vitpho/iStock via Getty Images

Heavy duty trucking in the United States consumes 38 billion gallons of diesel fuel each year and forms one of the fastest growing sources of carbon emissions. Shrinking this is a gargantuan task as demands on the logistics industry rises and with the pipeline of new class 8 electric trucks limited to the point of effectively being non-existent.

Hence, Hyliion (NYSE:HYLN) quickly garnered a strong bullish commentary when it went public on the back of the pandemic-era SPAC boom with a stated mission to replace diesel engines in nearly any heavy-duty trucks. The long-term bullish story was set. Decarbonization has almost become gospel with a number of logistics companies including Amazon (AMZN), Deutsche Post AG (OTCPK:DPSTF), and United Parcel Service (UPS) all promising to become carbon-neutral by future dates as part of their ESG commitments. Powertrain solutions by Hyliion might very well come to play a role in this.

The Austin, Texas-based company retails the Hyliion Hybrid powertrain and the Hypertruck ERX. The former is a hybrid electric booster for class 8 trucks which has failed to gain commercial traction whilst the latter is a natural gas-electric powertrain that provides a 1000+ mile range. The company also recently acquired a hydrogen and fuel agnostic generator called Karno from General Electric (GE) to be integrated into the Hypertruck powertrain platform.

Hyliion does not make trucks, it helps transform existing trucks. Hence, logistics companies can convert their existing freight trucks from purely diesel engines into Hyliion’s powertrain solution with a smaller capital outlay than could be expected if they were to go with outright purchasing a truck from the pipeline of new class 8 electric trucks coming online in the next few years. Retrofitting enables fleet operators to maintain the familiarity of their existing vehicles while reducing their carbon emissions. This essentially opens up a new total addressable market of commercial operators who want to jump on the electrification wave for environmental reasons but are constrained by the budget required for an entirely new electric fleet.

Revenue Growth Has Been Anemic, But Order Book Buildup On Hypertruck Is Optimistic

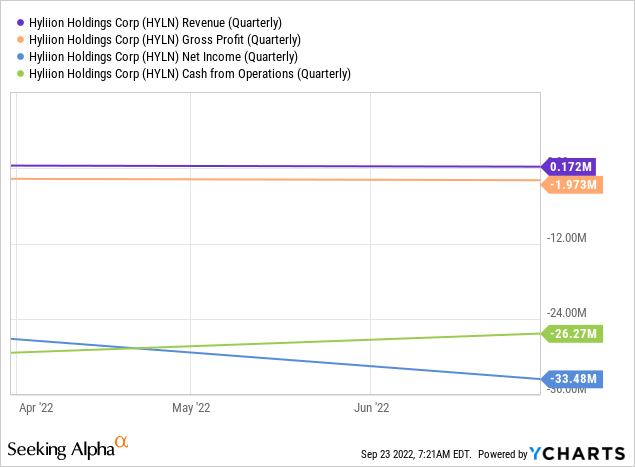

The benefits for fleet operators to go with Hyliion potentially extends beyond the green credentials and into actual operational cost savings with remote diagnostics and software that maximises fuel economy. The company last reported earnings for its fiscal 2022 second quarter which saw revenue come in at $172K versus nil revenues in the year-ago quarter and also underperformed consensus estimates by $203K.

The lack of revenue combined with high operational costs to lead a material deterioration of Hyliion’s financials. Gross profits were negative during the quarter at $1.97 million, with negative net income significantly higher at $33.48 million. Further, whilst some of these losses could be attributed to non-cash flow impacting items, Hyliion still realized $26.27 million in negative operational cash flow during the quarter.

The company reiterated its fiscal 2022 revenue expectations of between $2 million and $3 million and also lowered guidance for operational expenses to be in the range of $130 million to $140 million from the prior guidance of $135 million to $145 million. These numbers are so disproportional to the point of it being near comical. The company is essentially telling the stock market that it will spend $47 for every $1 of revenue it expects to bring in at the higher end of its guidance during its current fiscal year.

Hence, Hyliion still faces an incredibly uncertain future against Hypertruck orders with deposits that grew by 11% to reach 190 and nonbinding reservations that hit 2,000. That said, the recently passed Inflation Reduction Act could potentially change Hyliion’s fortunes. The Act represents the most significant investment by the US government in decarbonization ever, with $370 billion for energy and climate-related spending over the next decade. This has placed the drive to net-zero at the centre of the current American government, and Hyliion stands to benefit from the 30% tax credit of up to $40,000 on purchases of its Hypertruck ERX units.

Riding The Tailwinds Of Transport Electrification

Hyliion’s growing order pipeline was a green shoot in an otherwise abysmal quarter. But recent developments set the company up to ride the tailwinds of the decarbonization of logistics. Whilst this trend was initially being driven purely by a small number of logistics firms which caused anemic revenues for Hyliion, a growing number of companies are entering Hyliion’s TAM on the back of increased calls for corporations to enact pledges and initiatives to drive down their carbon emissions. This will boost medium to long-term demand for Hyliion’s drivetrains.

The world needs decarbonization if it is to achieve ambitious targets to reduce greenhouse emissions to try and restrict the rise in mean global temperature to well below 3.6°F above pre-industrial levels. With Hyliion ending its quarter with cash and equivalents of $389 million, its cash burn does not yet pose a near-term existential threat. Hopefully with the Inflation Reduction Act revenue becomes less anemic and starts to reflect the rising zeal of the world for decarbonization.

Be the first to comment