MJ_Prototype

We love railroad investments for several reasons, for example, a single train helps keep more than 300 trucks off of public roads, making them safer. An transporting cargo on trains is ~4x more fuel-efficient compared to doing so by trucks. This also results in ~75% less greenhouse gas emissions. On the financial side, railroads tend to have strong competitive advantages that allow them to raise prices often, and earn very decent returns on capital. Of course, they are not the perfect investment, railroads also have drawbacks such as high capital expenditure needs, and limited growth potential. Bought at the right price, however, railroads can be a very solid investment. Today we’ll analyze Canadian Pacific (NYSE:NYSE:CP), one of our favorite railroads, but one that at the moment we find overvalued.

Competitive Advantages

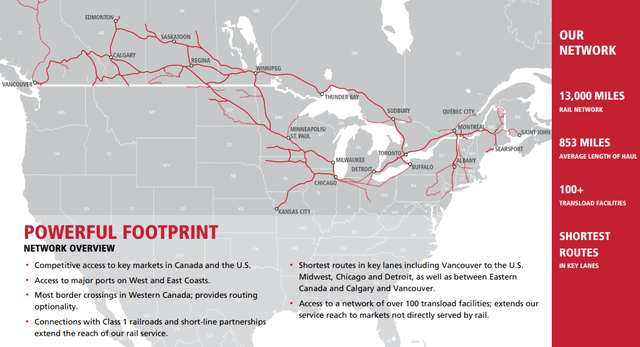

Canadian Pacific’s moat rests on its massive 13,000 miles rail network, which offers competitive access to key markets in Canada and the US. It also has access to major ports on the West and East Coasts, and has some of the shortest routes in key lanes.

Canadian Pacific Investor Presentation

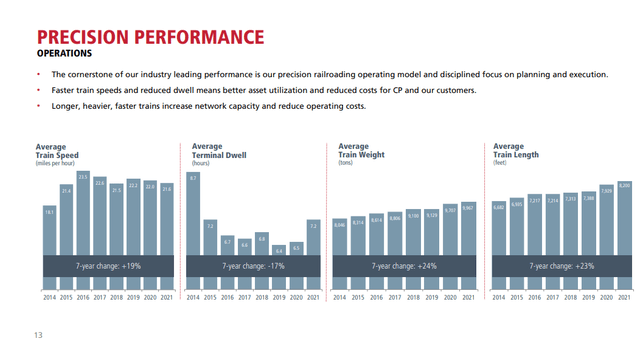

Strengthening the moat is the company’s culture of high performance and continuous improvement, enabling the network to process increasing amounts of cargo.

Canadian Pacific Investor Presentation

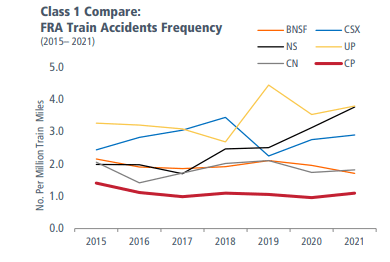

We are particularly impressed by their safety performance, which is much better compared to competitors including Berkshire Hathaway’s (BRK.A) BNSF, CSX Corporation (CSX), Norfolk Southern Corporation (NSC), Union Pacific (UNP), and the Canadian National Railway Company (CNI).

Canadian Pacific Investor Presentation

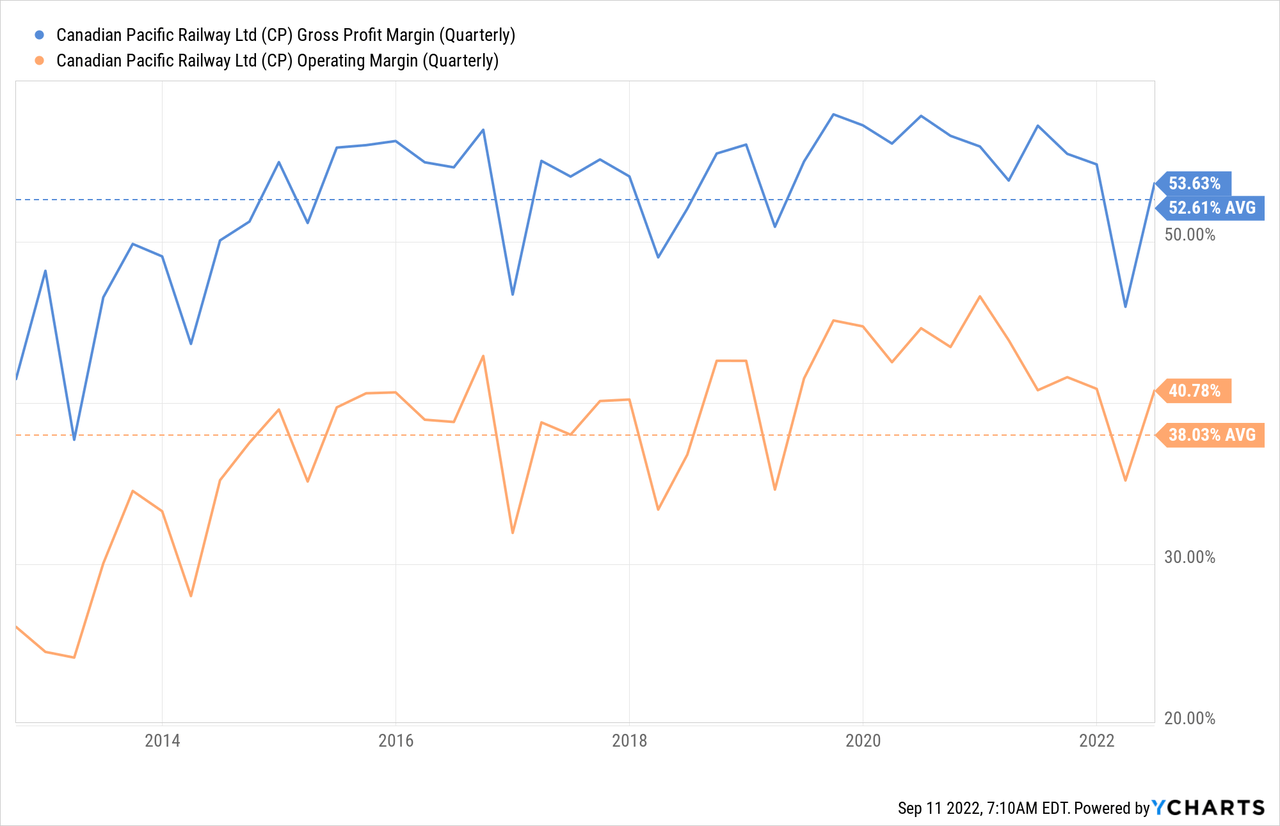

Financials

These competitive advantages are reflected in above average profit margins. Particularly impressive is the fact that over the last ten years Canadian Pacific has averaged close to a 40% operating margin. There are few companies in the world that have such a high operating margin.

