The U.S. drilling industry heavyweight and one of the beneficiaries of the U.S. shale boom, Helmerich & Payne, Inc. (NYSE:HP), has recently presented its Q2 FY 2020 results. It will not be an exaggeration to say that the quarter was one of the toughest in the company’s history due to the unprecedented oil market turmoil.

Though the driller was not ill-prepared for the crisis, as it had perfectly learned the lessons of the mid-2010s meltdown, due to the magnitude of the WTI decline and the company’s exposure to the U.S. shale patch, it still encountered severe issues.

I have been covering Helmerich & Payne since September 2019. The previous article was published nearly three months ago. In February, after the careful analysis of its fundamentals, I concluded its dividend was safely covered. Moreover, the company surely had one of the healthiest capital structures among North American drillers (it is still almost perfect).

Author’s creation. Data from Seeking Alpha

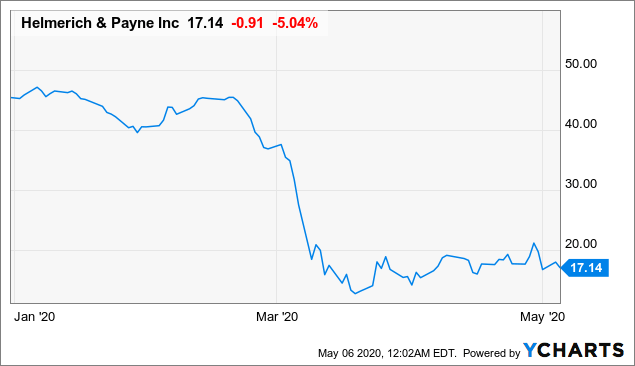

As, back then, the share price had been already depressed (the OFS companies’ issues had become mounting long before March 2020), I made a conclusion the stock was worth considering. However, as WTI extended losses, the company made one painful but necessary decision and cut the DPS. Though it reaffirmed the $0.71 DPS payable June 1, it reduced future dividends by 65% to just $0.25 per share.

In February, the CFO had already warned investors that the U.S. upstream companies’ 2020 capex would plunge by roughly 10%. However, as the oil price war and the COVID-19 pandemic had been whipsawing the crude prices, the oilfield services & equipment companies bear the brunt of much deeper capex reductions. I believe HP was perfectly prepared to live with WTI at $40 a barrel and slightly below, but if the price is oscillating well under $30, even such a robust company should focus on the balance sheet and reduce shareholder rewards.

Now, let’s delve into the Q2 results.

The top line

The company has already been facing issues due to the capital expenditures reduction trend in the U.S. shale patch. Even the WTI price we saw in 2019 was not enough to make Helmerich & Payne thrive, no matter how advanced its super-spec rigs were. Though the company offers top-quality cutting-edge services, the Texas light sweet price hurts one essential thing: upstream players’ liquidity. I have already touched upon that essential matter in my earlier articles on HP and some upstream players like Concho Resources (CXO).

So, there is no coincidence that, in the second quarter of fiscal 2020, HP’s operating revenues plummeted. They fell to $633.6 million vs. $720.9 million in Q2 FY19. H1 FY 2020 revenue slipped to $1.25 billion, representing a 14.5% decline. Compared to Q1 FY 2020, the U.S. Land segment delivered some improvements; the segmental revenues rose close to 30% vs. the final quarter of calendar 2019. However, that is just a temporary fluctuation that should not be considered as a sign of healthy revenue growth prospects in the calendar 2020.

For investors who closely watch the bottom line, a $421 million loss perhaps was the most disenchanting surprise of the quarter. Impairment of drilling equipment and related spares was a primary culprit, as the company decommissioned 37 rigs across the U.S. As I frequently highlight in my pieces, impairment is not worthy of concern for cash flow-oriented investors, as its influence on the net CFFO and FCF is close to zero (except for its impact on the taxes). Nevertheless, when a company writes off a massive amount of PP&E, its equity falls respectively, which, in turn, impacts the Debt/Equity ratio. In the case of H&P, D/E changed only slightly, from 12.1% to 13.9%. Nothing dramatic happened.

