Callon Petroleum (NYSE:CPE) is facing a challenging outlook. The plunge in oil prices is going to hurt its earnings and cash flows. The company, however, has been improving its cost structure and has some downside protection with hedges. But the Houston, Texas-based shale oil producer neither has a stout balance sheet nor robust liquidity. I think the company’s weak financial health could continue to weigh heavily on its stock.

Image courtesy of Pixabay.

The global oil market is confronting a huge imbalance in supply and demand that’s reached near-crisis proportions. The spread of the novel coronavirus and the ensuing lockdowns have pushed the global economy towards a recession and triggered the largest ever decline in oil demand, with consumption expected to drop by around 20 million bpd in April – that’s equivalent to roughly 20% of the global demand. With excess production and collapsing demand, the world could soon run out of crude oil storage capacity. Facing weak supply and demand fundamentals, oil prices have fallen by more than 55% this year to $23 a barrel at the time of this writing. The oil prices could remain subdued in the near term due to the storage overhang and weak demand, or at least, until we get a health solution that helps in containing or treating COVID-19.

The severe decline in oil prices to just $25 a barrel has put shale oil drillers in a tough spot. Several oil producers used oil prices of $50 to $55 a barrel for future planning purposes, including Callon Petroleum which expected to generate around $50 million to $100 million of free cash flows at these prices. This implied that the company could probably balance cash flows with WTI in the high-$40s a barrel range and might face a cash flow deficit at lower prices. As the oil price environment worsened, Callon Petroleum slashed its capital budget by 20% and shifted into maintenance mode by keeping production flat.

Callon Petroleum plans to spend $700 to $725 million in 2020 as capital expenditures, down from its previous estimate of $975 million. The reduction in spending will come as the company significantly reduces drilling activity. Callon Petroleum has been working with nine rigs but will remove four units by the end of the current quarter. It also plans to drop three frac crews and will work with just two crews. With the decline in drilling activity, the company’s production is now expected to come in flat as compared to 108,600 boe per day, including oil production of 73,000 bpd, produced last year (on a pro forma 3-stream basis). Callon Petroleum originally planned to increase its total production by 8% and oil production by 7% from last year.

Callon Petroleum’s new guidance, however, came before the extent of the demand loss began to unravel and oil prices eventually crashed to 18-year lows in late-March. That has prompted some oil producers, such as Devon Energy (DVN), to make additional spending cuts as they moved even more aggressively to protect their financial health. I think Callon Petroleum could also follow in their footsteps.

Callon Petroleum, like its peers, is facing a grim future. The company reported a quarterly profit of $0.23 per share (adjusted) and free cash flows of $9.1 million in Q4-2019 while realizing oil prices of $56.61 per barrel. With oil now in the mid-$20s, the company’s earnings and cash flows will take a severe beating. However, there are two things which, I believe, are going to help Callon Petroleum in this harsh period.

Firstly, the company has done a commendable job of improving its cost structure, which has put it in a better position to withstand low oil prices. The company completed its merger with Carrizo Oil & Gas by YE-2019 and has started realizing synergies, which translates into cost savings. Its cash G&A costs are on track to deliver $35 million of savings on an annualized basis. Its well costs will decline meaningfully in 2020, particularly in the core Delaware Basin, as the two companies share resources and realize efficiency gains.

Secondly, Callon Petroleum has covered a large chunk of its oil production for the current year with hedges. This minimizes the exposure of its cash flows to the weakness in oil prices. What I also like about Callon Petroleum is that it has restructured a number of hedges from three-way collars into swaps, which has made its hedges even better, considering swaps typically offer better downside protection than three-way collars. The company has hedged a total of 31,000 bpd of oil production for the current year using swaps, nearly all of which have an average price of $50.31 per barrel. This output is equivalent to more than 40% of the company’s oil production for last year on a pro forma basis. Callon Petroleum will continue to receive a decent price for these barrels, even as the benchmark prices continue to trade below $30 per barrel. In addition to this, more than 9,000 bpd of its oil production is covered with three-way collars using Brent prices. Furthermore, more than 33,000 bpd of Callon Petroleum’s output is backed by basis hedges, which is going to protect the company’s cash flows from any weakness in regional prices (for instance, Midland Basin vs. Cushing price).

That being said, moving forward, I think financial health is the one thing that is going to matter more to investors than anything else since it can have a huge impact on how well an oil producer weathers the storm. In my opinion, Callon Petroleum’s financial health is not in great shape.

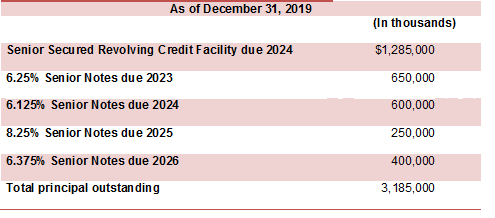

Callon Petroleum has seen its debt climb substantially in the past few months after it completed its merger. As indicated earlier, Callon Petroleum closed the Carrizo Oil & Gas acquisition in December. The company paid $740 million in stock and assumed Carrizo’s $1.7 billion in debt. As a result, Callon Petroleum’s long-term debt surged by 2.7 times from $1.19 billion at the end of 2018 to $3.19 billion at the end of last year. Its leverage ratio, measured in terms of debt-to-equity, now stands at a lofty 99%, up from a decent 49% a year earlier. Callon Petroleum’s debt-to-equity ratio is substantially higher than the median leverage ratios of mid-cap and large-cap independent exploration and production companies of 57% and 70%, respectively, as per my calculation based on Q4-2019 numbers.

Image: Author. Data: CPE 10-K Filing [link provided earlier]

The good thing, however, is that Callon Petroleum doesn’t have significant near-term debt maturities, as shown in the table above. If oil prices improve, then the company could start generating free cash flows, and it can use that excess cash to repay debt. But note that all of the company’s debt will become due between 2023 and 2026. This debt wall might not look threatening now, but it could become a lot more problematic if oil prices stay below $50 a barrel for the next couple of years. Callon Petroleum is reportedly trying to restructure its debt, which is the smart thing to do sooner rather than later, but the company hasn’t confirmed anything yet.

Furthermore, Callon Petroleum’s liquidity, which wasn’t robust, to begin with, could also come under pressure. The company had around $13 million of cash reserves at the end of last year, down from $16 million a year earlier. The company also had $697 million available under the $2 billion revolving credit facility. The company’s liquidity could decline in the future as it burns cash flows. Its total borrowing base was $2.5 billion at the end of last year (of which $2 billion was elected), but it will come under review in spring and fall of this year. In a low oil price environment, the company’s borrowing base could get reduced, which may hamper its ability to withstand the downturn.

For these reasons, I think Callon Petroleum is facing a tough outlook. The company’s shares have plunged by 90% this year from $4.70 to $0.50 at the time of this writing. The stock is trading just 0.7x trailing-twelve-months earnings, significantly below sector median of 5.6x. But I think Callon Petroleum stock might continue to underperform in a low oil price environment due to concerns related to above-average debt levels and weak liquidity. In my opinion, investors should avoid Callon Petroleum stock.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment