Geber86/E+ via Getty Images

Working in the health care or dental space often requires access to a significant amount of specialty products. Without these products, it is impossible to provide quality, up-to-date care for one’s clients. Given how large the medical and dental markets are, it should come as no surprise then that some companies have developed over the years to provide these necessary products. One such player is a company called Henry Schein (HSIC). Over the past several years, management has done well to grow the company’s revenue. Along the way, profits and cash flows have generally been on the rise. Although shares of the company seemed to be priced at a level that would be considered fairly valued relative to the competition, on an absolute basis, they do look somewhat undervalued. So long as current trends persist, investors could experience nice upside by buying and holding for the long haul.

A player in the health and dental space

Henry Schein makes its money by serving as a provider of health care and dental products. Today, the company has over 1 million customers globally spread across dental practices, laboratories, physician practices, ambulatory surgery centers, the government, institutional health care clinics, and alternative care clinics. Its operations are spread across 32 different countries and territories worldwide. To all of these clients, the company distributes more than 120,000 branded products, as well as its own private branded offerings. The company also has access to another 180,000 products that are made available through special order. All of this is facilitated through the 3.8 million square feet of space the company has split between 27 different distribution centers across the globe. Although the company is global in nature, it is worth noting that 74% of its revenue still comes from North America. That leaves the remaining 26% attributed to international sales.

Operationally, Henry Schein has two segments that it runs. The first of these is the Health Care Distribution segment. According to management, this particular unit includes both the global dental and medical businesses the company has. And through them, it sells consumable products, dental specialty products, small equipment, laboratory products, large equipment, equipment repair services, and more. Some of its offerings also include pharmaceuticals, vaccines, and even diagnostic tests. During the company’s 2021 fiscal year, this particular segment accounted for 94.8% of the firm’s overall revenue. It also is responsible for 85.5% of its operating profits. Breaking the data down further, we find that 60.8% of its sales are related to the offerings it provides in the dental space. Another 34% of revenue is attributed to the products it sells to the medical space.

The other segment the company has is the Technology and Value-Added Services segment. This unit is responsible for providing software, technology, and other various services to health care practitioners. These offerings include dental practice management solutions for dental and medical practitioners. They also provide dentists and physicians with electronic health records, integrated revenue cycle management, patient communication services, website design, analytics, and other related offerings. On top of this, the company’s offerings include practice consultancy, education, and financial service offerings that assist dentists and physicians to both operate and expand their businesses. During the company’s 2021 fiscal year, revenue from this segment accounted for just 5.2% of overall revenue. But it was also responsible for an impressive 14.5% of operating profits.

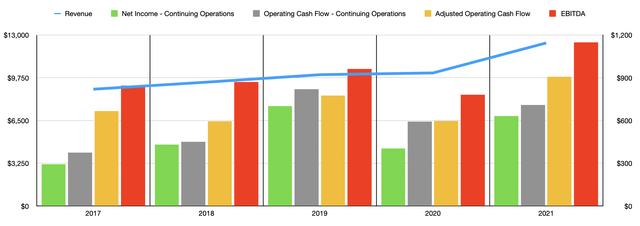

Author – SEC EDGAR Data

Over the past five years, management has done incredibly well to grow the enterprise. Revenue has expanded from $8.88 billion in 2017 to $12.40 billion in 2021. That implies an annualized growth rate of 8.7%. What’s more, the growth between 2019 and 2020 was particularly impressive, coming in at 22.6%. When it comes to profitability, the picture has been a bit more volatile, but generally positive. Between 2017 and 2019, for instance, the company saw its net profits rise from $293.2 million to $700.7 million. Then, in 2020, net income plunged to $403.8 million before recovering some to $631.2 million in 2021.

Profitability is important, but cash flows are also incredibly vital to look at. Between 2017 and 2019, operating cash flow for the business expanded from $375 million to $820.5 million. It then dropped to $593.5 million in 2020 before popping up to $709.6 million last year. If we adjust for changes in working capital, the picture has been even more appealing. This figure would have risen from $666.2 million in 2017 to $774.9 million in 2019. A drop still would have taken place, this time to $596.9 million in 2020. But then, in 2021 it would have hit an all-time high of $906.8 million. A similar trajectory can be seen when looking at EBITDA. Ultimately, however, it has risen over the past five years from $845.8 million to $1.15 billion.

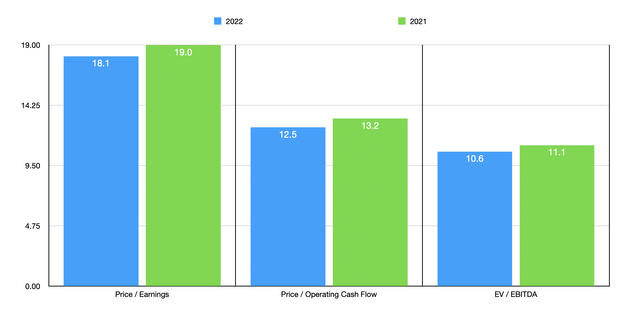

Author – SEC EDGAR Data

When it comes to the company’s 2022 fiscal year, no significant guidance has been given except for when it comes to earnings per share. At the midpoint, management expects earnings to be $4.83 per share. This would imply net profits of $662.5 million. If we assume a similar year-over-year growth rate for cash flows as we do for profits, then operating cash flows should be around $951.8 million while EBITDA should be about $1.21 billion. Taking these figures, we can effectively price the company. Using the 2022 estimates, the company is trading at a price-to-earnings multiple of 18.1. This compares to the 19 reading that we get if we use the 2021 results management reported. The price to operating cash flow multiple would be 12.6. This is down from the 13.2 we get if we use the 2021 figures. And the EV to EBITDA multiple would be 10.6, down from the 11.1 we get from 2021 data. To put this data into perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 14.3 to a high of 28.3. On a price to operating cash flow basis, the range was 7.2 to 25.7. And using the EV to EBITDA approach, the range was 7.5 to 21. In all three cases, using our 2021 data, Henry Schein was cheaper than all but two of the firms.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Henry Schein | 19.0 | 13.2 | 11.1 |

| Cardinal Health (CAH) | 28.3 | 10.5 | 21.0 |

| Owens & Minor (OMI) | 14.3 | 25.7 | 9.9 |

| Patterson Companies (PDCO) | 19.4 | N/A | 11.6 |

| Covetrus (CVET) | N/A | 23.4 | 18.6 |

| AdaptHealth (AHCO) | 14.3 | 7.2 | 7.5 |

Takeaway

Right now, Henry Schein strikes me as a very high-quality enterprise with very little risk. The risk comes from the company’s robust operating history and the fact that its net leverage ratio is about 0.66 as of this writing. Long term, I suspect the company will perform exceedingly well. Relative to similar firms, shares look to be about fairly priced. But on an absolute basis, I would make the case that they are slightly undervalued at this time. This is especially true when you factor in just how high quality the enterprise is.

Be the first to comment