Sundry Photography

With the impact of the pandemic winding down in the United States this year, one company that has seen a great recovery is vehicle rental giant Hertz (NASDAQ:HTZ). While overall revenues aren’t yet back to where they were back in 2019, the current street average estimate calls for 66% top line growth over the company’s 2020’s revenue bottom. Unfortunately for investors, there are a number of potential dark clouds on the horizon that could send shares to new lows in the coming months.

Perhaps the biggest problem in the short term could be what’s happening with online vehicle retailer Carvana (CVNA). Shares of Carvana were down about 40% on Wednesday after Wedbush detailed the increasing possibility of bankruptcy. Back in early November, I detailed how Carvana’s financial situation just continued to worsen, and shares have now lost about 99% from their all-time high.

The issue for Hertz here is that, a little over a year ago, the company partnered with Carvana to expand its distribution channel for used vehicles. This would allow Hertz to offload its used vehicle inventory to Carvana, with the news coming just after Hertz had announced a deal to purchase 100,000 vehicles from electric vehicle giant Tesla (TSLA). That initial news was for the Tesla Model 3, but earlier this year, Hertz boosted its offering by adding the Model Y for rentals.

One of the key items of business for Hertz is to dispose of vehicles at a certain point. Losing Carvana as a customer would obviously be a negative, especially at a time where used vehicle prices are dropping quite considerably. The November update from Manheim came out on Wednesday, with the closely watched used vehicle value index showing a 14.2% drop from a year ago. The use car price bubble was one of the items that played a big role in soaring inflation, which the Federal Reserve is now fighting. Carvana is currently selling over 400,000 vehicles a year, but it has to acquire them first, so it would be interesting to see what happens to the used vehicle market if Carvana suddenly goes away.

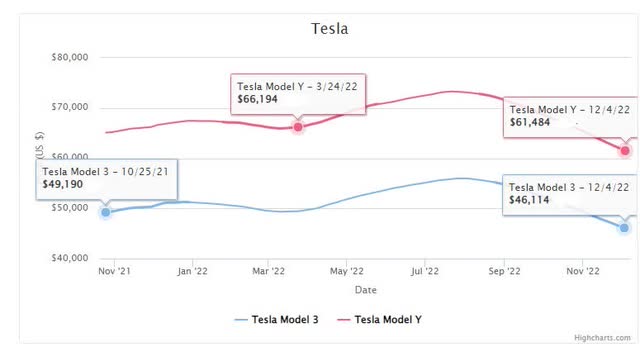

In recent months, used Tesla vehicle prices have fallen even faster than the overall market. According to CarGurus, used Model 3s are down 15.54% in the past 3 months, while the Model Y is down 13.58%. Both drops are significantly above the overall CarGurus index that is down 5.20%. For those curious, the graphic below shows how used vehicle prices of these two Tesla model lines have trended since the original Hertz deal in 2021 and the Model Y update from earlier this year linked above.

Used Tesla Vehicle Values (CarGurus)

At the moment, there are growing fears of a recession in the US. Obviously, that’s not good for discretionary consumer spending, and that’s the category Hertz gets lumped in to. While revenues are expected to rise another couple of percent next year, analysts currently see earnings per share dropping by 38%. With Hertz having bought up a lot of vehicles over the past year, we could see utilization rates dip a bit and that will pressure margins. The prices the company charges for rentals may also drop if demand weakens materially.

Another issue for Hertz currently is rising interest rates. One analyst recently discussed this issue when detailing a Neutral rating on the stock. Hertz finished Q3 with just $1 billion in unrestricted cash, but over $13 billion in vehicle debt. With a portion of these borrowings being variable rate, that adds to interest expenses by the quarter now, and refinancing maturing debts will be more costly in the future as well.

It will be interesting to see if the company borrows more funds next year given all these puts and takes. On one hand, they likely won’t be buying as many vehicles in a poor economy, but vehicle disposal proceeds will be impacted by the decline in used car pricing. Hertz is also buying back stock at the moment, which doesn’t seem like a great strategy with the way the balance sheet currently looks. In recent years, operating cash flow has not been enough to cover net vehicle capital expenditures, which is the cost of buying revenue earning vehicles minus proceeds from the sale of vehicles.

When looking at Hertz shares, the average price target on the street currently is $25.17, implying more than 50% upside from current levels. Given the economic uncertainty we have in front of us, plus rising interest rates, I just don’t see that valuation being warranted. A year ago today, the stock was trading at just under 6 times what the company ended up reporting for 2021 adjusted earnings per share. If we apply that valuation to next year’s current street average estimate, that implies a twelve-month target of $13.65 per share, or about 16% downside from Wednesday’s close.

In the end, it wouldn’t surprise me to see new lows in shares of Hertz moving forward. The company could be in a tough spot if Carvana goes bankrupt, as it would eliminate a partner that Hertz is using to sell its older vehicles. With used vehicle prices dropping right now, especially in regard to Tesla as Hertz makes a big electric vehicle push, the company may need to raise more debt in the next year if disposition proceeds fall short of expectations. Given the rise in interest rates with a large debt pile that’s partially based on variable rate borrowings, interest costs could jump. Analysts seem very positive on the name, but a consumer-focused company like this usually doesn’t fare well in a recession. Should the US economy struggle in 2023 as many are expecting, Hertz is not a name that investors should be buying right here.

Be the first to comment