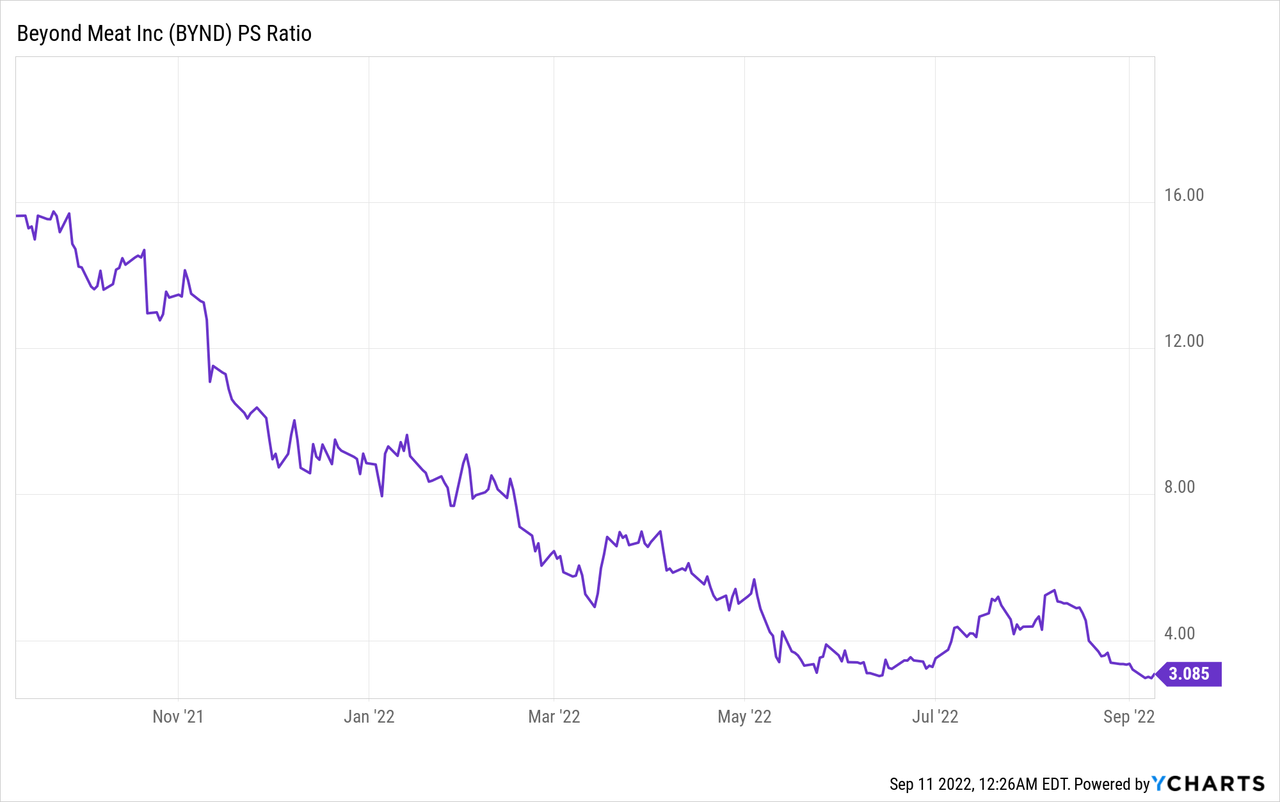

BYND shares trade at a $1.44 billion market cap at a Price to Sales ratio of 3. This is the lowest BYND valuation I’ve seen in a while.

Short sellers are the major reason why BYND has a super high 34% short interest, making it one of the most shorted stocks on Wall Street.

But I don’t believe there is any reason to panic right now. Capital expenditures are around $21 million per quarter, and the company has done a good job of managing costs during a tough period.

Negative free cash flow of $543 million TTM can be mitigated through issuing more debt or a stock offering.

Once inflation eases, I believe consumers will help lift Beyond Meat to record annual revenue in 2023 and help take pressure off the company’s balance sheet.

Beyond Meat Annual Revenue by Year

| Year | Revenue |

| 2022 | $265 million (as of Q2 2022) |

| 2021 | $465 million |

| 2020 | $407 million |

| 2019 | $298 million |

| 2018 | $88 million |

| 2017 | $33 million |

| 2016 | $16 million |

Food stocks can perform quite well over the long run because everybody must eat. So it’s all about Beyond Meat scaling revenue, becoming profitable, and perhaps paying a dividend in the future.

Risk Factors

BYND isn’t the safest stock to own right now, but you must buy the fear if you want to make outsized gains in the market.

- The McPlant trial in the USA failed miserably and Beyond Meat must deal with potential failed partnerships in the future, which would directly affect BYND stock prices once the bad news is released.

- The company continues to burn through cash and I don’t see plant-based diets becoming more popular at least for another few years.

- Cheaper private label plant-based meats are taking away from the more expensive Beyond Meat offerings, but the company must find a way to compete with cheaper brands.

- Taco Bell is developing its own plant-based meat, and other restaurants may drop Beyond Meat’s products in favor of its own plant-based meat products.

It could take much longer than expected for Beyond Meat to start scaling up revenue, so patience is key here.

Conclusion

I’m a flex Vegan that enjoys Beyond Meat’s products, even though they are the most expensive in restaurants and the grocery store.

Losing the USA McPlant deal was a huge blow to BYND stock, but there will be more restaurant deals in the future most likely.

If you held BYND stock this long, then realize lower CPI inflation will help lift heavily shorted stocks in the short run.

If inflation is under control, then consumers will start buying more expensive Beyond Meat products again because Beyond products taste better than the competition in my opinion.

BYND is a long-term play and now could be the time to buy while others are fearful.

Be the first to comment