baranozdemir

If what you’re looking for in an investment opportunity is a firm that is involved in the production and sale of aircraft or parts of them, one firm that is definitely worth knowing about is HEICO (NYSE:HEI). As the world’s largest manufacturer of FAA-approved jet engine and aircraft component replacement parts (excluding OEM firms and their subcontractors), HEICO is a rather sizable firm with a market capitalization of $17.41 billion. What’s really impressive about the enterprise is how stable it has been during the market’s general downturn. Although the company continues to generate strong fundamental performance, shares are incredibly pricey at this point in time. Normally, this would result in some significant downside as the market tanks. But so far, the company has been mostly immune from that. Although this has been the case recently, I do also think that investors would be wise to approach this prospect cautiously. If it weren’t for how high quality the enterprise is, I would certainly rate it a ‘sell’, but the quality of it leads me to keep it at a ‘hold’ for now.

HEICO is flying high compared to the market

Last time I wrote an article about HEICO was back in May of this year. In that article, I found myself impressed by how strong the fundamental performance of the company had been. I could not help but to conclude, based on the company’s historical financial data and its overall business model, that it was a truly quality operator in the aerospace market. I even went so far as to claim that the long-term picture for the company was favorable. Given how shares were priced, however, I found myself rating the company a ‘hold’, reflecting my belief that it should generate returns that more or less matched the broader market moving forward. Since then, the company has easily exceeded my expectations. While the S&P 500 is down by 13.7%, shares have generated a loss for investors of only 2.4%.

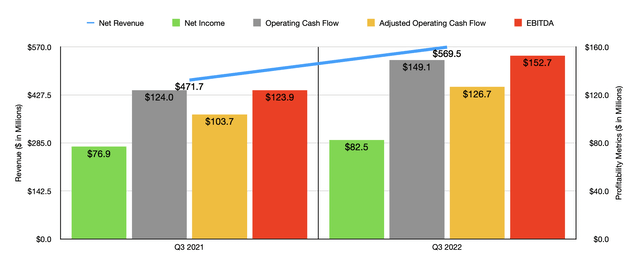

To understand why this return disparity exists, we should look at data covering the third quarter of the company’s 2022 fiscal year. This is the only quarter for which data was not available when I last wrote about the company but that is available today. Consider, for starters, revenue. During that quarter, sales came in at $569.5 million. That’s 20.7% higher than the $471.7 million generated the same quarter just one year earlier. Although the company did benefit from a modest increase in revenue associated with its Electronic Technologies Group, the vast majority of the rise came from the Flight Support Group. Revenue there shot up 39.3%, climbing from $237.1 million to $330.3 million. This increase, management said, can be attributed to strong organic growth of 25%. However, the company also benefited to the tune of $35 million from acquisitions made in 2021 and so far in 2022. Interestingly, management also said that sales price changes were not a significant contributing factor to the change in revenue. This is interesting when you consider recent cost inflation and the prospect of additional supply chain disruptions. Management did say, however, that both of these factors could help to push sales even higher for the rest of the year. The company should also benefit from acquisition activities it engaged in. For instance, on July 28th, the company announced its largest-ever acquisition of a global and leading electronic component supplier (95% of it at least) called Exxelia International in a deal valued at 453 million euros, plus the assumption of 14 million euros of liabilities. The firm has continued to make other purchases. But this is just the largest worth mentioning.

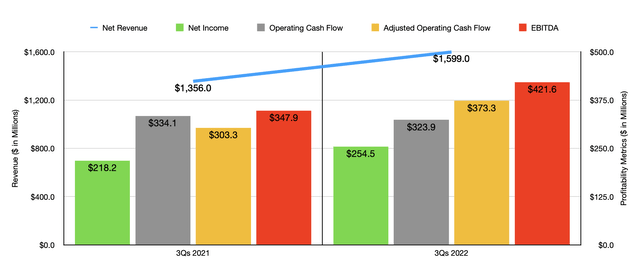

The rise in revenue for the company brought with it a nice improvement in profitability. Net income rose from $76.9 million in the third quarter of 2021 to $82.5 million in the third quarter of this year. The reason why the increase wasn’t greater is that the gross profit margin for the company dropped from 39.2% to 38.8%, driven by a change in product mix and offset some by higher production volume. Other profitability metrics followed suit. Operating cash flow rose from $124 million to $149.1 million. If we adjust for changes in working capital, it would have risen from $103.7 million to $126.7 million. Meanwhile, EBITDA also improved, jumping from $129.3 million to $152.7 million. As you can see in the chart above, the third quarter was not a one-time event. For the full nine months of its 2022 fiscal year, the company saw attractive revenue, profitability, and cash flow growth.

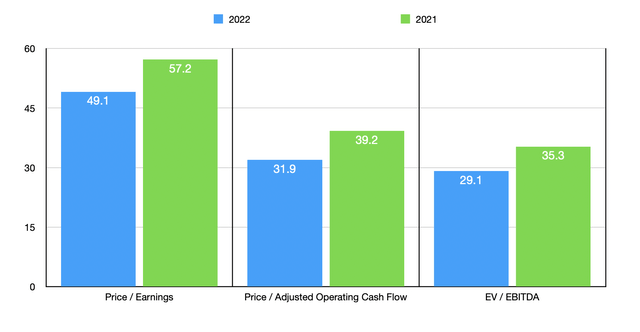

When it comes to the rest of the 2022 fiscal year, management has not really provided any guidance. But if we annualize results experienced so far for the year, we would get net income of $354.8 million, adjusted operating cash flow of $546.6 million, and EBITDA of $590.4 million. These numbers make it easy to value the company. The firm is currently trading at a forward price to earnings multiple of 49.1, at a forward price to adjusted operating cash flow multiple of 31.9, and at a forward EV to EBITDA multiple of 29.1. These numbers compare favorably to the 57.2, 39.2, and 35.3, readings that we get, respectively, when using data from the 2021 fiscal year. As part of my analysis, I also decided to compare HEICO to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 16.5 to a high of 49.5. And on a price to operating cash flow basis, the range was between 5.1 and 71.6. In both scenarios, four of the five companies were cheaper than our prospect. Meanwhile, using the EV to EBITDA approach, the range was between 10 and 18.1, with HEICO being the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| HEICO | 49.1 | 31.9 | 29.1 |

| Howmet Aerospace (HWM) | 35.9 | 23.7 | 18.1 |

| Textron (TXT) | 16.5 | 9.2 | 10.0 |

| Elbit Systems (ESLT) | 18.0 | 71.6 | 10.4 |

| Rolls-Royce Holdings (OTCPK:RYCEY) | 49.5 | 5.1 | 10.2 |

| Huntington Ingalls Industries (HII) | 15.3 | 11.1 | 10.6 |

Takeaway

What data we have today suggests to me that HEICO continues to prove itself as a high-quality operator in its space. Truthfully, I don’t see that picture changing in the foreseeable future. But this does not mean that the company represents an attractive buying opportunity at this time. Given how pricey shares are, both on an absolute basis and relative to similar firms, I cannot rate the company any higher than a ‘hold’ right now.

Be the first to comment