author/iStock via Getty Images

I have a complicated relationship with Heritage Global (NASDAQ:HGBL). I am bullish about their near-term business prospects but extremely at odds with their corporate governance, particularly executive compensation, a topic I addressed at length here. In short, I see explosive earnings growth this year that will send the share price up more than 100%. Nonetheless, it’s the nature of their business model to be lumpy, and their SG&A expense is not at all designed to ebb and flow with revenue. Business results could be much better and indeed much more consistent if their executive compensation practices were better matched with performance. Taken together, it would be fair to classify HGBL as the proverbial cigar butt: worth one good puff. My intent with today’s article is to get into the particulars about these matters and what my action plan is.

The Rose

Back in December of 2018, HGBL announced that in partnership with four other entities, they were purchasing a 110-acre pharmaceutical campus in Huntsville, Alabama, that is home to three large buildings and two empty plots. HGBL’s share in the joint venture is 25%. The first of those warehouses sold in 2020 wherein $2.3 million was recorded as net profit to HGBL. That sale alone gave them 41% of their EPS in the quarter and almost 22% of their EPS for the full year.

Fast forward to the most recent conference call. An analyst asked in the Q&A session about how things were proceeding related to the sale of the remaining two buildings in Huntsville. Here is the conversation:

Walter Bellinger, Mayflower Capital

Just a quick question for me. How is it going with your Huntsville disposition?

Ross Dove

So I guess the first word to say is well. So we’re at the point now where we sold all of the capital assets, all the machinery and equipment in all of the buildings, we’ve monetized 1 of the 3 buildings, and the good news is we’ve done all of the capital requirements on the other 2 buildings to get them prepared for sale. So there is no more capital expenditures whatsoever other than the minimal operating costs and holding costs. And we’re very positive — feeling very positive that they will be monetized in the near term. I’m not going to put a date on it for you but I will say as the CEO of the company, I’m bullish that we’re going to monetize them at a profitable price in the near versus the long term.

It’s each man for themselves in determining what “in the near versus long term” means, but I would interpret that to mean sometime this calendar year. If that is the case, HGBL would make A LOT of money this year. The building sold in 2020 went for $15,538,000. I looked up what they are asking for on the other two buildings and one says “Subject to Proposal”. The other has a price tag of $15,750,000, just barely more expensive than the one already sold. However, after calling the point of contact on the sales brochure, I learned that this building is currently under contract, to close in the next 60 days fetching $16.5 million! Taking an identical margin as the previous property, HGBL will net $2,442,000 on it, most likely in the second quarter. With current diluted shares outstanding, it will be 6.6 cents worth of EPS. For context, HGBL had only $0.08 in EPS for ALL of 2021.

The third and final building has no firm asking price. It is smaller than the other two, at 75% of the size. Using size as a VERY rough proxy (each building has substantially different innards), HGBL could be making in the ballpark of $0.05 in EPS on that deal. That being said, this third building might fetch a comparable or even higher price. Whereas the other building appears to be a warehouse with lots of empty space for maneuvering forklifts and a lot of shelving, the third building is a manufacturing facility with lots of expensive equipment inside. All of this is relevant information, but ultimately speculative.

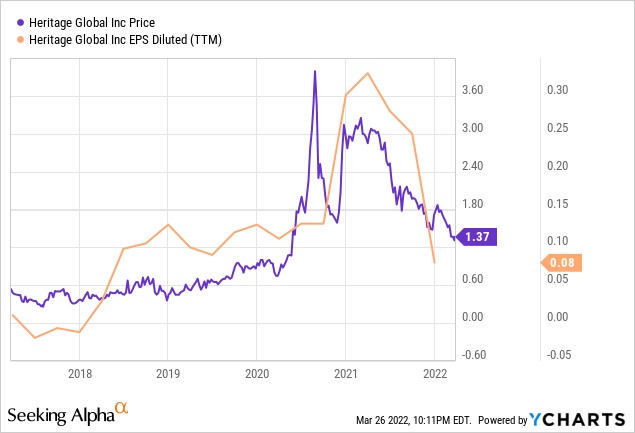

Again, this information is not gospel truth. What HGBL is going to actually record and when they will recognize transactions and the like is not determinable. This information represents best effort sleuthing by me, and should not be considered perfect. The point is that the likelihood is good that HGBL is set up this year to have a year like 2020, with substantial EPS. Look what happened in the lead up to the developments that occurred in the back half of 2020 when they had their gangbuster year:

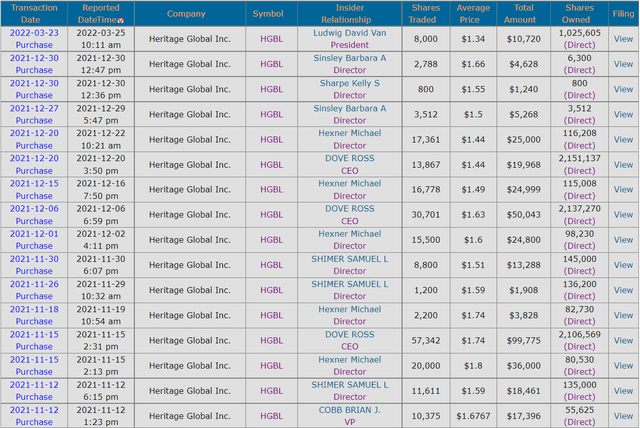

I anticipate a similar surge will occur this year. Apparently, so do insiders. There has been significant insider buying lately:

The Thorns

Executives at HGBL are compensated generously, and it is having a pronounced effect on business results. For the full-year 2021, executive compensation expense BEFORE stock-based compensation was almost 3.5X higher than what they had in net income! This is staggering. EPS for 2021 was $0.08, but executive compensation expressed on a per share basis was $0.28. The question deserves to be asked regarding what is left over for shareholders.

Again, I go into all this in great detail in my previous article on HGBL. The biggest problem is that these compensation excesses are holding back the company in big ways, soaking up monies that could otherwise be reinvested back into the business. This is especially important in light of the fact that HGBL is becoming an increasingly capital intense business. They have a stated goal of pursuing more opportunities where-in they act as principal instead of agent in some of their auctions, which supposedly comes at a higher margin. Acting as principal means that instead of being the entity that lines up buyers and sellers and collecting a fee from the arrangement, they invest their own money in the underlying assets and therefore become the seller. This allows them to collect on the spread between the buy and sell price.

Furthermore, HGBL has a business line that lends money to buyers of charged-off loan portfolios. Obviously, in order to lend money, you have to have money. The more money they have, the more of these loans they can make, and the more they can invest in infrastructure (human, electronic, etc.) that will support the increased business load. This point is particularly relevant since management has frequently cited in conference calls, the tremendous opportunity they see soon coming into the marketplace regarding all things distressed financials assets:

On the financial side, we’re a broker of charge-offs, and we’re a lender to the buyers. That business has not grown in the last 18 months because of very simple factors. There’s been massive stimulus checks that have impacted the amount of volume tied to the fact that consumer spending has hit all-time lows. What do we see going forward? We see that people are now starting to travel. We see that people are now starting to spend money. We see that there looks like the appearance of growth in consumer spending. If there’s growth in consumer spending, both our borrowers can buy more products so we can lend more and our sellers will have more volume to give us. We can’t tell you what’s going to happen next week or next month, but we can tell you that all signs point the growth over the next 24 to 36 months. We’ve seen an increase already. We have an increase in product and Buy Now Pay Later coming on board in December and January. We have an increase in fintech peer-to-peer loans, and we have a solid belief that we’re on a track forward in financial assets.

If all of this becomes true, the more money they have, the more they can participate in this environment. The more capital they have been soaked up in executive compensation, the less they will be able to make loans to borrowers and act as principal in the selling volume.

The issue is structural and is coded in the proxy statement. How HGBL determines what cash bonuses to give to executives is unlike anything else I have seen in all my research spanning dozens of companies across market caps, sectors, and industries. In essence, each executive gets a percent cut of any and all operating income generated by their division and the company at large.

For starters, once a net operating income target is reached (they fail to disclose what that target is), 5% of net operating income gets put into a pool to be split among the executive management group. Then more gets taken off for particular divisions.

For the largest division, their industrial auction division, the first $50,000 of operating income generated goes to the president of that division, Nick Dove, who is the CEO’s nephew. Then, 10% of anything above $50,000 is also awarded to him as a bonus.

The most egregious arrangement in place is for David Ludwig, president of their financial assets division, National Loan Exchange. His bonus (to be shared among other key employees, the proportion thereof to be determined by Mr. Ludwig) is calculated as being….

….. 30% of Net Operating Income in the aggregate for cash incentive awards. Also pursuant to the Addendum, for each calendar year, NLEX will allocate 20% of its Principal Net Operating Income for cash incentive awards.

Unsurprisingly, David Ludwig is by far the highest-paid executive at HGBL.

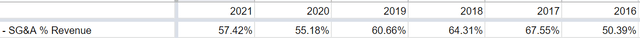

The problem with these arrangements is that HGBL can NEVER achieve operating leverage beyond a certain point because a percent will ALWAYS come off the top and have a proportional effect on margins. As a percent of revenue, SG&A expense has always been above 50% since 2016 and often above 60%:

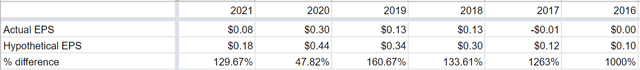

To put things in perspective, if for the years 2016-2021 the top four executives at HGBL each made $300,000 flat and then EVERY other employee at HGBL made $100,000 flat, HGBL would have saved millions every year such that EPS would have often been several times higher than it was:

Those earnings would have been retained and instead of having a 2021 ending cash balance of ~$13.5 million, they would be sitting now on a mountain of cash totaling ~$40 million! That is $1.09 per share in CASH. I am fairly confident that the shares would not be trading at $1.38 right now if they had $1.09 per share in cash. Better yet, I am positive that shares wouldn’t be trading at $1.38 a share right now if they had taken those hypothetical retained earnings and reinvested them back into the business, paid a dividend, or opportunistically bought back shares. Even absent these shareholder-friendly moves, at the very least, there would have been no need to issue 5 million shares at the end of 2020 to raise capital, a move that diluted existing shares by 16%. It’s not as if the pay structure I suggested above is disastrous. For a company of their size, top execs making $300,000 each and everyone else making $100,000 each is extremely generous. I don’t know about you, but I would love to have a six-figure salary.