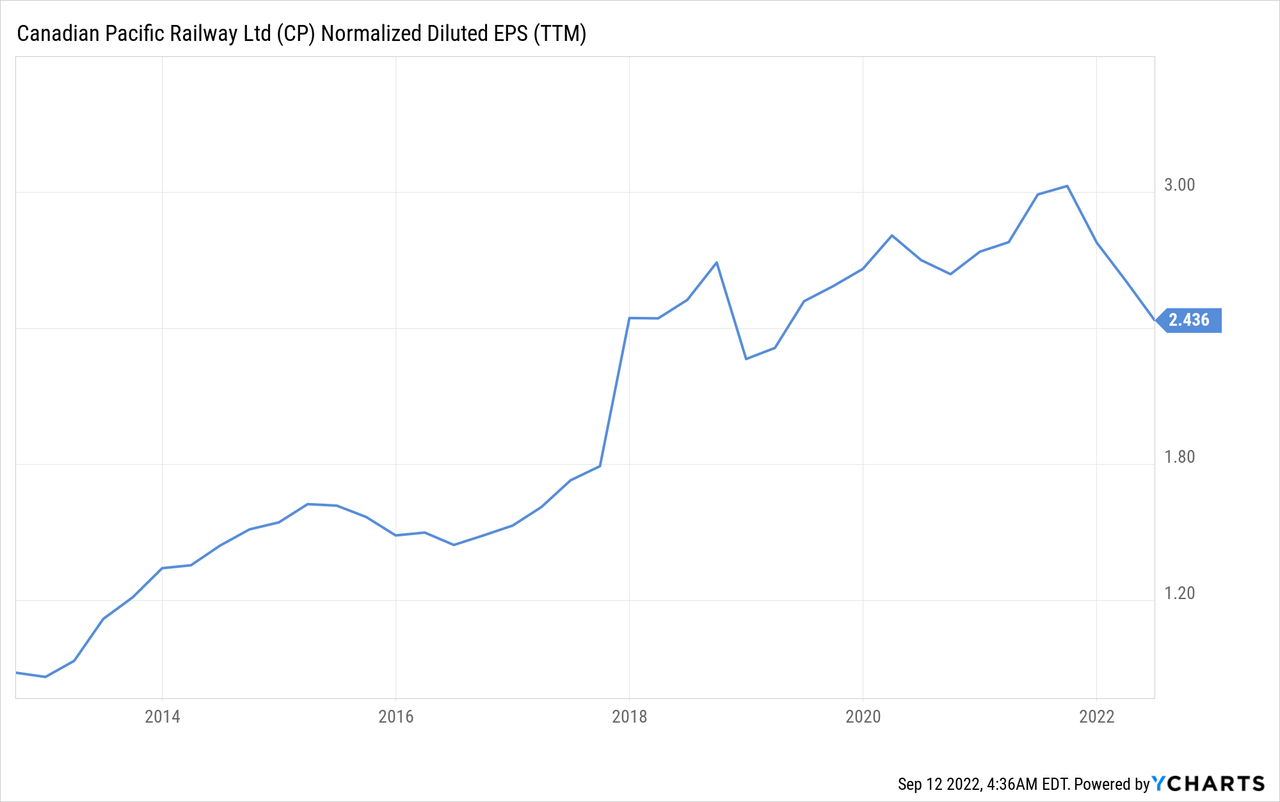

Buying back shares has been an important source of returns for investors over the last decade, and that explains why adjusted diluted earnings per share have increased much more meaningfully than other metrics like EBITDA and Net Income. As seen below, the trailing twelve months diluted earnings per share have more than doubled in the last ten years, and currently stand at $2.4 per share.

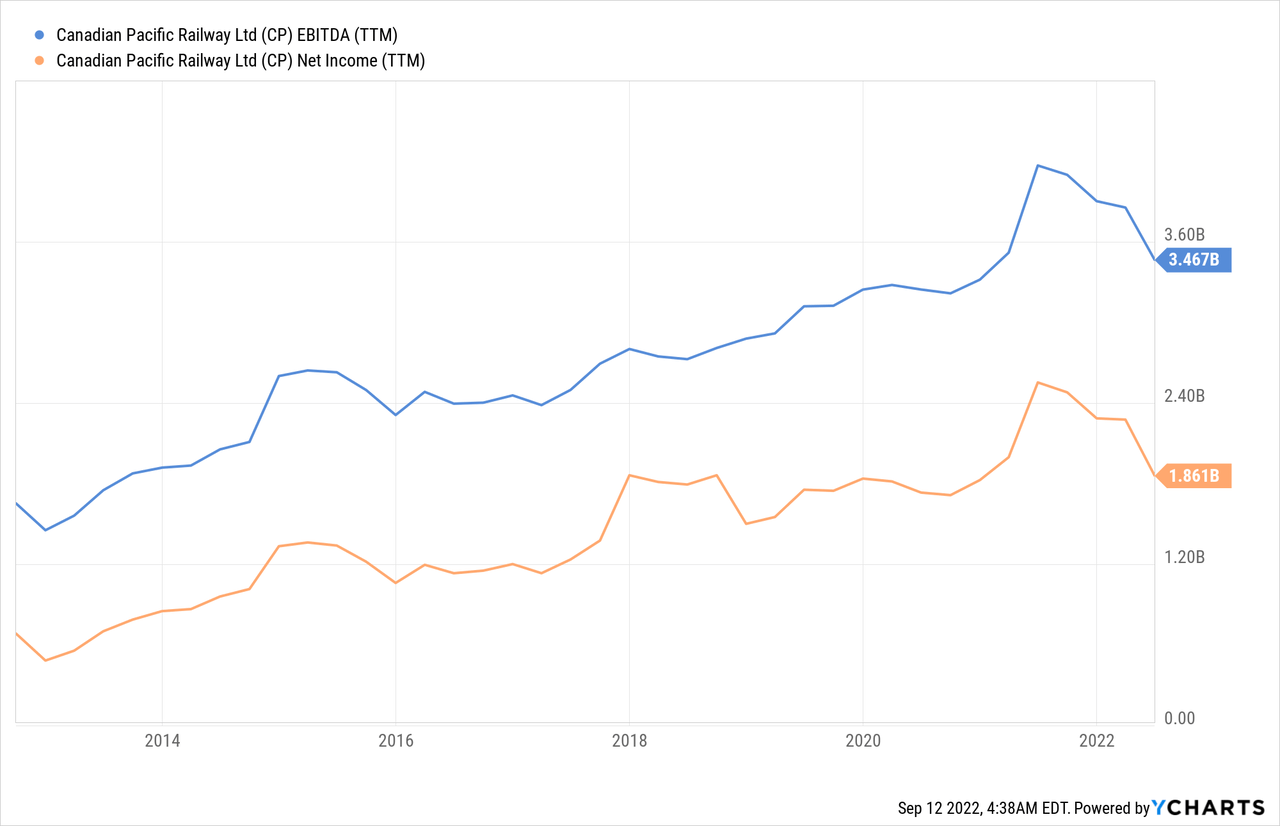

Below we can see the absolute EBITDA and Net Income the company has generated on a trailing twelve months basis. To put them into context, Canadian Pacific currently sports a market cap of ~$73 billion, and an Enterprise Value of ~$88 billion.

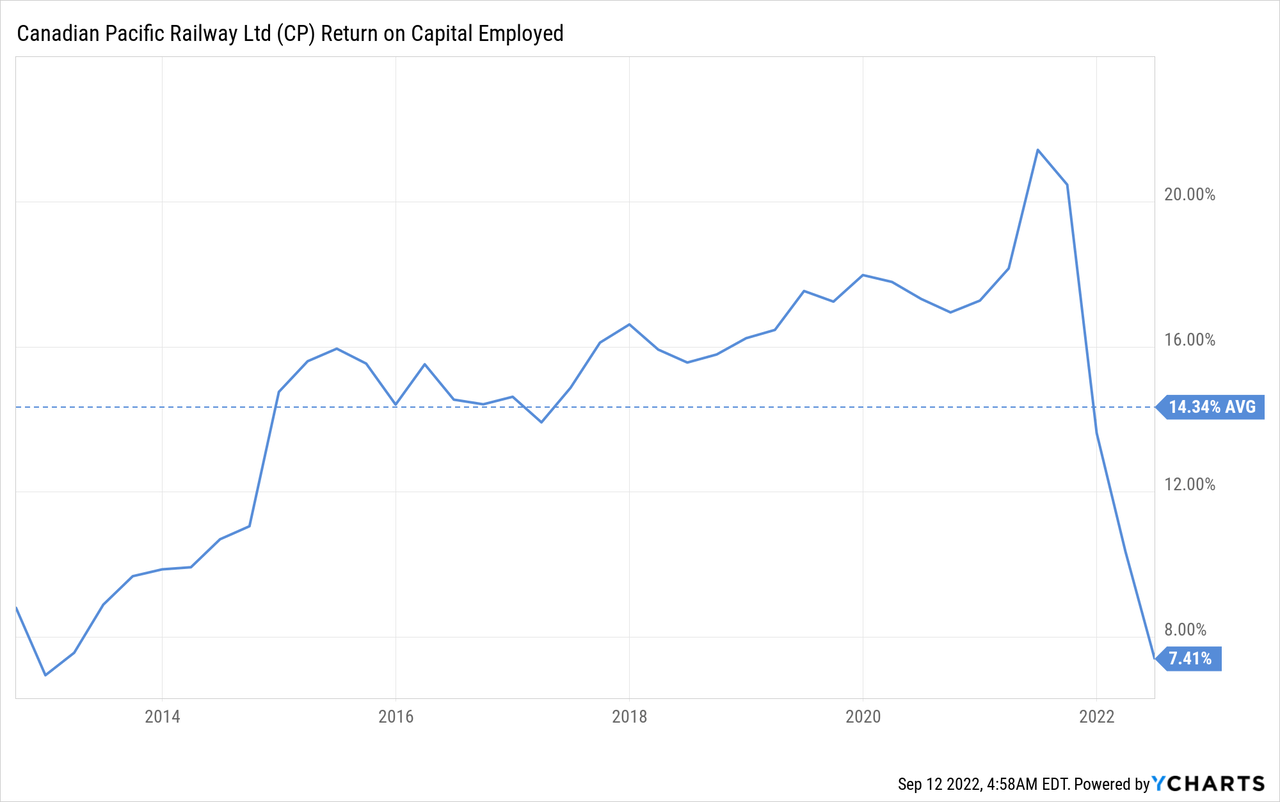

In general we would say that Canadian Pacific is a high quality business, not only because of its high profit margins, but also thanks to its high returns on capital. The business has been delivering high teens returns on capital employed the last few years, and has averaged 14% over the last decade. The current dip in the ROCE is due to the company taking on a lot of debt in preparation for the KCS acquisition closing, and since KCS is still not contributing to the company’s earnings, hence the dip. We therefore expect ROCE to bounce back after the acquisition closes.

Growth

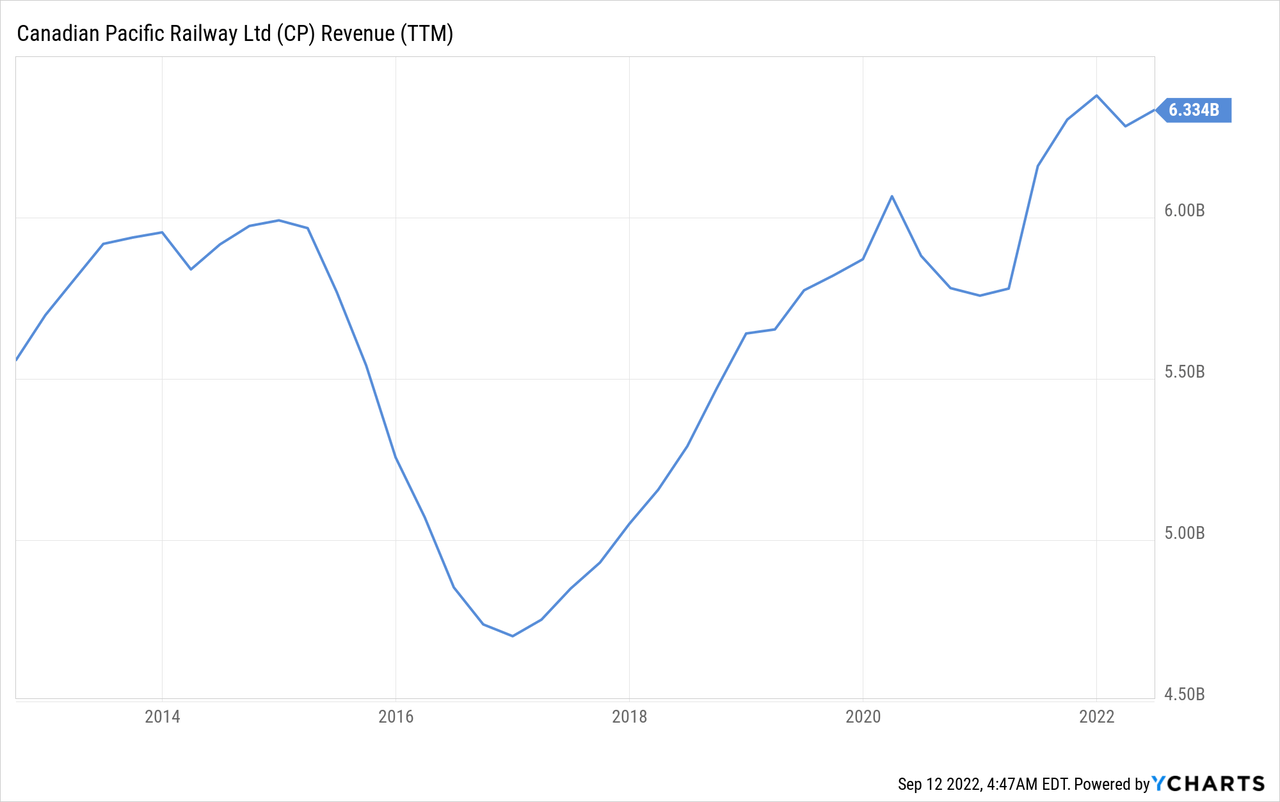

While profitability has much improved over the last decade, revenue is barely a little bit higher. The company has put tremendous effort into becoming more efficient operationally, but growth opportunities so far have been lacking. There is expectation that the merger with KCS will bring some revenue synergies, and that management will now be more focused on growth after spending the past decade working mostly on efficiency, but whether revenue growth can be reignited remains to be seen.

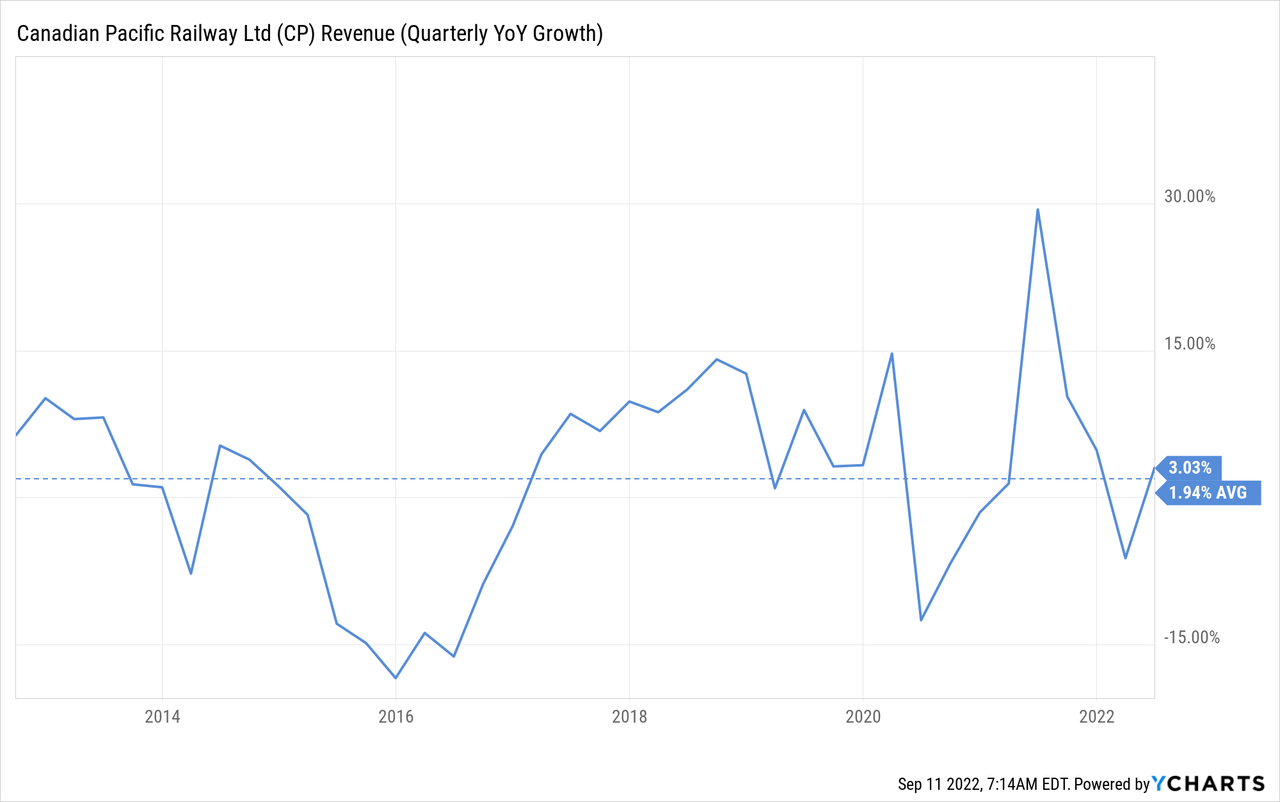

Over the last decade the average quarterly y/y growth has been a disappointing 3%. When valuing the shares investors should remember that this is a low-growth industry. Nevertheless, there is certainly still room for some growth acceleration. The company has talked about potential revenue synergy opportunities from the merger with Kansas City Southern. It has also pointed out that it has locomotives available for future growth, as well as yard and terminal capacity. It can increase network capacity through longer sidings and increasing speeds, and it also has the ability to further increase train length. Its surplus land also gives the company optionality to grow. Still, despite all of this, revenue growth has been very low. It will be interesting to see if there is some re-acceleration going forward after the KCS acquisition.

Balance Sheet

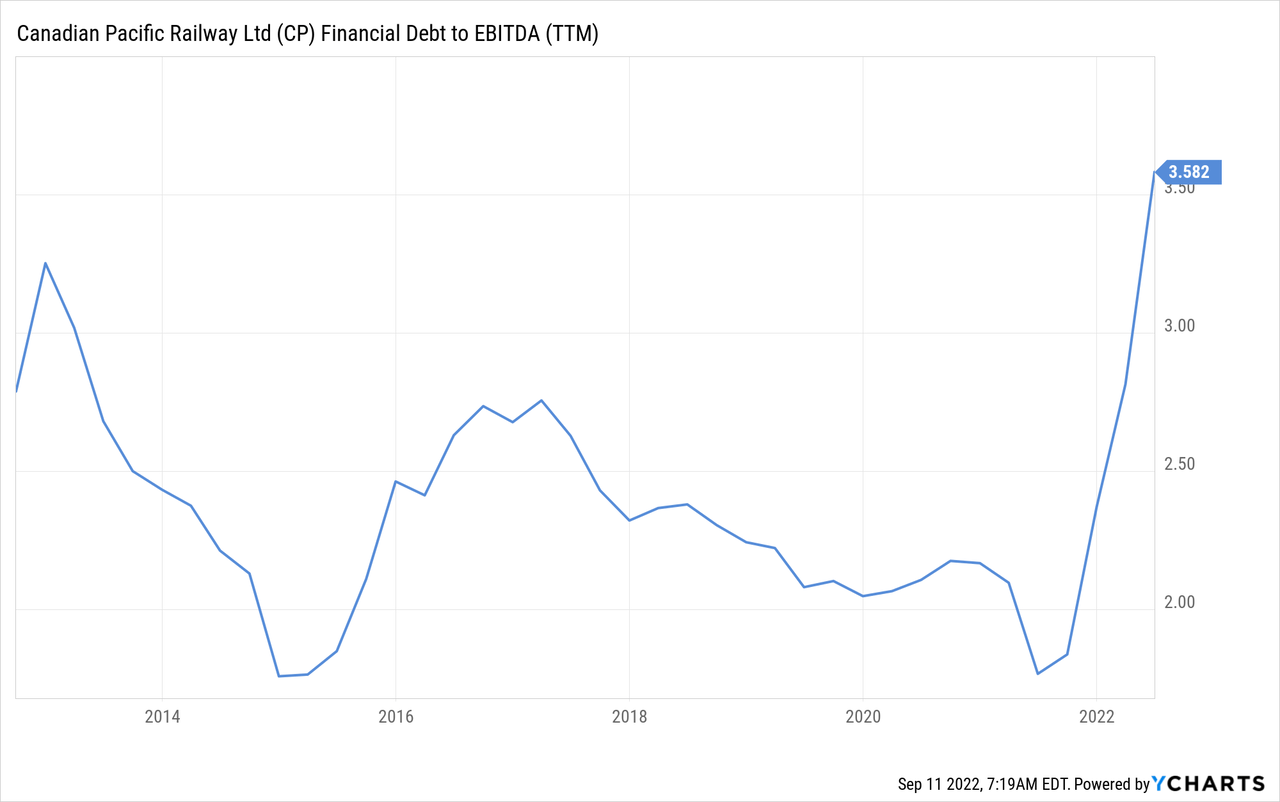

The company leveraged in order to pay for the KCS acquisition. As can be seen below, debt to EBITDA went from less than 2x to more than 3.5x. We expect leverage to come down after the KCS merger, and as the company pays down debt and realizes synergies.

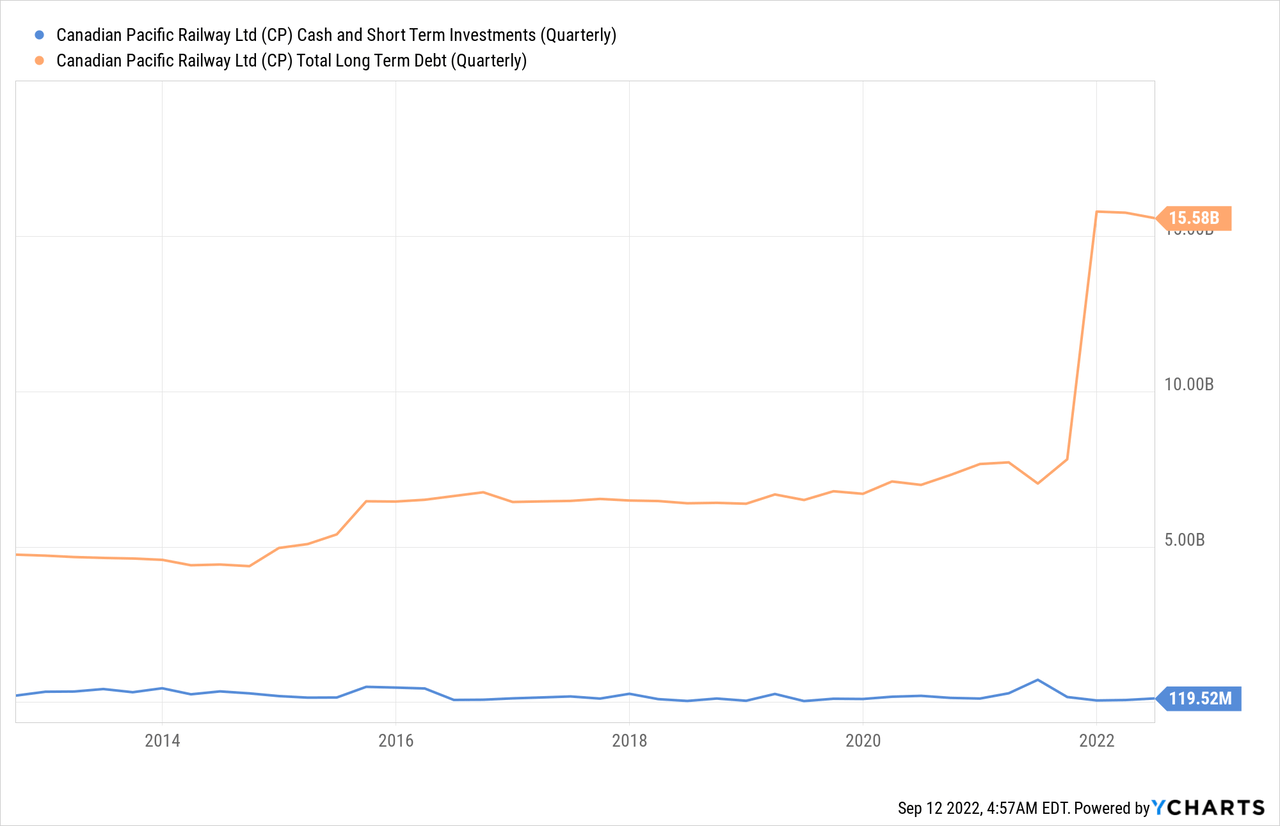

Looking at the graph below it becomes clear to what degree debt increased in preparation to the closing of the acquisition of KCS, approximately doubling to ~$15 billion. It is also interesting to see that the company operates with a relatively low buffer of cash and short-term investments, which amount to only ~$119 million.

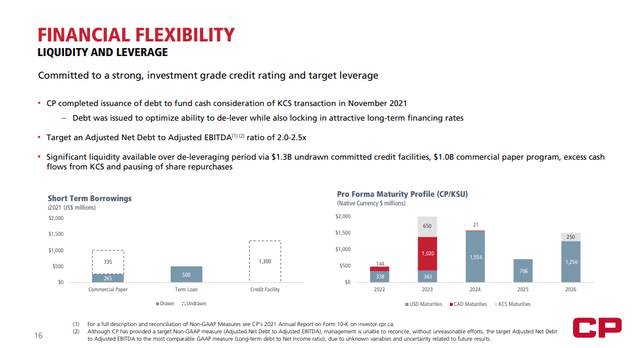

In any case, the company has recently reaffirmed its commitment to a strong investment grade credit rating, and a target leverage of Adjusted Net Debt to Adjusted EBITDA of 2.0 to 2.5x. The company does have significant liquidity available from its $1.3 billion undrawn committed credit facilities.

Canadian Pacific Investor Presentation

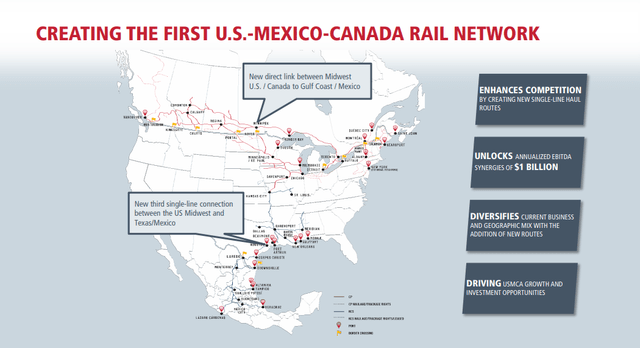

KCS Acquisition

We like the Kansas City Southern acquisition, which should create the first US-Mexico-Canada rail network, truly end-to-end. Following completion of the transaction, which is anticipated no later than Q1 2023, the company expects to generate $1 billion in annualized synergies within 3 years. Despite this positive, we believe it does not move the needle enough to justify the current valuation.

To put the $1 billion in synergies into context, the company currently produces an EBITDA of ~$3.5 billion, so $1 billion is indeed significant, and should help to meaningfully generate excess cash to reduce leverage. That said, we still believe that the positive impact is not enough to justify the valuation at which the company is currently trading. As we’ll see in the next section, the company is significantly overvalued compared to its historical valuation multiples.

Canadian Pacific Investor Presentation

Valuation

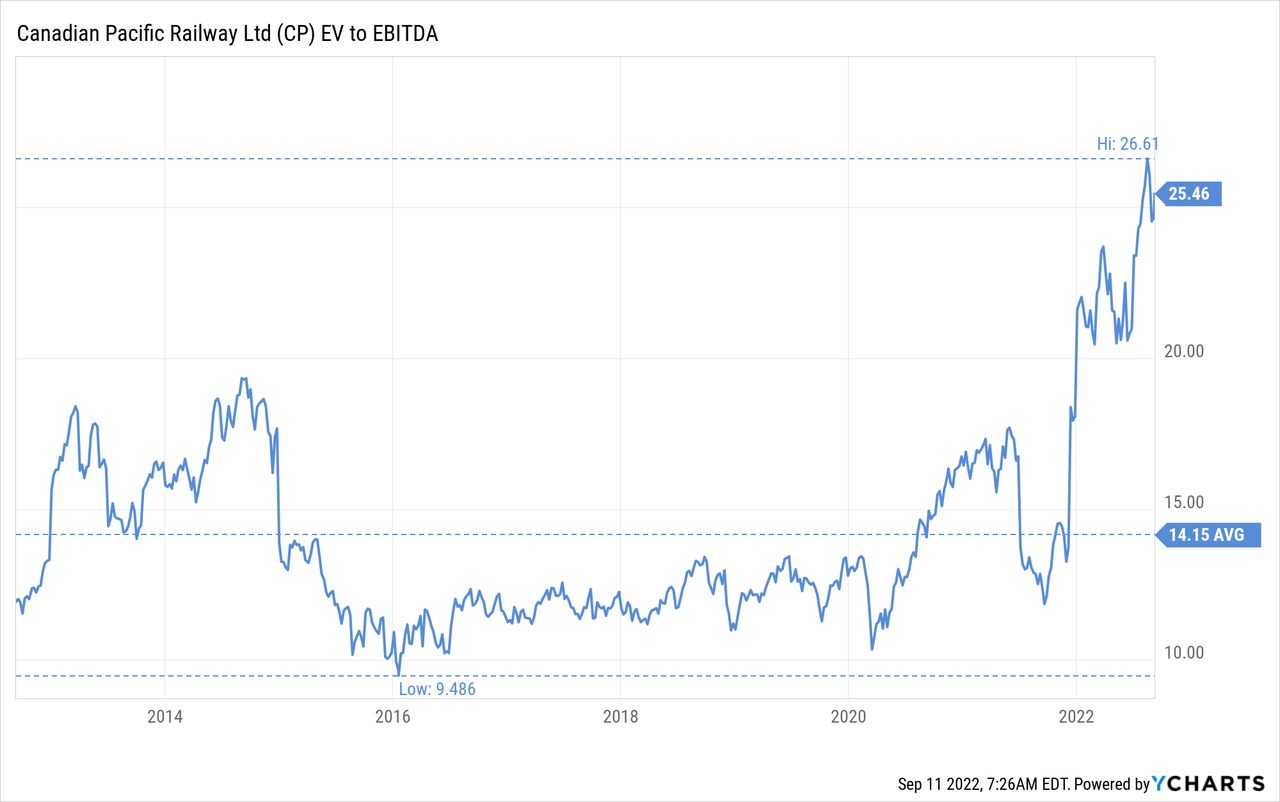

Based on EV/EBITDA, the company has rarely been more expensive. It is currently trading at ~25x, which is getting close to 2x its ten year average of 14x.

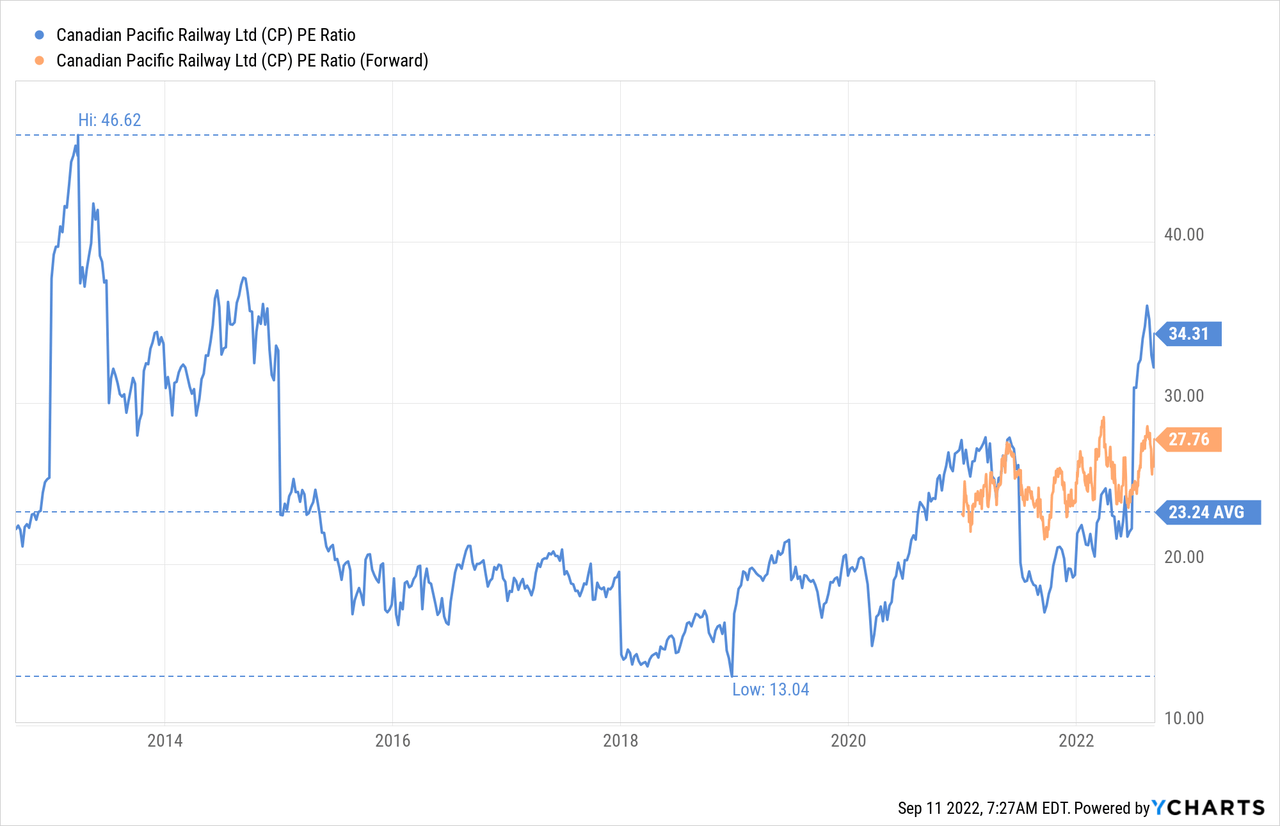

The P/E ratio tells a similar story, but less extreme. With the price/earnings multiple about 50% higher than then ten year average of 23x. The forward p/e is a little bit lower at 27x, but still too high in our opinion for a company growing at a relatively slow pace.

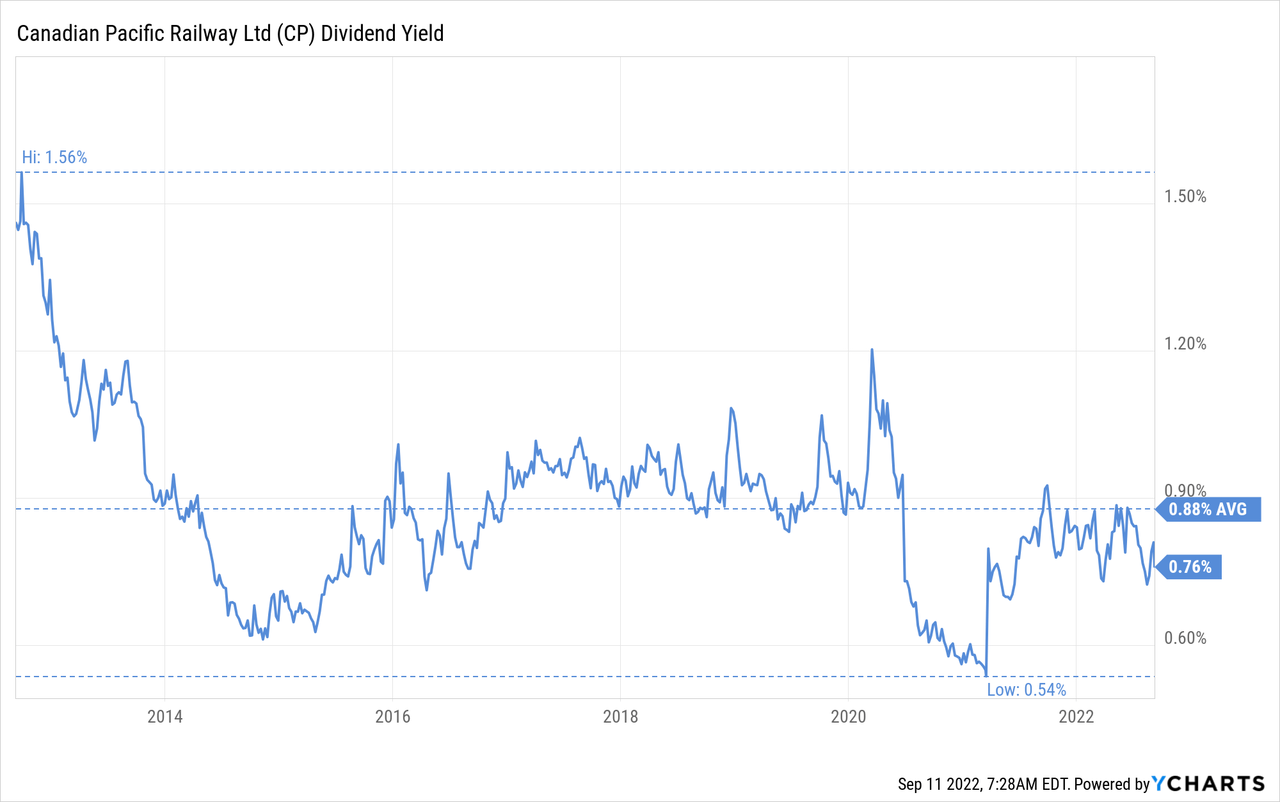

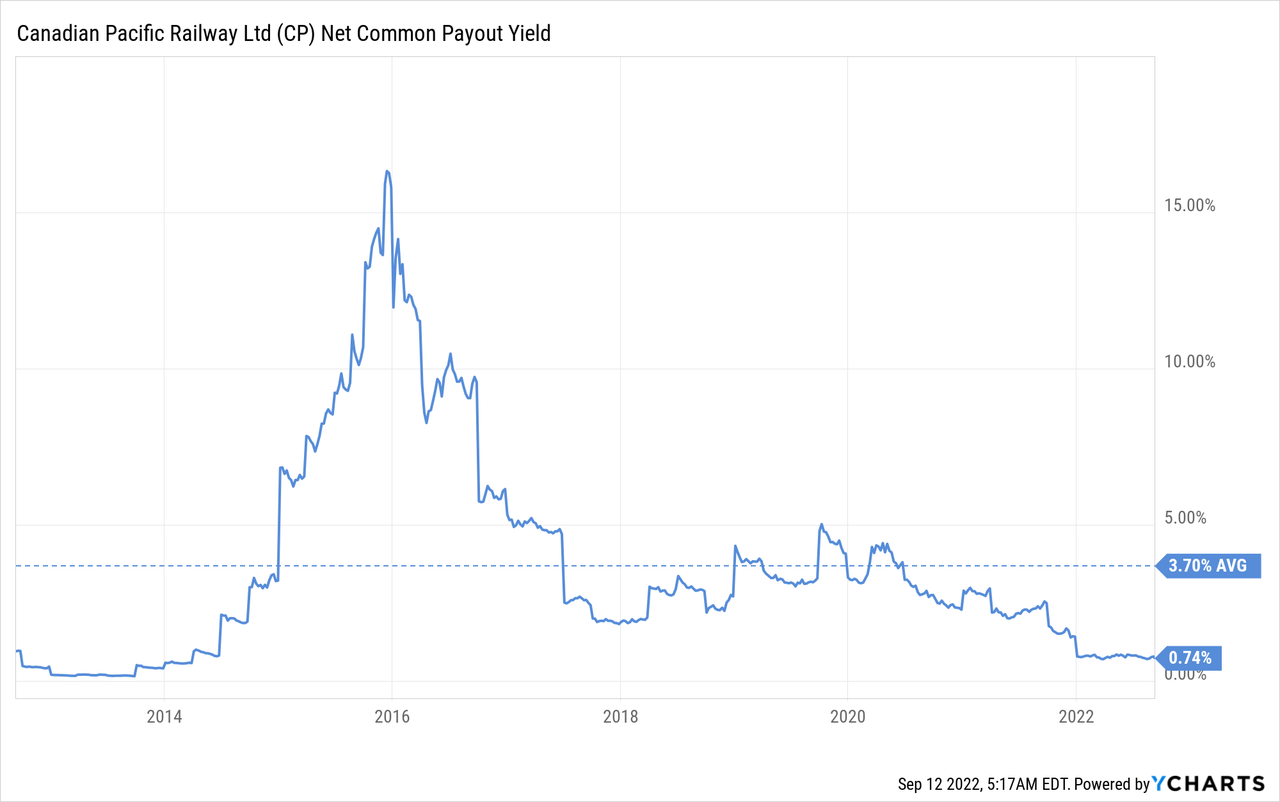

The overvaluation is also reflected in the low dividend yield, which is below the ten year average, and at the very low absolute value of 0.76%.

The company has historically been a big buyer of its own shares, which can be seen with the Net Common Payout Yield that takes into account both the dividend and the buyback yields. The historical average for this indicator is 3.7%, but it is currently much lower at only ~0.74%. Part of the reason is that the company is probably reducing its buybacks to strengthen the balance sheet in preparation of the KCS acquisition, but it also reflects overvaluation of the shares.

Risks

Right now the two biggest risks we see for Canadian Pacific’s shareholders are high valuation that leaves little room for error, and integration risks with KCS. While we expect the merger with Kansas City Southern to be mostly a positive, there can be negative surprises, and the current valuation does not leave much room for error. The biggest integration risk is probably that of company culture, as both Canadian Pacific and Kansas City Southern are big organizations with set ways of doing things, and it could be difficult for KCS employees to adapt to a new corporate culture. Finally, for railroads as for airlines, there is always the risk of worker strikes.

Conclusion

Canadian Pacific is a wonderful railroad, given its excellent operational performance and strong competitive advantages. We hope we’ll be able to own shares one day. However, we currently find them too expensive, even if the merger with KCS is expected to bring significant synergies. With an EV/EBITDA that is getting close to twice the ten year average we have to wait for a better entry price. In the meantime we’ll follow the integration progress with KCS to see if the synergies are indeed realized, and how the financials start looking after the merger.

Be the first to comment