FilippoBacci/iStock via Getty Images

Investment Thesis

Hello Group (NASDAQ:MOMO) holds two dating apps. The business is cash flow positive and has a very strong balance sheet. Clearly, all good considerations.

Furthermore, even though there are a lot of contradicting newsflows out there, I don’t believe that Chinese stocks are going to get delisted on mass from U.S. exchanges. This is all political posturing. Neither the U.S. nor China wants to go down that path.

Both countries are insanely focused on economic growth and we are all so much more interlinked than our leaders would want us to believe.

All that being said, I struggle to make the case that this investment is actually undervalued. Why?

Because when you invest in a stock, the multiple you get for your business drives a substantial portion of your return. And if the multiple continues to compress as revenues continue to decelerate, shareholders will struggle to get a suitable return here.

Chinese Stocks Are Out of Favor

The market loves to trade everything as ”one-trade”. Things are grouped together. For example, it’s a high growth stock, a commodity ”play”, or Chinese exposure.

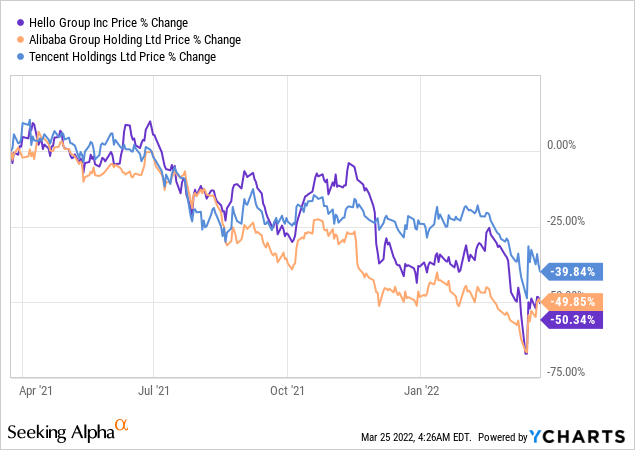

Indeed, as you can see above, irrespective of the underlying prospects of Alibaba (BABA) or Hello Group, over the past year both companies are down practically the same, and their trajectory essentially follows each other.

And given that these stocks have traded similarly in the medium-term, there’s the belief that since Hello Group has so much cash on its balance sheet that the business has to be underpriced. I don’t believe that to be the case. But I get ahead of myself.

Revenue Growth Rates Are Moving in the Wrong Direction

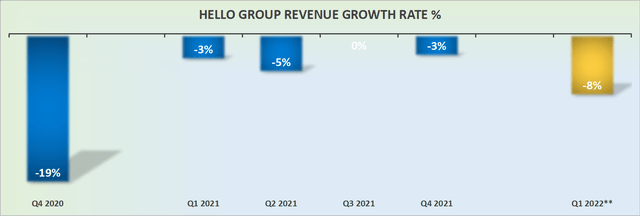

Hello Group revenue growth rates

Hello Group’s Q1 2022 guidance points towards its revenues decreasing by 8% y/y. Considering that Q1 of last year was already in negative territory, one would have hoped that 2022 would enter on a stronger footing. However, as you can see above, that’s not the case.

Why Hello Group? Why Now?

Hello Group is China’s version of Tinder (MTCH). It holds two main apps, Momo and Tantan. Momo connects people and facilitates social interactions based on location. While Tantan is designed to help its users find and establish romantic connections.

Given that Momo is 4 times bigger than Tantan, Momo’s prospects will be a significant driver of the overall thesis, either bullish or bearish.

Furthermore, Momo’s MAUs as of Q4 2021, were flat compared with the same period a year ago, at 114 million users.

Thus, even if management tries to drive more value-added services to this user base, it’s simply not growing. And when you invest in a public company, the business has to either grow fast or it will end up dying.

For their part, Hello Group contends that Covid’s resurgence caused the sequential slide in MAUs. But the Covid resurgence isn’t the reason why compared with last year MAU numbers were flat, now is it? The MAU numbers are flat because the apps have saturated their user reach.

Management declares that it will be focusing more on value-added services and less on growing its MAUs. However, I’m not sure that its efforts to stabilize its revenues are working out.

The Cash on Its Balance Sheet, What to Do?

Hello Group’s management doesn’t have meaningful projects to deploy excess capital into, so they’ve decided to give shareholders a one-off special dividend. The dividend comes to $0.64 per ADS, which translates into just over a 9% dividend yield.

On the surface, this sounds great. But when you think that there’s little reason to expect its share price from sliding further, I’m questioning whether that’s the best use of capital?

Indeed, after the dividend is paid out, Hello Group’s balance sheet will hold about $1.2 billion of cash and approximately $720 million of convertible debt.

Thus, starting next quarter Hello Group’s net cash position falls to less than $500 million.

MOMO Stock Valuation – The Illusion of Cheap

The problem with this investment is that it has the illusion of being cheap. Firstly, it has a strong net cash position, which makes up more than a third of its market cap, even after the dividend is paid out.

Secondly, the business is clearly not burning any capital. In fact, for 2021 as a whole, its free cash flows reached $230 million, putting the stock right now at approximately 6x trailing free cash flows.

The problem though here is that the market is always looking ahead. And the market simply doesn’t believe that Hello Group will be able to reignite its revenue growth rates.

And if the market doesn’t believe in its prospects, then you are left with the multiple that investors are willing to pay continuously contracting. And that’s a problem.

The Bottom Line

To be absolutely clear, I’m not against investing in China. In fact, in my highly concentrated portfolio, I hold a Chinese company. The problem has less to with investing in China, and much more to do with this underlying business.

I simply can’t see a path of how shareholders are going to get rewarded here. Remember, cheap can always get cheaper. And much cheaper than you can possibly imagine.

Be the first to comment