FG Trade/E+ via Getty Images

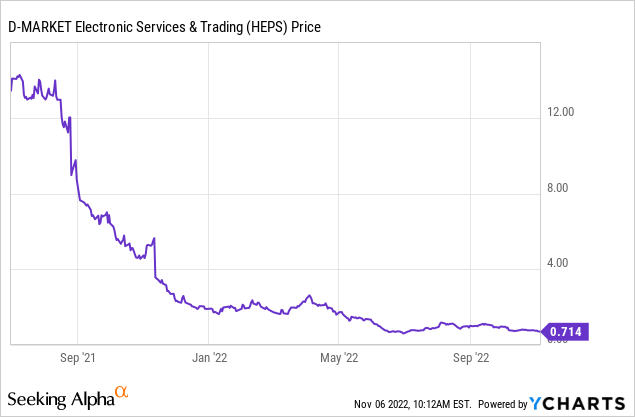

D-Market (HEPS), known as Hepsiburada, has been in trouble since its IPO on July 2021. After the successful IPO and a month of trading above the listing price, the stock started its downfall. Despite the management’s prior promises, the Turkish e-commerce giant’s financial headwinds continue.

Currently, the stock is trading around $0.71, drastically lower than its $12.00 IPO price. Hepsiburada had received a notification from NASDAQ as the current stock price does not comply with the minimum bid requirement of the stock exchange. Although the management claims the outlook is positive, last quarter’s financial results and the concerning macro-outlook of Turkey are telling a different story.

Financials Are Worse Than It Looks

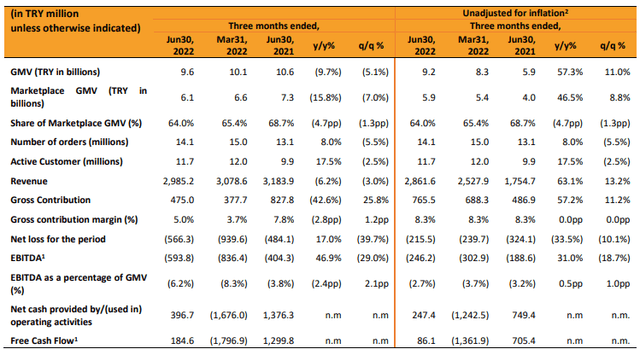

Hepsiburada continued to perform poorly in the last quarter. After a first glance at the Q2 report, one might say that the company had a slightly troublesome quarter. However, it is nowhere near the complete picture; to understand Hepsiburada’s financials, we should look into its reporting methodology. Hepsiburada is a Turkish company reporting in Turkish Liras (one of the most inflationary currencies of the last five years).

Under the IAS-29 regulation, Hepsiburada adjusts its financials with the official inflation rate. The inflation rate that the Turkish National Statistical Agency (TurkStat) decides. However, TurkStat is a state-owned institution; that lost its reputation and trustworthiness under Erdoğan rule. Thus, the private sector, investors, and financial authorities outside the public sector, often question the official inflation figures.

For Hepsiburada’s Q2, the official inflation adjustment rate was 1.79, representing 79% inflation. Even though the inflation rates are difficult to estimate, calculations made by independent parties may give us an idea. Inflation Research Group claims that real inflation is more than double the declared inflation rate and is close to 180%. Subsequently, we would have a drastically different financial report if we were to adjust the figures with the unofficial inflation estimates, even with a more conservative number like 120%.

Despite all its efforts, Hepsiburada continues burning cash yet struggling to generate growth. They are facing decreasing GMV and revenue. It is also alarming that the number of orders and active customers decreased quarterly. In addition, the YoY quarterly growth of orders and active customers was limited. Lagging growth is a concerning issue in a rapidly growing market such as Turkey, considering Hepsiburada spent a fortune in order to boost these figures.

Q2 Report (Hepsiburada Quarterly Report)

Competition Is Fierce

While the management didn’t do a great job, the Turkish e-commerce market is highly competitive. Trendyol (owned by Alibaba) and Amazon are expanding aggressively. Hepsiburada’s competitors have superior resources and the luxury to operate at a loss for a long time. Therefore, protecting its market share hasn’t been an easy fight for Hepsiburada. They had to overspend on advertising and marketing while launching aggressive campaigns and discounts to retain customers.

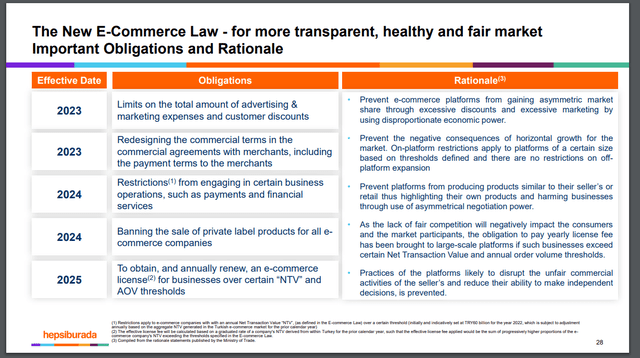

Although we will have to wait to see the impact of the upcoming e-commerce law, it can potentially cool down aggressive marketing and customer discounts in e-commerce. The new regulations will potentially benefit Hepsiburada the most, as they are disadvantaged against Trendyol and Amazon.

New E-Commerce Law (Hepsiburada Quarterly Report)

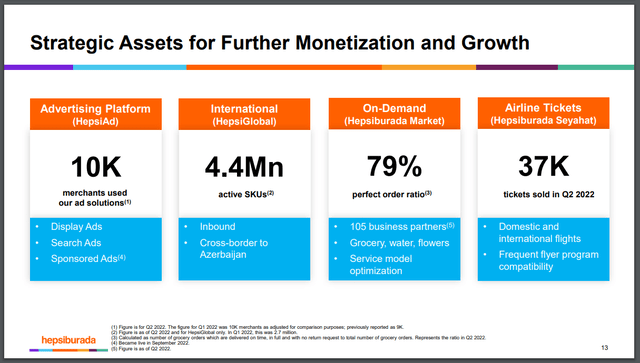

Hepsiburada’s New Businesses Are Not Promising

Overall, Hepsiburada failed to create a new business channel that promises monetization and expansion opportunities. I believe these new business ventures are not bright enough to change the outlook anytime soon.

New Businesses (Hepsiburada Quarterly Report)

HepsiAd & HepsiGlobal

HepsiAd is their online advertisement solution targeting SMEs in their platform, while HepsiGlobal is their initiative to add global merchants to their marketplace to increase their offerings in Turkey. Although both are successful initiatives, they are not new monetization channels. These are merely efforts to support their core business and keep up with the competition from Trendyol and Amazon.

On-Demand

On-Demand is an adjacent field that Hepsiburada could expand and utilize its customer traffic. Yet, the Turkish market is fiercely competitive. Getir, Yemeksepeti (Delivery Hero), and Tredyol have already consolidated the market. Therefore, I do not think On-Demand bears an opportunity for Hepsiburada. I believe management’s choice of showcasing the “Perfect Order Ratio” as a “further monetization and growth metric” tells the whole story.

Airline Tickets

Hepsiburada’s airline ticketing business is in its infancy stage, with 37k tickets sold while they had 11.7 million active users in the quarter. I think it will be another cost driver for the company rather than a strategic asset.

Macro Troubles Continue

The inflation surge slowed with the stabilizing Turkish Lira in the last couple of months. Yet, there haven’t been any changes in unorthodox policies or improvements in the economic fundamentals of Turkey. Most analysts expect Erdoğan to increase the minimum wage steeply and increase spending ahead of the upcoming critical elections. I believe the fiscal expansion will inevitably push inflation higher. In my opinion, it would be naive to expect economic stability as political elections are coming up, and the Erdoğan government is determined to win.

Conclusion

All in all, Hepsiburada has been a disappointment for its investors so far. The management promises profitability in the hopes that new regulations and cost-cutting can be the path to achieving its goals. However, last quarter’s financials were troubling, and if we take a higher inflation adjustment multiple instead of the official one, it turns into a financial nightmare. On the other hand, new business ventures are not enough to turn the tide around for the company. Last but not least, economic and political instabilities in Turkey bear significant risks for troubled Hepsiburada.

Investor Takeaway

Although the current picture is worrying, I refrain from giving it a Sell rating as the stock is already beaten down heavily and trading around 0.1x EV/GMV and 0.25x EV/Revenue multiples. The company still has the chance to bring shareholder value with the change of management and restructuring as it has an active user base, yet it is not worth taking the risk until there are concrete steps.

Be the first to comment