LewisTsePuiLung

Today, Hermès International Société en commandite par actions (OTCPK:HESAF, [ [HESAY]]) just released its three months sales update. As customary, Hermès is the first luxury house to report in the Q3 earnings season and there is no disclosure on margins. The next catalyst with the full report will be presented on the 17th of February.

Starting with the positive words of Hermès’ CEO:

the strong performance in the third quarter reflects the desirability of our collections all around the world and the relevance of our values. Our success lies in that of our teams, whom I would like to sincerely thank“.

During the third quarter, Hermès’ top-line sales achieved €3.13 billion and were up at the current FX and at constant FX by 32.5% and 24%, respectively. Numbers in hand, this positive development reflects an important acceleration compared to the first half-year results but is in line with the company’s Q1 release. This outcome was positively influenced by two factors: 1) EU travel rebound especially in Italy and France (as expected in many of Mare Evidence Lab’s publications) and 2) China’s recovery thanks to lower COVID-19 restrictions in the quarter. Looking at the nine months aggregate, the luxury French saddler increased its turnover by 30% at current FX to reach €8.6 billion. All Hermès divisions reported impressive momentum with exceptional growth in the Watches, Ready-to-Wear and Accessories, and Silk and Textiles business lines. At the geographical level, there was no single region to report a single-digit growth in sales. In detail, the strongest turnover was delivered by the Americas and Europe including France, supported by local demand and also by tourism recovery. Due to the ongoing economic challenges, Hermès group once again increased by an additional €100 its employee’s gross monthly salary starting from July. It is not the first company that supports its workforce; however, we positively welcome this development.

Conclusion and Valuation

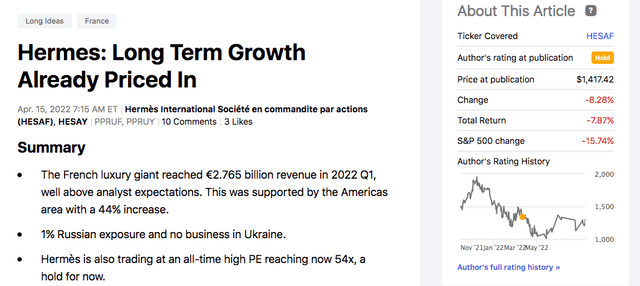

It is worth mentioning that the luxury saddler was positively influenced by the euro weakness, and the company voluntarily disclose a positive effect of €451 million on the revenue line. We should also include that Hermès’ buyback plan is ongoing and the company repurchased its stocks for a total amount of €116 million. As already happened in the half-year results and given the ongoing macroeconomic challenges, the company’s outlook is set only for the medium-long term horizon, which was confirmed again. EU stock markets and Paris Stock Exchange are hovering around equilibrium (after a two-session of rising in a row), there are also tensions in the bond market with inflationary pressure and central bank debate, Hermès is gaining 1.65%. It is not coming as a surprise after these outstanding results. Regarding the company’s rating, we decide to remain neutral. Despite the impressive numbers, Hermès’ long-term growth is already priced in and is exceeding its luxury comps’ multiple by more than 100% on both EV/EBITDA and P/E.

Be the first to comment