Accountability

Apart from being poor capital allocators, I believe management is highly disingenuous. They talk a fine talk, but their actions speak louder than words. See, I have approached management about these issues repeatedly. They responded with things like:

…. it’s fair for Mackie or any shareholder to question compensation. My job is to…. be responsible and accountable to critics.

We want you to be assured that the entire Board takes compensation matters seriously for both executive leadership and management generally.

Then they told me that our discussion was over and that I can wait for the proxy to come out to see if they are making any constructive changes.

Fast forward to the most recent conference call where they said:

We’re responsible and we’re accountable and you should hold us responsible and accountable to perform.

But here is the kicker. I got in the queue to ask a question during that very conference call. My place in the queue was confirmed. But they didn’t put me through. And it wasn’t for lack of time. They answered only two questions from other analysts and the whole call lasted 17 minutes. Granted, it could have been a technical difficulty.

I then emailed them. The CEO gave me a very brief response telling me to email the CFO. I did so, but got no answer. It has been nine days. I have taken them up on their offer of holding them accountable, and I find them lacking.

Cloudy Crystal Ball

One of the biggest things that management has underscored as bullish and a strong upcoming tailwind is the opportunity to monetize charged-off loan portfolios that they anticipated would soon hit the marketplace. This would hypothetically allow them to broker more of those assets, act as principal, and originate more loans to buyers of those distressed assets. From the March 2021 conference call:

We are optimistic about our prospects in our financial assets division. Over the course of the calendar year (2021), we expect to see an increase in the release of non-performing loans into the marketplace. The National Loan Exchange, or NLEX as we’ve referred to it, is poised to benefit from the increased activity.

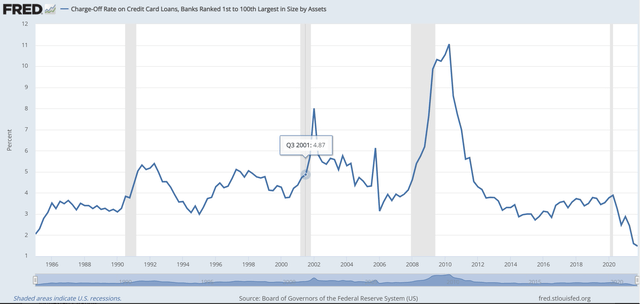

The problem is that they started making this prediction at least as early as September of 2020. When things weren’t materializing, they blamed it on all the relief packages sent out by the government. Now that relief packages have ended, is the opportunity at the door? Perhaps, but it’s nothing to put money on. Certainly not in light of the fact that the charge-off rate for credit card loans is at ALL-TIME lows:

COVID relief packages served their purpose. They kept people financially afloat during tumultuous times. But the relief offered is dovetailing into a strong economic environment where both employment rates and wage rates are showing a lot of strength.

In spite of increased consumer spending generally and activity specifically in buy-now-pay-later arrangements, and in spite of the cessation of financial relief packages and programs, it may well be that people don’t struggle to pay when later comes. I am not saying it won’t. But I have not found convincing data that it will.

Conclusion

I had a phone call once with Ross Dove, CEO of Heritage Global, before I ended up on their bad side. I asked him about the possibility of a share buyback since shares were trading at the time below the price they issued shares for a year prior. Seemed like a darn good deal to me in the absence of other productive uses of cash. He told me that they wouldn’t do that because he was optimistic about their future business opportunities. He also mentioned that only if the share price doesn’t respond to positive financial results in a positive way would they consider buying back shares. Well, I believe this is the year where we get to see if he is right about their business prospects and where therefore the share price might head. Watch for three things: 1) Are they able to effectively monetize the two remaining Huntsville buildings? 2) Does anything show up in the proxy showing that they have improved their executive compensation scheme and 3) do more charged-off products hit the marketplace and are they able to monetize them? For me, if all three don’t happen, I am done with HGBL. Item one is as close to certain as can be, at least for one building. Item two has a low likelihood of coming about based on how management has responded to me. And three is a toss-up. Fortunately, even if only number one comes true, that should be enough to send the shares up. One last puff. For those who have not yet established a position in HGBL, now is a great entry point. Shares are at multi-year lows. The likelihood of double-digit gains in mere months is quite good. Get in now, make money, then get out.

Be the first to comment