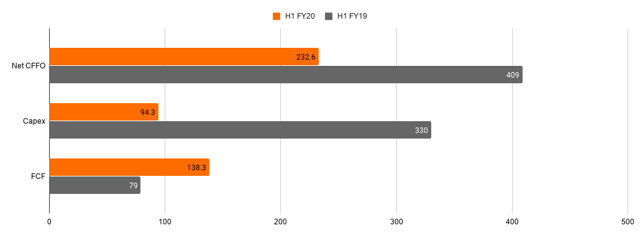

Also, there were some bright spots. For instance, in H1 FY20, though cash from operations almost halved, HP remained FCF positive. Its FCFE left after covering capex amounted to $138.3 million. FCF was bolstered by low capital intensity, as, during crises, there is no need to expand the asset base to capture market opportunities.

Author’s creation. Data from the Form 10-Q.

So, the company is not short of cash. It exited the unprofitable quarter with $381.74 million in C&CA, minuscule net debt of just $98 million, and a 13.9% Debt/Equity. Moreover, it has no debt maturities until 2025. A relevant question a reader might ask is why HP slashed the dividend if it has adequate cash balance and positive FCFE. The problem is that HP decided to cut the DPS not because it faced liquidity issues, but primarily because the return to higher capex in the U.S. oil industry remains highly uncertain. The coming quarters will be extraordinarily challenging. As the CFO said during the earnings call,

We expect to end the third quarter below 70 rigs with the vast majority of that decrease happening prior to June 1.

The worst is yet to come

According to the most recent data provided by Baker Hughes Company (NYSE:BKR), last week the count of the U.S. active drilling rigs tumbled by 57 to only 408. Compared to the respective week in 2019, the count had more than halved. That might be supportive of oil bulls’ arguments, as the data on active drilling rigs offer a glimpse into future production growth. Lower rig count hints production will fall, thus hurting supply, while the economic recuperation will boost demand. Falling supply and rising demand are two components required to push oil prices higher. Meanwhile, the data clearly illustrate the oilfield services companies are feeling the burn, and the June quarter can be even tougher than the March quarter.

Analysts are predicting HP’s fiscal 2020 revenue to virtually fell off the cliff. As the drilling activity in North America hibernated, FY 2020 operating revenues may fall to $1.78 billion. That is an almost 36% decline year over year. Their assumptions for the third quarter of fiscal 2020 are much gloomier as they predict a more than 50% revenue decline. In the previous article, I said that “2020 is anticipated to remain lackluster.” Now, it is possible to change the adjective to abysmal.

Next, the data presented in the March energy survey conducted by the Dallas Federal Reserve, one of the sentiment barometers in the shale industry, point to the fact that even if WTI rebounds, it will likely be not expensive enough to bolster drilling campaigns. Though companies can cover opex even in a mid-$20 to mid-$30 a barrel scenario, they need at least mid-$40 a barrel to cover new drilling.

To sum up, the scars of the oil price collapse are too deep that investors should not expect HP’s revenue to surge if WTI price climbs higher spurred by the OPEC+ output curbs, organic production decline caused by voluntary wells shut-ins, and the global economic recovery after the COVID-19 pandemic (the timing is highly questionable).

Final thoughts

The principal takeaway is that Helmerich & Payne is run by competent and experienced executives who undertook necessary measures to optimize its opex, eliminate the Achilles’ heels of the balance sheet, and prepare for the possible economic downturn.

This spring has brought historic disappointments. Even the energy mammoth Royal Dutch Shell (NYSE:RDS.A) bent to the pressure of the oil market catastrophe and cut the dividend for the first time (!) since the Second World War. When in the February article, I said that “the oil market might not price the coronavirus impact accurately,” I frankly did not expect WTI to edge to single digits. Unfortunately, the coronavirus downswing is much deeper than anyone could imagine, and even robust HP had to scale dividend down.

After a steep price decline, Helmerich & Payne is cheap, no doubt.

Data by YCharts

Data by YCharts

Enterprise Value/LTM EBITDA of 3x is close to a decade nadir. At these levels, HP might be a speculative stock worth considering for investors who want to benefit from the U.S. shale industry return to growth in the medium term (the timing remains questionable). But, given the uncertainty regarding the possible second wave of the COVID-19 pandemic, I maintain the neutral rating.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment