Ary6/E+ via Getty Images

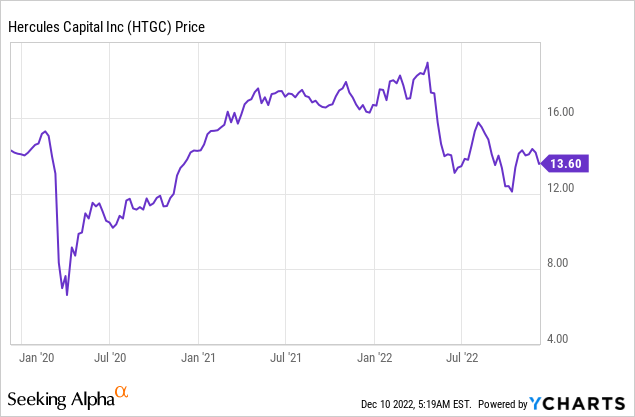

Hercules Capital (NYSE:HTGC) had been on my watchlist for months stubbornly hugging its 52-week peak until high inflation figures and Fed rate hikes partnered to pull down the common shares of the Palo Alto-based internally managed business development company. I’ve been aggressively buying shares since then. I’m not just attracted to the current 10.6% dividend yield but to the high growth business set to ride what arguably forms one of the USA’s comparative advantages.

The US’s ability to cultivate and attract talent anchored around clusters of innovation where world-leading universities and capital help form global knowledge-based companies is dramatic and done at a rate that’s hard to be matched.

Hercules Capital provides senior secured venture growth loans to fast-growing venture capital-backed companies. Their portfolio has a distinct focus on companies in the technology, life sciences, and sustainable and renewable technology industries. This has provided the BDC with exposure to relatively future-proof and highly agile companies set to ride relevant secular growth trends over the next decade. This ranges from decarbonization and human health to digitization and includes electric bus manufacturer Proterra (PTRA), space technology company Rocket Lab (RKLB), and plant-based meat substitute maker Impossible Foods.

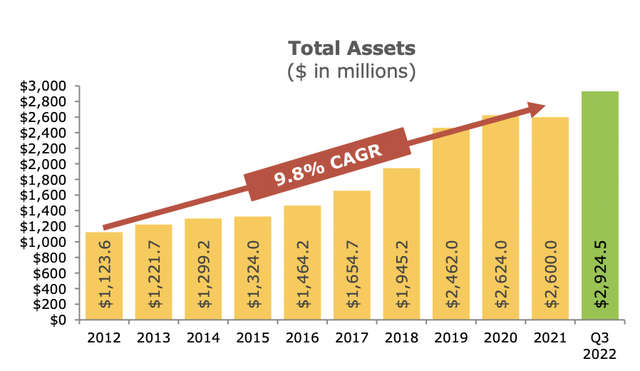

As of the end of its last reported fiscal 2022 third quarter, the company had committed $16 billion to over 600 companies since inception. Hercules is arguably the largest non-bank source of venture financing to its targeted industries, recently taking part in underwriting a secured $300 million loan to Oak Street Health (OSH) and a $125 million term loan to Kura Oncology (KURA). The former is a network of primary care centers whilst the latter is a biopharmaceutical company focused on the development of precision medicines for the treatment of cancer.

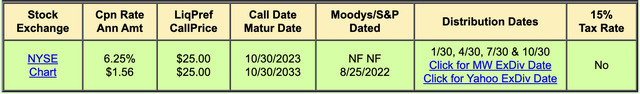

Before I bought the commons I briefly considered the 6.25% baby bonds (NYSE:HCXY).

These currently pay out a $1.56 coupon in quarterly instalments. Not only is the current yield at 6.37% lower than the commons, but any capital gains are anchored to the $25 redemption price. It also does not provide exposure to supplemental dividends payouts. Hence, even with the lower volatility and nearly guaranteed payment, the commons are a better investment for almost every other investor bar those that cannot bear any volatility. The call date is also less than a year from now in October 2023 and Hercules has a history of paying off its retail-level Notes before maturity.

The 12 Labors Of Hercules Capital

There is one core reason why I’m excited to own Hercules and intend to keep buying. The dividend income. The company’s last quarterly cash dividend payout was $0.36, a 2.9% increase from the prior payout for a yield that currently stands at 10.6%. Hercules also pays out supplemental dividends along with the regular payouts. Supplemental dividends of around $0.15 have been paid out along with the last four regular dividends. These add up to $0.60 and an additional aggregate yield of 4.4%.

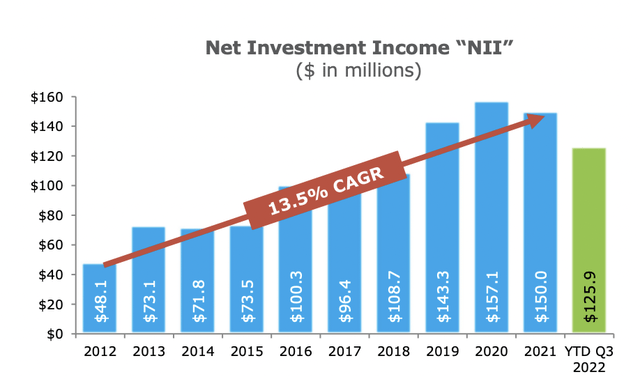

Of course, dividends have to be supported by strong financials otherwise it would fast become a yield trap. The company’s recent earnings saw a net investment income of $50 million or $0.39 per share. This provided a healthy 108% coverage on the just increased regular dividend payout and was a growth of 25% over the prior second quarter. NII has grown at a 13.5% compound annual growth rate since 2012.

Management stated during their earnings call that they expect NII to increase sequentially for their fourth quarter which will mean a record NII of at least $175 million for its full fiscal 2022. This bodes well for continued dividend support and will also mean its undistributed earnings spillover of $134.1 million or $1.03 per share continues to remain robust to maintain future supplemental cash dividend payouts.

This Isn’t A Yield Trap

The company also realized record originations performance with gross debt and equity commitments of over $817 million, a record third quarter.

The torrid macro environment has not slowed down Hercules with January to October end commitments at $2.76 billion a new record and ahead of commitments of $2.64 billion for the whole of fiscal 2021.

Bears would be right to flag broader recessionary risks from inflation and rising interest rates as a reason for some pause. The technology and life sciences industries are inherently high risk and come with a large degree of failure. Hence, a deep recession starting next year could cause outsized disruption to the company’s portfolio. However, rising interest rates, set to be hiked by another 50 basis points by the FOMC in December provide a tailwind to the lender with the company’s balance sheet broadly funded with fixed rate instruments.

There will be some more short-term volatility as Hercules tracks the market lower but I see this as an opportunity to keep buying until I reach a full position of around 2,000 shares. The well-covered yield, a rising rate environment, and a portfolio of companies in high-growth industries have made this company a core position within my portfolio.

Be the first to comment