Dzmitry Dzemidovich

Fourth Quarter Market Discussion

There comes a point in every market when investors finally realize that this time won’t be different after all. That’s essentially where we find ourselves after the fourth quarter.

History tells us that whenever the Federal Reserve Funds rate climbs above the yield on 2-Year Treasuries, something breaks. This happened during the global financial crisis in 2008; in the aftermath of the dotcom bubble in 2000; in the late 1980s, ahead of the savings & loans crisis; and in the stagflationary years of the early 1980s. All of those episodes preceded official recessions.

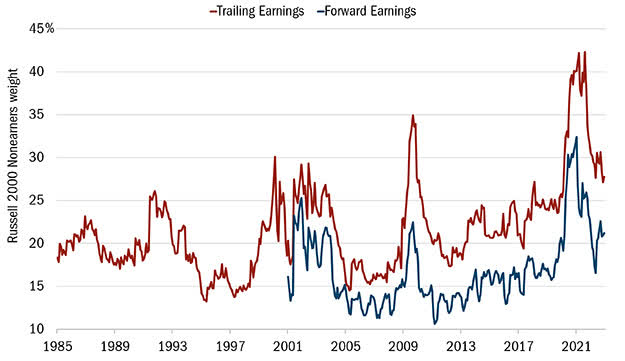

Yet for much of the year, as the Federal Reserve has been aggressively hiking the Federal Reserve Funds rate in an attempt to throw cold water on inflation, many investors were still in denial. You saw this in some of the false narratives making their rounds: “At least the consumer is still strong,” some said. “Maybe this time, the Federal Reserve can pull off a soft landing,” others wondered. “At the very least, corporate earnings are hanging in there, right?” many thought. Never mind that the profit outlook was being clouded by the fact that earnings were pulled forward by the flood of monetary and fiscal stimulus injected into the economy during the global pandemic. And never mind that the percentage of companies in the Russell 2000® Index that aren’t profitable is higher than it was during the global financial crisis and climbing.

Source: FactSet; FTSE Russell; Jefferies, monthly data from 1/31/1985 to 12/31/2022. This chart represents the small cap’s percentage of the US equity market by trailing earnings and forward earnings. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

After the latest Federal Open Market Committee (FOMC) meeting in mid-December, the effective Federal Reserve Funds rate jumped above the 4.23% yield on 2-Year Treasuries. And market participants are finally coming to terms with the fact that the risks they’ve been overlooking are indeed real, that the cost of money isn’t free, and this time isn’t different after all.

Active And Selective

Much like those other historic periods marked by inverted yield curves, this is a market where we believe it will pay to be extremely selective.

We have historically focused on identifying undervalued small companies with solid balance sheets that permit them to self-finance organic growth and strong free cash flow to raise their dividends over time. On top of that, we favor companies with compelling self-help strategies to provide an extra catalyst. Those principles of attractive valuations, financial soundness, compelling business strategies and catalysts for recognition are core to our 10 Principles of Value Investing™.

The markets, however, don’t always compensate investors for these traits. That changed, however, as our style of investing has recently come back into favor. Indeed, security selection was the biggest reason for our outperformance versus the Russell 2000 Value Index during the quarter. And it was the primary reason for our outperformance versus the Index in a challenging year.

However, investors haven’t bought in completely. For example, one factor that investors aren’t being penalized for yet is leverage. But that’s likely to come — along with a renewed focus on financial soundness — now that the Federal Reserve seems to be almost done with slamming the brakes on the economy. For that final shoe to drop, we need to see signs of capitulation from management teams. We’re not there yet, but the markets are nearing that point, and we believe our Portfolio stands to benefit even further once the market finally pays attention to balance sheet strength again.

Attribution Analysis

It’s important to note that we are not just hiding out in defensive areas of the market. If that were true, we would be considerably overweight in Utilities and REITS, which we are not. And we wouldn’t be overweight in economically sensitive sectors such as Industrials, Materials, and Energy relative to the Russell 2000® Value.

It’s more accurate to say we favor companies with defensive characteristics that are likely to be secular winners, even if the economy doesn’t offer much of a tailwind. And once the next cycle begins, these are companies that stand to benefit as the economy re-accelerates.

Industrials. An example is Powell Industries (POWL), which manufactures electrical power distribution equipment and components used in pipelines, offshore drilling platforms, data centers, and large industrial facilities. After experiencing a downturn along with oil prices in recent years, Powell is now enjoying a tailwind from energy’s rebound, especially liquified natural gas related. Order activity, in fact, has risen for six consecutive quarters. And for the full year, new orders rose 78% compared to fiscal 2021.

Powell enjoys self-help catalysts as well. The company, with significant insider ownership, has been focused on internal capital allocation moves lately to position itself for a more profitable future. In fiscal year 2022, for instance, the company divested a low-margin industrial valve repair division within Powell Canada. At the same time, the company has been investing in its higher-margin services business to improve its overall mix of revenue sources.

Yet, very few sell-side analysts cover the stock, and those who do, don’t seem to appreciate the internal and external tailwinds the company enjoys. This is where our selectivity comes into focus.

Outlook

We understand that one of our primary responsibilities is to protect investors on the downside. And while our portfolio won’t be immune to the effects of slow growth and lingering inflation, we think our companies will be less affected than the broader market.

But another responsibility is to do what hockey great Wayne Gretzky famously espoused — skate to where the puck is going to be. That’s why we don’t just focus on companies with defensive characteristics. We also search for well-run companies that are positioned to be secular winners. So, at a time when the markets are recognizing the growing chance of a recession, we’re looking at next year’s earnings and the next cycle and beyond.

It’s this type of contrarian and long-term thinking that helped us weather a challenging year. And it’s the same type of thinking that we believe will serve our clients well in the quarters and years to come.

Fund Returns

12/31/2022

| Since Inception (%) | 20-Year (%) | 15-Year (%) | 10-Year (%) | 5-Year (%) | 3-Year (%) | 1-Year (%) | YTD* (%) | QTD* (%) | |

|---|---|---|---|---|---|---|---|---|---|

| Value Plus

Investor Class |

9.87 | 9.97 | 7.80 | 8.18 | 7.91 | 10.15 | -4.95 | -4.95 | 16.33 |

| Value Plus

Institutional Class |

10.00 | 10.16 | 8.06 | 8.43 | 8.15 | 10.41 | -4.75 | -4.75 | 16.41 |

| Russell 2000® Value | 9.16 | 8.99 | 6.81 | 8.48 | 4.13 | 4.70 | -14.48 | -14.48 | 8.42 |

*Not annualized

Source: FactSet Research Systems Inc., Russell®, and Heartland Advisors, Inc.

The inception date for the Value Plus Fund is 10/26/1993 for the investor class and 5/1/2008 for the institutional class.

|

In the prospectus dated 5/1/2022, the Gross Fund Operating Expenses for the investor and institutional class of the Value Plus Fund are 1.15% and 0.92%, respectively. The Advisor has voluntarily agreed to waive fees and/or reimburse expenses with respect to the institutional class, to the extent necessary to maintain the institutional class’ “Net Annual Operating Expenses” at a ratio not to exceed 0.99% of average daily net assets. This voluntary waiver/reimbursement may be discontinued at any time. Without such waivers and/or reimbursements, total returns may have been lower. Past performance does not guarantee future results. Performance represents past performance; current returns may be lower or higher. Performance for institutional class shares prior to their initial offering is based on the performance of investor class shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. All returns reflect reinvested dividends and capital gains distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions. Subject to certain exceptions, shares of a Fund redeemed or exchanged within 10 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual’s return. To obtain performance through the most recent month end, call 800-432-7856 or visit heartlandadvisors.com. An investor should consider the Funds’ investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information may be found in the Funds’ prospectus. To obtain a prospectus, please call 800-432-7856 or visit heartlandadvisors.com. Please read the prospectus carefully before investing. As of 12/30/2022, Powell Industries (POWL) represented 3.83% of the Value Plus Fund’s net assets, respectively. Statements regarding securities are not recommendations to buy or sell. Portfolio holdings are subject to change. Current and future holdings are subject to risk. The Value Plus Fund invests in small companies that are generally less liquid and more volatile than large companies. The Fund also invests in a smaller number of stocks (generally 40 to 70) than the average mutual fund. The performance of these holdings generally will increase the volatility of the Fund’s returns. There is no assurance that dividened paying stocks will mitigate volatility. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market. The Value Plus Fund seeks long-term capital appreciation and modest current income. The above individuals are registered representatives of ALPS Distributors, Inc. The Heartland Funds are distributed by ALPS Distributors, Inc. The statements and opinions expressed in this article are those of the presenter(S). Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The specific securities discussed, which are intended to illustrate the advisor’s investment style, do not represent all of the securities purchased, sold, or recommended by the advisor for client accounts, and the reader should not assume that an investment in these securities was or would be profitable in the future. Certain security valuations and forward estimates are based on Heartland Advisors’ calculations. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change. There is no guarantee that a particular investment strategy will be successful. Sector and Industry classifications are sourced from GICS®.The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (MSCI) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages. Heartland Advisors defines market cap ranges by the following indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell Top 200®. Because of ongoing market volatility, performance may be subject to substantial short-term changes. Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. There is no assurance that dividend-paying stocks will mitigate volatility. CFA® is a registered trademark owned by the CFA Institute. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indices. Russell® is a trademark of the Frank Russell Investment Group. Data sourced from FactSet: Copyright 2023 FactSet Research Systems Inc., FactSet Fundamentals. All rights reserved. Heartland’s investing glossary provides definitions for several terms used on this page.

|

Be the first to comment