tdub303

Second Quarter Market Discussion

Nervous investors entered the quarter waiting for another shoe to drop, and it did. As the Federal Reserve aggressively raised interest rates to cool inflation that’s been running hotter than in four decades, stocks fell into an official bear market. Now, those same investors are wondering whether the force with which the Federal Reserve has slammed on the brakes of monetary policy might drive the economy into recession.

But with consumer confidence sinking and consumer credit exploding, that question may be moot. The consumer economy appears already to effectively be in a downturn, and that is resetting the market’s expectations. From our perspective, the real next development to watch out for is the point when market anxieties rise to where investors finally begin to focus on balance sheet strength again, as they did briefly in the first quarter of 2020 at the start of the COVID-19 recession and in 2007 at the start of the global financial panic.

In our opinion, we’re not there yet, but we are paying close attention as this would signal the next leg in the downturn, which we think will refocus attention on attractively priced and well-managed companies with high-quality balance sheets that enjoy a margin of safety from both an operational and valuation standpoint.

The Best Offense May Be a Good Defense

Given this economic backdrop, we don’t anticipate strong equity market performance for some time. Yet history has shown that active managers can find promising opportunities in otherwise weak markets. Many pockets of the small-cap universe, for instance, outshined large-caps for several years in the 1970s against a weak economic backdrop. And value outperformed the broad indexes in the years immediately following the bursting of the dotcom bubble. Today’s economy is not an exact repeat of those periods. Nevertheless, we believe we’re in another stock picker’s market.

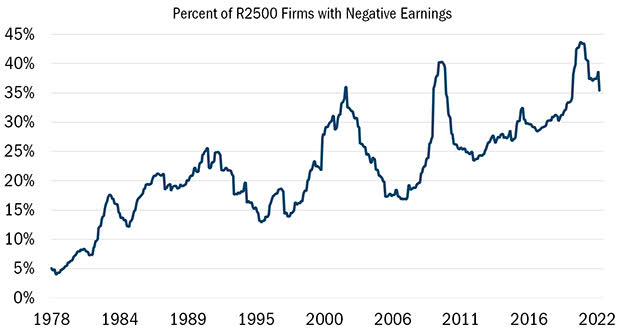

What traits should stock pickers be looking for? Balance sheet strength is always our first consideration, even ahead of income statements, because we approach companies like credit analysts. In the current environment, this mindset seems to be particularly useful as we believe the markets are about to enter a period of negative earnings revisions, as analyst estimates still seem far too optimistic. In effect, investors will likely have difficulty identifying corporate earnings—or the “E” in the price/earnings ratio— so investors shouldn’t let P/E ratios be their primary guide. Moreover, the percent of stocks that are unprofitable has hit a record high. (see the chart below)

Growing Negative Earnings

Source: Kailash Capital, LLC, Yale University, Compustat. https://kailashconcepts.com

The chart above shows the percent of Russell 2500 Firms with negative earnings. Monthly data from 12/31/1978-6/30/2022. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Our view is that if credit markets tighten, as one would expect in a recession, companies that can self-finance their growth stand to be far more attractive. That’s why we prefer well-managed companies with strong balance sheets and consistent free cash flow generation. This is also why we tend to prefer dividend payers and growers—though not the highest yielders—because the ability to consistently boost dividends, even in difficult economic times, signals management’s skills at capital allocation.

For similar reasons, we prefer companies with little or no leverage, which is a constant in our Ten Principles of Value Investing™. While the markets haven’t been rewarding companies with low leverage, that could soon change in today’s “risk off” market, especially if the economy takes another leg down. In June, the median net debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio for our portfolio stood at just 0.8 times, versus around 2.9 times for our benchmark. That gap between our net debt-to-EBITDA ratio and that of our benchmark is the widest it has been in nearly four years.

Attribution Analysis

Even with multiple layers of safety nets, strong balance sheets and cash flow generation, investors likely can’t protect against stock market losses in the short term. In the second quarter, for instance, the portfolio was down slightly, though less than the Russell 2000 Value Index, thanks in part to stock selection and a focus on quality.

Industrial Strength

To address inflation in the long-term, we believe the economy will need to expand capacity through reshoring industrial production back to the United States. Several of our holdings are likely to benefit if this theme unfolds. Powell Industries (POWL), for instance, develops, manufactures, and services custom-engineered equipment systems used in oil and gas refining, mining and metals, electric utility, and other heavy industrial markets.

Until the recent quarter, Powell shares seemed to be acting like they were in their own mini recession after running up against a series of headwinds, including the COVID-19 shutdowns, supply chain problems as the economy reopened, and inflation in the post-COVID-19 environment. While the company has been working its way back to profitability, the stock has been trading below book value with an attractive dividend yield. This past quarter, Powell enjoyed very strong bookings, a proxy for future revenues, while benefiting from the tailwind of the infrastructure build out while also being able to raise prices.

Healthy Healthcare

![]()

Like Powell, many of Healthcare stocks never benefitted from the post COVID-19 rally in the stock market. As a result, our Healthcare stocks are among our cheapest holdings. Haemonetics (HAE) and Phibro Animal Health (PAHC) are two good examples. Haemonetics, which provides disposables and devices used for blood and plasma collection, appears to be a recession friendly stock as its products are not economically dependent. Moreover, as households feel economic pressures, they are more likely to donate plasma, for which they are compensated.

Phibro’s strength lies in its animal-health related franchise, with medical feed additives and nutritional products for production animals. The company is also working on early-stage opportunities in its companion pet business, which could not only diversify its revenues but potentially provide a catalyst for the stock. Phibro is trading at only around 1x sales, and the stock has enjoyed insider buying.

Outlook and Positioning

We believe we are well positioned for the current environment. Well before this past quarter, we began looking for opportunities among beaten-down high-quality stocks with defensive attributes. If we hit rockier shores, the attractive valuation of such companies should provide some downside protection. And if the credit markets begin to shut down, such holdings shouldn’t need access to debt financing to fund themselves.

This speaks to the nature of our portfolio. In great times, we try to exceed expectations. In not-so-great times, we try to win by avoiding big drawdowns. And in all types of markets, we seek out investments demonstrating financial strength, capable management teams with sound capital allocation policies, and solid business strategies at attractive prices—all of which is more possible now, after the downturn, than a year ago.

Thank you for the opportunity to manage your capital.

Fund Returns (6/30/2022)

| Since Inception (%) | 20-Year (%) | 15-Year (%) | 10-Year (%) | 5-Year (%) | 3-Year (%) | 1-Year (%) | YTD* (%) | QTD* (%) | |

|---|---|---|---|---|---|---|---|---|---|

| Value Plus

Investor Class |

9.77 | 9.11 | 6.65 | 8.07 | 8.92 | 9.89 | -11.34 | -11.57 | -7.97 |

| Value Plus

Institutional Class |

9.91 | 9.30 | 6.90 | 8.32 | 9.17 | 10.14 | -11.16 | -11.47 | -7.92 |

| Russell 2000® Value | 9.20 | 7.77 | 5.58 | 9.05 | 4.89 | 6.18 | -16.28 | -17.31 | -15.28 |

*Not annualized

Source: FactSet Research Systems Inc., Russell®, and Heartland Advisors, Inc.

The inception date for the Value Plus Fund is 10/26/1993 for the investor class and 5/1/2008 for the institutional class.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment