bjdlzx/E+ via Getty Images

Investment Thesis

Phillips 66 (NYSE:PSX) has been on a rocky ride this past month, with its share price falling 10% in the past month.

Meanwhile, news of a very tight refining capacity continues to surface, with investors arguing that Phillips 66 is well-positioned to participate in this abnormally high refining margin environment.

While I recognize that Phillips 66’s downstream operations have ample potential, I make the case that Phillips 66 Refining business is too small to meaningfully move the needle on the overall business.

Altogether, there are some good aspects, such as its 6% capital return program, and some bad aspects to investing in Phillips 66.

Hence, I assert Phillips 66 with a tepid buy rating.

Phillips 66’s Near-Term Prospects

Phillips 66 is a diversified energy company.

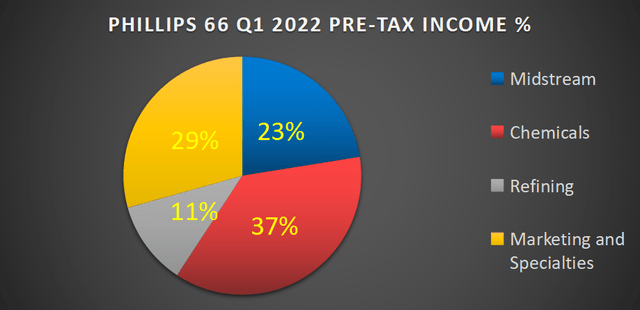

Author’s calculations

Note, the figures above are an approximation as there is a 20% portion that overlaps in the figures that get taken away back to Corporate and Other. However, this approximation works for our purposes.

As you can see above, Phillips 66’s biggest segment is its Chemicals segment. With Marketing and Specialties coming in second place. Phillips 66’s small segment is its Refining segment.

Put another way, Phillips 66 Refining segment could increase 100% y/y and still be Phillips 66 smallest segment.

In essence, I make the argument that investors should not back Phillips 66 simply because of its refining operations.

Capital Returns to Shareholders

Phillips 66 has a net debt profile of $11.1 billion. For a business that made $1.1 billion of cash flows from operations during what some could argue is a notably strong quarter, this demonstrates that Phillips 66 is meaningfully leveraged.

Consequently, its ability to return substantial sums back to shareholders is somewhat impaired.

For example, during its Q1 earnings results, Phillips 66 declared that it would look to increase its dividend yield.

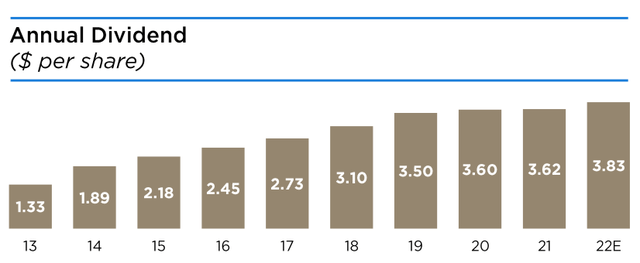

Phillips 66 investor presentation

However, when the final announcement came out, a few days after the quarterly result, the dividend was actually just a 5% increase to $0.97. On an annualized basis, this comes to approximately 4.0% yield.

Given all the risks of investing in a commodity company, getting paid a mid-single-digit yield isn’t quite going to get anyone’s blood racing.

Similarly, management talks about restarting its share repurchase program. Phillips 66 has an open-ended $2.5 billion share purchase program.

Yet, recall that this remaining $2.5 billion share repurchase program is what is left from the original $15 billion announced back in 2012. Consequently, I doubt that Phillips 66 will exhaust its full authorization over the next twelve months.

Perhaps Phillips 66 will deploy approximately half its authorization over the next twelve months. While it’s difficult to ascertain just how aggressive Phillips 66 will be, I believe the following quote helps direct our analysis.

During the earnings call, when analysts questioned Phillips 66 about their capital allocation strategy, management said,

[…] we will have some balance between reinvesting in the business through the capital program, which we have said about $2 billion in aggregate for the next couple of years, returning funds to shareholders through the dividend. We are back in share repurchases, but also working on the balance sheet with a continued — some form of cadence to debt reduction and increased cash as you highlighted.

Accordingly, what you see noted above is a management team that is looking at a multipronged approach to capital allocation, between reinvesting back in the business, paying down, keeping plenty of cash, and returning funds to shareholders through a dividend.

What you do not see is an active discussion about significantly ramping up its share repurchase program.

Hence, I believe that in the best case, Phillips 66 will return $500 million to $1.0 billion via share repurchases. At the high end of this range, this would amount to a 2% capital return program.

This would bring the total shareholder return on an annualized basis to 6%, at the high end.

PSX Stock Valuation – Priced at 7x Free Cash Flow

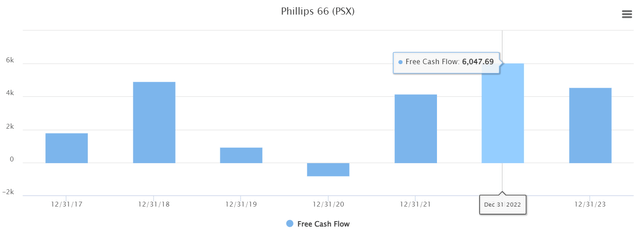

During Q1 2022, Phillips 66 free cash flow was approximately $730 million. This was a low figure. However, keep in mind that Q1 is typically the low season for Phillips 66.

What is more, in 2021, despite significantly lower crude oil prices and dramatically lower crack spreads, Phillips 66 free cash flow reported was approximately $4.2 billion.

Consequently, while it’s impossible to predict oil prices for the rest of 2022, if we assume that oil prices stay in the range of $100 to $110 WTI, this would most likely see Phillips 66’s free cash flow reaching somewhere around $6 billion.

TIKR.com

Indeed, as you can see above, analyst consensus presently points to $6 billion of free cash flow for 2022.

This would put Phillips 66 priced at 7x free cash flow.

On the other hand, there are a lot of near-term risks that also should be considered.

Investment Risks

Nobody can predict oil prices. Oil prices may remain elevated or they may fall.

Also, there’s been some argument to be had that high-interest rates are going to lead the US economy into a forced recession that would kill demand.

Meanwhile, even though I do not buy the argument that WTI at $100 is enough to kill the economy, after all, we are an oil economy, there is an argument to be had that there’s the possibility that high oil prices could lead to demand destruction.

Separately, if natural gas prices remain high, this could squeeze Phillips 66 Chemical’s business margins. Natural gas prices appear to have cooled down of late, given the fire at the Freeport LNG facility, but this is something to also watch out for.

The Bottom Line

I see a lot of investors comparing Valero (VLO) and Phillips 66. Yet these businesses are really quite different. Yes, both companies benefit from high crude oil prices. But Valero is much more exposed to high refining prices than Phillips 66.

I hope that this analysis has opened up the conversation and directed the discussion into what Phillips 66 offers and what it doesn’t offer.

It offers investors a 5% to 6% total shareholder return. At a time when in other sectors investors are clamoring for a 2% to 4% total shareholder return, Phillips 66 is clearly a better opportunity.

Be the first to comment